If you still think of New Mexico as a quiet desert between Texas and Arizona, you’re about 80 years behind. This is the state that built the atomic age, test-flew the rockets that defined the Cold War, turned a supposed UFO crash into a tourism engine, and is increasingly the heart of quantum computing.

New Mexico is not “trying to be a startup ecosystem.” It has been an R&D engine for generations. What I want to look at is how well it’s doing finishing the job; turning invention into scalable, visible, compounding entrepreneurship.

As I tend to dig into when exploring a region economically for entrepreneurs, I’ll get into the impact of the history there, the inventions, the money, and the startup development organizations, but this time I want to talk about capacity building because what we have in New Mexico is a region of the world with cities distinct in their own right but an identity uniform in implication; New Mexico startups continue leading in frontier tech begging a question of if that eye to the future becomes a flywheel that accelerates more startups or another set of innovation districts that look great in a brochure while quietly disappointing founders. I’m not suggesting New Mexico is disappointing! We’re here to explore it because you all know what I’m talking about, many regions of the world fall short; I think there is something special happening here from which we might learn.

Article Highlights

- A Culture Built on Risk, Secrecy, and Strange Ideas

- A Long Narrative of Invention From Nukes to Quantum Dots

- The Macro Picture: Oil, Government, Labs… and now Quantum

- New Mexico Startup Development Organizations and the Impactful Infrastructure

- New Mexico’s Capital Stack: angels, funds, and sovereign wealth

- So how good is the New Mexico startup ecosystem really?

- Ten considerations for capacity (where New Mexico is strong, and where it’s not)

- 1. Overcoming silos: shared infrastructure and community

- 2. The missing middle: the gap between early startup and established company

- 3. Securing long-term funding and incentives for ecosystem actors

- 4. Measuring outcomes, not activity (and telling the story)

- 5. Culture and behavior: collaboration as default, not forced

- 6. Including the full spectrum of talent and not just the usual suspects

- 7. Architecting environments where people perform at their highest potential

- 8. Aligning government, academia, and private sector around outcomes

- 9. Ecosystems accelerating innovation and reducing risk by unlocking local competitiveness

- 10. Adapting global best practices to local realities (not copy-pasting Silicon Valley)

- Ten considerations for capacity (where New Mexico is strong, and where it’s not)

- What Might New Mexico Do Now?

A Culture Built on Risk, Secrecy, and Strange Ideas

New Mexico’s innovation story didn’t start with startups. It started with weapons, rockets, and an uncomfortable willingness to be the proving ground for things that might blow up.

