Yesterday, I had the distinct honor of hosting a topic of discussion during the first conference focused on the convergence of mobile, gaming, entertainment, and entrepreneurship. I started by remarking that the name of the conference, Captivate, could not have been more appropriately chosen by Jennifer Bullard and Suzanne Freyjadis as the very responsibility of the entrepreneur who hopes to be successful is to captivate the world.

With kudos to the team aside, the conference was indeed a tremendous success and a new cornerstone for Austin’s incredible gaming and mobile communities, it occurred to me that Slideshare alone doesn’t do the audience who heard my talk justice. So while the slides are posted there, and here, let’s get into what it takes to raise money.

Article Highlights

If you’re creative, you have to keep innovating bigger!

Captivate kicked off with a keynote from the co-founder of one of Austin’s most innovative and significant resources. Whurley, co-founder of Chaotic Moon, shared some perspective on innovation and risk that started with the simplest of premises; we know, you should know, that there is no such thing as new ideas, however innovation is at the heart of a startup, “If you’re creative, you have to keep innovating bigger!”

What caught my attention with regard to what it takes to raise capital was not that simple premise but a more subtle point made during the keynote, a fact that most entrepreneurs (and far too many investors and advisors) overlook.

“Innovation is about conveying your imagination to someone else.”

Innovation and Marketing

Peter Drucker, the man many say invented management, was a brilliant writer, professor, management consultant and self-described “social ecologist,” who explored the way human beings organize themselves and interact much the way an ecologist would observe and analyze the biological world. As an amateur sociologist, entrepreneur, and science geek myself, it isn’t too much of a leap to realize why I’m a bit of a Druckerist. Whurley’s comment struck me to the core for the very reason that one of Drucker’s defining principles is the idea that in business, only Marketing and Innovation matter.

|

There are some incredibly subtle points buried in that idea. For one, entrepreneurs have to realize that you can’t acquire customers. Sure, you can pay for downloads, you sign up subscribers, you increase traffic to your website, but customers are those who are engaged with your business, and in innovating an idea, you can only create them anew. To do that, a venture must effectively engage in marketing and innovation. As we turn the discussion to the question of fundraising, consider that venture capitalists and angels don’t give you money to cover your costs. Well, rather, that’s precisely what they are giving you money for, but they aren’t giving it to you because of those costs – if you aren’t prioritizing, focusing, on the activities that produce results, you will not raise money.

And yet, survey’s of company priorities often reveal a consistent focus: Finance (you have to have and manage money), Sales (Sales = traction), Production (you have to have a product, an MVP at least), Management (you have to lead and/or have a strong founding team), Legal (Who doesn’t think patent trolls are a problem? And your IP IS worth something!), and People. Only the last I’d consider having serious merit but what’s alarming is that neither innovation nor marketing fall in that list.

Mind boggling as the advice consistent among successful entrepreneurs is to prioritize the following: Talk to customers, improving account metrics (renewal and referral rates for example), understand the entire market, engage with content marketing (throughout the industry, with customers, and to foster transparency), and AARRR. What is AARRR? We’ll get to that but note first what’s consistent therein: Marketing.

Fundraising Priorities

Here are my four

- Know what’s in the box – YOUR box

- Establish your Marcom foundation – Marcom is Marketing and Communications

- Consider that Culture is far more important than strategy

- Understand investors

Know what’s in the box

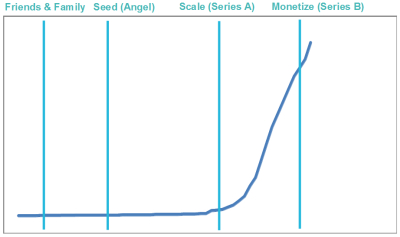

Before you start doing anything more with you business, realize that everything has an adoption curve. The question you and your partners MUST ask and answer, is in which of those curves you believe, and are dedicated.

Before you start doing anything more with you business, realize that everything has an adoption curve. The question you and your partners MUST ask and answer, is in which of those curves you believe, and are dedicated.

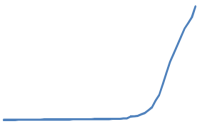

While incredibly unrealistic, this curve to the right represents the ambition of a certain type of entrepreneur: one comfortable with a long development cycle with little fruit from the labor, resulting though in rapid growth that takes the market by storm. Patience, dedication, and passion blended to create something incredible and explosive. Something that will change the world.

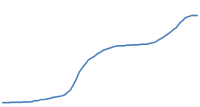

The more familiar, and realistic, curve among entrepreneurs looks something like what I have here to the left. The startup curve. Pivots, shifts, and changes and result in a sustainable business.

