Which One Are You?The Tale of Two Founders

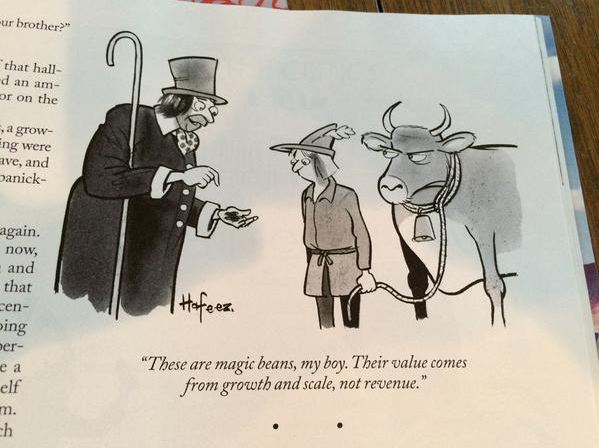

The implications of being a founder chasing the Product - Market Fit vs. the Market - Product Fit characterized, brilliantly in the story of the boy with the cow and the magic beans.

How to ExitStart Up with the Exit in Mind

Whether that’s getting acquired, merely successful, going public, or otherwise, most startups struggle to bring on board resources and capital because they never think through and communicate what the FUTURE means for everyone.

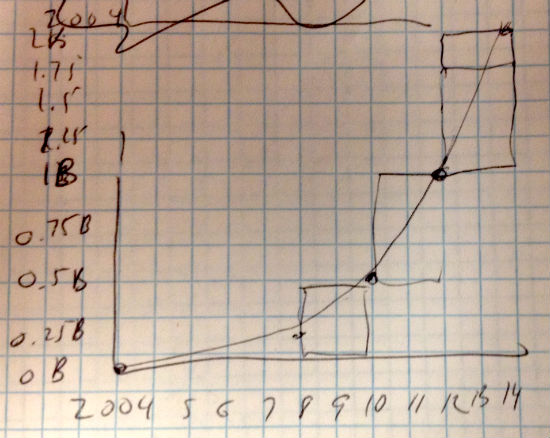

Do It RightStartups, It’s About Returns to Investors

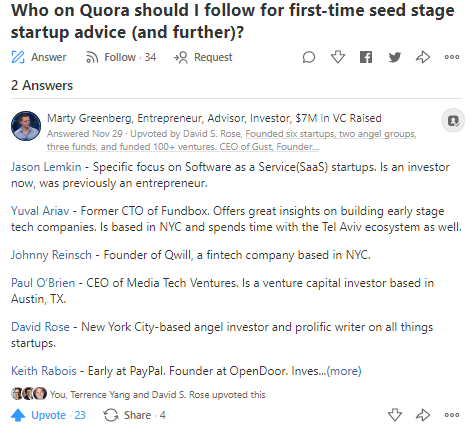

Gust founder and Venture Capitalist, David Rose, “an angel typically invests in 20-80 companies over a five-year period, with about $25,000 per company; they also tend to invest along with 5-10 other angels."

Have What It Takes?What It Takes to Raise Money

Investment is born of passion and ideas. Successful businesses worthy of investment are born of the only things that produce results: Innovation and Marketing.

Have You Thought?What Startup Founders Might Consider Before Seeking VC

Venture Capital seeks opportunity, not a sales pitch. The mindset to have is that you don’t want to have to seek VC, you want investors to seek you.

Invest in MarketingMarketing Before Raising Capital

Of course you can acquire those 500,000 potential customers; what are you doing to remove the barriers to acquiring everyone?

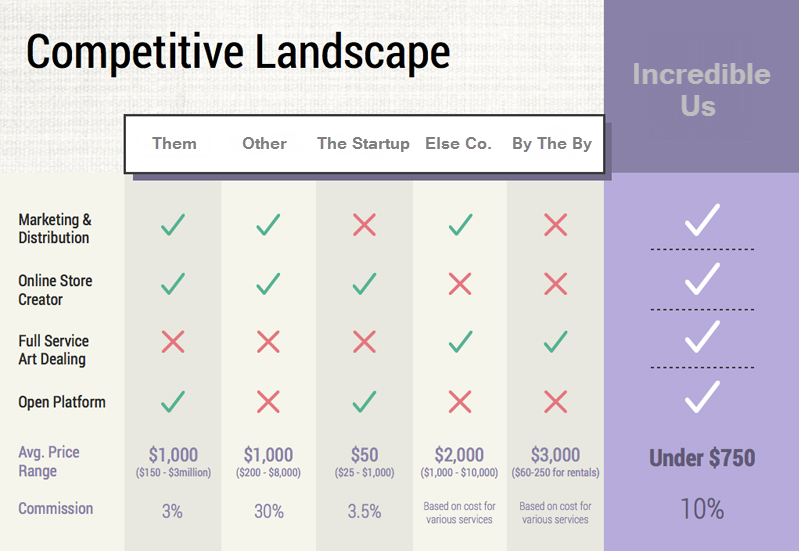

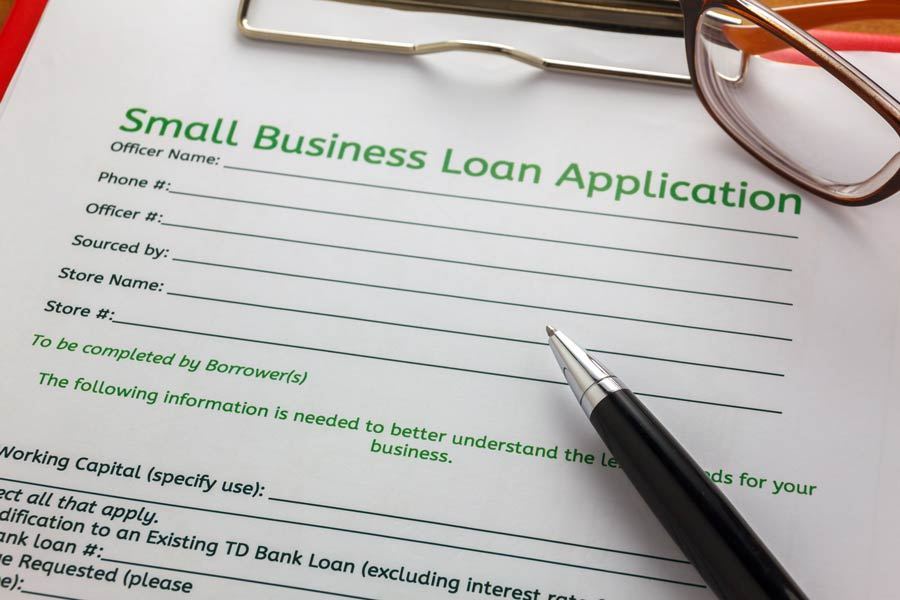

Not the SameHow Startups and Small Businesses Differ When it Comes to Funding

Funding doesn’t determine a startup from a small business; the nature of the business determines the funding.

Wait, What??“A VC is asking 6% for acting as an advisor…”

That’s the start of an all too common question from founders trying to figure out if they should part with equity to get someone involved.