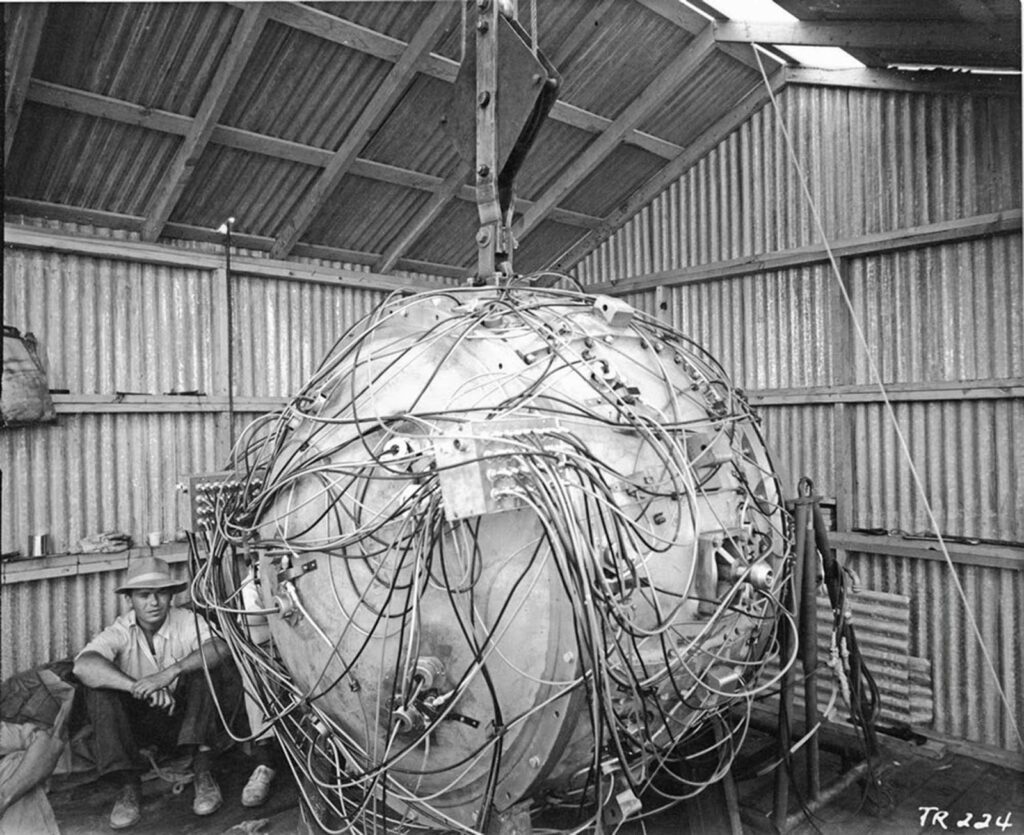

Los Alamos National Laboratory was founded as Project Y in 1943, the top-secret site designing nuclear weapons for the Manhattan Project. Its scientists assembled the “Trinity gadget” (the world’s first tested atomic device) at a ranch site in the New Mexico desert.

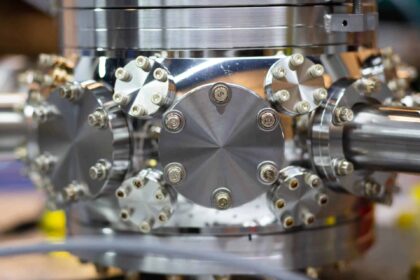

Sandia National Laboratories spun out of that work, beginning as “Z Division” and becoming Sandia Laboratory in 1948; by 1949, it was a major nuclear weapons engineering lab, today a $5.1B operation headquartered at Kirtland Air Force Base in Albuquerque. Since 1949, Sandia scientists and engineers have been doing “breakthrough research in weaponization” (the polite way of saying they build the most sophisticated physical systems on earth.

White Sands Missile Range, established during World War II as a bombing and gunnery range, became a rocket sandbox after the war. From 1946 onward, the U.S. assembled and test-fired 67 captured German V-2 rockets there, and between 1945 and 1954 missile launches went from 14 per year to 656. In 1946, White Sands launched the first American-adapted V-2 high-altitude missile that could be controlled in flight.

So, if we’re asking whether New Mexico’s culture is comfortable with risk and experimentation, we can stop pretending that’s an open question.

That context matters when you look at the cities:

- Los Alamos is effectively a lab town; a place where “almost 80 years of science and innovation to protect the nation” has attracted high-end physicists, engineers, and now quantum scientists.

- Albuquerque sits at the intersection of Sandia, Kirtland AFB, the Air Force Research Lab, and now a growing space and data-science sector. StartupBlink notes ABQ’s ecosystem grew 6.2% in 2025, with nearly 100 startups and over $86M in funding.

- Santa Fe leaned hard into the creative economy. Meow Wolf (the immersive art company) has raised roughly $169M over 8 rounds and is now a globally known experience brand, with the New Mexico Economic Development Department itself listed among investors.

- Las Cruces anchors New Mexico State University and Arrowhead Center, and connects to White Sands and Spaceport America, mixing agriculture, space, and border trade.

- Rio Rancho is literally wired into the global semiconductor supply chain. Intel has invested more than $17B in its New Mexico operations since 1980, with a $3.5B expansion making Rio Rancho its “domestic hub for advanced semiconductor manufacturing,” projected to create 700 new jobs and a $1.2B annual economic impact.

- Roswell is the weird one; a critical feature of a creative and innovative ecosystem. The 1947 “Roswell incident” may have been a crashed military balloon, but the narrative I’m sticking with is that there are little green men squirreled away here thanks to a crash that created the UFO industry; the city’s UFO Festival alone generates over $2M in local spending.

Add Spaceport America, the commercial spaceport used by Virgin Galactic and others, plus NewSpace New Mexico’s co-innovation hub around Kirtland, funded with $11M in federal dollars to “facilitate growth in the emerging space industry” around Albuquerque.

This is not a culture afraid of frontier tech. It’s a culture that normalized it decades ago… but seemingly stopped at the government contract.

