Working with cities throughout the world, developing startup ecosystems, every one of them echos the same in their effort to encourage entrepreneurship, “we’re focused on bringing investors to the table.”

What they’re doing is typical, ironically, of founders, who hear a problem and the focus on the solution (which by the way founders, is wrong). They hear startups and entrepreneurs in their city frustrate by a lack of capital and so they set out to fix that by bringing capital to market. Why this, and Problem / Solution oriented founders, are wrong is what I call the problem within the problem.

Economic development offices across America continue to treat venture capital like it’s some magical unicorn that blesses your startup ecosystem with wealth and talent. News flash: it doesn’t work like that. Capital doesn’t build the ecosystem. Capital follows it.

Let’s repeat that for the folks in the back: Venture capital follows opportunity — it does not create it.

For decades, cities and states have tried to lure VCs and angels into town with slick branding campaigns, tax breaks, or “innovation districts” that are just underutilized office parks with espresso machines. Meanwhile, most never stop to ask the one damn question that matters: Why isn’t capital here already? Until we confront that question honestly, we will keep making the same costly, ineffective mistakes.

Article Highlights

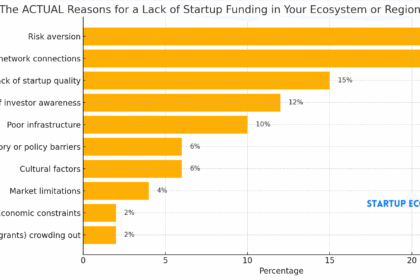

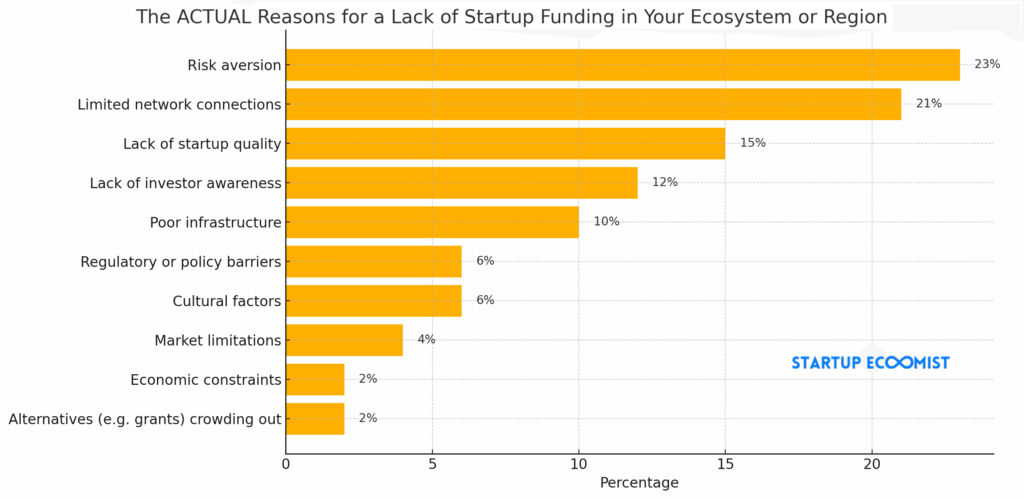

- To answer that, I asked; about 5,000 survey respondents, “What do you think is the real reason for a lack of startup funding in your region?”

- Venture Capital Is a Symptom, not a Catalyst

- Let’s Ask Everyone

- 1. Risk Aversion (23%)

- 2. Limited Network Connections (21%)

- 3. Lack of Startup Quality (15%)

- 4. Lack of Investor Awareness (12%)

- 5. Poor Infrastructure (10%)

- 6. Regulatory or Policy Barriers (6%)

- 7. Cultural Factors (6%)

- 8. Market Limitations (4%)

- 9. Economic Constraints (2%)

- 10. Available Alternatives Crowding Out (2%)

- Ask Why. Then Ask Why Again. And Then Ask Why That Is Still True.

- What Actually Works: A Playbook for Economic Developers

- Why Cities Fail to Attract Venture Capital and What Ecosystem Developers Must Fix

To answer that, I asked; about 5,000 survey respondents, “What do you think is the real reason for a lack of startup funding in your region?”

Venture Capital Is a Symptom, not a Catalyst

The idea that bringing in more capital creates innovation is as backwards as thinking that installing more traffic lights will cause more cars to appear. Research consistently shows that venture capital tends to concentrate in places that have already demonstrated high-quality deal flow, human capital, and infrastructure, not the other way around.

For example, Josh Lerner and Ramana Nanda’s landmark study, “Venture Capital’s Role in Financing Innovation: What We Know and How Much We Still Need to Learn.” (Journal of Economic Perspectives vol. 34, no. 3, Summer 2020) confirmed that ‘while capital can initiate some activity, long-term success depends on a preexisting culture of entrepreneurship, skilled labor, and institutions that support high-growth firms.’ The Kauffman Foundation — perhaps the single most respected body on entrepreneurship research — notes more bluntly: Capital is the last thing to show up.

And according to data from the National Bureau of Economic Research, while government-sponsored VC funds can stimulate local investment in the short term, they often underperform compared to private capital, and worse, tend to invest in less innovative startups when not matched with experienced ecosystem leaders.

This is not an issue of capital shortage! Capital is abundant but often directionless, or risk averse, or ignorant (frankly). It’s just not choosing your city. So… why not?

Let’s Ask Everyone

I did. Over the last few months, we conducted a national survey of venture investors, family offices, and founders. Thousands of responses. One question: What’s holding back venture capital your own backyard? The results are sobering but deeply clarifying.

Let’s unpack this, layer by layer, like a bureaucratic onion.

1. Risk Aversion (23%)

This is the polite way of saying: Your startups aren’t worth the gamble. It doesn’t mean investors are timid, it means your deal flow is unconvincing. Venture capital is inherently risky; if investors are still avoiding your region, it’s not them, it’s you.

And yet… why are investors so risk-averse? Likely because your ecosystem has no track record of returns. No M&A activity. No unicorns. No exits. That suggests a lack of experience, support, or policy infrastructure to de-risk early-stage ventures. Fix that first.

Here’s how we systemically de-risk the entire game

2. Limited Network Connections (21%)

Translation: Nobody knows anybody. Investors are relationship-driven. If you don’t have well-connected general partners, advisors, mentors, and second-time founders, capital isn’t going to flow.