The more familiar, and realistic, curve among entrepreneurs looks something like what I have here to the left. The startup curve. Pivots, shifts, and changes and result in a sustainable business.

Entrepreneurs are not cut from the same cloth; some dream a little more while others are practical. Neither is right nor wrong but understanding WHO you are is the key to raising capital as investors have the same approach to the markets in which they are interested.

Four types of entrepreneurs

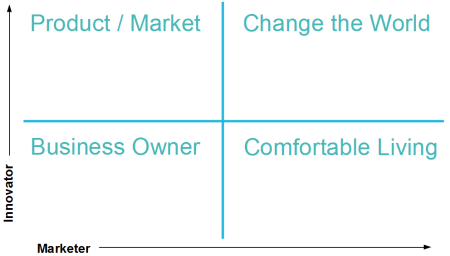

Not long ago, I shared some thoughts on the measure of an entrepreneur and captured the essence of 4 different types.

- The Business Owner – Are you an entrepreneur because you want to own something? Your local restaurateurs might be a good example of this.

- The Comfortable Living – Are you an entrepreneur because you believe you can make a better living yourself? Consider real estate professionals who don’t own their business but excel in creating customers.

- The Product / Market – Perhaps you’ve found a gap in the market to be filled or you have a personal passion to fix or improve something.

- Changing the World – You’re an entrepreneur because what you do is who you are. You’re determined to change the world.

I believe that everyone working for themselves falls on a matrix that looks like this (I haven’t thought of if/how this applies to people that work for others). On the left access, the extent to which one is innovating. Along the bottom, one’s passion for, understanding, and implementation of marketing.

I believe that everyone working for themselves falls on a matrix that looks like this (I haven’t thought of if/how this applies to people that work for others). On the left access, the extent to which one is innovating. Along the bottom, one’s passion for, understanding, and implementation of marketing.

For the sake of this discussion, let’s concern ourselves with the top of the chart. What’s distinct about those on the left vs. the right? Is it Marketing? Surely, each excels in innovation. And don’t misunderstand me, the left side does NOT mean they aren’t marketing nor excellent at it, any more than the bottom means that such entrepreneurs aren’t innovating. This is a question of relative degrees.

Incredible Product / Market fit stories (the upper left):

- Dell – I’m sure being in Austin that someone will skewer me for putting Dell in this camp but consider that Dell found an opportunity in market and filled it. They innovated though they didn’t invent the computer, they didn’t invent ecommerce nor the lean operations principles that let them so significantly capture market share. Their product found a niche and they sold into better than anyone else.

- An Inconvenient Truth – Yes the movie! This is a great example of how important it is to be clear about who you are. Are Gore and the team behind this film passionate? Of course they are. Are they trying to change the world? Well yes, indeed they are too. But were they the type of entrepreneurs to actually succeed in doing it by any means or did they find a segment of the market and speak to it? I think the film found a market and delivered a product that fit. They took an innovative approach to the issue of global warming but their marketing was limited to where it fit.

- Madden – From film to games, it certainly should be said that Madden football has pushed the envelope of graphics, experience, and variety but is it a product that serves a particular market and year after year, it recreates the product with a bit of innovation and serves the same audience.

Let me take a moment and clarify that marketing is NOT about acquiring customers. Marketing, is the link between a society’s requirements and its economic patterns of response. Oof. Hefty thought. The point is, Marketing is about knowing what it takes to change the world and not just sell into a market segment. Of course, marketing results in the customer creation that drove the incredible success of Dell and the popularity of An Inconvenient Truth and Madden, but there are gaps therein that prevented those innovations from entirely dominating and transforming their markets (of course, you could argue with me; this is meant to be more thought provoking than reality – if I’ve made you think about it, my job is done).

Success in Changing the World (the upper right):

- Google – It’s a search engine putting blimps over Africa to provide internet access. If I have to explain further, I’m happy to but I wrote a bit about Google’s ideals here.

- Star Wars – Yes a movie. And more money in merchandising than you can imagine. And people who dress up as Jedi Knights decades later. And legions of fans who could have made a better Episode I.

- Grand Theft Auto IV – Did you notice when they got world headlines for announcing that Amazon breached the embargo before the release and started shipping orders to people? Oops. I wonder how much that advertising cost.

The simple point is that the fundamental philosophies of those companies determine how and where investors will pay attention. If you’re a dreamer, raising capital from the practical investor is likely a waste of time. If you’re practical, looking for that validated product / market fit, pitching a dreamer is probably a waste of their time. The distinction is Marketing because, as Drucker once said, “The aim of Marketing is to make selling superfluous.” If you have to sell your product or idea to customers, partners, or investors, you aren’t effectively marketing.