Making it a case study in how to start and where to go from there: converting that legacy into a startup economy rather than just a contractor economy; exactly the distinction I’ve hammered on in pieces like “From Texas to Tulsa: How Innovation Shifts to Opportunity.”

A Long Narrative of Invention From Nukes to Quantum Dots

If you draw a straight line from Trinity to quantum computing, New Mexico is what’s under the pencil.

Historically, Los Alamos and Sandia have produced a pipeline of technologies that later become platforms in industry: nuclear engineering methods, materials science, high-performance computing, sensors, and control systems. Los Alamos National Labs explicitly frames its history as “almost 80 years of science and innovation to protect the nation.”

White Sands and the V-2 program provided the early rocketry and telemetry experience that fed the U.S. space program.

Fast-forward to the last decade and you see a pattern: lab-grade invention, spun out into high-growth companies:

- Descartes Labs, founded in 2014 by researchers from Los Alamos National Laboratory, built a “data refinery” turning petabyte-scale satellite imagery into usable analytics. TechCrunch described it as “focused on taking satellite imagery, turning it into something coherent and analyzing it for useful data” after it spun out and raised early capital.

- UbiQD, based in Los Alamos, is a quantum-dot materials company powering greenhouse film and solar applications. Its UbiGro films “use red-shifting quantum dots to optimize sunlight” for crops. A USDA-funded UC Davis study recently showed UbiQD’s quantum-dot glass boosted lettuce yields by nearly 40%. Not a Pinterest mood board, actual peer-reviewed AgTech.

- RS21 in Albuquerque is a data-science company using AI, data engineering, and UX to help organizations make better decisions in health, infrastructure, and security (an Inc. 500 “fastest-growing” company).

- Build With Robots (now Breezy Med) builds disinfecting and automation robots from Albuquerque, selling turn-key systems that “eliminate over 99.9% of pathogens” in public spaces.

- Meow Wolf in Santa Fe took immersive art and story-driven environments, wrapped them in venture and community capital, and built a creative-industries growth engine that has raised at least $169M.

When people are unfamiliar with New Mexico and innovation, they’re just confessing they don’t read beyond Bay Area headlines.

What’s more interesting is that many of these companies look like exactly the kind of “startup studio” infrastructure I’ve argued cities should invest in instead of vanity coworking. Instead of investing in startup ecosystems (places that actually blend infrastructure and innovation) most cities are building overpriced coworking spaces and pretending that counts as ‘innovation.’ New Mexico, by accident, has more of the former than the latter. The question is whether capital and policy have caught up.

The Macro Picture: Oil, Government, Labs… and now Quantum

Macroeconomically, New Mexico is small but leveraged.

Real GDP in 2024 was about $112.8B, growing roughly 2.2% after inflation, with real GDP per capita just under $53K (among the lower tier of U.S. states). Government is the single largest contributor to GDP at about $25.3B.

On the private side, oil and gas quietly bankroll the whole game. New Mexico doubled its oil production from 900K barrels/day in 2019 to 2M by 2024, becoming the second-largest oil producer after Texas and generating $11.3B for state and local governments. Natural gas output also hit record highs, accounting for 8% of U.S. production.

That money is paying for early childhood education and tuition-free college, but it’s also what lets the state create a sovereign wealth-fund-backed venture strategy.

Add the national labs (Los Alamos, Sandia, and the growing nuclear-modernization program) and you have a state whose budget is heavily tied to federal spending and extractive industries. Los Alamos alone is central to a $1.7T modernization push and has added about 2,700 employees in recent years.

This is precisely why the quantum push matters: it’s not a PR flourish, it’s diversification away from a two-legged stool of nukes and oil.

The New Mexico Economic Development Department’s Technology and Innovation Office (TIO) now explicitly supports startups in advanced computing, advanced energy, aerospace, and bioscience, “driving commercialization of innovation” and sector-specific assistance. That office is backing:

- State SBIR/STTR matching grants of up to $100K for local tech companies in sectors like space and climate tech.

- New $5M tech grant rounds for science and technology startups.

New Mexico Startup Development Organizations and the Impactful Infrastructure

This is where things get interesting for founders and investors, because New Mexico quietly has a dense web of Startup Development Organizations (SDOs). It’s not literally every single one but this is the spine.

