Can we connect with investors in 2 slides?

It’s said that at the earliest stage, investors are looking for the right people, validation, and a market opportunity but as pitch coaches, advisors, and incubators focus on the merit of the elevator pitch or the perfect email, does it not make sense that the pitch deck could be as simple?

Look, the pitch deck is far from perfect.

Whether a result of my twitter-like attention span or the fact that venture groups get dozens of pitches per day, 10 slides is a lot of material it we might appreciate that most of that material doesn’t really apply until we’re staring at a term sheet or considering the diligence of your work.

4 things matter most; 2 slides:

- The Opportunity

- The Problem in the economy

- The Solution as a business

- The Market

- The Business Model you have in mind

- The Competition that was, is, and will be

Think about it… present that and IF it’s really an opportunity, I’m interested.

Let’s be honest, your numbers are made up, it doesn’t matter where you went to school nor the title you give yourself now, you’re going to spend the money as best as possible toward the success of the venture, and the amount your raising and terms are just plucked out of the air based on norms from other blog posts and circumstances pulled from Pitchbook and Crunchbase, so are those slides REALLY necessary?

I followed my bullet points with some context in italics because most founders fail to deliver the message that matter.

We need only see the opportunity in the economy and as a business and the model and competition in the market that you propose will work.

“Do you have any customers?” or “how will you make money?” are questions that ignorant or disinterested investors will ask IF you fail to capably present those two slides.

Let’s take a crack…

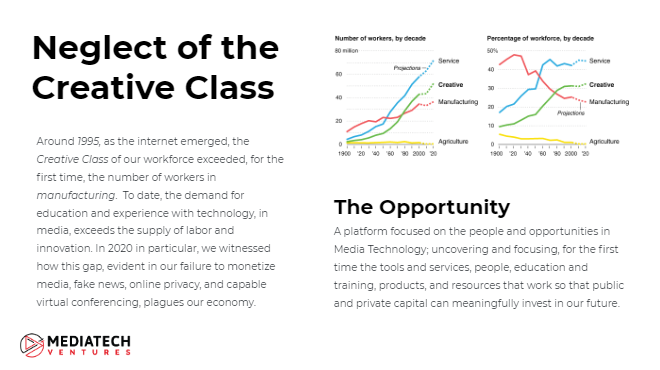

Problem:

Around 1995, as the internet emerged, the Creative Class of our workforce exceeded, for the first time, the number of workers in manufacturing. To date, the demand for education and experience with technology, in media, exceeds the supply of labor and innovation. In 2020 in particular, we witnessed how this gap, evident in our failure to monetize media, fake news, online privacy, and capable virtual conferencing, plagues our economy.

Solution:

A platform focused on the people and opportunities in Media Technology; uncovering and focusing, for the first time the tools and services, people, education and training, products, and resources that work so that public and private capital can meaningfully invest in our future.

Business Model:

Platforms enable all participants in a sector of the economy and as with any platform, users pay a fee for better results, consumers pay for experiences and solutions, and partners pay for data and access to the audience.

Competitors:

IMBD’s data reflects a need, via film, while Techstars Music helps accelerate later stage innovation. Google’s breadth of an index validates demand while LinkedIn serves careers and companies. In this Creative Class, the rapid pace of change exposes the need for a new platform that serves, distinctly, the workforce of a global economy in which everyone, in some way, works online.

Develop Yours With Us

I want to invite you to join me in such discussions live and together.

Join me online here

I think I might take this and modify it for a client sales environment. More specifically for the pre-sale pipeline.

Create this, and then do a story overlaying it inspired by growth.design. Any thoughts?

I think I might take this and modify it for a client sales environment. More specifically for the pre-sale pipeline.

Create this, and then do a story overlaying it inspired by growth.design. Any thoughts?

Love it. One of the most frequent talking points in teaching a Startup Pitch is that it’s *not* a Sales Pitch. Need more examples and distinction to help show that.

