Venture Capital Investor Training

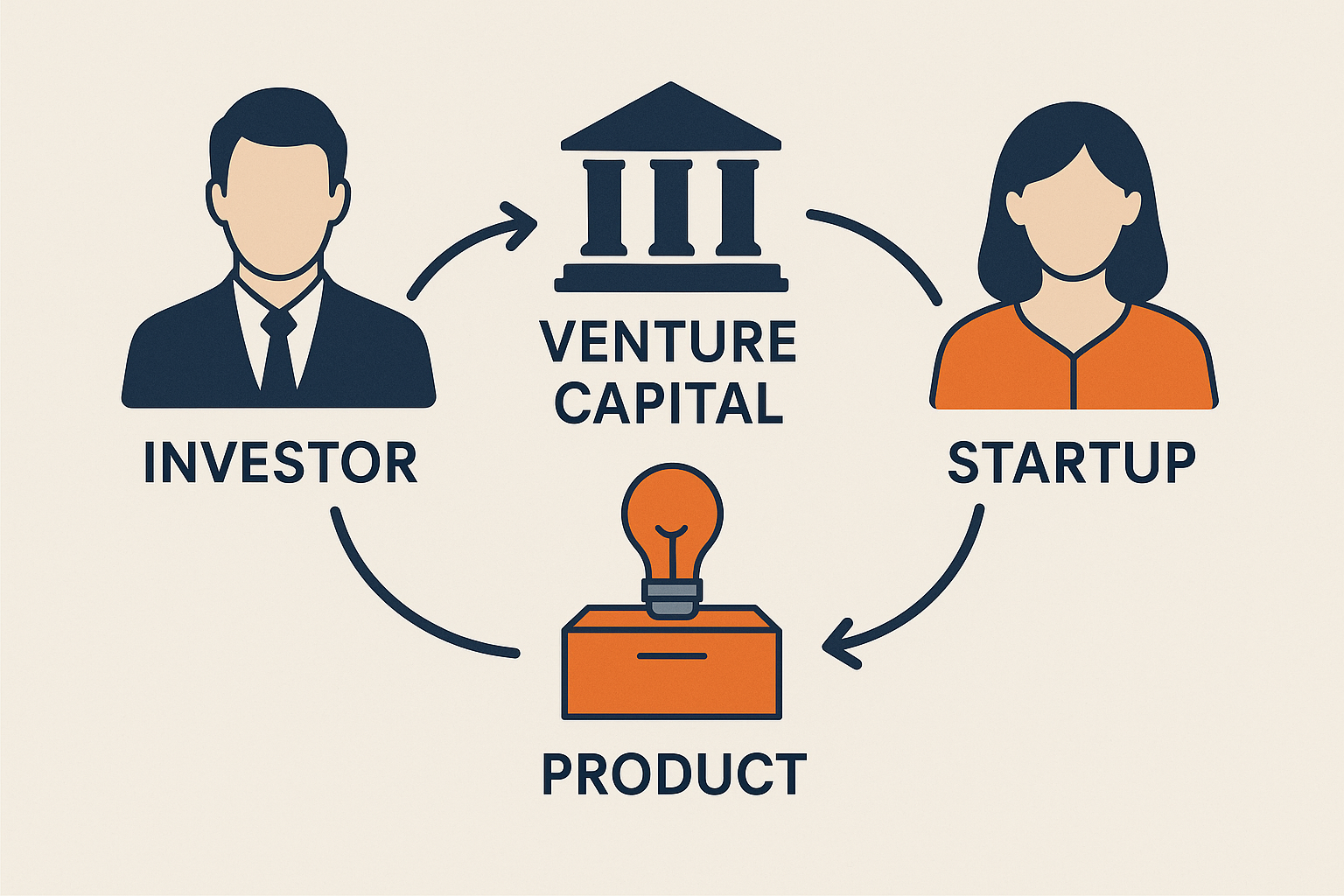

Venture capital isn’t just about writing checks — it’s about understanding markets, evaluating opportunities, and making strategic investments that generate real returns. This is learned from the people who work with startups.

Venture capital education is essential for anyone looking to succeed in this field.

The go-to authority on venture capital, startup ecosystems, and high-growth investment strategies, with decades of experience spanning Silicon Valley, Texas, and global startup economies, Paul has helped countless investors—angel networks, venture funds, and corporate teams—navigate the complexities of startup investing.

Decades of experience in venture-backed startups, economic development, and startup ecosystem building, means I’ve advised founders, investors, and policymakers on how to create sustainable, market-driven venture opportunities that thrive.

Actionable, no-nonsense, market-driven insights tailored to your startup’s stage and industry.

Venture Capital Secrets, Smarter Deals, Better Returns

Whether you need a custom training program, an investor workshop, or a keynote speaker on venture capital, you want more than the education, you want access to the community and an engaging voice of experience that empower investors to make better, smarter investments.

Deep Expertise in Venture Capital & Startup Growth

With a background in VC-backed startups, accelerator programs, and economic development, this is firsthand experience in how venture investing really works.

Real-World Investment Strategies

This isn’t theory. Learn how to evaluate startups, structure deals, and build a winning portfolio.

Engaging, No-Nonsense Speaker & Educator

Whether it’s a private investor workshop or a keynote for your firm, this brings insights that challenge conventional thinking and drive better investment decisions.

Insider Access to Top Startups & Deal Flow

Investors need more than just knowledge—they need access to the right opportunities and our connections in venture networks, accelerators, and startup ecosystems provide investors with an edge in discovery.

Master Venture Capital – Invest Smarter, Win Bigger

Unlock the strategies, insider knowledge, and deal flow access that separate top investors from the rest. Subscribe now to gain the insights and connections you need to make better investments and maximize returns.

“This read right here is better than half the classes at most incubators and 1000% better than any entrepreneur course at a university.”

Nicolia Wiles – PRIMEPR

The Better Startup Pitch Test: Why Most Decks Fail Before Investors Ever Say No

Most pitch decks don’t fail because the startup is doomed (though I’ve explained how we know t…

The Customer of Venture Capital Isn’t the Founder, It’s the Investor

Until Cities Get That Straight, Startups Will Keep Starving for Capital It’s a weird day when the wo…

“I’ll See It When I Believe It,” Entrepreneurs and Startup Investors Put Conviction Before Cash Flow

That tired phrase has been responsible for more missed fortunes than bad timing or bad luck. It’s th…

Bootstrap or Raise Capital: How to Decide What’s Right for Your Startup

If you’re like me, it might have been Labor Day in the U.S., and it was a beautiful one here i…

You Don’t Need Traction. You Need to Understand Why They Say You Do.

There’s a special kind of eye twitch that founders get the 37th time they hear, “We’d love to invest…

Your Startup Pitch is Bad; Let me Explain How I Know

Over the last couple of weeks, I’ve been pushing us to question traditional startup methodolog…