If you want a map, UNM’s “New Mexico Startup Ecosystem Toolbox” is a decent starting point; it catalogs incubators, accelerators, funds, and support programs statewide. Pull that next to the Founder Institute “Startup Ecosystem Canvas” framework and you can see where New Mexico is strong and where it’s thin.

Some of the core SDOs:

Albuquerque / Central New Mexico

- UNM Rainforest Innovations & InnovateABQ: the tech-transfer and innovation district around UNM; they run SBIR support, licensing, and startup programming tied into the statewide SBIR matching grants.

- CNM Ingenuity & ABQid: Central New Mexico Community College’s engine for applied entrepreneurship. ABQid, once a standalone accelerator, is now under CNM Ingenuity and focuses on early-stage founders with intensive accelerators and investor networks.

- WESST: a statewide small-business and startup support organization with a major hub in Albuquerque, offering training, incubator space, and microloans, notably for women and minority entrepreneurs.

- FatPipe ABQ, The BioScience Center, and similar hubs provide sector-focused coworking and incubation; the Toolbox and local ecosystem maps list them among key innovation centers.

- NewSpace New Mexico: a 501(c)(3) running the Unite & Ignite Space co-innovation hub, providing workspaces, rapid prototyping, and stakeholder coordination across the space industry.

Santa Fe

- Santa Fe Business Incubator (SFBI) is one of the more mature incubators in the state, which has “helped launch and grow over 100 businesses” and continues to diversify the local economy.

- Creative Startups: the “world’s leading accelerator for creative companies,” headquartered in New Mexico but running programs globally, and for over a decade providing creative-industry founders with capital-raising and business-building support.

- Santa Fe’s own business resource map highlights a dense network of mentorship, financing, and incubator programs feeding into these anchors.

Las Cruces / Southern New Mexico

- Arrowhead Center (NMSU): the university’s entrepreneurship engine, “working with students, startups, and communities to create meaningful economic opportunities” statewide.

- Arrowhead SPACE Incubator: supporting startups at the intersection of space, agriculture, and energy.

- Arrowhead RenewTech Accelerator: a clean-energy and water-tech incubator launched with federal EPIC funding, explicitly designed to “support an innovation-centric ecosystem” in New Mexico.

Statewide / Sector-specific

- NewSpace New Mexico (already mentioned) for space.

- NMexus: a new global accelerator in Albuquerque, announced by the Governor at SelectUSA, designed to attract foreign startups. The program aims to support up to 40 companies annually, create 1,500 jobs, and generate roughly $400M in economic impact over five years, and already hosts companies from India and Oman.

On top of that, you’ve got:

- Tribal and Native-focused entrepreneurship programs often run in partnership with Creative Startups and regional partners.

- A variety of local incubators and accelerators cataloged in the Toolbox, from bioscience to rural innovation.

This is not a state lacking in “places to go” as a founder. The opportunity, as usual, is coordination, capital, and narrative; exactly the issues I wrote about in Why Startups and Cities Fail Without a Clear Narrative, “Most cities trying to be ‘the next Austin’ or ‘Silicon Valley’ don’t have a capital problem, they have a belief problem.”

New Mexico’s story is better than its reputation. That’s actually a solvable problem which is why we’re going to turn from my usual economic development assessment of a city to instead explore capacity building here.

New Mexico’s Capital Stack: angels, funds, and sovereign wealth

Now, the money (which is where most regional ecosystem conversations devolve into fantasy).

At the early stage, New Mexico Angels remains the flagship organized angel group; together with vehicles like New Mexico Start-Up Factory and local syndicates, it provides the first checks into lab spin-outs and local founders.

On the institutional side, you have:

- Sun Mountain Capital: a Santa Fe-based firm managing regional private equity and venture funds, often in partnership with the New Mexico State Investment Council (SIC).

- Tramway Venture Partners: an Albuquerque life-science and health-tech VC fund focused on early-stage companies, frequently tied to UNM and lab innovations.

- Cottonwood Technology Fund: historically investing in high-tech startups in the Southwest and Europe, often pulling from lab-related IP in New Mexico.

- Roadrunner Venture Studios: now explicitly part of the quantum strategy, funded to connect scientists with entrepreneurs and turn quantum R&D into companies.

The real accelerant, though, is the state’s sovereign wealth approach.

