Imagine a modest Ozarks town (once underestimated) emerging as a national hub for retail, supply chain, and CPG innovation. Now imagine that the parent company is actively relocating talent, building a new urban HQ, and doubling down on ecosystem development. That’s Bentonville; once pigeonholed as “Walmart’s little hometown,” now staking a claim as one of the most fascinating emergent startup geographies in the U.S.

Yet, the narrative is not obvious or predetermined. Bentonville startups and Northwest Arkansas have structural advantages, cultural traits, and historical paths that both accelerate and impede startup growth. This go around the world. I want to map the past, survey the present, and forecast the future of entrepreneurship in Bentonville, analyze the region through the lens of 6 Considerations of Startup Economic Development, and offer a candid assessment of strengths, gaps, and risks.

Let’s start by walking back in time.

Article Highlights

- Bentonville, AR Historical and Cultural Foundations

- The Walmart Effect: Engine, Constraint, and Paradox

- The Rise of the Ecosystem: Accelerators, Programs, Capital Infrastructure

- Sectoral Strengths & Startup Theses (Beyond Retail)

- “6 Considerations of Startup Economic Development”

- Strengths, Risks & Strategic Recommendations: Big Picture

- Forecast: Bentonville 2030; What Will Be

Bentonville, AR Historical and Cultural Foundations

Pre-Walmart and Early Settlement

Before Sam Walton consolidated his retail vision, Bentonville was a quiet county seat in Northwest Arkansas, surrounded by the hills and forests of the Ozarks. Its economy was rooted in agriculture, small-scale trading, and local crafts. The region sustained a rural social fabric with churches, local schools, and county fairs dominating civic life.

Culturally, Bentonville and NWA have long been drawn to blending natural beauty, folk traditions, and small-town civic identity. This is important: the region has never been a conventional “tech city” forced to retrofit for talent. Rather, it starts with a midwestern, meeting-oriented, in-person civic culture. That shapes how founders, networks, and capital interact. You see more handshakes and stories than pitch decks.

The arrival of Walmart in the 1960s and ’70s (originally in nearby Rogers) was the inflection point. But the full cultural shift took decades. The Walton family’s investments in arts (Crystal Bridges Museum), education, trails, and quality of life began to reshape Bentonville’s self-image from “retail town” to “creative node in the Ozarks.”

Let me pause there to point out to those of you new to my work, and to remind subscribers: creativity NOT tech is the key to entrepreneurship. Tech and capital follow opportunity so when developing nurturing startup cities we have to understand the dependence of that on culture.

The Bentonville Film Festival (founded in 2015 by Geena Davis) is emblematic. It gives local cultural expression in a welcoming and belonging community with a public stage, helping Bentonville signal that it wants more than commodity retail. Nearby, and helping us all see the critical tie between the creative and the innovation: The Scott Family Amazeum (a children’s STEAM/museum center) is another cultural anchor that signals investment in creative, science, and curiosity-based infrastructure.

So: the cultural foundations are a hybrid of small-town civic culture, Ozark nature orientation, and Walton-driven patronage.

The Walmart Effect: Engine, Constraint, and Paradox

No account of Bentonville’s startup future can omit Walmart. Its sway is existential.

Catalytic concentration of suppliers and talent

One of Sam Walton’s often-cited principles was: “If you want to sell to Walmart, you better have a presence here.” Over time, that meant many vendors, suppliers, and supporting firms established satellite offices or functions in the Bentonville/Rogers area to stay close. That supplier concentration creates a “target-rich” environment for B2B, logistics, retail tech, supply chain, data, packaging, and product innovation ventures.

In other words: Bentonville has a built-in “customer density” for many kinds of supply chain/retail adjacent ventures. Jeff Amerine of Startup Junkie illuminates NWA’s strength, that you don’t have to sell in remotely, you already have proximity to big buyers, “People here are by nature entrepreneurial and helpful. They had to band together. So, when people come here from elsewhere, they’ve captured that, they’ve built on that, and it’s gotten even better.” – Jeff Amerine with The Bentonville Beacon’s James Bell

Over time, many transplants (executives, engineers, product managers) came into the local ecosystem via Walmart or supplier firms. That creates a latent talent pool, though not always a founder pool.

The paradox: corporate gravity can crowd out risk

I’ve explored a similar consideration, that the flush seed capital available to founders in Europe, through the EU, can actually stifle scale. We must weigh what it means when a place has a prominent corporate presence because that impact can work both ways.