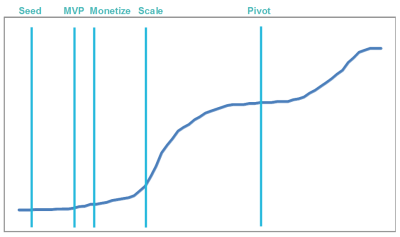

Let’s get back to the adoption curves for a moment and consider how those curves are a reflection of those philosophies.

On the left, the more realistic curve with pivots and fits and starts. You’re probably on that curve if you think in terms of an MVP, validation, and pivots; not because that’s wrong, it’s a very effective approach to startups, but because it’s focused on trying to find a way to fit an innovation into a market. It tends to focus on monetization earlier and as such, requires a different approach to investment. On the right, the aspirational curve of a dreamer who doesn’t need validation. For those individuals, seed capital from investors is usually raised on the dream and the passion for innovation while subsequent rounds follow that dream – first, changing the world by getting everyone involved; then, figuring out how to make money.

Your Marcom Foundation

The distinction between the two lies not in innovation but marketing so let’s start with your foundation. You might be surprised to find that my priorities for you are NOT in lead gen, SEO, search marketing, social marketing, or email; your foundation is not in acquiring customers! Regardless of your philosophy, think about this: everyone one of your competitors can buy the exact same lists, build the exact same website, optimize the same funnels, and bid the same keywords. You will not excel, you will not differentiate your business, by considering marketing marketing merely customer acquisition. Without this foundation, for every dollar you spend, you’re probably hoping to recover one. With a foundation, we’re turning a dollar spent into evangelists for life and revenue streams.

Innovation AND Marketing

If you aren’t treating marketing as a necessary, productive investment, and rather, a cost (as too many entrepreneurs do), you will fail. A solid foundation in marketing comes not from a book but from experience in your industry. The following core components of your foundation are well known by experienced, effective marketers in your industry; rather than hiring an agency or trying to figure this out yourself, start building your team with an investment in the right partner – the partner who can create synergy in your marketing channels by establishing this foundation:

- Business Intelligence & Analytics; there is no excuse for not knowing everything about your business, market, website, and performance.

- User Experience & Design; take as long as it takes to get this right. Let me put it bluntly: quality equals conversions and referrals. When you spend to acquired a customer (yes, I meant “acquire”), that money spent should result in 3 more – it won’t if you don’t nail your UX and design.

- Website Architecture; I’m not talking about whether or not your site is done in HTML5 or Ruby on Rails, we’re talking about architecting the hierarchy, navigation, and user experience. Heck, we’re talking about more than architecting your site, give this a read: Architecting Growth.

- Content Marketing; What stories are you going to tell? No, not your story. Stories. Understand the role that a blog, press releases, partnerships, and social media play in those stories. Here’s a tip, you aren’t tweeting to acquire customers.

- Optimization & Capture; Build your app or website in such a way that you are constantly optimizing and capturing every potential lead. I’ve done it with this site – yep, this little ole blog has a CRM and Marketing Automation on the back end so I know who’s here, when you’re here, when you come back, what you view, and the site changes based on that interaction.

What is your engagement model?

The reason it’s so important to understand creating customers vs. acquiring customers is that the oft made joke about the Silicon Valley-like aspiration and that logarithmic growth curve is that they have this unreasonable believe that if you can just get a million users, you can make money. You get funded to scale, then make money. Coming from the Valley myself, I hear that crack all the time, people are astounded at how so many technologies come out of the Valley having acquired millions of users before making dollar one (think Facebook, Twitter, Google, Yahoo…).

Here’s the hook: HAVING THOSE CUSTOMERS MEANS NOTHING. Acquisition alone is a fairly worthless endeavor and entrepreneurs and investors with that aspirational goal to change the world know that. Having millions of users means nothing in and of itself. It does however, mean brand awareness and an incredible sample size from which to test and learn in minutes what it takes smaller competitors days or weeks to learn. What really matters to your business, your Key Performance Indicators if you will, should be tied to the AARRR model popularized by Steve Blank and Dave McClure.

- Acquisition

- Activation

- Retention

- Referral

- Revenue

Every successful entrepreneur with which I’ve worked focuses on the middle: retention and referral rates. Most of the advice I hear from advisors, investors, and incubators starts and ends with the first and last: acquire customer and revenue. Explain to me how your business will excel above and beyond other in your space if your acquired customers are retained or referring others? Explain to me how you can conceive of any investor wanting to give you money if you don’t focus on creating a business that creates customers who are retained and referring others? Investors aren’t investing in your costs, they are investing in your results.