New Mexico’s new $315M quantum initiative will allocate $185M from the state’s sovereign wealth fund for venture capital firms investing in local quantum businesses, with $60M each from DARPA and the state for Quantum Frontier Project development and commercialization, plus another $25M for Roadrunner’s venture-studio work.

That is not a grant program; that is the state pre-committing to fund the funds that back the companies. It’s the opposite of the “we built a shiny incubator, where are the startups?” model that even Los Alamos Makers has rightly criticized in quoting Allan Wille warning that incubators often focus on real estate and lack focus or experience – the human capital that actually builds companies.

New Mexico’s quantum play is closer to what we have well established as better: invest in studios, infrastructure, and methodology, not furniture.

Why Quantum, and Why Now?

Let’s look at the two key quantum announcements together: the state’s $315M commitment and the DARPA partnership.

Reuters summarized the state’s move succinctly: New Mexico will invest $315M to position itself as a leader in quantum computing, focusing on fabrication facilities, a quantum network based in Albuquerque, and VC support for quantum companies. Governor Michelle Lujan Grisham explicitly tied it to the state’s structural advantages, “a skilled scientific workforce, low-cost land and energy, and the presence of two U.S. National Labs and an Air Force Research Lab.”

On the federal side, DARPA’s Quantum Benchmarking Initiative (QBI) is about figuring out whether quantum computers can reach “utility-scale operation” (where the computational value exceeds cost) by 2033. As part of QBI, DARPA and the state are creating the Quantum Frontier Project, with matching contributions up to $60M each over four years.

DARPA’s Joe Altepeter explained, “World-class national laboratories in New Mexico, such as Sandia and Los Alamos, are already a part of QBI’s independent verification and validation team.”

And Governor Grisham didn’t mince words about stakes:

“Quantum computing may prove to be the most consequential technology of this century — for national security, for breakthrough innovations, and perhaps most importantly, for avoiding strategic surprise.”

This is exactly the kind of future-oriented bet regions should make instead of chasing generic “tech hub” labels. We’re not entering some magical DIY epoch; the reality is that capital still concentrates where the math makes sense: scalable innovation, defensible advantages, and talent density.

New Mexico checks those boxes for quantum:

- National-lab IP and verification capabilities (Sandia, LANL)

- AFRL and defense demand sitting in Albuquerque

- Cheap land and energy relative to coastal peers

- University coordination through efforts like the Quantum New Mexico Institute at UNM and state-level Quantum Moonshot efforts

If Texas has been the poster child for shifting attention from California with its semiconductor incentives, energy grid (such as it is), and startup enthusiasm, New Mexico’s quantum move is the next iteration: go narrower, deeper, and more aligned with your existing R&D base (ironically, something I’ve pushed Texas to do for these very reasons)

Innovation migrates from the coasts to the center, and into communities that rewrite the rules; New Mexico is leaning into being the test range for the next computing paradigm.

So how good is the New Mexico startup ecosystem really?

If you zoom in on Albuquerque, external observers are catching on. A 2025 analysis by EWOR notes that while there’s a growing startup ecosystem, founders still wrestle with regulation and access to funding, but the local focus is often on “building the ecosystem rather than highlighting intense competitive barriers.” StartupBlink’s index has Albuquerque ranked around #215 globally, with just under 100 identifiable startups and ~$86.8M in funding.

This access to funding challenge is something repeated by every EDO (economic development office) in the world and you’re all going at it the wrong way so let’s fix that.

Meanwhile, Intel is pouring billions into Rio Rancho, NewSpace New Mexico is scaling space innovation, and companies like UbiQD, Meow Wolf, RS21, and Build With Robots are concrete proof that deep-tech and creative-tech firms can scale from the state.

What New Mexico is missing is the kind of integrated capacity…

Ten considerations for capacity (where New Mexico is strong, and where it’s not)

On paper, New Mexico is unusually rich in shared infrastructure: InnovateABQ, Arrowhead Center, NewSpace New Mexico, SFBI, the state’s SBIR programs, and a Technology and Innovation Office that explicitly serves startups.

The problem is that labs, universities, defense, and private startups often still operate as parallel universes. Lab employees live in one world, Santa Fe creatives in another, Las Cruces ag-tech founders in a third.

New Mexico does better than most on physical infrastructure. It’s still weak on relational infrastructure (the connective tissue of mentors, repeat founders, and capital that easily crosses sectors) the thing I push in “Marketing and Storytelling Manifest a Startup City”

Good: lots of hubs, lot of R&D infrastructure.