For example: many ambitious technologists may see Walmart (or one of its large affiliates) as the default career destination, suppressing risk appetite. We saw this a bit in Austin by way of Dell. The presence of large corporate functions also makes it harder for smaller ventures to punch through visibility.

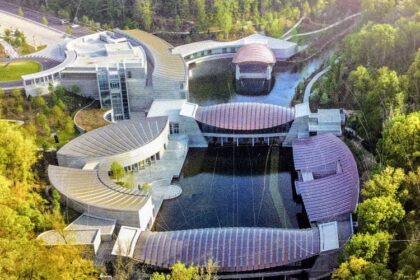

What matters is that Walmart is signaling more tech and innovation orientation; its new 350-acre headquarters in Bentonville is part of that, the full shift of Walmart from retail toward a more tech/capabilities company is still underway. The new campus includes amenities, green space, biking trails, and intends to host more employees and functions.

With that, Walmart is actively recruiting people from Austin, Silicon Valley, New York into Bentonville, which helps bootstrap what a vibrant Bentonville Startups could look like.

“Seeing leaders relocate from Austin, Silicon Valley and New York to Bentonville reinforces that this is a place where innovation can thrive,” said Serafina Lalany, executive director of the Northwest Arkansas Council’s entrepreneurship program StartupNWA. “They bring valuable experience, talent and networks that strengthen our startup community and fuel the region’s innovation ecosystem.”

Not to point out my experience in Texas too much, but this reflects the fact that immigration to a region is a catalyst to startups and innovation. Silicon Valley experienced massive growth, just as 15 years ago it started in Austin; here, we see the early stage of that development growing in Arkansas.

New HQ, New Ambition

The new Walmart headquarters is more than a real estate bet. It’s signaling that the company wants its core innovators, decision-makers, and culture closer to the ground in Bentonville. The campus is designed with LEED Platinum aspirations, significant green space, bike paths, childcare centers, and amenities intended to attract top talent.

This also sends a message to venture capital, startups, and suppliers: Walmart expects that the nucleus of its future value chain logic will be embedded in Bentonville. That expectation can shift investor perception of risk.

The Rise of the Ecosystem: Accelerators, Programs, Capital Infrastructure

If the early 2000s were the Walmart supplier era, the 2010s–2020s are the emergent era of formal startup infrastructure. Serafina shared that in Bentonville there are in the neighborhood of 19 incubators / accelerators / venture studios in the region. Here is a substantial mapping of the known ecosystem, and an assessment of the gaps.

Core ecosystem organizations and programs

StartupNWA / Northwest Arkansas Council

A backbone of the ecosystem is StartupNWA, a program under the Northwest Arkansas Council. It connects founders to capital, community, mentors, events, and funders. StartupNWA runs “Onward FX,” a flagship VC immersion / founder-investor event bringing top-tier VC firms into the region.

Before we really wrap up the impact of the Walton Family, let me revisit it one more time in this context; that the Walton Family Foundation’s Home Region program strengthens communities in Northwest Arkansas and the Arkansas-Mississippi Delta. In Northwest Arkansas, it invests in entrepreneurship and innovation through programs like Science Venture Studio, StartupNWA, 412 Angels, Plug and Play Supply Chain and many others, helping founders access capital, mentors and markets. The foundation also advances education, arts and culture and public spaces – signaling that it really appreciates what drives entrepreneurship and offering another lesson to everyone that that’s a usually overlooked piece of the puzzle. Its support extends from early learning and K-12 schools to institutions such as Crystal Bridges Museum of American Art and the Momentary, while also backing trails, parks and other civic assets that make the region more connected and livable.

In 2025, the third Onward FX event brought 40 venture firms (with ~US$2 b of AUM) to speed-date with ~250 founders from 32 states / 4 countries.

StartupNWA also manages a “Hub” (physical and virtual) to centralize access to accelerators, business associations, investors, etc. The tech behind it is partly powered by EcoMap Technologies.

Incubators, accelerators, venture studios & related programs

Here are many of the known startup resources:

- EforAll Northwest Arkansas – A national nonprofit network, local chapter in NWA, which provides training, mentorship, and entrepreneur support.

- Fuel Accelerator – A regional accelerator focusing on growth-stage tech / enterprise-readiness (Seed ? Series B). Their program is no-equity, no-fee.