Upon this foundation you build your functional marketing: SEM, email, print, events and tradeshows, etc. And upon that, your culture and public relations (not just press releases but customer service, employees, partners, and position in the media), expands. Too many entrepreneurs focus only on the middle of such a pyramid, thinking marketing channels alone will get them ahead, but it’s the top and the bottom of this model that fosters synergy and growth. I could go on for hours (er, pages) about marketing but this is about fundraising, learn more about startup marketing here, let’s talk about the other end of this pyramid.

Culture Over Strategy

There is no better story to tell in this case than that of Zappos. Luckily, as this post is getting incredibly long, this is a simple story to tell. A shoe store, with an ecommerce site. Why? HOW?! Because they understand that in entrepreneurship, it’s not about what you’re doing nor you’re exit, but what comes after that.

There is no better story to tell in this case than that of Zappos. Luckily, as this post is getting incredibly long, this is a simple story to tell. A shoe store, with an ecommerce site. Why? HOW?! Because they understand that in entrepreneurship, it’s not about what you’re doing nor you’re exit, but what comes after that.

(I hope the subtlety of what culture is eating for breakfast isn’t lost on you)

Zappos is in the business of delivering happiness. It just so happens that they sell shoes. In defining and developing their culture first they created a world-renowned brand and a world-class business. Their culture, their passion, purpose, story, and brand (ahem… marketing), arguably made their approach the marketing, the strategy, irrelevant. Take the time to define and develop your culture and ensure that that culture is conveyed to others. That’s the secret of PR. That’s the trick to social marketing. And when those stories are told and embraced, your strategy is arguably irrelevant.

Understanding Investors

After all, the entire point of this talk, this post, was to help us all understand what it takes to raise money. Hopefully now you appreciate why your philosophy, your approach, is so important. No two investors are alike and what one investor embraces, another shuns. You’re wasting your time if you fundamentally disagree with a source of capital. To help you understand the implications of your philosophy, you have to understand your business and your market, and that requires a foundation in Marcom. Only from that foundation, and with a clear, exciting, and engaging culture, do your efforts in marketing pay off in spades. Only then are your investments in marketing costs to acquire individuals so you can create new customers worthwhile. Because with those elements in your business, sales becomes superfluous – you don’t need to reach out to, nor convince, others to engage with you; great employees, partners, customers, and investors will flock to you.

So let me leave you with a couple of thought provoking ideas about investors. I don’t know that this advise is solid but it’s worth consideration.

1. Never tell an investor they are wrong. Wait… what?? Really? Never is such an extreme term; certainly, some investors love a good debate. Well of course they do. Think of it this way, an investor that’s wrong (someone you’re about to refute) isn’t as likely an investor that’s passionate about you and your business. They are advising when their purpose is to invest. They are trying to help when what you need is capital. Why is that?

2. They don’t know your business better than you do. Even if you’re new to the startup scene, just out of school perhaps, if they knew your industry, market, and better than you, they’d be doing what you’re doing (there is more money to be made in owning an explosive new venture than investing in them). Don’t misunderstand, they are worth their weight in gold when it comes to what you can learn from them but you know best. Or rather, you should know best, shouldn’t you?

3. Engaged Investors Question Everything. If one and two are correct, and again, I’m not saying they are; this is food for thought. If one and two are correct, this happens. Investors that believe in you and your passion, your culture, your performance, and your ambition, question you. You are on to something incredible and they need to validate what they think to be true by questioning everything.

Over drinks one night, with some board members at a former startup, one joked (though seriously) that the best presentation from an entrepreneur is the one that looks like this.

Over drinks one night, with some board members at a former startup, one joked (though seriously) that the best presentation from an entrepreneur is the one that looks like this.

If you’ve done what it takes to raise money, your conversation with an investor should be just that, a conversation; due diligence. That doesn’t preclude the need to build the fundraising deck, to know your financials, and competitors, and team, and roadmap; but that’s an exercise in knowing your business and how to run it.

Investment is born of passion and ideas. Successful businesses worthy of investment are born of the only things that produce results: Innovation and Marketing.

I’ve never considered entrepreneurs being on a marketing/innovating scale, that was really interesting! I also liked your idea that if you market well enough, you shouldn’t need to sell.

[…] If you’re creative, you have to keep innovating bigger! […]

[…] Startups are an efficient and exceptional application of innovation and marketing. […]