It would seem I struck a bit of a chord the other day, pushing the popular Myers-Briggs personality assessments well beyond the overdone “What’s the best Myers-Briggs Personality of Entrepreneurs?” to instead share what personalities make the best startup advisors. Begging then the question of whether or not personalities correlate with quality startup investors.

A good venture capitalist (VC) must blend curiosity, resilience, and decisiveness with strong interpersonal skills and unwavering integrity. They need a deep understanding of financial concepts, industry knowledge, risk management, and strategic thinking, alongside strong analytical and negotiation abilities. Most successful VCs have backgrounds in entrepreneurship, investment banking, or technology, often supported by advanced degrees and a robust professional network. Raising capital and building a proven track record are essential for those starting their own VC funds. The role is challenging, requiring constant learning and adaptation, but it is crucial for navigating the high-risk, high-reward world of startup investing.

I put in bold a couple of considerations there to draw your attention the fact that those aren’t personality traits but rather experiences that, arguably, distinguish a startup investor from a business or retail investor.

This is overwhelmingly critical to your ecosystem because the expectations we can and should have of VCs are drastically different from people of wealth, investors in real estate, or people who invest in companies. Hence the question here, can Myers-Briggs help us identify is someone is more likely a “good” VC? It would seem so:

Retail Investor? What’s that?

Retail investors are non-professional investors who generally invest smaller amounts in stocks and bonds. The retail investment market includes retirement accounts, personal real estate, brokerage firms, online trading, and wall street investments.

1. ENTJ (The Commander)

Natural leaders, strategic thinkers, and excellent at planning, ENTJs are assertive, confident, and comfortable making tough decisions, which are crucial qualities for a VC. John Doerr comes to mind, a prominent venture capitalist at Kleiner Perkins, is often cited as having an ENTJ personality, because the role requires guiding startups and making investment decisions.

2. INTJ (The Architect)

INTJs are strategic, analytical, and visionary, exceling at long-term planning and often seeing patterns and trends that others might miss, invaluable in the rapidly changing world of startups. Peter Thiel, co-founder of PayPal and early investor in Facebook, strikes me as the traits associated with the INTJ type, explaining why he seems to make informed investment decisions that foresee the potential of a startup or sector of the economy.

3. ENTP (The Debater)

This is me, and to be transparent in saying that, as most know, I’m not a VC (but I love to advise). Innovative thinking and strong networks are immeasurably valuable in startup investors because a VC needs to think outside the box, draw from others’ experiences, and keep tabs on a sector, most effectively accomplished by talking to people. ENTPs are innovative, curious, and enjoy exploring new ideas. They are excellent at nurturing communities and persuading others, which are key skills for sourcing deals and supporting portfolio companies. Someone who comes to mind in this case is the co-founder of Andreessen Horowitz, Marc Andreessen, who seems to me to be an ENTP. Natural curiosity and the ability to challenge the status quo make an investor adept at identifying disruptive startups and guiding them through early growth.

4. ESTP (The Entrepreneur)

Literally distinguished by Myers-Briggs as “The Entrepreneur” personality, ESTPs are dynamic, energetic, and thrive in fast-paced environments. They are excellent at seizing opportunities and can make quick decisions. Who comes to mind? Mark Cuban, entrepreneur and investor, is often associated with ESTP traits, known for his high energy and quick decision-making skills, he exemplifies that among the greatest startup investors are the people who themselves have been there and done that. ESTPs’ ability to thrive under pressure and make rapid decisions are particularly beneficial in startups and the pace at which effective startup investors need to work.

5. INFJ (The Advocate)

INFJs are insightful, principled, and driven by a sense of purpose, often having a strong vision for the future and providing deep support and mentorship to the startups they invest in. Indeed, INFJs also make great advisors. The founder of Lowercase Capital, Chris Sacca, is sometimes described as having INFJ traits, known for his vision and advocacy for entrepreneurs. Their ability to connect deeply with founders and a vision can lead to strong, supportive relationships and insightful guidance for startups source.

Take all of this with a grain of salt because I’m using these VCs as examples, drawn from my estimation of them more so as a technique to help you identify the investors in your community who share (or lack) these traits. I’ve not spoken with any of them about this and my haphazard assessment may not be who they really are.