- Highstep (Bounds Accelerator program) – Arkansas-based early-stage accelerator, focused on AI-enabled professional services in retail space.

- Startup Junkie – a coalition of multiple entities, brands, and programs that work together towards a shared mission of empowering existing and aspiring entrepreneurs, innovators and small business owners.

- Endeavor Heartland – ScaleUp Accelerator – Bentonville-based; in recent years has selected cohorts of high-growth companies for a 12-week scaling program.

- Science Venture Studio – A studio focusing on science/tech startups, collaborating with Innovate Arkansas, Northwest Arkansas Council, University of Arkansas Office of Entrepreneurship & Innovation.

- McMillon Innovation Studio – Delivered through local infrastructure; nurtures creative mindset, entrepreneurship, and connects to real-world impact.

As well as

- 1 Million Cups

- GENESIS Technology Incubator (in nearby Fayetteville)

- Innovate Arkansas

The University of Arkansas which brings to the table the Office of Entrepreneurship and Innovation, also hosts Greenhouse – Bentonville Collaborative – This is a newer incubator plan. It will house three incubators: Outdoor Recreation Program (GORP), a BioDesign incubator (coming), and a Digital Product incubator (coming). It will also provide co-working, mentorship, access to interns, events.

This is a partial but strong base to reflect for you the diversity of programming and experiences for founders. If I’m missing something, please share in the comments.

It’s worth noting that many of these programs are “home grown” in NWA (or Arkansas broadly), which has both advantages (local alignment) and constraints (less external bench strength – something easily remedied).

Venture capital and funding players

The region is less mature in capital than coastal hubs, but progress is real. Notable VC / investment firms and capital vehicles include:

- Circumference Group – based in Bentonville; invests in public and private markets (seed to post-IPO) using its “Core Value Assessment” framework.

- RZC Investments – a Bentonville multi-strategy investment firm; checkbook sizes range from ~$3 million up to $200 million.

- NewRoad Capital Partners – based in Rogers (adjacent), operator-led firm focused heavily on supply chain, logistics, marketing technology and retail/commerce adjacencies.

- VIC Technology Venture Development – Fayetteville-based early-stage / seed tech and life sciences focus.

- Tyson Ventures – investment arm of Tyson Foods (located in Springdale / NWA), focusing on food systems, alternative proteins, agriculture tech.

Stephens Group – older investment firm headquartered in Little Rock, active in early & late stage, including in Arkansas ventures. - Venture Center Arkansas Fund – primarily focused on scalable B2B companies in high-value sectors that are core to the state and the region’s prosperity.

- Winrock Validation Fund – evergreen, not-for-profit fund dedicated to deploying early-stage awards to validation-stage.

- RevTech Ventures – expanding its presence in NWA

- Precursor Ventures – based in SF, but already backing two NWA-based companies (Carrot, Airtime).

- Arkansas Capital Corporation – a CDFI / community development finance group providing regional support.

One data point: In 2023, Northwest Arkansas captured the majority of venture capital activity in Arkansas, though total investment declined 12% year-over-year. Average deal sizes dropped ~13.6%, exposing early-stage capital gaps.

“We are seeing more $5M – $20M growth deals landing in NWA, but the real bottleneck is pre-seed and pre-revenue capital. That’s where we need to compress time, de-risk more aggressively, and create more bridge capital.” – Serafina Lalany

Events and convenings

- Onward FX – Already noted, an annual (or semiannual) event where curated VC firms come to speed-meet local founders. The 2025 edition involved 40 firms and ~250 founders.

- Pitch and demo days in local accelerators (ScaleUp cohorts, Highstep, Fuel, etc.) – These serve as a more regular cadence for deal flow and investor visibility.

- Onward HQ – A co-working space and community for early-stage entrepreneurs that provides community, resources, mentorship and access to capital through StartupNWA.

- Local startup summits, workshops, and community events – e.g. 1 Million Cups, regionally organized meetups.

In sum: Bentonville/NWA now has a credible set of support organizations, events, capital anchors, and institutional backing. The infrastructure is not yet mature, but it is real.

By the way, the Onward FX work and coalition of partners was so successful that the Arkansas Economic Development Commission partnered to scale the program statewide. The coming event is in Little Rock on Oct. 29-30. I’ve said it many times before, do not do things in isolation or silos; when we’re serving the highest risk takers in the economy, we need concerted coordination so that the strengths of each compound to accomplish more.

