Every few years, someone declares a new epoch in entrepreneurship. We’ve had the “Era of Lean,” the “Rise of the Micro-VC,” the “Democratization of Innovation,” and (God help us) the phase where every city believed a coworking space with a yellow logo and a couple late career bankers counted as a “startup ecosystem.”

With AI and criticism of VC throughout the past few years, I cringe at hearing that now is the era of bootstrap not because most founders weren’t bootstrapping but because saying it now is a use a data misrepresenting reality.

Article Highlights

The Era of the Bootstrapped Startup

Welcome to it everyone! Now, your bootstrapping is admirable (as though it wasn’t before). Now, people can really do it themselves (as though they weren’t able before). Don’t look behind the curtain at the fact that the overwhelming majority of all startups have always had to bootstrap, because now it’s an era!

No, it isn’t the era of the bootstrapped startup. And pretending otherwise is how regions misallocate money, how founders misunderstand capital markets, and how bad advice metastasizes into bad policy.

What we’re really experiencing is far less poetic. It’s arithmetic.

And a long-overdue correction to 14 years of terrible incentives.

If you want the TL;DR in one line:

It’s not the era of bootstrapping, it’s the era of more startups and finally better advice.

Let’s walk through the actual cycles because if we don’t ground this in data, history will repeat itself like a The Matrix.

How We Got Here: Two Cycles and a Lot of Disillusioned Founders

Around 2010–2012, cities across the U.S. (and abroad) were in full “Let’s Become Silicon Valley Too” mode. The Kauffman Foundation reported record entrepreneurship rates while the Brookings Institution published reams of research urging regional innovation policy such as, “Rise of Innovation Districts.”

Those weren’t inherently bad.

The problem was how local actors interpreted them.

We entered two seven-year cycles that shaped founder psychology in ways we still haven’t fully unwound. By the way, in startups, it’s helpful to think in terms of 7-year cycles (when they start and end isn’t as important as philosophically appreciating that it takes startups 7-10 years for startups to exit, build enduring companies, or establish new innovation; hence, 15 years = roughly 2 cycles of lessons).

Cycle 1: The Accelerator Gold Rush (2010–2017)

Everyone built an accelerator. Some good. Many dreadful. Most modeled themselves after Techstars or Y Combinator but replaced actual investor networks with “mentors” who were, at best, middle-manager consultants. At worst, people who genuinely believed owning a coworking space made them a venture capitalist.

Founders were told:

- Quit your job

- Pay a membership fee

- Give up 1 percent

- And we’ll “connect you to investors”

It was the Oprah meme brought to life:

“You get funding, and you get funding…”

Except the trunk was empty.

Regions mistook startup participation for startup capacity; exactly why I dug into how ecosystem builders create meaningful startup communities.

Cycle 2: “VC is Broken” (2017–2024)

When accelerators didn’t deliver introductions to VCs (because they couldn’t) founders naturally got pissed.

Meanwhile, new funds were popping up labeling themselves “pre-seed VCs,” which is the linguistic equivalent of “jumbo shrimp.” Pre-seed wasn’t a stage; it was marketing to inexperienced founders.

By 2020, the trope had hardened:

“VC is broken.”

But NVCA data never supported that narrative. Early-stage venture remained a power-law game, with a small number of startups receiving most of the capital.

VC wasn’t broken. How do we know? We asked… VC wasn’t willing to take the risks on your ecosystem because what had preceded had peed in the pool

The expectation that it was available to everyone was broken.

The Startup Math That People Keep Misreading

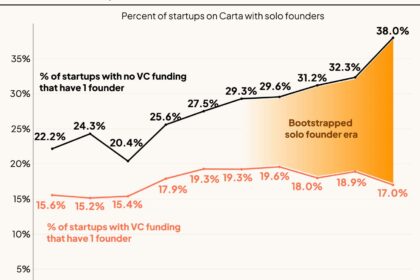

If you want to understand why everyone thinks we’re in a “bootstrap era,” ignore Twitter analysts and dumb down the math to a simple scenario:

2005:

- 100 founders

- 10 got angel

- 1 got venture

- 89 bootstrapped or died

2015:

Because accelerators pumped more people into trying entrepreneurship:

- 200 founders (not 100 more; what we mean is that 10 years later, twice as many were trying)

- 20 got angel

- 2 got venture

- 178 bootstrapped or died

2025:

More people than ever are attempting a startup (reports now show the highest new-business formation rates in 40 years).

- 300 founders (highest rate per capita yet)

- 30 get angel

- 3 get venture

- 267 bootstrapped or died

Bootstrapping didn’t rise as a strategy.

It was exposed through a denominator problem.

You have more voices. More frustrated founders. More failed accelerator alumni. More people discovering that “pre-seed VC” doesn’t exist outside coastal metros and that capital markets don’t abide by motivational-speaker fantasies.

Of course it feels like a bootstrapping era.

That’s because there are more people not getting funded, not because bootstrapping suddenly became vogue.

So, Are Founders Suddenly Bootstrapping? No.

Bad actors got weeded out.

The accelerators that charged rent instead of adding value? Dying.