But again, ask why: Is this because your community lacks social capital? Because universities and corporates aren’t integrated into the founder pipeline? Because local press and reporters don’t know how to capably cover the startup sector? Because your chamber of commerce thinks “venture” means hosting another speaker series? Networks don’t magically appear. They have to be intentionally designed and incentivized.

What most lack are online, active community groups – this was a catalyst of Austin, TX

3. Lack of Startup Quality (15%)

Ouch. But honest. If what you’re building isn’t disruptive, market-led, or even viable, VCs won’t touch it. Want to attract capital? Build better startups.

This is a direct reflection of education, mentorship, and resources. Ask: Why aren’t quality startups being formed? Is it the fault of startup development organization pipelines? Are founders being misled by bad startup advice? Or are local economic development strategies treating all businesses the same?

Spoiler alert: Startups are NOT small businesses

4. Lack of Investor Awareness (12%)

If a startup raises in the forest and no one hears it, did it really happen?

Investors can’t invest in what they don’t know exists. This is a marketing problem. A media problem. A policy problem. And a public affairs problem. Where’s your deal newsletter? Where’s your local angel syndicate doing demo days? Where’s your economic development board helping highlight early-stage wins?

Notice, very related to issue number 2 so let’s appreciate that we can tackle a couple of these problems in one fell swoop (If you know what you’re doing). Awareness is built, not assumed. And too often, local governments sit back expecting VCs to come find them.

Notice too though, reasons 1, 2, and 3, are agreed upon by 59% of respondents, to be the primary cause! Why are your demo days failing to fix this one? Because you didn’t address the top 3!

5. Poor Infrastructure (10%)

We’re not just talking about broadband and mobility (although those matter). Infrastructure means predictable governance, IP protection, affordability in both mobility and physical space, tech-enabled services, and efficient permitting.

Truly, if you keep encouraging all the startup meetups to be in the most expensive part of town, because it looks good to your constituents, you’re clearly not genuine in your intention to serve entrepreneurs.

6. Regulatory or Policy Barriers (6%)

Six percent may sound small, until you realize that policy is the lever that moves all others. If taxes are punitive, if equity incentives are unclear, if nonprofit venture funds can’t legally invest in startups, if you hire the wrong kind of people because you fund workforce and corporate development while pretending they serve startups, you’ve got systemic rot that no amount of cheerleading can solve.

Here’s what public choice economics tells us: policy shapes markets more than product.

If a startup can’t be assured of opportunity because of your confusing regulation about IP, they’re not going to scale.

By the way, public choice economics is the application of economic principles and methods to the study of political science and government decision-making. It assumes that individuals, including voters, politicians, and bureaucrats, are primarily motivated by self-interest, just like in the private marketplace.

7. Cultural Factors (6%)

This is your “good ol’ boys club” problem. Or your “we only back B2B SaaS” problem. Or your “our city doesn’t fail gracefully” problem. If your local culture punishes risk, mocks failure, or prioritizes conformity, then congrats, you’ve built an economy optimized for mediocrity.

When I moved to Austin, there were some local startup icons who repeatedly said, “we don’t do consumer here,” when what they should have been saying is, “I don’t have a clue.”

Startups thrive where failure is normal, and success is exponential. That takes cultural courage. I’d bet, having worked with nearly a hundred cities, your culture sucks.

8. Market Limitations (4%)

Sometimes your town just isn’t big enough, isn’t diverse enough, or isn’t accessible enough to support scalable ventures. That doesn’t mean you can’t be a startup hub, it means you need to focus on certain verticals or connect better to other regions.

This is where a strategic cluster approach matters. What I will forever find amusing is that in the research published frequently by PitchBook, Kauffman, and even Government entities, they compare “Silicon Valley” performance to distinct cities – and I can’t help but rant a bit in reply: Silicon Valley is 3 major cities with most of the venture capital 45 minutes outside of San Francisco! Media perpetuates ignorance about your market but that just makes it all the more important that you step it up and communicate both regional distinction and opportunity beyond Our City.

Become the “Topeka of agtech” or get beyond Bentonville because of Fayetteville, or even Tulsa!

9. Economic Constraints (2%)

This is almost never the actual problem, because capital is abundant and the entire point of venture capital is sophisticated investing in risk (which means, to borrow from Wall Street wisdom, buying in a down market). But it might indicate local family offices are tied up in real estate. Or that banks are risk-averse. Ask why, and you’ll probably uncover regulatory or incentive design flaws.

10. Available Alternatives Crowding Out (2%)

When grants, tax credits, or government funds are abundant, they can crowd out private capital by removing the incentive to invest. This is the cruel irony of most economic development programs. If you subsidize everything, investors don’t bother competing.

You’ve created a charity, not a market.

This is why, by the way, Europe languishes – prolifically available public funding

Ask Why. Then Ask Why Again. And Then Ask Why That Is Still True.

This is first principles thinking. Don’t stop at “risk aversion.” Ask why investors are averse. Then ask why that reality hasn’t changed. And then again, why not? That’s where you need to be.

In doing so, you might uncover that your university tech transfer office has never once helped a founder. Or that your workforce programs don’t differentiate between startups and restaurants. Or that your metro’s media never once covers a Series A win unless it’s in real estate.

These root causes are fixable. But only if you start digging.

What Actually Works: A Playbook for Economic Developers

Economic development leaders must stop chasing capital. That dog won’t hunt. Instead, focus on:

- Startup Development Organizations that serve founders for free and aren’t real estate plays

- Public policy frameworks that define startups distinctly from small businesses

- Incentive reform that stops rewarding stagnation and starts rewarding disruption

- Marketing and media that elevate local deal flow, not just ribbon cuttings

- Technical infrastructure like broadband, IP law access, and civic tech platforms

- Founders who actually understand the market, not just a pitch deck

We’ve covered how these structures evolve, how coworking spaces, incubators, and accelerators need to be rethought, and how venture studios and public affairs offices can work in tandem to build something real. If you’re working on this, make sure you’re subscribed, via LinkedIn here or Substack as you prefer.

Why Cities Fail to Attract Venture Capital and What Ecosystem Developers Must Fix

Be clear: cities, states, and even national governments, make one of the most expensive, damaging mistakes possible when they try to attract capital rather than build the conditions that capital finds irresistible.

