A challenge of the premise behind the famous 10 slides; as you prepare to take the stage to pitch, think about how the idea of an elevator pitch (what you say in 30 seconds or less to convince your audience to listen further) factors in.

Generally speaking, if you don’t close a deal in the first 3 bullets, you’ve failed to figure out the messaging as the rest is merely information contingent on the first 3 points.

How to approach your startup pitch

There are many schools of thought on the pitch deck and how to communicate to investors. From Guy Kawasaki’s 10 slides to Onevest’s Alejandro Cremades’ Killer Pitch Deck, most pitch deck advice follows a scripted format evangelized by all the right thought leaders. Naturally, you’re inclined to defer to that and build what is suggested gets you funded, and they aren’t wrong, but frankly consider that it’s a straightforward template popularized to simplify for new entrepreneurs the idea of pitching.

Invariably, the perfect pitch looks something like this:

- Problem

- Solution

- Product

- Market Size

- Competition

- Traction

- Team

- Go to Market Plan

- Roadmap

Take those slide titles as simply as they are put and you can infer how such direction can lead to a dumbed down story of a venture.

Is there a problem? Yes, of course, here it is. Great, is there a solution? Yep, here and look, we are sure that it’s a billion dollar market and that our competition is behind.

Perhaps that’s the appeal encouraging such a pitch deck; simplification of the story for investors while demanding of the founders pitching that they’ve at least done the minimum amount of due diligence on behalf of their own venture.

Usually in my experience, such communication fails. Think about how easy it is that such simplification leaves a lot of holes: You’ve failed to establish any credibility up front; how can I take the rest seriously? What if I don’t agree that that’s a problem? What if your market size is wrong? What if you overlook a known competitor or the traction isn’t what the audience is seeking?

Rather than merely being a pitch to investors, think of these slides in the context of how you would encourage anyone to engage with you. To close the deal, with who you might be talking, you have to overcome their unique initial objections and answer every conceivable, fundamental question, in 10 slides or less.

Pitch Why

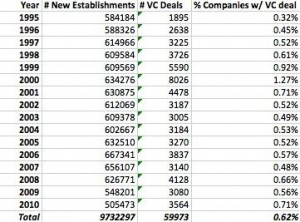

Start with WHY? Want some sobering insight? Market researcher Rick Kelley aggregated some PricewaterhouseCoopers data with new business data from the U.S. Bureau of Labor Statistics and found that roughly only .6% (yes point 6%) of new U.S. businesses receive venture funding. Now granted, there are many reasons for that but as you head into the most important form of communication in your profession, it’s worth explaining to those who have given their time to listen why they will benefit from the conversation.

Answer that question in your mind, why, in the dozens of different ways it could be asked. Why is this an opportunity? Why will anyone care? Why do you care? Why are you capable? Why would anyone pay you for this? Why should investors get involved? More to consider. A simple (though yes perhaps overly simple) approach that I encourage of entrepreneurs is to map out in a shared spreadsheet every conceivable question and answer stemming from the elementary questions who, what, when, where, why, and how. Those answers, pitched in order, add sophistication to your communication and help ensure you aren’t caught off guard while keeping your as simple as being, well, elementary.While the perfect pitch is debatably perfect, ultimately what matters is that you get funded, should you deserve to be. Having heard hundreds of pitches and developing more than a few of my own that have resulted in venture funding, the simple problem — solution statement generally seems to fall short while what works is the evolution of those bullet points a narrative that’s meaningful to everyone and presented in a way that puts the most important information in the first few moments:

- Team — establish credibility, capability, and commitment

- Market Opportunity — problem and solution blended with WHY

- Product Solution — what it is today and what it will be

- Competition — using a pro/con assessment that highlights where you’re not just better than your competition but where they might be better than you. Explain why.

- Staged and Niche Market Size (and cost/barrier to entry_) — how big is the piece of a market that’s applicable and attainable.

- Roadmap — traction, go to market plans, and inflection points (pivots, investments, etc.) in one

- Engagement Opportunity — why an investor would invest (or why a client would buy, why an employee would join, why a partner would care… your previously slides should have capably set the stage for any conversation).

