Not long ago, the Austin Business Journal’s Chris Calnan explored the economic impact of business Incubators in Austin, remarking that the support system for nascent companies is stronger than ever thanks to the explosive impact of these resources. Interestingly, this growth follows on the heels of Austin’s explosion of coworking space, leading to a series of great questions such as if and how the growth of coworking might have predicted or led to the rise of incubators, whether or not these evolutions can be studied for the sake of economic development, and practically, where does one fit in??

As our experience with acquiring working capital evolves, from the comfort with risk on the part of VCs in your town shifting over time to the introduction of Crowdfunding as a serious source of capital, entrepreneurs everywhere are trying to understand not just how to connect, network, and collaborate, but how to develop relationships with the right investors. Incubators, accelerators, and coworking spaces are the place to start.

“Investors of all shapes and sizes are getting a piece of the action by putting small amounts of capital into budding businesses,”

Calnan, “The goal: To do what Paul Graham did with Y Combinator in Silicon Valley. That seed accelerator has pumped cash and other resources into more than 500 startups in about seven years, taking about 6 percent equity along the way.”

Simply put, Calnan adds that whether an angel with a few thousand dollars, or a VC with hundreds of millions in a fund, incubators enable investors to get in at the beginning. Still, with an incredibly diverse set of incubators (and coworking options), Calnan lists the following incubators in Austin alone, Tech Ranch Austin, Dreamit Ventures, Longhorn Startup, IC2 Institute, Door64, Austin Startup, Austin Technology Incubator, Napkin Venture, Incubation Station, and Austin Tech Live, should you simply leap into any that accepts you or should you be considering first, the right fit?

Finding the Right Fit: coworking, incubator, or accelerator?

As we’ve explored here before, culture trumps strategy, every time. Finding the right fit for you as a person, your team, and your passion, is critical. To wit, the initial Boston operation of Y Combinator was closed out of frustration with New England’s typical investment style; making it difficult for Y Combinator’s consumer, web-based ventures to to receive funding.

As we’ve explored here before, culture trumps strategy, every time. Finding the right fit for you as a person, your team, and your passion, is critical. To wit, the initial Boston operation of Y Combinator was closed out of frustration with New England’s typical investment style; making it difficult for Y Combinator’s consumer, web-based ventures to to receive funding.

Suggesting that where, precisely, matters more than if you get in, no?

Not every company is an easy-to-launch-for-$30,000-social-media juggernaut with no employees. Therefore not every company benefits from a mere 3 month series of introductions,” says Wayne Barz, Manager of The Ben Franklin Technology Partners TechVentures incubator in Bethlehem, PA. Of their diverse collection of medical diagnostic, advanced material, semiconductor, and electronic device companies he adds, “These companies require significantly more time to get up and running. Companies in our facility are there for 12 months at a time. We ask many to depart for lack of execution before they reach a 5 year maximum.”

Vijay Anand, Founding Partner at The Startup Centre, suggested a bottom line on the distinction between incubators and accelerators:

- Incubators and Accelerators are not terminologies to be used Inter-changeably. They both mean very different things.

- We need both the Incubator Ecosystem and the Accelerator Ecosystem for the Larger landscape to remain a healthy one

- The process and learnings from the faster iterations of Accelerators would fuel the larger incubator ecosystem as well in the longer run.

- Accelerators as a Model, work only for “Fringe” opportunities for Software and Software-based Startups

I’m still a little unclear about the difference though, aren’t you?

“The conditions Y Combinator enjoys are not present in Austin and other parts of the nation, making it difficult to get the same results with the same business model,” shared Austin-based bootstrap evangelist and author of “The Human Fabric,” Bijoy Goswami, with Chris Calnan, “In short, the size of Silicon Valley’s  investment and startup community eclipses Austin’s. The Bay Area counts VC investments at the end of the year in the thousands; Austin by the dozens. And while the University of Texas and other local universities are prized talent generators, they’re outgunnned — especially tech-wise — by the collective power of Stanford University, Cal Tech and dozens of other schools in the Bay Area.”

investment and startup community eclipses Austin’s. The Bay Area counts VC investments at the end of the year in the thousands; Austin by the dozens. And while the University of Texas and other local universities are prized talent generators, they’re outgunnned — especially tech-wise — by the collective power of Stanford University, Cal Tech and dozens of other schools in the Bay Area.”

“People are trying to replicate the [Y Combinator] model without understanding all that supports it,” Goswami added.