Very different audiences, but their can be subtle differences in the presentation of information for the two of them. It’s like phenotype and genotype, slight changes in the first make massive changes in the second.

Of course the idea matters, but what about the team? An “average” idea executed well has a better chance than a great idea executed poorly. No one invests in bad ideas. Yet how many of those investments see a return? Why is that? Often it’s the execution, yes?

Yes, far more than the idea. Driving this was that ideas aren’t viable in a bad market or model. Teams *can* overcome that but if, at the end of the day, there isn’t a market, no team can succeed.

IF the company had been producing and could include the last 3 Monthly Updates, you have a winner. The two slide slide deck is the ‘movie poster’. The last 3 monthly updates are the trailer. Without the trailer you can’t get them hooked….

Ah that’s a neat way to put it. Both work. Both entice us to the movie.

Without either, no one knows (or cares). And if either sucks, you’re going to have a tough box office.

Would love to see this happen. Useful for both the entrepreneur and potential investors.

Part of the challenge is the way people perceive these items is not congruent with market realities frequently.

Smart to include economics in slide one. I would likely push on that in a more explicit fashion as it is a huge source of magical thinking.

I would likely push for more economics in slide 2. Who exactly are you taking money from. Even if new idea generally becomes zero sum problem in final push for sales.

Could be interesting to have a cohort back fit this into their model evolution and see the learnings and outcomes.

Good stuff as always Paul.

Thanks for sharing!

Yeah I think I’m still missing a bit that matters in source of and use of funds, and a bit of team seems too important to just neglect. Still, I love the exercise of focusing on what matters and simplifying the message of an opportunity.

Hmmm. Well… https://www.linkedin.com/feed/update/urn:li:activity:6683529329659445248/

ha yes 🙂 I like exploring different approaches

No right answer, only fresh ideas

I like the idea of keeping it simple. I would add a slide about the current team as well, title or not, since studies have shown strong teams have better chances of startup success. What do you think?

Yeah my head was there too, it almost always comes down to the team, alone, but, I went this way because so many founders miss this stuff. A great team will still fail if the market and model won’t work… A great team can overcome they but without that at all a startup really has nothing.

James Griffin take a look at what his suggesting. I agree completely. The less long-winded wording the better in my opinion.

I like it but traditional VCs want pedigree almost before opportunity. IMHO.

Often, you’re not wrong. The number of incredible founders and opportunities that *don’t *have that is astounding. Trying to find a way to break that tendency some investors have (pedigree, right school, part of the network…) is a bit of what’s driving me to explore different ways of communicating opportunities. Too many people and businesses are overlooked.

I would only add ‘why are we the right team to solve the problem’ to slide 1

I got a few things I would add, maybe about 8 more slides 😉

Ryan – what’s your minimal slide deck look like?

Joe Payton I actually don’t like decks, I like one page exec summaries with bullet points tbh.

Ryan – I nice. Do you have a template you like a lot? I’d love to see it. I like one or two page summaries also

Joe Payton we use our templates with our accel startups, I don’t believe we make them public.

Ryan – my email is [email protected], I’d love to see whatever you’re willing to share. Also interested to be on your Angel list.

I think you still need to show that you’re the right team or that you’re aware of the gaps on your team. I’ve seen several incredible solutions to problems within a great market that were presented by teams with no ability to execute whatsoever.

I completely agree that the numbers are made up and titles are irrelevant.

I think less is usually more but the problem with such a short deck is it doesn’t allow the company to show any true understanding of the 4 things mentioned above. I could make a deck that says

1. Autonomous vehicles are going to revolutionize personal and commercial transportation.

2. Owning a vehicle personally doesn’t make sense when it’s not in use 95% of the time, so we will build a fleet of on demand cabs.

3. Users will pay for usage and access on an as needed or monthly basis.

4. Were competing with traditional car ownership, on-demand taxis, and self driving car manufacturers.

That’s all well and good, but what do I actually know about any of that? What am I/are we uniquely capable of executing in this space? Are we scientists, manufacturers, marketers, or financiers? Is this just an idea or are we post revenue?