Needs work: cross-pollination and a shared, loud, believable story.

2. The missing middle: the gap between early startup and established company

New Mexico does okay on idea-stage: SBIR assistance, pre-accelerators like Creative Startups LABS, Arrowhead Sprints, CNM/ABQid cohorts.

Where it suffers is exactly where most ecosystems suffer: the $1–10M scale-up zone. That’s the space between “we have a cool prototype” and “we can raise a serious Series B from coastal funds without moving.”

Sun Mountain, Cottonwood, Tramway, and a handful of national funds help bridge that but the number of post-revenue, scaling New Mexico startups is still modest.

Good: clear seed and grant programs, early-stage SDO support.

Needs work: more aggressive growth capital, revenue-driven scale programs, and corporate customers willing to take the first risk.

3. Securing long-term funding and incentives for ecosystem actors

Here, New Mexico is quietly excellent. LEDA expansion, Intel’s use of it, and the sovereign-wealth-fund-backed quantum initiative are long-horizon plays. Intel’s own report notes over $17.6B invested in New Mexico operations since 1980 and ~$1.2B annual economic impact.

The Technology and Innovation Office is not a one-off grant program; it’s a standing unit in the Economic Development Department with a clear mandate.

Good: structural funding mechanisms, not just ARPA-era sugar highs.

Needs work: ensuring SDOs aren’t fighting for the same grant scraps and locking in multi-year commitments for incubators and studios that actually work.

4. Measuring outcomes, not activity (and telling the story)

Here New Mexico behaves like most places and I’m not surprised, the digital age has left marketers behind, and storytelling is slowly emerging again as though it’s something we invented in 2020. With a bias toward listing programs and ribbon cuttings instead of tracking: survival rates, scale-up numbers, export revenues, and follow-on capital, organizations take the shortcut out by making announcements that things are going well.

The Santa Fe Business Incubator does a relatively good job reporting that it has helped launch over 100 companies that continue to diversify the economy. NewSpace New Mexico, Arrowhead, and TIO have some outcome-oriented language (jobs, capital raised, energy impact).

But the statewide narrative still sounds like a brochure, not a dashboard. That’s exactly what I mean when I say “Narrative isn’t fluff. It’s infrastructure.”

Good: pockets of metrics and case studies.

Needs work: a unified, public, relentless scoreboard of startup outcomes and exits.

5. Culture and behavior: collaboration as default, not forced

You do see genuine collaboration: DARPA and the state jointly funding QBI’s Quantum Frontier Project; Intel and state/local governments aligning around a hub strategy; NewSpace New Mexico co-creating with AFRL; UNM and the state co-funding SBIR matches.

But labs still dominate. The New Yorker’s coverage of Los Alamos’ nuclear boom points out the real challenge: the region’s dependence on lab jobs can crowd out other forms of risk-taking and economic diversification.

Good: strong lab–state collaboration and a long history of multi-institution work.

Needs work: more founder-centric norms, more repeat-founder leadership, and less default to “get a lab job and call it a day.”

6. Including the full spectrum of talent and not just the usual suspects

On inclusion, New Mexico has some real advantages and some glaring gaps.

Creative Startups has run programs globally and works with creative entrepreneurs often excluded from traditional tech circles. WESST and various Native-focused programs explicitly support underrepresented founders.

Yet the gravitational center of the ecosystem still sits around PhDs at lab towns and engineers at Intel. That’s great for quantum and semiconductors; it’s less great if you want service, consumer, or community-scale entrepreneurship to thrive.

Good: some of the best creative and Native-focused accelerators anywhere.

Needs work: making sure the quantum and deep-tech boom doesn’t become another closed guild.

7. Architecting environments where people perform at their highest potential

New Mexico actually has an advantage most “innovation districts” don’t: the lifestyle is legitimately attractive – outdoors, culture, affordability relative to coasts, and a creative identity that’s not just a marketing slogan.

What’s missing is that innovation is not a real estate play, and an innovation district is likely disappointing entrepreneurs.

Albuquerque and Santa Fe have not gone nearly as far down the “glass box with free Wi-Fi” rabbit hole as some other cities, which is good. But there’s room to be much more intentional about environments that blend lab-grade work, creative energy, and founder-centric services.