This is why it is vital to work with ecosystem developers and policy strategists who actually understand startups. Workforce development programs that focus on welders and corporate site selectors aren’t going to help a B2B AI SaaS startup in Round Rock raise a Seed round. And pointedly, evident in the survey I’ve pushed on thousands, your having venture capital available doesn’t change anything when the problems are underlying.

If your economic development agenda doesn’t distinguish between startups and small businesses, you’re not building an ecosystem, you’re misallocating public funds and wasting everyone’s time.

Think you’re building a startup hub?

Then stop asking how to attract capital. It’s there. Ask why it isn’t showing up as venture capital.

Then dig until you hit bedrock.

And then, reach out, not to capital, but to the people who understand what makes it move. Because until your city gets that right, venture capital will keep following opportunity, just not yours.

Ready? Send this to your team:

I hear this every day when talking to governments – they say “we don’t have a startup problem, we have a capital problem”.

I tell them “a capital problem is a startup problem, because if you had good startups the capital would follow”

Jonathan Greechan the fact that so many of it so incessantly hear it, despite everyone working on it, is all we need to know as entreprenurial people to know that the solution is missing the mark.

Love this, Paul

I did a boatload of research for the SBA a couple of years ago, looking into why (many) small towns fade or crash & how some small towns/ regions thrive, and honestly your bar chart could be mine from back then.

Risk aversion & insular networks at the top, + all the other ways to say “we claim we want to grow but we actively prevent it” a little further down the list.

Givin’ me PTSD just remembering back to that work, yet still I’m clicking through…

Kelly E. I’ve been pushing the U.S. Small Business Administration hard to make this distinction

https://seobrien.com/new-collar-jobs-and-the-critical-distinction-of-startups-from-small-businesses

Paul O’Brien I know it’s an essential distinction for you, and you & a few folks over my 14+ yrs on Quora have talked me into agreeing… I think there’s a huge spectrum of how much it matters to others, though.

Kelly E. oh for sure, it is a spectrum; the problem is, we blend without regard and that creates waste, misleads people, and holds capital from participating. Rather than bundling it all as the same, draw clear distinctions and then work out the exceptions.

“We don’t have a startup problem, we have a capital problem”. This is what I hear most often when speaking to government officials.

But unless there are structural or legal hurdles in their region, their ‘capital problem’ is a ‘startup problem’ because CAPITAL FOLLOWS GOOD BUSINESSES.

“We don’t have enough Series A investors” typically just means “we don’t have enough companies with the growth to justify a Series A”.

I get it – the simplest diagnosis is to say it’s a money issue, because there are clear ways to fix that issue. But in reality money is just a small part of the equation.

Create more high quality startups + a strong community of leaders/ feeders and the capital will follow.

I think I can argue that homes / real estate is contributing to the VCs Gone Missing effect. How much is that contribution? You tell me.

Over 25% of all homes sold in the first three months of the year (2025) were bought by investors. Yes, mostly small investors (1-5 homes in their portfolio), but nonetheless, investors. Add in the large institutional investors that add just enough to keep the prices going up, and you have a perpetual motion machine that prints money. Mind you, res real estate doesn’t have the upside of a startup unicorn, but it doesn’t have the risk either.

The key is to be a startup that solves the residential home problem. lol. I know. I know. That’s mainly a local problem that bubbles up into a national embarrassment. That is, a solution can’t be found and scaled.

https://abcnews.go.com/Business/wireStory/investors-snap-growing-share-us-homes-traditional-buyers-123560969

Mark Simchock Residential real estate is absolutely contributing to the VC vacuum effect. But I don’t think in the way most think.

It’s like when I moved to Austin and everyone said it was better for startups because it was more affordable … the data doesn’t show that to correlate with funding for startups.

The problem isn’t just that investor ownership is crowding out homebuyers. It’s real estate tying up capital — the risk capital, the family office capital, even the attention span of your local banks and angels.

Why risk a 10x startup exit over 7 years when you can get a 3x home flip in 18 months, with tax incentives and predictable demand baked in?

And yet, the path forward in startups is in property!

It’s that local governments make scale impossible through zoning, regulation, and fragmented oversight. Try getting a housing-tech startup scaled past one MSA without tripping on a dozen local permitting regimes and legacy fiefdoms.

Money flows to predictable returns.

Smart founders either build elsewhere — or leave entirely.

And your local ecosystem stagnates while City Hall congratulates itself on a new angel fund with no actual deals.

When everyone is a housing investor, no one bets on the future.

cc Gavin Nicholson

Jan E. Odegard, some excellent stats to know for HTX and your work.

Very well said Paul O’Brien

Check it out Erin Jacobs James Yuen

Great perspectives. Botswana is a good case study of a patient suffering this disease.

Mooketsi Bennedict Tekere I really haven’t encountered a region of the world that isn’t

I would add ‘lack of sophistication’ as a reason they won’t admit. And as an indictment of the venture world, I would add ‘lack of sophisticated offerings that are better than gambling’. Keep up the good work.

Joe Milam yeah my head wasn’t there when I put together the survey, but I think 1, 2, and 3, actually cover that. If they know what they’re doing, risk aversion wouldn’t be so substantial, lack of connection wouldn’t be an issue, and they’d be involved, helping the ecosystem fix quality.

Thanks for sharing, Paul. Id love produce a piece towards Botswana on this.

Lack of evidence of great exits (M&A, IPO).

Ecosystems bring capital.

Do you stand in an empty lot with your money waiting for a grocery store to appear to buy food?

No.

So why do you expect venture capital to do that?

YES!! Thank you for sharing Sheffie!

We have to rope together the islands. Somehow. If Silicon Valley is 3 cities…

Elizabeth Horne there are a handful of us trying, not easy when the cities compete and the state likes it that way. Always looking for more forward-thinking policy makers, economic development zone efforts, and cities willing to put the work in.

I find it extremely satisfying when my gut instincts get backed up by data and research. Paul O’Brien’s article backs up what I suspected in my gut for several years: communities don’t need VC investors to create great start-ups; great start-ups attract VC investors to communities. The latter builds momentum in the flywheel.

If you’re in the entrepreneurial ecosystem trying to grow and expand it, this is a “must-read” article.

Thank you for not missing the flywheel. Communities are stuck because they can’t make it spin. Funding isn’t the catalyst, it’s the fuel that makes it spin faster; we have to get them pushing properly without.