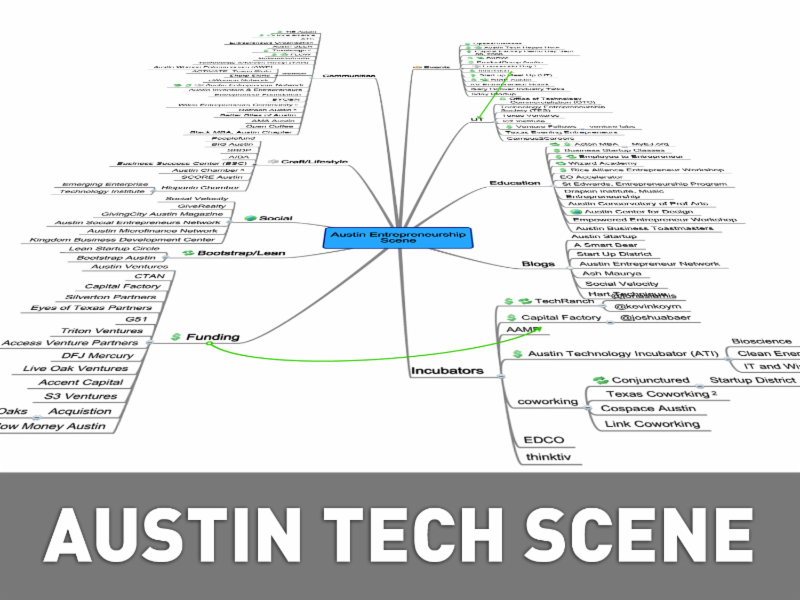

A ha! Every community, your city as well as mine, is unique, with as many variables as Goswami’s mind map of Austin lays out. What might be an incubator in your town may not be the same where I live. Where entrepreneurs may best be served by getting involved with the coworking space down the street, your venture, in your town, may be better suited to the accelerator downtown. Wherein do we understand all that’s involved? All that supports it? We have to experience them all and simply ask, “what makes you distinct and right for me?” Rather than merely applying an crossing your fingers in hopes of getting in to such programs, qualify their role on your behalf – are you right for me?

And that’s why I’m incredible excited that many of the leaders of such spaces in Austin, are getting together to explore the very question of WHERE.

Where should you work?

Thursday November 14, 2013 from 2:00 PM to 5:00 PM CST at Austin’s IBM Innovation Center, the Texas State SBDC, is hosting many of Austin’s coworking, incubator, and accelerator thought leaders in the ambitious goal of understanding the role they play, distinctly and collectively, in Austin.

The Texas State SBDC’s Spectrum program blends mentorship, education, and collaboration to assist innovators and their technologies from ideation to commercialization using the tools and resources that already exist in the technology eco-system.

Some topics we’re going to explore

- Where does innovation begin?

- What is the role of incubators, accelerators, an office, or coworking? How do I know what’s right for me? How do the services you all provide weave together to foster success for business owners?

- Are there hybrids of coworking and incubation, or office space and classes? If so, why?

- Austin likely has the highest per capita % of coworking spaces in the country begging a question such as what that means for commercial office property owners. Why is Austin’s culture and community (and yours) moving into shared work space?

- How do such spaces seed not just ideas and collaboration, but work collectively to attract capital, talent, and attention to your market and industry?

Joining us in Austin are

- Kerry Rupp; CEO of DreamIt Ventures

- Jason Seats; Managing Director of Tech Stars Austin

- Kevin Koym; Co-Founder of Tech Ranch

- Ryan Field; Research and Information Manager at ATI

- Stephen Frayser; Executive Director of STAR Park

- Kris Looney: President of Emergent Technologies

- Josh Baer; Executive Director of Capital Factory

- Alex Smith; Longhorn Startup Mentor

- Brian Schoenbaum; Founder and Creative Director at Vuka

To know where and how you fit, you have to explore your community from the 30,000 foot view and first ask why. What role does your space play? How does it benefit me? And why should I get involved? If you’re in Austin, I hope you’ll join us: register here

Starting a Venture Capital Company in Austin, Texas, Asking for Ideas and Advice, Advisers, Investors, and Mentors

I am searching for ideas and advice as well as Advisers and Investors as I will be starting a Venture Capital Company in Austin, Texas.

Over the years both in Canada and the USA, I have helped Companies raise money using Venture Capital, Private Equity, Angel Investors, and other forms of Capital.

I have met multiple Companies in Austin, Texas looking for Equity and Start-Up Capital.

Austin, Texas is one of the top areas for Entrepreneurs and a top City for Business.

I have worked at 3 Fortune 1000 Companies, Bank of America – Merrill Lynch, Countrywide, and TD Bank.

I have an International MBA, Completion of the CMA Coursework, and a Microsoft, IT, MCP Certification.

I have 10 years of Financial Planning & Analysis, Accounting, Operations Management Consulting, Internal Audit & Controls, Management, Bank Reconciliation, Payroll, Business Process improvements, Budgeting, Forecasting, Compliance, Financial Statements, IT, P & L, Operations, and Policies and Procedures experience for multiple small, medium, and large Million and Billion Dollar Public and Private Companies both in the USA and Canada.

Please either call me at 619-504-9939 or email me at [email protected] with your ideas and strategies to further discuss your interest in becoming an Advisor, Investor for my Venture Capital Company in Austin, Texas.

Thank you

Jeff Muchnik

great question @seobrien – Much confusion. Here is how I interpret them based on experience:

Incubator: Nourish: Turn idea’s into Proof of Concept / Product Market Fit.

Accelerator: Scale your product / Funding, Connections, etc.

Co-Work: Get a desk!

Loosely the same distinction, appreciate the perspective!

What gives me pause (trying not to put this negatively but in support: positively critical) is when one blends with the other so that founders believe they’re getting incubator/accelerator but it’s really just coworking

Yes, and there is a lot of that going on. General Business Coaching w/o continuity or coordination across the Mentor group creates confusion. Also some of these Coaches/Mentors do way too much talking and way to little listening and therefore too much ineffective guidance.

[…] It’s tested. It’s been done over and over. It’s called an incubator. Not an accelerator (learn the difference), not a coworking space with startup murals and $5 coffee, but a bona fide startup incubator. And […]

Learn how incubation centres help young entrepreneurs navigate challenges through mentorship, workshops, and professional guidance. To read the full blog Click here Thank You.