The “mentors” who gave advice based on a single exit in 1998? Retired again.

The local angels who thought convertible notes were witchcraft? Fading.

And thanks to more credible research, venture-backing now meets reality:

- Most people don’t get funded.

- Most shouldn’t pursue venture.

- Most should bootstrap.

Not because we’re in a new era.

Because we’re finally telling the truth.

Entrepreneurship is not supposed to begin with fundraising; it’s supposed to begin with value creation, and everyone bootstraps their way there. Instead of chasing VC or complaining it’s broken, all because some local advisor told you they’d introduce investors, founders are doing what they’ve been doing since Oog sold a rock to Ugg, doing it themselves.

Myths Are Dangerous for Cities and Ecosystem Builders

If economic-development leaders believe we’re in an “Era of Bootstrapping,” they’ll misinterpret what’s actually happening.

We don’t have:

- more bootstrappers by preference

We have: - more founders discovering that they were misled

And if cities think this is the “bootstrap era,” they’ll create yet another cycle of misguided programming (celebrating romantic founder martyrdom instead of building the actual infrastructure required for capital readiness).

Bootstrapping is not the new frontier.

It’s the baseline. It always was.

VC is not broken.

Expectations were.

And accelerators didn’t democratize entrepreneurship.

They democratized attempts at entrepreneurship.

The Era We’re In: The Age of Competent Advice

After 14 years of noise, hype, inflated expectations, bad mentors, and worse incentives, the market is finally catching up to what Silicon Valley has known since the 1970s:

- Venture financing is for a tiny percentage of companies

- Angels fill the narrow gap just before revenue

- Everyone else builds their business the normal way:

by making money having built from scratch

Bootstrapping isn’t new. What’s new is clarity. Entrepreneurship, successful entrepreneurship, depends on being clear about these distinctions so that founders who can’t or shouldn’t raise capital, get the advice and direction they need while investors are meaningfully aligned with fundable opportunities and outcomes.

If founders today finally know they won’t get funded…

If accelerators can’t sell false hope anymore…

If cities are waking up to the importance of real entrepreneurial capacity…

What would our ecosystems look like if the last 15 years hadn’t taught people the wrong lesson about how startups get built?

We know the answers and we know how, it starts with being honest about your ecosystem so that you can work with people, programs, and policies best suited to what needs to be done there.

Very insightful, thanks

Gabriel Vázquez Torres my pleasure; this really matters. VC is as prolific as ever – it’s meant for certain things. Getting this wrong makes entrepreneurship more difficult for everyone.

This is much more polite than my wording, well done! Maybe I’ll publish my VC / Ecosysteming thoughts one day when I’m done bootstrapping Shandoka

Ernest I had to pull it back a bit where I started

Spot on, Paul O’Brien! The “era” didn’t change — the expectations did.

When founders shift from chasing capital to proving value, ecosystems get healthier and companies get stronger.

Honest advice > manufactured optimism every time.

Fortunately I prepared for a long stretch of bootstrapping and haven’t been disappointed by that plan yet!

Couldn’t agree more Paul. Appreciate the thoughtfulness and narrative here. Going in my newsletter today 🙂

One nuance I’d suggest for the role of angel investors (not sure if your comment “Angels fill the narrow gap before revenue” is meant to include angel groups or not) – individual angels and angel groups tend to participate a little differently.

Angels who are engaged directly/relationally EARLY in a founder’s journey (who already have high trust in the person) do fill the pre-revenue gap, 100% with you.

On Angel Groups: recent data from the Angel Capital Assocation’s 2025 Angel Funders Report (aggregated data from ~70 angel groups, I’m a HUGE fan and broke down the report with coauthor John Harbison at the link below) showed only 5% of angel group deals were “pre-seed”, 48% were at the seed stage, and 30% Series A. While (obviously) a good chunk of those will still be pre-revenue (depending on industry), many will be a tad more well-developed and so I would NOT default to saying a pre-revenue deal should go the angel GROUP route (I’ve seen and worked with many that have stated or functional “post-revenue” requirements).

Link to interview: https://podcast.thediligentobserver.com/2459970/episodes/17689098-episode-45-breaking-down-the-2025-angel-funders-report-aca-board-member-john-harbison-on-valuation-compression-board-seat-decline-and-follow-on-performance

What’s the new KPI? Revenue per Founder?

Adam Lupu ah, for that, you’re going to have to wait. I’ve had a half drafted thesis, maybe a white paper. Now I’ll race at getting it done.

Paul O’Brien and Adam Lupu the only ones I’ve seen that publish real metrics are Cyclotron Road (which became Activate) and Y Combinator – jobs created follow on funding raised, and revenue/startup “helped. Both are highly selective, both bring funding to cohorts (ESSENTIAL for success). What really helps? Money/space/cohort.

Michael Waggoner Jobs created is probably what the municipalities want but not what investors or founders want… Follow on funding starts to smell of ponzi… money/space/cohort… what do you mean by that? What’s considered a “space”? a cohort?