Well said Paul – lots of people need to read this.

Paul O’Brien

Thanks for highlighting the distinction between small business and startup businesses.

Such a necessary perspective, Too often we chase investors before building real momentum. I’ve seen how much shifts when the focus turns to value creation first. This is the kind of clarity more ecosystems need.

Good read

Took the survey was looking forward to what the results would be. Thank you for taking the time and sharing!

Great info Paul O’Brien … where does Austin land in your opinion?

Great piece, Paul O’Brien! Your survey data nails what many ecosystems overlook: VC is an effect, not a cause.

I’d add that the same root issues you highlight—thin networks, timid deal flow, limited exits—also explain why equity/investment crowdfunding (Reg?CF) keeps gaining ground. Platforms de?risk early capital by letting founders raise from customers and local champions before they have the traction VCs demand. That early validation builds the very “track record” investors say is missing.

Instead of chasing outside funds, cities could embrace community?driven financing as step?#1:

Drive awareness with public?private campaigns that spotlight successful Reg?CF raises.

Partner with local universities and SDOs to mentor founders on compliant crowdfunding.

Use policy levers (matching funds, tax credits) to amplify resident participation.

Do that, and you create the exits, networks, and momentum that VCs love to follow—on founders’ terms. Capital follows opportunity; community capital creates it.

Jeff (J.D.) Davids we’ll get it out more, newsletter drops again today

What we need, is Cities and policy makers demanding better

Investment Crowdfunding Expert love this.

JC Prieto Williams let’s put it this way, I spent 12 years in Silicon Valley and 16 now in Austin, and in that time Austin because the darling of startup ecosystems, has capital meaningfully shifted over the years OR are there lessons evident in Austin? I think the latter.

Well said. Great post

It’s a chicken and egg situation.. best explained by governer of Miami, buildimg ecosystem is decades long project..

Dhiraj Wohra is it though? Not an argument, this is an important discussion.

I find every city thinks it’s a chicken and egg problem, and because what’s in these funding is hard (they don’t know how to do it, which means hiring people), they do what they know how to do: Networking and Events – claiming that that is bringing investors to the table.

The question isn’t “do you have investors?” It considers that they aren’t investing.

Besides, Money != Startups. Every startup requires the entrepreneurs putting in the effort, money or no; most never receive funding. It isn’t chicken and egg. It’s scrambled eggs and chicken parmesan and we’re wondering why people aren’t sitting down to eat.

This is spot-on!

exceptional boots on the ground work

Cheers Jim, that’s what’s needed

Paul O’Brien thanks for detailing Paul.. I think we are over simplifying it.. when I said it’s a chicken and egg situation, I meant in a most compelx perspective possible.. coz as human being we haven’t been able to solve the chicken or egg problem as yet.. although I do have an thought for it, but let that be for another day..

I know money follows the right startups, where ever they may be, but startups need the right ecosystem of everything to flourish, example environment promoting innovation, common R&D equipment, capital subsidising common infra, talent wanting to come there, founders already there, even lifestyle that founders flourish in, environment of M&A or buy out opportunities, ease of regulations, legacy of environment/mindset, and many more..

Politicians would complain that money doesnt come where they want, founders would always complain that politicans don’t know how their ecosystem works.. I would always side with founders.. example El Segundo was a dying aerospace cluster now even after all the LA problems it’s becoming the best hard tech hub.. the question, what happened, the answers, founders were there, they found a location where they could build, capital followed..

That’s my 2 cents opinion..

Complex?? This is complex?? Come on, we’re talking startups here, this is simple

Cheers, great points.

Top reasons VCs avoid your region…

Definitely realized this after trying to get Investment in my Company Symbiosis Agriculture & Robotics. VCs here in New Mexico are great, but there are definitely some limiting factors in my opinion that need to be reassessed and changed, to truly inspire innovation and great companies to want to start and STAY in New Mexico. Some of the best business operators and founders I know, all have the same story of how they had to go outside of NM to get funding. This is something I hope changes in the next 5-10 years. We need more innovation, more risk taking, more growth minded companies, bigger ideas that actually fix genuine problems for a community as a whole (Not another SaaS!) VCs need to be more adamant about investing in companies that are actually making a change for the betterment of society; Furthering innovation, local manufacturing, and creating a distribution source to execute. Hopefully we see these changes come soon!

Christiano Duran, this really captures something so many emerging innovation hubs are wrestling with when they’re trying to attract and keep transformative companies in their region.

“limiting factors in my opinion that need to be reassessed and changed, to truly inspire innovation and great companies to want to start and STAY in New Mexico.”

Christiano, in my experience, these issues that need to be addressed to get more VC involved are the same as the issues that need to be addressed to inspire entrepreneurs. Great observation.

I love that all of this is solvable. We need civic leaders to step up and get the right people involved. Thanks for sharing Carl

Incredibly impt insights on why cities, positioned themselves as startup city, are not attracting VC money, places like Kula Lumpur, #Malaysia, #Jakarta #Karachi, take note…

Rushdi, I’ve put Kula Lumpur, Malaysia, Jakarta, and Karachi on my list of regions in which to dig deeper. Thanks for sharing!

This is possibly the best summary of why venture capital investing isn’t happening in some regions:

“Capital doesn’t lead ecosystems

Capital FOLLOWS opportunity”

Thanks for sharing, Maisy, and a very good reminder of the order of things, far from marketing or political statements.

Kathleen Gallagher

Maisy, it always amuses me that we teach founders to create value and awareness, so that investors come to you, and yet we don’t demand the same of our cities.

I just had this conversation with Startland News in KC. Maybe they’ll take my words more seriously now.

You have my hopes that they do (few cities want to hear this, because they don’t know how to do it)

I think they are being overly generous in this article.

Rebecca MacKinnon in what way?

Paul O’Brien I think it’s time for a change in thinking about venture capital as a whole. More focus and resources towards startups working on problems that effect the community directly in a large way, whether it’s agriculture, manufacturing, construction, etc. Less focus on MRR and ARR and more on actual impact with real results that show a difference in the next 3-5 years.

Good information here.

