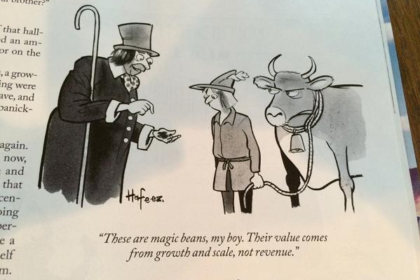

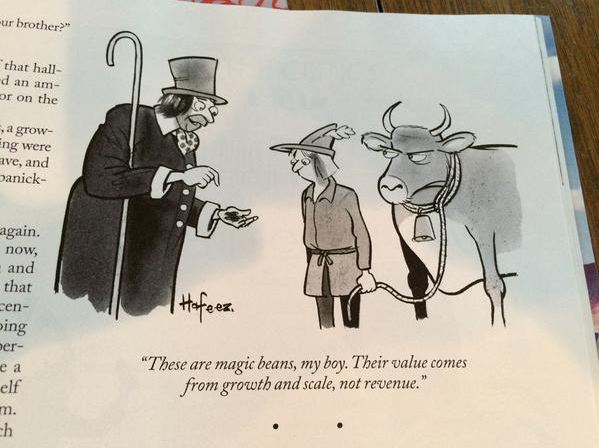

Yesterday, famed New York Times cartoonist Kaamran Hafeez featured a sketch that has garnered quite a bit of attention in the startup community. Implied by one “faction” (a term I’m using not to be critical but to distinguish) to offer a tongue-in-cheek jab at founders and investors who arguably embrace market share and scalability over revenue, the cartoon posits, “These are magic beans, my boy. Their value comes from growth and scale, not revenue.”

Take a look at the cartoon. It’s hard to argue that there isn’t a bias in the message being delivered. On the left, the shady merchant offering the innocent young man beans which promise the boy riches in exchange for the cow. You know the story. Yet it’s the delivery of the message by the merchant that distinguishes between the two types of founders reading the cartoon. “Their value comes from growth and scale, not revenue,” says the con man… come on, trade me, you’ll get rich because these beans grow and scale (ha ha), who needs real revenue?

Depending on how you read it, it’s saying that revenue or growth and scale, matter most. Keep in mind, it’s a con man, a shady merchant, trading the beans he may or may not know will bring trouble, for something of real value, so is he being honest and saying to the kid that the trade is good because the beans indeed create riches because of the scale and growth, or is he spinning a tale the boy wants to hear… this is a good trade, who needs revenue, these will give you scale!

The beauty of a comic, any good cartoon, is it’s ability to make you question your point of view. The risk in a cartoon is that you interpret it only from your point of view, and refer to it as evidence that you’re right. In this case, what is Kaarmran really trying to convey??

It’s an age old debate in the startup community. How do Silicon Valley startups get valued so significantly when they have no revenues?! How do founders raise money without customers?? Clearly you need customer validation and paying customers to affirm that you have a business!! Clearly you need to solve for scale because you can grow a business. Which side of the argument is right? The answer, depends.

Article Highlights

What is your definition of success?

There are two types of entrepreneurs: those that want to start successful businesses and those that want to change the world. It’s a subtle difference; both, varying degrees of success. What I’ve learned over my time in The Valley and in Austin, TX is that generally speaking, you can be and have one, or the other, but achieving both from the get go is near impossible. The difficulty of success in both is in finding the right alignment of your team, priorities, investors, and advisors. Everyone has a passion, some want to create the next Google whereas some are happy being the next Samsung.

What’s wrong with building Google or Samsung?! Nothing at all; I haven’t done it and probably can’t (though I won’t count myself out). But I’ve chosen those two examples intentionally as one epitomizes the success of a Product – Market Fit based approach whereas the other epitomizes a Market – Product Fit. Catch that difference? It’s near impossible to build the right product and serve the ideal market at the same time (what are the odds?!). Rather, you have to start with the product and find the market or start with the market and build the product.

Samsung has always built a product for customers and though innovative in their approach, taking over the smartphone world, they are quintessentially a Product – Market Fit company. Make sure you have customers for your product. Sell it. Revenue = Success.

Samsung has always built a product for customers and though innovative in their approach, taking over the smartphone world, they are quintessentially a Product – Market Fit company. Make sure you have customers for your product. Sell it. Revenue = Success.

On the other hand, Google builds product after product with no mind toward monetization. Indeed, their Search product went without revenue for years as their vision, their goal, was on market first: building something that would index all the world’s information. A day seemingly doesn’t go by without Google launching or acquiring a new product, often shuttering it weeks later or leaving it to languish with no regard to how to sell it. Fundamentally, Growth and Scale = Success. Why? This is tough for many entrepreneurs trying to raise money to grasp; with market share and scalability, your path to greater success is understood – you can instrument your growth and define how you make money.

To really appreciate my point, it helps to understand the difference between growing and scaling your startup, as “growth” can be aligned with your revenue focused priority – after all, success requires some growth of your sales channel. Growth however, is not synonymous with scale, nor is scale simple.

Growing vs. Scaling your Startup

You might liken growth to Sales; with a budget, the right product, and the right price, you can grow your business selling just about anything to anyone. The more you sell, the bigger you get, and Samsung you become. Growth.

But scale is a question of how you design that growth so as to remain ahead of competitors, dominate a market, and change the world. Google didn’t grow by way of customer acquisition given revenues and budgets; they scaled by understanding their market, the potential of the technology, and changing the way we find websites online. In the process, they decimated the value of precursors such as Excite@Home, AOL, MSN, and Yahoo such that they’ve defined the search marketing industry. Only after determining how to scale (and win) did they turn to revenue.

Neither is wrong but it’s critical to understand which it is that you, your partners, team, advisors, and investors are. A Market – Product Fit founder building the next Google and focused on growth and scale first, revenue second, will fail if their team and investors are seeking revenues. The Product – Market Fit founder will fail if chasing customers and customer desires alone when their investors and team members want to build the next $40 billion valuation (the customer is NOT always right).

The risk inherent in not aligning your approach, is that it is, frankly, rather easy to grow and sell OR scale. The problem is that it’s all too easy to get distracted and lose your way. Consider, if it isn’t that hard to sell just about anything to anyone, it isn’t difficult to think that early customers and revenue = the right answer and off you go. What if that’s wrong? Or too slow? Or just a niche? Oops. On the other hand, if you know how search engines, email, optimization, and marketing work, you can architect the scale of just about anything, but what if you do that with a product no one wants? Oops. Without the alignment of your team around your vision as a founder (scale or revenue), you’ll get distracted and fail. And while Google can afford to test, try, acquire, let languish, and fail on grand scales – today – you can’t, so if you’re chasing a market, you have to be truly committed and visionary as a Market – Product Fit founder; just as Google’s founders were in the beginning, if you hope to retain the focus needed to find success.

The Tale of Two Founders.

The Product – Market Fit founders, the Lean Startup enthusiasts who proclaim paying customers are the definition of success, seem to be trumpeting this cartoon as implying their very message: don’t fall for the bill of goods from the con man that growth and scale creates value, not revenue. And for them, if their companies (teams and investors) are clearly aligned as such, they’re right. And yet, I think most are neglecting the subtlety of nature of the cartoon: the story of the boy with the cow and the magic beans, that without the growth and scale of the bean stalk, the boy would have never found the riches above the clouds.

Sounds like Bull to me ( see what I did there) ?

True and precious advice to founders. Although valuation drivers change with the development of a company, at early stages (bootstrapping, seeding for sure), growth and scale must be the obsession of founders.