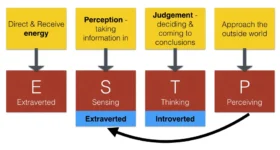

Notice from my assessment of ideal advisors, they’re not the same: ENTP, INTJ, ENTJ, INFJ, INTP. Alright well, they’re damn close to the same. What difference have I drawn between ideal VCs and Advisors? INTP as an Advisor whereas ESTP can make a great investor – the ESTP is, frankly, likely too entrepreneurial to give a founder the focus they need whereas the INTP likely overthinks the deliberate risks that need to be taken to invest in startup. The rest are, arguably, similar personalities because again, what matters is most is that advising, investing in, or working in startups IS NOT THE SAME as supporting businesses. Evidenced by Oxford’s study of successful startup founders, people all but must have a need for variety and novelty, reduced modesty, an openness to adventure, and heightened energy levels. If that’s not you or isn’t on your team, you must seek advisors, investors, and cofounders who are.

Peer reviewed research has proven that certain personality types are more likely successful founders, so it lends itself to the fact that certain types of people are going to make capable startup investors. “Myers- Briggs Type Indicator Score Reliability Across: Studies a Meta-Analytic Reliability Generalization Study,” in Educational and Psychological Measurement finds that it is a credible framework for understanding individual differences in perception and decision-making, demonstrating that MBTI can effectively identify traits such as risk tolerance and supportiveness by categorizing individuals into distinct personality types, each with unique behavioral tendencies.

Why might this matter so?

In MediaTech Ventures‘ work developing startup ecosystems for cities, governments, and sectors of our economy, it’s evident that regions of the world defer first to local investors; after all, these are the people who show up at events and make themselves known as available investors.

Let me be bold: Should they?

Clearly, startup experience, risk tolerance, and certain personality traits matter but what happens in most startup communities is that those business and retail investors, perhaps real estate investors, step up (usually yes, with good intentions) to help the community. The rub in that is these investors have little experience and draw from a very different comfort with risk. As a result, and you might be able to see this in your city, you have a dearth of “Angel Investors” in part because those Angel Investors want to be known for stepping up and supporting while at the same time, they don’t know with whom to invest funds into a Fund more substantial (don’t know who, or who to trust). At the same time, in developing ecosystems, you probably have a small handful of larger funds, because they’ve been able to show some success (or they have privileged access to Limited Partners, the people who invest in Venture Capital Funds).

What results from this is called the Series A Gap.

Series A Funding Gap

Most cities have this. In transition from a nascent startup ecosystem to something more mature, a process that takes 7-20 years, most wealth participates in their singular capacity as Angel Investors because the sophistication isn’t yet developed so that most wealthy participants make the wiser decision of investing in startups *through* Funds. The relatively few funds that are established remain a bit risk averse because there remains a shortage of capital to deploy (and lose).

Series A startups are shifting from proof of concept to scale; they need to demonstrate significant progress and a clear path to scaling, which can be a challenging hurdle. Investors at this stage are looking for evidence of product-market fit and early traction. The highly selective funds need to seek the startups that seem to more capably show the potential for rapid growth. And it’s this selectiveness creates a bottleneck where many startups fail to secure the necessary capital to scale.

Angels remain angels, and besides, often lack the experience necessary to advise founders about how to scale. You hear this in frequent advice from investors to, “focus on customers and revenue” – such investors aren’t actually giving you good/actionable advice, they’re giving you advice that sounds good because they don’t know what else to advise.

Such investors should be allocating their funds to Funds, but that would remove their visible participation from the ecosystem; never mind the fact that it would result in better ROI and more meaningful investment, because the capital would be in the hands of people who know what they’re doing.

Hence this personality assessment of Startup Investors matters

While my assessment is by no means complete, hopefully it paints a picture of how and why you should AVOID the “startup investor” or “angel investor” who clearly has an emotional attachment to what you might be doing while they’re likely also to push you too hard to focus on revenue, or a stable business – particularly when they have no idea HOW you should do that.

These are the personalities showing up, and indeed likely *wanting* to help. What’s that saying? “The road to hell is paved with good intentions.” That might rarely be more evident than in startup investing, where a lot of people want to be involved and want to help, but if you, a founder, end up with investors who don’t know what they’re doing, or who lack the tolerance to stomach the turmoil of a startup, you’ll certainly be in hell despite those good intentions.