All that detail matters to me in taking someone seriously. I get that someone may not want to read more than 2-3 slides to see if it fits their own investment thesis, but certainly you’d want more than just those slides to keep reading more about it?

I think you can cover those 4 slides in a one sentence pitch, and then attach a 6-12 slide deck (depending on stage, complexity, and sophistication level of the company). If you like the sentence, open the deck. If not, no problem.

Here’s a mad-lib style sentence I’ve used over the years to help people craft a one sentence pitch.

COMPANY helps CUSTOMERS solve PROBLEM by providing SOLUTION that is DIFFERENTIATED from COMPETITION.

The team is one of the most important slides IMHO. especially for early-stage companies.

Who cares about the problem or market size if the team doesn’t have the chops to deliver anything?

The business model is not really important either. It’s a hypothesis. The market will dictate what business model you should follow, that slide is not important to me

Very cool topic.

Interesting and thanks Paul. I’d add a slide for sources and uses of investment (past, current, future) and a slide on the team’s credentials (who’s in the cockpit and what missions have they flown before). Angels want to know you have a budget, and you didn’t give the company away to an earlier investment – or intend to dilute you, and they don’t want to invest in the penguins from the movie Madagascar.

Think Paul’s point is that the rest of the slides remain relevant, but it’s not worth digging into if these four topics don’t line up. I’d cut the Business Model, especially for early stage companies, but I do like to see go-to-market strategy, which most startups get wrong. In a first meeting, I spend most of my time on these topics anyway.

“the rest of the slides remain relevant, but it’s not worth digging into if these four topics don’t line up” PRECISELY

Really wrestled with how/if the team slide is not also critical. Many have pointed out that it is and they’re not wrong but I increasingly felt that nailing these 4 things is evidence that team is probably right. Even then, thus, the team is relevant only if these four topics line up.

Spot on. Too many first-time founders fail to realize the importance of market size to investors. If you don’t have a crystal ball, you have to be aiming for the fences on every investment.

Paul, I support the TL;DR approach. I would only add a team slide. For seed rounds especially, the investor mantra is “bet on the jockey, not the horse.”

And it’s not just about venture track record like exits and such. Even if you’re a college (or HS) student, showing what you’ve accomplished can be enough to grab interest, which is the only objective of a deck like this. Then investors will follow up/ask for details.

Paul O’Brien I these topics don’t line up, the right team will fix it.

Roberto Inetti were that true, companies would much more frequently innovate and create new value and opportunity; they have great people and teams.

Not disagreeing; I’m chewing on how one begets the others… great teams can’t overcome ideas that have no merit.

Too many founders egos or teams obscure what matters more; which is simply whether or not there is a market and opportunity.

Not disagreeing with you either 🙂

The market is an unknown for new spaces/markets, all we can have is educated guesses.

Great ideas, very well might sound terrible ideas at the beginning, otherwise, everybody will be doing them.

If I had to choose between a perfect deck with all the answers and a “B” team and a mediocre deck and an “A” team, I will choose the latter every time.

Paul O’Brien, when we were raising for Fallbrook, $150M all in over 10 years, it seemed like every time we turned around, investors wanted more info, not less. We had a couple of slides at the beginning that drew you in, and in the early days a very tight 10 slide or so deck, but in the later stages, some of the decks were 40+ slides. No doubt you have to hook investors unfamiliar with you or the opp (to your point, pedigree, right school, network, etc) in the first few slides, but after that, you’re tailoring to what the investor wants. Some want deep dives on b-model & financials, some want tech deep dives, some want both.

I like the general direction, but the problem is the underwhelming demand for just about everything right now. For example, I think getting creatives to sign up will be relatively easy, but getting clients quite a challenge. And a lopsided market is a painful thing to have built.