Melissa Vincent Christina Dreiling

I see so much overlap betweeen Limited Network Connections, StartUp Quality, and Poor Infrastructure “take that how it may mean for a geo/metro”. I see this chart and wonder how might a Farmer translate these issues, and then I remind myself that US Farming requires assistance and subsidies to survive… hmm

Thanks Paul O’Brien. As the Q2 2025 PitchBook-NVCA Venture Monitor shows, Bay Area, NY, Boston, LA account for 48.2% of deal count, 72.3% of deal value in Q2, and Austin had 76 deals with a value of $1.3B, compared to Denver with 83 deals at a value of $1.6B and Seattle with 87 deals and $1.9B. There are higher tier cities such as NY or LA, but none compare with the Bay Area’s 664 deals for a value of $35B.

Can Austin grow in its offer of accelerators and incubators to support more startups that in turn attract more capital?

JC Prieto Williams we’ve had high turnover of incubators and accelerators in Austin, and with those that remain, you’re rather reinforcing my point – by now, we should have seen better outcomes, if they were effective.

Unfortunately most of them here fail, for, frankly, many of the same reasons: lack of experience, wrong culture, wrong expectations.

https://seobrien.com/why-accelerators-fail-startup-founders

I’m working with a few other cities in Texas, where they’ve asked how to avoid Austin’s missteps, and we’re pushing hard on the fact that the Venture Studio model should overcome what tends to fall short.

Happy to share if you’re interested

Corey Boelkens I see the same overlap, but most people are tired of hearing “do marketing” without understanding how. We’re digging deeper to push specifically what needs to be addressed.

Thanks for sharing, Paul

Ashby Green a lot more to come; now we do deep dives and try to fix the causes

100%, why we are considering bootstrapping instead. More freedom, less strings.

Wow! Great share.

Really resonates. These same dynamics show up in so many regions. Curious which of the 10 you think is the hardest for most ecosystems to tackle first.

Gregorio Braga Santiago hardest? Is actually in the middle, not the top. The top is fixed with good marketing; regions COULD do it, though in fairness, great marketers are difficult to find, but it’s not difficult to address those things.

Infrastructure, policy, and culture? Those are addressed only through great leadership and vision. Most regions have career politicians. Most regions are stuck chasing what keeps people in office rather than what really should be done. This is the hard.

All founders seeking capital should read this!

And then kick their local leaders in gear!

Attracting capital to emerging startup ecosystems is a classic “chicken and egg” problem. Paul O’Brien digs deep on this one – worth reading.

This is spot on Paul – as always, insightful.

My sense from our own experience in Australia is that the first generation of the wave of today’s most successful global startups were initially self-funded or bootstrapped Atlassian being the most famous examples financed on the cofounders credit cards.

The attraction of venture and in particular cross-border venture (Other people’s capital) naturally follows successful startups not the other way around as you say. There is of course a feedback loop and network effects too.

You can see this on a macroeconomic historical scale too. The birth and growth of NYC finance scene with capital from London; East coast money funding the birth and growth of Tech and Entertainment industries in California etc.

Paul X McCarthy Exactly. You’re describing the core truth that economic development offices still resist: capital is reactive. It’s always chasing heat—not starting fires.

Atlassian is a perfect case study. Bootstrapped, resource-constrained, and forced to build quality and momentum before capital showed up. That’s what made the money meaningful when it finally did.

And you’re right about the historical pattern: the NYC–London flow, Boston–Silicon Valley, even cross-border waves of capital into Israel or Singapore. Capital migrates to gravity. The feedback loop only starts once something real exists, network effects, policy signals, or startups breaking through on their own.

But what’s frustrating is how often that feedback loop gets misinterpreted.

Cities see the presence of capital and assume it can be replicated through attraction strategies, branding, tax incentives, innovation districts. But they’re skipping the part where founders suffer through scarcity, build something compelling, and force capital to pay attention.

We need to stop romanticizing capital inflow and start designing the conditions capital can’t ignore.

Appreciate your perspective and would love to see more from Australia since I’ve been digging in there.

This hits hard—and it’s right.

Richard Florida has presented the data that over and over that capital follows creatives, not the other way around. The places that thrive aren’t chasing money, they’re building environments where builders, designers, and technologists want to live and create.

Any city that wants to attract capital needs to study “The Rise of the Creative Class”

• Jeff Eversmann, Richard Florida nailed this over 20 years ago, and somehow cities still haven’t absorbed the lesson.

It’s not about chasing capital or even startups directly, it’s about creating the conditions where creativity thrives. Places where technologists, designers, and builders want to live, not just work.

That’s what creates gravity.

Capital follows people.

People follow purpose, quality of life, and a sense of belonging.

Too often, economic development strategies try to reverse that flow, assuming that if you bring in the money, the rest will follow. But as Florida showed in The Rise of the Creative Class, the causality is the other way around: capital chases creativity, and creativity clusters in places that are open, authentic, and rich in serendipity.

So yes, any city serious about venture, innovation, or entrepreneurship better start with culture and community, not capital. Otherwise, you’re funding ghosts.

Paul O’Brien Oof, this! In particular:

“This isn’t a shortage of cash. This is a shortage of reality. So, stop saying your city needs investors. Start asking: Why doesn’t capital believe in us?”

Tough pill to swallow but hard to refute.

Paul O’Brien Well said – The middle requires real courage and vision because there’s no quick political reward there. Infrastructure and culture changes aren’t headline-friendly, but they’re essential long-term investments. Leadership willing to make tough, unpopular decisions to build genuine progress is rare, yet that’s exactly what’s needed.

That certainly falls in line with Michael Potter’s theories in his book Competition in Global Industries

Bill Louden ah! I’m not familiar. Thank you! Looking it up

Michael Porter first wrote his seminal work, Competitive Strategy in the 80s. He was one of my professors at GE Crotonville. I have several of his books. Let me know and we can meet up for coffee and I can loan you some.

One exception I would offer to this. Self-sustaining ecosystems are the result of available capital. To build an ecosystem from scratch, OR fix one that struggles, $s need to be mobilized first. Texas has no shortage of innovation, but is GROSSLY lacking in a funding ecosystem. Silicon Valley innovation (and venture infrastructure) expanded rapidly after 1979 when the ERISA laws changed and made it easier for pension plans, foundations & endowments to invest in venture capital. Prior to that, vc in Silicon Valley was anemic. See ‘Secret History of Silicon Valley’ https://www.youtube.com/watch?v=ZTC_RxWN_xo&t=3193s

Joe Milam it’s a flywheel

Everything moving forward is ideal

Great stuff, Paul. Thanks for doing this analysis. I figure you had a fair share of respondents from NEOhio? William Tavel Daniel Dudley Sarah Marilyn Barrick

Randal Doane let’s just say, I’ve never been somewhere this doesn’t apply. It’s just a matter of the degree to which…

I find local leaders are happy enough having a startup hub, while economic development offices and chambers put in the effort because it looks good (technically, they’re focused on workforce and corporate development).