Sectoral Strengths & Startup Theses (Beyond Retail)

When people hear “Bentonville startup,” they often assume “retail / e-commerce clone.” But the more interesting, defensible bets lie in sectors where Bentonville has an edge that is not purely retail arbitrage. Let’s review some of the segments where Bentonville may develop a comparative advantage, and challenges within them.

CPG / Consumer Brands & Product Innovation

Because of the retail supply chain depth in the region, many consumer packaged goods (CPG) and “brand + product” ventures can find unique advantages here. The proximity to buyers, test channels, packaging experts, raw material suppliers, shelf validation, and logistics gives a lower friction path to go-to-market.

Startups that design new packaging, sustainable materials, brand extensions, or “consumer-product + software” businesses can benefit from the local density of brand operations.

However, barriers include the strength of incumbents, capital intensity (manufacturing, inventory, supply chain risk), and the need for national/regional scale quickly.

Supply Chain, Logistics, & Infrastructure Tech

This is arguably the prime white space. Because Bentonville already sits near major distribution, logistics, warehousing, and vendor networks tied to Walmart and other big players, building software, AI, optimization, predictive logistics, cold chain, last-mile, reverse logistics, and sensor/IoT layers has latent demand nearby.

The region has a built-in “sandbox” of anchor customers who both understand and need these tools. A startup can pilot new logistics tech with real users here. The challenge: matching capital tolerance to the friction and long development cycles of physical infrastructure, convincing investors that a mid-America logistics software stack can scale nationally, and overcoming talent constraints in engineering, data science, and hardware.

NewRoad Capital Partners is already betting on this thesis: their focus is “smarter commerce solutions” and “demand-driven” plugins to supply chain.

eCommerce, Retail Tech, & Omnichannel Tools

Even though Walmart looms large, there is room for innovation in downstream retail tech: merchandising automation, content/AI tools, catalog management, customer analytics, loyalty systems, unified commerce tools, marketplace infrastructure, etc. Junction AI (a local startup) is a case in point: an AI platform to automate merchandising and marketing workflows.

The trick is not to duplicate what has failed, but to find defensible vertical domain niches where Bentonville’s local knowledge is an edge. Competing head-on with Shopify or Shopify-level generalists is a tough bet.

Healthcare, Wellness, Health Tech

Arkansas historically scores poorly on health outcomes, access, and healthcare equity. Such challenges mean opportunity to entrepreneurial people. Local philanthropies (notably Alice Walton’s interests) and local institutions are pushing to reimagine care delivery.

The Heartland Whole Health Institute (an Alice Walton–endorsed project) is an example of this ambition (though direct startup linkages remain emergent). The idea is to reimagine how medicine, integrative wellness, behavioral health, prevention, and community care operate in undercapitalized markets. To that end, the Alice Walton School of Medicine and Northwest Arkansas Council has convened a Health Care Transformation Division, comprising all major health systems, working together to improve care across the region – and it’s kind of coalition in which startup ecosystems thrive.

Startups in telehealth, remote monitoring, community health, risk management, chronic care, care coordination, social determinants of health, and decentralized diagnostics could find joint funding from public/private/philanthropic sources.

Challenges in the sector are of course the same as anywhere in the U.S.: regulatory risk, reimbursement models, physician adoption inertia, recruiting health-tech talent in a non-medical hub. Capital for early health innovation also tends to be more cautious and require deeper expertise.

Why Bentonville For More?

Given Bentonville’s natural amenities – trails, parks, biking culture, having drawn a reputation as an outdoor destination – ventures that align with lifestyle, outdoor gear, experience monetization, augmented reality in outdoor settings, and active-living tech can also be a local niche. The Greenhouse incubator’s “Outdoor Recreation Program (GORP)” speaks to this idea.

Thanks to Crystal Bridges Museum, The Momentary, Walton Arts Center, Walmart Amp, TheatreSquared, and Walton family philanthropy, Bentonville carries more cultural capital than you might expect. Startups in media, immersive experiences, storytelling platforms, AR art, or audience engagement could cross-pollinate with the cultural institutions.

Still, this is a lower-probability but high-visibility play, and startup ecosystems need to define and promote their distinction in the world.

Because NWA is surrounded by agricultural production and food chains (especially with Tyson and other food companies in the region), agritech, food safety, supply chain traceability, and alternative protein startups may find proximity advantages. Tyson Ventures’ presence is a good signal.