A company might sell mainly on: 1) Luxury/exclusivity. 2) Cost savings/vendor switching. 3) Proprietary solution. And surely many other ways I’m not even vaguely aware of. For things getting started now, #2 really seems like the best chance for success to me at-least. Looks like this is closer to #3, although perhaps it has a cost savings component I’m aware of.

I’ve researched the topic endlessly, “how to create projects online that succeed”. It’s probably a heck of a lot more random than we care to admit. But if there’s one thing to pay attention to, it’s price. If the pricing strategy is on point, well, it has better odds to do something amazing than if it’s wrong. Just ask WP Engine.

Paul O’Brien I’d concur that problem/market analysis and solution novelty will typically tell you what the team is made of.

So, as an investor, if your 4 elements line up I’ll be excited about the solution and want to know who’s behind it. How you tell THAT story in 1 slide all but seals the deal.

I’d agree with Roberto’s point above: Even an “A” team won’t have it all figured out just yet. I could invest in that. Conversely, 2 immaculate slides and a “B” team would give me more pause. Not to say they couldn’t and won’t crack it, I just know how finicky/risk averse investors are.

The Great Equalizer here, of course, is real traction. And income always speaks loudest. Those are my “Shark Tank” rules.

Rob Smithson Paul O’Brien

Agree this 2-slide trick is one tool for a robust toolkit that includes potentially endless variations.

An email intro draft / one pager are similar tools that require condensing the company narrative into a few sentences that should fill up no more than ~2 slides.

What about the Team? A slide about the team’s experience and the ability to execute are critical to success.

Personally, I’m a fan of less words and more photos. But…. this is good to leave behind.

There’s something that happens when the brain sees words…. people are less likely to hear what you’re saying, which is usually the part that carries the passion and energy.

I’d highly recommend the book “Resonate.”

Well said and good advice. It’s certainly never been said that I’m short on words ?

Interesting approach, but I think I’m with Zack and Rob, where I’m generally looking for more details than less. That’s surely informed by my history as a biotech investor where the standard first meeting is an hour and decks are somewhere in the 20-50 slide range. I usually don’t need very much on the problem, we’re all pretty aware that cancer sucks, but I’m going to need you to spend a lot of time walking me through the scientific justification for why your solution is going to work. Moving over to the tech world, what I’ve seen so far is an over-emphasis on brevity that I think self-selects for stories that can be easily digested and understood from a 3-minute pitch, and neglects ideas that necessarily involve a lot of investor education.

To spark your interest Reid? I agree, more detail is ultimately needed but when looking at 20 inquiries a day, no one is spending an hour through 40 slides.

Well, when I was an investor, weren’t looking at that many inquiries a day by any means, but we still got quite a few. Generally, we ignored any that didn’t have a hefty section on the scientific rationale. We wouldn’t necessarily go through all of it in detail, we’d wait until a meeting for that, but you could usually tell in one or two minutes of flipping through a deck, who knew what they were talking about and who was trying to sell you something.

I get the idea that Theranos was a master of the 3-minute pitch, and her investors were conditioned to not really dig much deeper. We tried hard to avoid that kind of mistake by filtering at the beginning for companies that were taking a data-centric approach.

Really cool deck Paul! Good old fashioned “less is more”.

Cheers Christopher Greene! Precisely that.

Now I’m playing around with the idea of what’s said in what’s not said. Should get interesting….

I think you’re really onto something. To steal a theatre/film term, more founders should thoroughly evaluate the mise en scène of their deck.

Christopher Greene ooooh! Wonderful notion there (cc Kristie Whites and our other theater fans)… we should play around with that direction of “setting the stage” for funding\

Having been on both sides of the table, I love this approach. Actually, I find it a useful starting point. Any deck I build now, I limit to five slides. Inevitably, they grow. They grow with feedback from investors, etc. etc. Regardless, THIS as a starting point is powerful. If you can’t communicate it in 2-5 slides, you can’t in 20-50… you’re just wasting more time.

Precisely

Great recommendation here. I’ll be filing this one away with @GuyKawasaki’s 10/20/30 Rule