I have a confession to get off my chest. In my work through Austin, I’ve long celebrated and promoted the maturing of Austin’s startup ecosystem by illuminating that we’re starting to specialize and move beyond downtown; that, as the most effective startup ecosystems do, the city of Austin isn’t generically “tech” and shouldn’t be considered or compared as a “best place for startups” – what makes Austin exceptional is that it is ideal for SOME sectors, and that entrepreneurs and investors thrive efficiently when they focus on where those strengths converge and collaborate.

Austin is CPG, food and beverage, shipping and logistics, smart city, video games, social media and data, 3D printing, and advanced manufacturing, to name a few.

Founders, investors, journalists, the best of use of your time is in identifying the PART of a city where that industry is found and focusing your time and attention there.

This is evident in WHY cities like New York are known for their Districts and is hopefully more appreciating in recognizing that various cities aren’t “best for tech,” “the next Silicon Valley,” nor “ideal for startups,” because macroeconomically, cities have strengths and weaknesses – Atlanta and television, Houston and space or energy, Raleigh Durham’s Research Triangle for biotech and healthcare.

In a world where we’re considering how remote and global workforces can actually work together reasonably well, the fact remains that proximity, face time, and even living close to work, enables entrepreneurship and innovation.

All that said, I’ve not yet shared my confession…

In my talks celebrating Austin’s strengths and rallying people to focus on our specialties, I’ve often pointing out that Austin isn’t, for example, ideal for FinTech.

I’d like to reconcile that and beg your forgiveness by sharing how MediaTech Ventures‘ work in and model of venture development (establishing startup ecosystems in cities), uncovers how wrong I was.

Uncovering FinTech

May 15-18, 2023. CONNECT 23 returns to Austin, TX with insights from industry thought leaders and new innovations to help financial institutions transform their digital banking experience, thanks to Q2.

Now, as a measure of clarifying my own apology, let me point out that I know Q2 well; everyone in Austin does, thanks more publicly and culturally to their support of Austin FC, who plays at Q2 Stadium.

That too said, let me stress that a company does not an ecosystem make, but it’s in that quick glance at the work Q2 is doing, that we can better realize and appreciate the present and future of the ecosystem here, and the fact that I was wrong.

A big part of the reason Silicon Valley was so substantial in innovation is because the companies play an active and collaborative role in supporting their sector. Companies sitting on the sidelines are a sign that that region of the world isn’t actually creative, innovative, and supportive of entrepreneurship; they’re happy doing what they do behind closed doors. And there is nothing at all wrong with a company operating that way, but when the companies in your city aren’t involved, it’s valid to ask WHY they aren’t hosting meetups, underwriting innovation programs, producing conferences, and sponsoring the culture.

A better part of how and why Austin has become the hub of innovation and entrepreneurship that it is SXSW, a conference, and the opportunity for everyone here to connect, learn, and collaborate, in that case, with a hint of Film and Music driving the innovation. Q2’s CONNECT 23 is an investment in FinTech Austin.

Let me take a step back though, and clarify Venture Development.

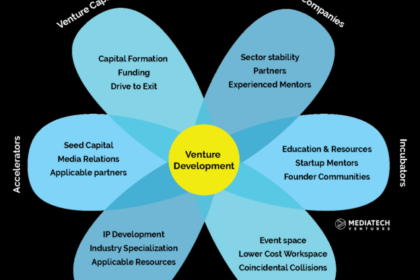

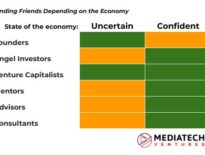

When we work with cities, VCs, and companies to help a region of the world develop a startup ecosystem, we’re looking holistically at sectors of the economy there to discern and strengthen that which already exists.

From companies we look to incubators and where geographically (in coworking or offices) an industry can be found. We look further into related startup studios, accelerators, and of course, the venture capital ecosystem in support of the sector in question. We do this with a city, to then help put in place whatever might be LACKING so that the entrepreneurs in that region flourish; we organization those gaps in 5 ways: the network of people, education specific to that sector, promotion of the industry itself, the tools and platforms (industry norms) and how well those are established, and the places where people can connect and collaborate.

With these two maps of an ecosystem overlaid, entrepreneurship thrives WHEN the region works with others to close the gaps so that founders aren’t struggling through missing pieces.

While I used to point out that Austin isn’t the banking or financial hub of a place like New York City (hence, it wouldn’t be ideal for FinTech), starting with Q2, Austin’s FinTech ecosystem is much more vibrant than might be obvious.

On June 15, 2021, cryptocurrency-specific legislation was passed under the laws of Texas when Governor Abbott into law amendments to the state’s Business & Commerce Code to address virtual currency. This was the first of its kind in the country. Overall, the law specifically addresses cryptocurrency by recognizing the legal status of virtual currency, ensuring that cryptocurrencies are subject to commercial laws under Texas regulations, and supplying legal rights to cryptocurrency holders. The Act legitimized the legal status of cryptocurrency by providing it a legal definition “a digital representation of value that is used as a medium of exchange, unit of account, or store of value” that is not legal tender. There is quite a bit more to appreciate herein, and my article is not about cryptocurrency so take a peek at Freeman Law’s great summary here if you’re interested. My point is in highlighting how Texas led the way in standardizing recognition of what’s next in FinTech; it wouldn’t have done that without local domain expertise and demand from industry to establish norms.