“6 Considerations of Startup Economic Development”

Let’s overlay Bentonville / NWA onto the framework from our referenced article (the 6 Considerations). For each, I’ll describe relative strengths, gaps, and implications.

1. Founders and Entrepreneurial Talent

Strengths

- The region inherits managerial, product, supply chain, vendor, and operations talent from Walmart and its suppliers. Many people here know retail, logistics, packaging, forecasting, vendor operations.

- The Walton family / philanthropic investment in arts and education has improved local quality-of-life, making it easier to retain or attract people who might otherwise only live in coastal cities.

- The in-person, midwestern culture fosters dense networking and closeness – founders can more easily get face time with executives or mentors.

Gaps / Risks

- There is no long tradition of “tech founder culture” – fewer serial founders, fewer risk-tolerant founder networks, and fewer mentors with deep successes in high-growth tech (versus retail/CPG).

- Engineering, AI, software development talent is more limited relative to major tech hubs. Even for those who exist, retention is a challenge (they may be pulled to coast or big city roles).

- The “migration pipeline” of bringing founders from elsewhere is weak; Bentonville must improve signals, branding, and incentives to attract founders, not just employees.

- Early-stage founder education (e.g. scaling lean startup, raising pre-seed capital, navigating IP) is still maturing.

Implication

To move forward, Bentonville needs to accelerate the first-time founder pipeline: structured founder fellowships, cross-cohort peer groups, founder-in-residence roles, incentives for external founders to relocate, and more storytelling of exits to build local hero narratives.

2. Risk Capital and Funding Pathways

Strengths

- The presence of local investors (Circumference, RZC, NewRoad) provides some capital on the ground.

- Onward FX immersion series show the region is now earnest about importing capital.

- The Walton Family Foundation’s ecosystem support helps underwrite risk in foundational stages.

- In 2023, NWA led the state in total VC activity.

Gaps / Risks

- The deepest gap is pre-seed / seed capital and pre-revenue bridging. Many promising ideas may stall before getting to a viable, investable product.

- The drop in average deal size (–13.6% in 2023) suggests that smaller bets are harder to justify.

- Investors may remain skeptical of “flyover” region risk: concerns about recruiting, visibility, exit paths.

- Lack of local LPs (limited high net worth, family offices, institutional capital) means dependency on outside capital, which may not have as much attachment to local outcomes or patience.

Implication

The region should consider setting up local seed/angel fund programming to help develop Angel Investors (such as what Founder Institute offers) while supporting groups like 412 Angels, perhaps backed by Walton-aligned capital, or a “match guarantee” scheme to de-risk investing in early-stage local companies. Also, building continued engagement with out-of-state VCs via infrastructure that connects investors, immersion, site visits, and partnership programs is vital.

3. Talent Pipeline (Workforce, STEM, Universities)

Strengths

- University of Arkansas is a cornerstone. The UARK Office of Entrepreneurship & Innovation supports spinouts, incubators (e.g. The Greenhouse).

- Local internships, co-op programs, student-run ventures can be curated to feed startup hiring.

- The Greenhouse incubator space is explicitly designed to integrate student talent (e.g. interns) into startup ventures.

- The local quality-of-life improvements make it more viable to retain graduates rather than losing them to big coastal cities.

Gaps / Risks

- STEM and deep technical degrees (especially in AI, machine learning, data science, hardware, embedded, biotech) are less concentrated locally than in leading tech hubs.

- Universities in the region have less experience in large-scale spinout acceleration and tech commercialization compared to universities like Stanford, MIT, or UC systems.

- Students may prefer migration to larger tech centers rather than staying locally unless convinced of opportunity.

Implication

Deep integration between UARK and local startups is essential. Expand student accelerator programs, co-located R&D labs, fellowships for graduates to stay locally, and mechanisms that lower the switching cost for students to jump directly into local startups.

4. Infrastructure and Ecosystem Platforms

Strengths

- StartupNWA’s Hub, co-working, event infrastructure, a growing accelerator/incubator network, and the growing list of support orgs.

- Physical amenities (trails, greenway, arts, museums) improve quality of place, which matters for recruiting.

- Walmart’s new headquarters and its associated amenities may anchor downtown Bentonville into more dense office, mixed-use, and infrastructure that spillover founders can use.