The results speak for themselves: cities aren’t doing these things, and if they are, or think they are they’re not doing them well

Facts. And the so-called risk takers with all the capital need to actually take big risks – and move fast, just like the startups they purport to support

Paul O’Brien – thanks for the quick reply. It’s a common refrain in NEOhio that the problem is #4: our Midwest character leads us not to brag about our amazing accomplishments.

So . . . does it follow that the folks in Detroit are a bunch of narcissists? That doesn’t quite wash. My key takeaway from this is that you better have #2 & 3 buttoned down before you decide on #4.

Note: could you please share some of the metrics of #1? Is it really a distinct independent/intervening variable from #3? It seems to me to be the dependent variable. Jeff (J.D.) Davids Jeffrey Stern JumpStart Ventures North Coast Ventures David Sylvan Jason Therrien Elizabeth Falco Tyler Guthrie

Randal Doane well… I grew up in Michigan and had family in Ohio, so while I feel you, I can also confirm that “we” can get it right for entrepreneurs – it’s not bragging when appreciated through the lens that what founders need most and lack most significantly, is attention. We need to tell their stories.

In incubators, I preach to founders that they should be talking to investors BEFORE starting. Not when reason to raise money. Are you? Are they? That #4 addresses 1, 2, and 3, to a great extent, doesn’t it?

Funding is a matter of relationships because we know at most founders will fail – it’s not a sound investment if we’re being realistic. It’s a philanthropic investment, it’s funding research (in a sense), it’s giving back to the economy. And so, venture investors, rightly, want to know the people they’re funding.

I’ll buy stock in Dell but I’m not funding your SaaS Booking AI until I get to know you.

And the ecosystem, your region, can support that. Tell the stories, build the communities, connect people – not for “deal flow” but because everyone is taking great risks — and those with resources can/should use them meaningfully to alleviate risks.

https://seobrien.com/why-most-startups-fail-to-get-enough-attention

You have some great questions here, and I am digging deeper while, frankly, also seeking for the funding in collaboration of more research. So, we’ll unpack more data.

Take this for now. #4 addresses 1, 2, and 3, to a great extent.

They’re not as averse to risk when investors they KNOW the community, know the founders, and know the local leadership. Again, not for the sake of deal flow… for the sake of BETTER matches and efficiency.

With effective social networks (which almost every city sucks at, frankly; they have some web-based community on their chamber website or something), everyone is connected. Aware investors are part of that network (by the way, that means it’s on Facebook, LinkedIn, and Twitter, at least – not some city website).

And with investors aware they give better feedback. They participate. They advise. And let’s be frank, they’re also accountable to that advice, because they’re more public and connected – that means better advice (or better investors). All of which improves startup quality.

definately seen this challenge back home, lots of intent to attract capital, matched funding from Gov, fund of funds models etc…. but there needs to be deal flow to be successful.

Hard truths, but insightful.

A song almost as old as time. This is why had to leave our ecosystem and go to another to find the capital that we need. As Metallica put it, sad but true.

Here your comment had me thinking Beauty and the Beast and you’re going with Metallica

We go with what we know Paul.

The truths aren’t as hard as the empty promises cities give, leading entrepreneurs to try when the ecosystem is against them.

Thanks for sharing Doug!!

Great post Paul O’Brien – thank you for the original, helpful content

Having lived in and several US and Canadian innovation ecosystems, I can say these reasons track pretty well to my own experiences.

Austin and Vancouver share some similarities in this respect and I’d be curious to know what practical solutions you’re finding for these root causes?

Samim Safaei thank you

I’ve had some chats with Vancouver over the years, so I would agree with you, and I’d add that it’s through my conversations that I know to agree with you. The answer to your question is relevant to our consideration – they’re very “do it ourselves” and Vancouver focused.

It’s, what, an hour and some change to Abbotsford? That means you have a region there, not a distinct City. And in this regard, that matters, because cities rarely encompass enough opportunity AND other places aren’t likely to collaborate with a (competitive) city – but they will collaborate with the ideal PLACE for *something*

1. Break down the silo’s and pull in people from elsewhere

2. Promote some sector of distinction, incessantly. Be that.

3. Connect everyone. Austin did this well online – that was a catalyst and I’ve not seen really any other place do it as well

4. Demand the money step up – banks, law firms, real estate, and investors — the ecosystem is under supported and the money has a role to play: demand it.

As I read this Paul O’Brien I believe that the ideas can be applied to a microcosm of a geography just as well. “Why isnt my entrepreneurship center at my huge university not booming”. “Why is my economic development zone not developing any economics?” The tenants of the flow of opportunity arent contained to a geography, just measured in a geographical context. Venture builders are a good model at those levels as well. Man, we gotta catch up.

Brian AM Williams glad you caught that nuance.

The framework here applies just as much to microcosms like university innovation centers, incubators, even startup coworking spaces. The principles of gravity, trust, and network density don’t require a zip code, they require signals of opportunity.

When a university entrepreneurship center isn’t thriving, it’s usually *not* for lack of funding or ambition. It’s because the center isn’t embedded in a living, breathing network of founders, capital, and downstream opportunity. It becomes a silo, not a signal.

Same with economic development zones. You can draw all the lines you want on a map, but if founders don’t feel connected, capital doesn’t see movement, and mentors aren’t present, you’ve built a ghost town with great branding.

This is why venture studios and builders are so powerful, they create that density of trust, repetition, and signal in one place. They don’t wait for an ecosystem, they simulate one.

We should catch up, DM me a focus of work. We have the models now. It’s just time to stop mistaking infrastructure for ecosystem and start actually building gravity.