Adam Lupu I’m in cleantech manufacturing, so facilities are needed. I’ve got a 45,000 square foot incubator (I’m incubating my own company, open to incubating others). In Seattle, there’s an incubator called “AI House” that provides co-working spaces for AI folks. I think being co-located near other founders is a benefit – you can whine, vent, and share learnings. 🙂

Michael Waggoner fascinating, I’ve never thought of dollars invested per square foot per industry, but that would be a really cool metric to measure in any startup hub

VC has been hyped for decades and has permiated the minds of entrepreneurs at all levels. It has become the funding for any business to aim for. And it is the wrong funding for most. I worked at a defense contractor firm that pursued venture funding two decades ago. Not a fit then, but they pursued the glamor and prestige. Returning to the basics is the move. And it will drive more successes in the long run.

Matthew Burris amen

Interesting read.

There some immutable rules in VC funding and one is that the vast majority of funded startups fail.

The money has always been:

1. bootstrapping;

2. friends & family;

3. angels;

4. organized angels;

5. seed funders; and,

6. series A/B/C/D.

A huge amount of funding efforts end with bootstrapping because they don’t have the right product or are not good at raising funds.

What are vegetarians? Really bad hunters.

There are plenty of examples of companies that were bootstrapped and then moved up the continuum of funding sources thereafter.

Jeffrey L Minch we’re on complete agreement. What sticks in my side is how entities misrepresent themselves and their expectations, creating confusion and frustration. A lot of founder headaches would be alleviated with everyone consistent.

Andrew Kazlow that is…. Aggravating. “Angel” Groups investing later are essentially more so syndicates (not technically but effectively) and misrepresenting to founders that “Angels” would only invest later, is well, aggravating.

I hope this means that we are at the end of the “we are the Uber of XYZ” era as well

Scott I hope so too

“We’re in the Era of Remembering How Entrepreneurship Works“- i love this my mentor Paul O’Brien

Been there… doing that..

Mat Sherman I read this article and thought of you. I’m curious if you have any thoughts or reactions.

Mat Sherman, I’m in Phoenix at the end of the month if we can find some time.

I pretty much agree with the post, Daniel S. Lee. These things are incredibly nuanced though. Often more traction will not lead to funding. A company not fundable on day 0 will often not be fundable on day 1,000 with more traction. But sometimes it will be :). welcome to the game.

Paul O’Brien ill DM you

People are suckers for a good lottery Paul. For me, entitlement peaked last week when someone I know who had been fundraising as long as I know them (without any success) publicly condemned the entire establishment for not funding them. They bought a ticket to the dream. Lots of people did. There is this whole ecosystem of dream-sellers, but the responsibility is on us founders to spot frenzies and be smart. Incoming fallout.

Marc Ragsdale I feel you. I’ve had my share of far too many frustrated that they’re not getting investors; interestingly, even when well advised, they don’t take it and pivot.

Paul O’Brien stubborn-ness is a double edged sword! 🙂

I fuckkng love this. It’s exactly why we built Bootcamp Startup. Accelerators are broken. VC is broken. Startups are broken.

Why? They’re all lying to each other making promises they can’t keep and ultimately providing little to no value to each other.

There’s a better way. Heck pretty much anything is better than that. Anyway, enough ranting.

Good stuff, thanks for sharing.

Completely agree, Paul — Austin only works because it forces founders to get the sequence right: proof ? value ? capital. I actually referenced your perspective in my new Austin Funding Flywheel post because the data shows founders who treat fundraising as a system, not a starting point, consistently raise on better terms.

Here’s the post where your ecosystem thinking is featured ? https://www.linkedin.com/posts/leadwithomar_austinhealthtech-texasstartups-digitalhealth-activity-7401435864482070528-GuEu

Would love to see more cities adopt this level of honesty.

Omar K. absolutely re: system not a starting point.

This hits on something we see constantly — founders weren’t failing to bootstrap; they were operating under completely mismatched expectations about how early-stage capital actually works.

What’s fascinating is how wide the perception gap is between what founders believe matters in a raise, and what investors actually prioritise. Advice like “raise first, build later” shaped an entire generation of startups — but the data tells a more nuanced story.

We’re mapping these differences across early-stage raises right now, and the patterns are surprisingly consistent across sectors and regions.

If any founders want to contribute their experience: swireconsulting.com/swireiq

I think the challenge comes from lack of transparency. Every sustainable organization has a business model. Accelerators generally get money from corporations or public entities, and must market that they help startups. Their prime focus is often marketing to those agencies for their own survival. Tracking metrics of $’s invested by stakeholder -> ROI (whether it’s jobs or corporate innovation) would help. Fundamentally, the most helpful things are money, cheap/free space, and cohorts. The accelerator with the best metrics I’ve seen in cleantech was cyclotron road. They gave founders 2 years of burn, helped them find low cost space, and nurtured a strong community. Methods to replicate that success would cost more ($400-500k/founder?), but could lead to success more often. Providing nearly free physical incubation/fabrication space that is not tied to bureaucracy would also help.

Exactly. It’s not a new bootstrapping era – it’s the end of the delusion. The founder pool grew faster than reality. Now we’re back to first principles: build value before chasing capital. When ecosystems stop teaching ‘raise first,’ they finally create companies worth funding.