What my exploration of Q2 should help you see is that what we have is not just a company but a company investing in the ecosystem – providing the Promotion, Network, and Education elements in CONNECT, and driving the creative class and culture by sponsoring the football club’s stadium.

Not yet mentioned, Q2 Innovation Studio, addressing our Incubator and Startup Studio needs and it’s from within Q2’s Innovation Studio that we start to see a flywheel of innovation spin through collaboration in Austin, Tailwind Business Ventures, one of the country’s leaders in banking and finance software development from right here in Central Texas, joined Q2 as their first certified SDK partner.

Pieces of a puzzle come together

Clients have high demands, especially after the pandemic, in terms of what the experience should be and what they want it to feel like. Q2 and Tailwind have been fabulous partners, working with us to customize that experience by segment.”

– Katie Heim, Johnson Financial Group’s senior vice president and director of bank product solutions

Supporting and promoting the ecosystem at large, Tailwind goes well beyond being a company on the sidelines as well, hosting a wonderful series of interviews through FinTech and other industries, called Humanizing Software. Subscribe (via LinkedIn), because it’s only in FOCUSING your work on the participants in the ecosystem that you start to see the patterns that I overlooked and find what is more meaningful to your work and to help you thrive. For example, one of Andrew Tull’s earlier interviews was with Gartner’s Teri Kelly, who’s career in data science previously had her working with Austin based Valkyrie, where founder Charlie Burgoyne and then Principal Scientist Dr. Meredith Butterfield penned, Why Banks Need to Radically Rethink Data.

Now is the time for banks to pivot quickly with the customer at the center of their strategy and with new tools to understand their behavior and new solutions to serve their needs. This is the moment to experiment, to take risks and test the waters as we chart a plan and put a stronger foundation in place to sustain our growth. New technologies, new products and new relationships to data aggregation are going to be the fuel for the future.”

That thought epitomizes the culture and spirit of Austin itself and so it certainly reflects that we’re here a hub of FinTech and innovation in banking and finance.

Chief Innovation and Technology Officer Allan Rayson was been named the 2022 Digital Banker of the Year by American Banker. His innovative digital strategy for Encore Bank, through Austin, played unprecedented growth for a bank, which surpassed $2 billion in assets in May 2022, just three years after being founded in 2019.

In the spring of this year, PayPal announced consolidation of their offices in the region into the Domain in North Austin. PayPal’s buildout of the 60,000-square-feet office — about 20 percent of the building’s leasable space – signals the strength and focus of WHERE to be, and my point that a mature ecosystem of innovation identifies in what part of town to concentrate. Tailwind is in Cedar Park, NW of Austin, Q2 is in NW Austin, and PayPal is consolidating there as well… VISA has offices off 183 in NW Austin… and I could go on.

What it’s well time to explore and energize is that Austin is FinTech and with more concentration of events, meetups, investors, journalists, and companies, in financial innovation in the NW region of this city, we’ll see innovation and entrepreneurship thrive through collaboration, connection, and concentration of the future of Finance here. We can do more, let’s develop a FinTech incubator on our platform, let’s support the meetups, and let’s help the media tell the stories such as this, so that everyone knows why Austin.

Q2’s CONNECT 23 is here in a matter of weeks. As we do in Austin with SXSW, take advantage of it, whatever your role in FinTech – get together, meet, and work together; the ideal way to start is by connecting with everyone and every company I’ve mentioned here so that your work as a FinTech founder flourishes (I love ending on alliteration!)

Love this idea Paul O’Brien! Very timely as some of our local banks need help keeping pace with the #fintech evolution. I just pinged Andrew Tull on this today (ESP!)

Been on my mind for a while, through media, we see a ton of payment/monetization platforms… Really want to get the team in place with us to launch a FinTech focused program

Paul O’Brien Austin has come a long way in FinTech since I started my company here in late 2011 – I felt very alone. It’s different now. I recently joined DoubleCheck Solutions – also a Q2 partner – with a headquarters here. This segment is huge, and I’m excited to see what future innovations will bring!

Brilliant Jon Weisblatt

Let’s weave all you’re doing into the narrative

Nice read Paul O’Brien. Would love to see more fintech in Austin…We have quite a few colleagues @ Brex building and operating in Austin! I’m currently planning a Brex Supper Club with fintech founders in Austin as well!

All here, take note

Michael Morgenstern, let’s get you on board our Incubators as we get FinTech off the ground

And in any event, thank you

Great share Paul O’Brien

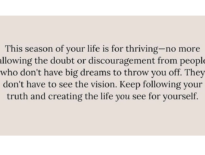

This is a great time to pursue this Paul O’Brien! Despite the economic headwinds that will persist through 2023 (and the first part of ‘24) there is a lot of momentum behind the #fintech space. Let’s do it!

YESSIR! Let’s chat next week

[…] O’Brien, Austin ecosystem developer and CEO of MediaTech […]