The process of developing your pitch to such a degree is a little more intense and introspective but working through your communication with such diligence helps design everything from your sales pitch to the messaging on your website.

That consistency and clarity are what drive demand!

Close the deal in the first 3 bullets or you’ve failed to figure out the messaging — the rest is merely information contingent on the first 3 points.

Really great points Paul.

From the Angel’s perspective, getting a read on the Founder(s) is the driving force whether or not to get involved. Really understanding their why and determination is such a critical component.

Many startups fail because the Founders give up.

It is incredible how often that’s overlooked Cris; often it’s as simple as reassuring that you can and will.

I think too many ppl go for funding just for the sake of it. Or they are funding focuses – perhaps many ppl should focus on generating sales and business with the same energy they chase funding… I prefer funding for just the growth phase after concept has been proven and sales established.

1. you give less equity away

2. receive better funding terms.

My point of view anyway.

Investors want a product and traction – when you have both just scale it with customers and forget investors.

How do you fund innovation then that isn’t as simple as putting a product in market?

What about starting with the last bullet (why an investor should invest)?

Yeah I’ve had the same thought. That seems to fixate founders on what investors say they want (more customers, more revenue, etc.) and distracts startups from what the economy signals really matters (competitiveness, market, team).

You’re not wrong, I’m just playing with the psychology of people and how we better drive the right perspective to founders.

I can see that – makes sense. My thought is that starting with the why might open the investor/s up to actually hear the rest of what you are pitching rather than anticipating when the why is going to show up. Different psychological approach, I think. Thank you for sharing this!

Joe Lee Daniel J. Valentino, Ph.D. Peter Perez Antony Gallagher

Accordingly to us, the perfect pitch is the one which covers all the elements mentioned by you in your post in an easy to read and understand manner, packed with a persuasive storyline.

From the pitch, the investor should get a clear understanding of:?

1. What problem startup is planning to solve

2. Your solution

3. Is it investable and scalable?

4. Market validation/proof of concept?

5. Does the team have the capabilities to implement it (your team and roadmap slides says it all)?

6. Are you all in?

If you can get a clear ‘Yes’ on a few of the above items, the investors will call you for a meeting because they are also looking for good startups to invest.

The problem comes when you try to convince the investor over the pitch by putting loads of information, belittling your competition, putting ambiguous lines such as significant cost savings, etc. This indeed leaves the investor confused and might not call you for a meeting.

To sum it up…

keep your pitch simple, be honest with what you put in the pitch, and remember the purpose of your pitch deck is to get a FaceTime with the investor and not to right off a cheque.

” packed with a persuasive storyline.” good point.

Thank you Qcept Presentations

Thanks for sharing! Very, very good points.

In my experience too many people sacrifice the right narrative flow for their specific situation to try and fit a specific template/format they think they need to follow. This is a good thread hitting on some of the key points you emphasize: https://twitter.com/epaley/status/1278732792189399041?s=21

All great advice on this thread so far! I think it boils down to presenting investors with what they see as offering them an opportunity to invest rather an a request for funding. The story to prove it needs to be really powerful on all the categories you mention above

Wonderful point and precisely. Too often it’s presented as a potential solution to a perceived problem; and that MAY be an opportunity but as presented, it’s just a possibility.

Proper prior planning prevents poor performance … know your audience. Do your homework on who is going to be in the room. What they have done before. What they might be looking to do. And sell what they want to buy.

Best pitch I’ve witness, was by a single person without a slide-deck. He told his story and took the panel on a journey and the questions and answers just flowed in the conversation that followed. His philosophy, he needs to capture their interest, and if they are interested they will ask the questions he needs to answer. He had the answers, he just didn’t use slides.

I’ve seen something similar Peter and it was indeed incredible. Founders brought up two boxes and proceeded to just tell how one was full of notes from interviews with people who were *not* interested (imagine that). The other, they said, was filled with the interviews with people were ready to pay.

They went on to point out that they brought both on stage so that anyone in the audience could peruse all they’d learned about what NOT to do, so that they could capably serve the market that wanted what they were building.