Good: authentic quality of life, meaningful physical assets (labs, spaceport, Intel).

Needs work: fewer generic “hubs,” more integrated, studio-style environments tied to outcomes.

8. Aligning government, academia, and private sector around outcomes

The quantum initiative is a textbook case of alignment done right: state government, DARPA, labs, and venture studios all focused on a 2033 target for utility-scale quantum computing.

New Mexico’s creation of the Technology and Innovation Office inside EDD is another signal; it’s not a side project, it’s in the economic engine.

Compare that to states where economic development, universities, and VCs barely speak, and you can see why DARPA chose to partner here after similar QBI agreements with Illinois and Maryland.

Good: above-average alignment on targeted sectors like quantum, space, semiconductors.

Needs work: pushing that same alignment into broader startup sectors (not just the sexy frontier tech).

9. Ecosystems accelerating innovation and reducing risk by unlocking local competitiveness

This is where New Mexico can genuinely lead.

The combination of:

- National labs validating claims (critical for quantum, climate, and security tech).

- A space innovation hub co-located with Air Force research.

- An ag-tech cluster emerging around quantum-dot greenhouse tech like UbiGro.

- Intel’s advanced packaging and manufacturing presence in Rio Rancho.

…means New Mexico can become the place where high-risk technologies get de-risked faster and cheaper than in coastal cities obsessed with valuations.

Good: extraordinary ability to prototype, test, and validate frontier tech.

Needs work: making sure that when the risk is reduced, the company stays in New Mexico instead of relocating to California at Series B.

10. Adapting global best practices to local realities (not copy-pasting Silicon Valley)

In “To Grow Your Local Startup Community, First Map It Out,” Founder Institute argues that most ecosystems misdiagnose their problem as “a lack of capital” instead of fragmentation; the remedy is to map your ecosystem and intentionally fill the gaps.

New Mexico is doing that; with the Toolbox, with targeted sector plays, with TIO’s sector focus, and with international programs like NMexus bringing in Indian and Omani companies to use New Mexico as a North American landing pad.

This is not Austin, not Boulder, not the Bay. It’s a nuclear-and-oil state with world-class labs, a creative capital city, a spaceport, and a sovereign wealth fund willing to gamble on quantum.

Good: genuine adaptation – quantum, space, creative-tech, and manufacturing, not “let’s build our own SOMA.”

Needs work: more explicit articulation of New Mexico’s model – the “why here, why now” story for founders and funds globally.

What Might New Mexico Do Now?

If you step back, New Mexico is ahead of most U.S. states on the things that actually matter for frontier innovation:

- Deep, long-standing R&D capacity (LANL, Sandia, AFRL, White Sands).

- Real industrial anchors (Intel, Meow Wolf, space companies, deep-tech spin-outs).

- A state government willing to put sovereign-wealth money into venture scale quantum bets and tech grants.

- A growing web of SDOs: Arrowhead, Rainforest, CNM/ABQid, SFBI, Creative Startups, WESST, NewSpace, NMexus.

Where it’s behind is exactly where most ecosystems are behind, but with higher stakes:

- Scaling companies from $1–10M to $100M+ without losing them to the coasts.

Building a capital class that actually understands venture, instead of treating everything like a grant or a real-estate play – the issue I call out directly in “Startup Ecosystems Fail Because of Investors.” - Owning the narrative, instead of letting the national press reduce the state to “labs, nukes, and UFOs.”

Given this specific history, talent, and capital structure, which of these ten levers are you willing to pull this quarter in a way that founders will feel six months from now?

Is it rewriting how your angels do deals? Is it building a quantum-native startup studio aligned with QBI and Roadrunner? Is it a serious, public outcome dashboard? Might it be alignment of a narrative more accessible to entrepreneurs? Is it step easier than most places think such as finally stitching labs, creatives, and space into one ecosystem instead of three silos?

Because New Mexico has already done the hardest part: the risk. It built the infrastructure. It bet on the future with quantum.

The next phase is less glamorous and more uncomfortable: changing local behavior, capital norms, and expectations so that this doesn’t become yet another story of a place that invented the future… and exported all the value.

Wrestling with that tension – between invention and entrepreneurship, between labs and founders – is what many of us love to do so it’s the conversation worth continuing because we now know how to ensure a place like New Mexico isn’t just frontier tech, it’s frontier startups.