- The region already has robust logistics, transportation, and supply chain infrastructure due to its retail backbone.

Gaps / Risks

- Some accelerators and incubators are nascent or thinly resourced. They may lack capital reserves, experienced management, or sustainable business models.

- The pipeline “middle” (after incubation before serious scale) is less well supported – bridging programs, scale labs, growth capital assistance are fewer.

- Ecosystem connectors – high-quality mentors, domain experts, exit advisors, legal/IP support — remain less mature.

- Physical infrastructure for labs, prototyping, hardware, wet labs (if biotech play is intended) is limited.

Implication

Scale up the incubators and studios, ensure that they have durable funding (not just grants), and place emphasis on “scale support” functions (legal, regulatory, operations). Consider building shared prototyping or hardware labs. Strengthen connectors (retired executives, domain experts, corporate mentors) as part of program offerings.

5. Markets, Customer Proximity & Anchor Demand

Strengths

- This is a major win for Bentonville: proximity to Walmart, supplier networks, logistics customers, retail demand, and packaged goods trade means startups can pilot, iterate, and sell to local anchor customers while scaling.

- Because the region is a supply chain hub, many target customers are already nearby: distribution, procurement, vendor operations, brand owners.

- Local anchor demand reduces “cold start” risk for startups in supply chain, logistics, retail tech, and CPG adjacent domains.

Gaps / Risks

- Overreliance on local anchor demand can cause myopia: startups may over-index to Walmart or supply chain adjacent biases rather than broader scalable markets.

- For sectors further from retail/logistics (healthcare, biotech, SaaS generalists), local anchor demand is weaker, requiring direction to external markets earlier.

- The size and risk tolerance of anchor customers is variable – not all big corporates adopt disruptive technology quickly.

Implication

Startups should be encouraged to use local anchor customers for early pilots, validation, and feedback, but aggressively plan outward expansion. Programs can facilitate matchmaking between regional startups and larger national enterprise customers. Also, encourage cross-region pilot deals (beyond Bentonville) to avoid overfitting to local customers.

6. Culture, Narrative, and Storytelling

Strengths

- The region is already generating interesting stories: local ventures making national moves (e.g. Ox raising $16M, local VC immersion success)

- The involvement of Walton philanthropy and cultural institutions helps provide narrative legitimacy: Bentonville is not just a “retail town,” but a place of art, culture, innovation.

- Events like Onward FX, Bentonville Film Festival, and other local showcases give momentum to the narrative (Idea: You see the emerging and impact of something like SXSW when you stick entrepreneurship and the arts together)

Gaps / Risks

- The “tech narrative” is nascent; many people still think of Bentonville as Walmart’s HQ first, tech hub second.

- Success stories (exits, large scale up) are still few, meaning local media and outsider attention are limited.

- The “brain drain” narrative still exists; without strong stories, perception may bias people toward assuming startups are harder in small markets.

Implication

Deliberately seed high-visibility venture stories and publicize them. Use external PR and media, case studies, founder profiles, and cluster branding to reshape the narrative. Invite tech media, VC press, and influencers to visit. Cultivate local “hero founders” who become role models.

Strengths, Risks & Strategic Recommendations: Big Picture

Putting together the historical, structural, and 6-consideration lens, here is a synthesized assessment and a strategic roadmap.

Distinct Competitive Advantages

- Anchor proximity / customer density – For supply chain, logistics, retail tech, and CPG adjacent ventures, Bentonville is a sandbox few regions can match in the U.S.

- Philanthropic backing & institutional investment – The Walton family, Walton Family Foundation, public-private partnerships, and cultural infrastructure provide a cushion and legitimacy for risk capital.

- Physical quality-of-place and cultural amenities – Trails, art museums, outdoor recreation, greenways make Bentonville a more attractive “small city with amenities” than many mid-tier metros.

- Relocation momentum from Walmart – The relocation of employees from Austin/SV/NY into Bentonville helps shift talent and expectations.

- Emerging capital and investor infrastructure – The presence of RZC, Circumference, NewRoad, plus Onward FX, provide early traction for investment flows.