The list is incomplete since it does not directly list existence of large businesses with major R&D centers. Most successful founders of product based startups leave their jobs to start a business next door to their employer. Employees are the most valuable resource. Experienced employees are found in R&D departments of large established businesses supported by universities. That was the case for Silicon Valley, Boston and Lehigh Valley. Each had a few major companies R&D centers next to colleges with in-depth research capabilities.

shahri naghshineh You’re not wrong—major R&D centers and research universities are an important part of a healthy innovation ecosystem. But I’d argue they’re an indicator, not a cause.

Most major metros do have innovative companies, university programs, and even accelerators like Techstars. Yet we still see venture capital not showing up. That’s exactly the point of this research: the presence of those assets doesn’t explain the absence of capital.

If world-class institutions are in place and VCs still avoid the region, it’s because of the downstream issues we identified—risk aversion, weak networks, poor startup quality, lack of awareness, etc.

Said another way: these factors don’t appear missing on paper, they fail in execution. You can have a Techstars and a top-tier university, but if you’re not generating credible startups, exits, and trust-based networks, capital stays away.

The value of the list isn’t in identifying all ecosystem components, it’s in revealing what’s broken when those components are already present.

Great infrastructure with no movement? That’s not an omission. That’s a symptom.

Paul O’Brien maybe I should be saying for an ecosystem to attract venture funds we need:

1- large corporations with R&D

2- small businesses that support the large corporations

3- startups by form employees of these large and small corporations .

As the saying in the movie Field of Dreams goes , “you build it and they will come. “

Finally, all startups need funding but fortunately most do not need venture capital funding. They need customer funding in various ways and not all in cash.

shahri naghshineh love that you characterize customer revenue as funding in startups. Need more of that. When a venture doesn’t yet have a clear, established, competitive business model (i.e. a startup, not a company), customers should be considered a source of funding with pros and cons relative to any other.

Paul O’Brien happy to get into this. I can share my personal experience of trying to get into the industry as a VC and establishing my own firm in 2022. I ended up pivoting from VC to Technology enabled PE by the end of 2023 for three main reasons.

1. Lack of quality deal flow within the Vancouver ecosystem. The best startups (including some of my friends) were directly going to Silicon Valley and there was no way we could compete for those top 10% of startups.

2. Startup valuations and terms for the remaining 90% stopped making sense to me in 2023. Most startups were building their fundraising parameters based on comparable in Silicon Valley and not deals being done locally. This was caused by the amount of money being poured into the ecosystem in the beginning of covid, which dried up once the interest rates started rising.

3. Most family offices and private funds who had exposure to the real estate market were taking hits from their real estate side of their portfolio making them overexposed to alternative assets, making VC fundraising extremely difficult for an emerging manager.

Therefore we made the decision to focus on profitable cash flow producing assets in the Canadian manufacturing sector.

I think we’re missing the real issue here. Everyone I meet is building to get acquired, not to actually solve problems. Like half these startups are just features dressed up as companies, hoping Shopify or someone will buy them out. When that’s your plan from day one, of course the ideas are weak and investors aren’t interested.

We’ve got this whole ecosystem optimized for quick flips instead of building things people actually need. Then wonder why funding is hard to get.

Honestly though, if you really want to build something that matters, none of this Vancouver stuff even matters. You can ship from anywhere now.

Jaskirat Singh well articulated

Love how this cuts through the noise — funding isn’t missing, readiness is.I see this often when helping non-tech founders with pitch decks: great ideas, but the story’s not clear, the ask is vague, and networks are thin.100% agree — education + tighter community ties are the unlocks.

I really don’t like the way the original author framed this. By his own admission, the number one reason for a lack of funding is *not* actually risk aversion. Specifically,

“It doesn’t mean investors are timid, it means your deal flow is unconvincing. Venture capital is inherently risky; if investors are still avoiding your region, it’s not them, it’s you.”

So the top reason why more startups don’t get funded is that they aren’t good enough to be funded.

Chris Neumann I think “Lack of Startup Quality” properly framed if startups aren’t good enough to be funded. But hey, I’m always happy to be disagreed with; I just asked the questions and that’s what came back.

In my experience? It’s not wrong. The overwhelming majority of those who show up claiming to be angel investors or VCs, don’t actually have the risk tolerance for 1 in 10. They’re seeking business opportunities while taking advantage of the name to appear cool and helpful with startups.

Worked with startups around 25 years; through incubators teaching thousands… It’s definitely more a factor that investors aren’t taking the risk, than a lack of opportunities.

Paul O’Brien While I agree that many people who claim to be angel investors aren’t necessarily prepared for what that really means, I generally disagree with the stereotype that investors aren’t taking risk.

An investor’s primary objective is to make money (not to subsidize economic development). In my experience, the majority of investors all over the world are making rationale economic decisions based on the population of startups that they can potentially invest in.

(The fact that they might restrict their investment scope to a narrow geographic region is certainly a contributing factor, but to suggest that they simply don’t like to take risks is something of a red herring imho.)

This post I did awhile back goes into more detail on how I think about it… https://chrisneumann.com/archives/why-wont-vcs-here-invest-in-napkins

Chris Neumann sure but “in napkins” is startup quality, not risk aversion. Investing in ideas is just dumb

A big part of the problem I find throughout the world is that founders are allowed to continue hoping there is money to start, because no one will tell them seriously otherwise.

People hoping ideas or napkins get funded certainly falls in lack of startup quality – NOT investor risk aversion.

Co-sign all of those points!

I can talk to you all day about risk aversion. At least in the enterprise security world almost all we do is think about risk—something humans are notoriously bad at grasping intuitively.

At the end of the day risk aversion is a natural human response, but strategic risk calculation, weighted against benefits, gives you the confidence to charge ahead while others miss out on opportunities. Yes my work is in security allowing companies to charge ahead with AI initiatives knowing that I’ve handled their AI risk, but I firmly believe it’s the same with the startup ecosystem. If you’ve calculated the risk, you can charge ahead into new markets and new opportunities where the default response from everyone else is knee jerk risk aversion.

My personal experience is that if you start with generating credible revenue instead of selling visions, investors will climb out of the woodwork to find you even here in “risk averse” Canada. But this requires listening more than speaking, and most people that want to be founders are bad at this.

However, BC can be hard to build in for reasons such as cost of living pressures for the type of people willing to grind on startup work. High COL = high velocity requirements for developers, which leads to faster burnout.