Hi Founder Institute I’ve looked at bringing you to New Mexico for a while. Open to a conversation. Contact me

Hi Sandra Hirschberg, MBA, Ayhan K. Isaacs or I can chat with you about this.

Sandra Hirschberg, MBA – Just sent you a connection request

New Mexico offers unique advantages for startups including close cultural ties, shared national border and shared language with the United States’ #2 Trading Partner, Mexico. Economic Development in NM is highly dependent on high-speed, reliable broadband internet across a large and sparsely populated state. It’s great to see support at the Federal and State level for expanding broadband access to rural populations. One major takeaway from a recent hashtag#NMBroadbandSummit I attended was the motto of “New Mexico Solutions for New Mexico Problems.”

Stephen Landis

An inspiring experience.

What’s different this time is that New Mexico has gone beyond technology and put in place most of the infrastructure that will sustain the environment that encourages both innovation and commercialization. There has been and continues to be lots of technical talent and very likely for the foreseeable future. What’s new is there is early-stage money and a supportive ecosystem that provides what most technical entrepreneurs lack (i.e. legal, accounting, marketing, managing and related support) including help with the entrepreneurial journey. Still missing are move-in ready facilities that growing companies need and C level talent that can raise later stage money and scale the companies.

Stuart Rose move in ready, are you referring to merely office space? Or, presumably, something more?

I’d like to hear Sonia Dagan, PhD optinion on her experience with New Mexico since we met last year at the New Mexico House

Great Article, Paul. I just forwarded it to my son, who’s been to both Los Alamos and Sandia with the University of Rochester Lab for Laser Energetics:)

John (JR) Reale

Office space is not the problem. L move-in ready lab space and near move-in manufacturing spaces are in severe shortage

Great analysis and crucial landing: “Is New Mexico finally building the connective tissue (the capacity) that turns 80 years of invention into compounding, founder-led entrepreneurship?”. This is just the beginning. We need to actually capitalize on this great momentum and not repeat mistakes.

Prisca T. What do you think is missing most? Where is the best focus if one thing could be addressed?

The recently published New Mexico S&T Roadmap is a strong high-level strategy, but it underestimates several structural barriers in New Mexico’s innovation reality. Its core weakness is an overreliance on federal laboratories and universities as the primary engines of commercialization, despite decades of evidence – nationally and within NM – that research institutions rarely generate scalable startups… mostly because academic and national lab researchers often don’t want or don’t have time to form companies (I just commented on an article about that.). A national review of technology transfer confirms those issues.

While the Roadmap correctly identifies the state’s scientific strengths, it does not adequately address the on-the-ground gaps that prevent research discoveries from becoming companies, jobs, or diversified regional economies.

New Mexico has world-class science, but not a world-class commercialization pipeline, yet the Roadmap still assumes universities and national labs will fill that role.

Love this, and just to add to it — don’t forget about the $1.8B of capital that the New Mexico State Investment Council has deployed to 35+ of the world’s best VCs to be invested into startups that build from New Mexico!

we keep a running list here: https://docs.google.com/spreadsheets/d/1iDd7_iPX4y49_6YyapbcjJWaMCQFdO1jA8zWZpH6uQc/edit?gid=0#gid=0

David Ellmann thank you!! Wonderful add that I missed

Check this out as well. It adds to Save Ellman’s list by including professional investors active in NM who have not taken money from the SIC. https://www.thebiosciencecenter.com/capital-doc/NM%20Capital%20Continuum.pdf

Love seeing stories like this Paul O’Brien. Building a startup econ outside of the valley is a true rebel flex. Commenting so I can check out the stack later, curious what’s going on.

Connective tissue – a huge mission for us and our tech ecosystem events!

Cheri Wildheart “Rebel flex” indeed!

Paul, Interesting article. Thanks for mentioning cottonwood. Send me a note at [email protected]

Paul, thanks for the solid article. To give a more details…NM Vintage Fund is the most active VC in the state, with more than 10 investments in 2025 and nearing 40 in its 4 years. NMvintagefund.com for more. NM Angels Members supported 17 companies in 2025, serving as an ecosystem partner for the entire state, as well as investor.

The state has some solid collaborations and invites companies, investors and partners. More and more is happening, including a fantastic SkiLiftPitch.com in Taos the other day. NM Innovation Hub just opened in Santa Fe.

All are welcome. Drew Tulchin