They got seed checks that night.

Agree completely that the story is important, but I’ve found many startups don’t really have a great story, or one that would make them stand out. I like pitches that answer all my questions before I ask, and don’t spend too much time on touchy feely stuff unless that’s part of the reason that the business will be successful.

I wonder if the startup funding rate is so low because many startups just aren’t that interesting? I know on my own journey, I’ve had some fairly silly startup ideas that would hopefully NOT fund if I had ever pitched them. All part of the learning process as an entrepreneur.

One key thing I’d add to all these comments is an obsessive focus on the customer and how you’re bringing value, particularly differentiating value. If this can be well defined, I’m always impressed.

I agree with all on the compelling and inspiring story piece, but I wanna challenge the part about a “silly” ideas. Ideas that sound silly today might be the real pioneering stuff in the future. Even though most investors and others who receive pitches are smart people, they still have their own biases, preferences, limited cognitive and know-how in some areas. Hence finding an idea “silly” or “revolutionary” is in the eye of the receiver who interprets it differently in his/her own context and time frame.

And yes still there are just pure silly ideas…

I think the point about thinking you have to stick to a set of slides and/or in a particular order gets us tripped up early on; many of the “typical” formats don’t support really good storytelling in their format, e.g., team or product slide coming mid-way through, when maybe either or both of those are key drivers to the solution, and if you were actually “speaking” to this, telling your story, you wouldn’t go in that “order”.

I try to (tend to) teach that the templates are academic; they’re what you’d learn in school about “how to pitch” and then the teacher and class would make you give that pitch a few times as practice.

The facts in there aren’t wrong; but no one really ever actually communicates or works the way that we’re taught in school. We learn the techniques and the methodology; we DO things differently.

Woohoo!! I loved what was said in the original post and comments, so I actually updated my pitch deck to give some level of story or context, more on the “why”. I’m so glad I did.

I will say though that it’s the thoughtful Investors who care more about this and in the past, the feedback I got was to “leave out the fluffy stuff.”

Because it takes a while to get something to properly convey your business in a short time or space, all pitch feedback is/was useful.

What I took that to mean (cut the fluff aka mission statement) was that the story wasn’t compelling. It wasn’t interesting to my audience, so that helped me understand what they were looking for because time is important to everyone and I want to be effective.

The people I was speaking to were not my customers, I needed to make that transition in my head, their use case was different.

I learned its is important to distinguish your audience and know/care where they are coming from. Some people simply don’t care about the things you think are really important and it’s necessary to learn from that. Are those things actually important? Are these just not your people (don’t share common values) Can you do a better job telling the story?

Anyway, thanks for the great post & comments – this helped me and I acted on it. The Pitch feedback sessions that have been suggested will also be very helpful! Paul O’Brien Jason Kraus Kevin Randolph tim logie Adam Gerstein Deva Hazarika Peter de Haan

Appreciate the input here! Haven’t read the rest of the comments yet, instead I ran off to fix my pitch. ??

Glad we could help! My company Prepare 4 VC works with startups to help tell their story, grow their business and fundraise (www.prepare4vc.com). Happy to chat further

Thanks for this Kelly Keurzoneff! That “fluffy stuff” some advise taking out is usually what results in you getting the investors you want rather than the investors simply seeking a financial opportunity and return 🙂

Love this.

Should startups be pitching VCs or interviewing them? I think that latter.

Yup. This is why @oforvertical‘s next accelerator program will be for founders who want to build a revenue-generating tech venture and have it @microacquire’d in as little as 18 months without depending on traditional funding.

Nice summary Paul O’Brien. My 2c on what makes a pitch deck perfect (or at least clear, concise, and compelling, which is the first hurdle where many fail. https://www.linkedin.com/posts/malcolmlewis_founders-startups-fundraising-activity-7348849524179619840-4QAh

Malcolm Lewis wow! Throwback to one of my old ones. And love this, I’ve tackled the TWO myself

https://seobrien.com/the-2-slide-startup-pitch-deck

Paul O’Brien Lol. I searched for “pitch deck” posts to see if I could add some value. Yours came up fast! Must be a classic 😉