Toby Tobkin let me challenge that? Among the most expensive places in the United States? San Francisco Bay Area and New York. The most VC in the united States? San Francisco Bay Area and New York

You’re not wrong about faster burnout but in studies where it works, it’s the discernment of startups from businesses, of angel investors from partners, and of business investors from VCs, that ENABLE the people who have that ambition, grit, and passion, to thrive even where expensive (perhaps more so, because the high-cost drives higher expectations). It’s in expensive cities where they don’t discern OR in affordable cities that think it is about affordability, that things don’t work well because genuine VC won’t be involved when the risks are inherently higher because the of the ecosystem.

I saw this on your other post. I think, LinkedIn. Can I share it?

Existential Stage – You have an idea. Nobody cares. Your job is to define a value hypothesis so tight it could cut glass. Identify a real audience on a critical path, define what your offer solves, and articulate a value proposition that could be tested tomorrow.

Discovery Stage – Now prove it. Validate that your audience cares, and that your solution works. No scale. No fluff. Just prove that your offer delivers a Guaranteed Outcome: something repeatable, controllable, and worth paying for.

Adoption Stage – Shift from proving value to building the infrastructure that delivers it consistently. This is where monetization programming replaces brute force selling. Nick shared what they call the A.C.E.S. model (Awareness, Consideration, Engagement, Sold) to guide customers through a journey that mirrors the internal process of the business.

Sustainability Stage – Here’s where the real startups emerge from the crowd. Profitability becomes predictable here (and this is why I’ve pointed out that investors asking you about customers or revenue metrics, before you reach this point, is problematic). Here, customers become a community. You stop thinking like a founder and start thinking like an owner. Your venture becomes sellable (and therefore fundable) not just functional.

Scalability Stage – Want to dominate? Good. But don’t break your model in the process. Retention, recruitment, and resource management become your new religion in what is called “controlled chaos” – the eye of the storm between product-market fit and market ownership. Pause here – Now I mention product-market fit?? Yes! How many times have I written that there is a ton of marketing work to do BEFORE product-market fit and that PMF does not mean you have customers. It exists around here in your growth; after you are sustainable, not before.

Saturation Stage – You own the space. Congrats. Now it gets political. Your success depends on navigating market forces, community stewardship, and keeping your model fresh before entropy sets in. This is the Netflix-trying-to-stay-relevant phase.

Event Stage – A wild card that can happen anytime. A disruption, an acquisition, a collapse, a crisis. The test here is adaptability. What do you do when the game changes?

I feel like I’m vacillating between all of these at different times. Is that a good thing?

Funny. I think it’s less loss aversion and more lack of hype about gain.

Ah yes! My latest article about growth stages? It sort of relates nicely to this one, about VC. Joel Reyna absolutely, please do share it. These stages deserve to be part of how we frame both startup development and how ecosystems evaluate readiness.

Founders do vacillate across these stages, and frankly, so do ecosystems. Many cities, programs, and even investors are stuck at the Adoption or Discovery stage, still trying to prove relevance while pretending they’re built for scale.

And here’s where it ties directly back to this VC article and survey:

Venture capital doesn’t avoid cities because they lack ambition, it avoids them because they misdiagnose what stage they’re actually in.

They say they’re scalable, but they’re still discovering.

They say they need capital, but they haven’t de-risked repeatability.

Most founders think product–market fit is a gate to funding. In reality, it lives after sustainability; after traction is proven, not pitched.

This is also why infrastructure like Founder Institute, Techstars, universities, or accelerators don’t guarantee capital inflow. That’d be insane, frankly (no startup program should invest in ideas they’re also trying to help). If the region isn’t helping founders mature through these stages, investors can smell it a mile away.

I’d love to see this mapped to regional development and I expect Nick Alter and his team, and I, will explore that as we have more conversations about what they’re doing and my world. What stage is your startup city in? How do we stop pretending we’re in Scalability when our startups are still defining value?

Thanks again for sharing it; and again, yes, please do share it further. More people need this lens.

I’m doing more on Substack so here is that article, there, if you wouldn’t mind sharing that link:

https://paulobrien.substack.com/p/why-nobody-understands-startup-growth

Such an in-depth look into the challenges that regional startup ecosystems continue to face when trying to attract outside investment, especially when starting from a more shaky foundation than you think.

“Notice too though, reasons 1, 2, and 3, are agreed upon by 59% of respondents, to be the primary cause! Why are your demo days failing to fix this one? Because you didn’t address the top 3!”

Cfr.

Thank you for sharing. This isn’t rocket science; address the top 3 issues or you’re part of the problem.

Venture capital follows opportunity; it usually doesn’t create it.

Too often, regions try to “bring in the money” with branding campaigns, tax breaks, flashy innovation districts, or by establishing government-backed VC funds. All these tools facilitate the development of interest in startups, but until there is a little quality deal flow, little private capital will be attracted.

The real solution isn’t chasing investors: it’s building the kind of ecosystem that investors can’t ignore.

How? Have a look at his article to learn more!

Highly recommended read for anyone in economic development, policy, or startup support.

honestly curious which parts of an ecosystem actually pull in the big money investors when they’re looking at newer markets vs places like SF or NYC?

Alexandru Daniel Ciobanu the startups pull. The point is that cities and ecosystem builders tend to think they also pull, by hosting events, talks, and demo days for investors – they’re wrong.

What happens in most regions of the world, certainly outside of SF and NYC, is that the way the ecosystem and economy operate, hinder investors. You can have a startup there, attractive to VC, but if the ecosystem is causing problems, why would investors take the increased risk? Or, more relevant to this discussion, if a city and ecosystem isn’t ideal to investors, why would they bother paying attention?

Alexandru Daniel Ciobanu I agree with Paul O’Brien. Moreover what do you mean with big money investors? you mean late stage investors or institutional capital? For both cases I still think that the reply is the same. Good quality startup attract capital, but you need scale. If your region has one random startup capable of raising a lot of money, that’s not enough make money move toward that ecosystem and your startups will move elsewhere. What I think is required is systemic and organic growth, not sporadic success cases, to grow an ecosystem, and that’s the hard part!

lovely piece of insight – thanks for sharing

VCs have absolutely no interest in economic development, they simply chase returns. Like any gambler they’ll visit a casino, but they won’t help to build it.

Alexandru Daniel Ciobanu Think of high-roller gamblers in Las Vegas. Which casino do they choose, and why?