Key Risks & Gaps to Overcome

- Insufficient pre-seed and bridging capital

- Weak density of experienced tech founder mentors and serial entrepreneurs

- Talent constraints in deep tech / AI / specialized engineering

- Ecosystem fragmentation – multiple small programs, some overlapping, some with weak resourcing

- Narrative lag – not yet widely perceived as a serious startup hub

- Anchor overfitting – danger that startups align too closely with Walmart / supplier constraints and lose scalability outside the local funnel

Strategic Moves & Ideas

- Create a local seed fund / angel matching program, possibly anchored by Walton-aligned capital, to plug the earliest gap. Frankly though, don’t create it from scratch, use the platforms that already exists to do this.

- Launch a founder residency or “import founder” stipend program to attract non-local founders to relocate to Bentonville, especially those willing to build in logistic/retail adjacent domains.

- Strengthen mentorship pipelines: recruit retired startup executives, domain experts, venture partners, scalable mentors from outside, and embed them into accelerator programs.

- Increase cohort-based founder education, perhaps combining local and remote faculty, to accelerate founder skills in product-market fit, scaling, fundraising, growth.

- Expand physical infrastructure: shared prototyping labs, hardware testbeds, logistics/IoT labs, wet labs (for health) where applicable.

- Formalize corporate-startup bridging efforts: Walmart can run internal innovation challenges with local founders. Suppliers can serve as pilot customers. Local procurement agencies can require startup innovation.

- Double down on storytelling and external visibility: host investor bootcamps, bring in tech media, site visits, founder retreats, external benchmarking.

- Embed evaluation and measurement: track founder origin, capital raised, exits, jobs created, diversity metrics, and publish transparent “ecosystem scorecards.”

- Focus on path-to-scale: encourage internal expansions (beyond local) early, to validate startups on national/international axes.

- Encourage sectoral specialization (supply?chain tech, health tech, logistics AI) rather than generalist tech bets, until the founder and capital base scales up.

“Bentonville has everything it takes to be the Heartland’s hub for supply chain, retail and health innovation,” added Serafina. “What we need now is more early risk capital, more founders moving here and a bolder presence on the national stage. The assets are here. The challenge is moving quickly enough to put them to work.”

What Bentonville reveals is something every region in America needs to understand: ecosystem design matters more than hype. When foundational infrastructure aligns with local industry advantages and community leadership, innovation follows naturally; especially in overlooked sectors.

Forecast: Bentonville 2030; What Will Be

If Bentonville plays its cards well, by 2030 we might see:

- Several dozen ventures scaling to $50M–$200M valuations out of NWA, especially in logistics / supply chain / retail tech / health tech niches.

- A $100M+ local seed/venture fund (perhaps anchored by local capital, Walton interests, or external LPs) supporting early-stage companies.

- The region becoming a recognized “second tier” startup node (in national rankings), drawing founders who prefer “smaller, scrappier, lower cost, high access to customers.”

- Greater integration with Razorback / university spinouts, external VC engagement, and cross-regional flows (e.g. Texas, Midwest, Southeast).

- A thriving culture of serial founders, more exits, more mentorship, and local success stories triggering virtuous cycles of startup formation.

The region focusing on the gaps is paramount (especially in capital, narrative, and founder development), Bentonville could remain a niche railroad stop; interesting for niche supply chain bets, but not a full-fledged tech hub. But it doesn’t look that that will be the case and everyone else should be paying attention.

Interesting and informative article. WTF would Sam think?

Jeffrey L Minch pace of innovation alone accelerates everything so fast now, it’s hard to even conceive of what companies will look like 5-10 years from now.

you cannot become a tech hub by hosting more pitch nights. you become a tech hub when the first 15 startups land paying customers that are not named Walmart

Very cool! Bentonville isn’t just “Walmart’s hometown.” It’s America’s most overlooked startup lab for supply chain, CPG, and retail-tech.

Thank you for sharing! Startup boom town in the heartland

Beautifully and expertly argued as usual, but there is one seriously unsurmountable problem, namely “Walmart” itself.

If Walmart cannot sell one pallet per store, per week, the product gets dropped from the line card. That’s mass-consumer big box merchandizing, there is absolutely no room for entrepreneurship in that business model.

You can do any of three things but never all of them: price, speed and quality. Amazon or big box retailers like Home Depot, offer only three brands and if the goods are moving margin, their own competitive product. In other words they do price and speed. Amazon also does Whole Foods, which goes to prove that a company that does price and speed can also do quality (sort of).

Walmart shines in comparison to Costco, in both quality and service, but that is not a very high bar to cross. At heart, Walmart is still a nickel and dime store, and I mean that in the good sense of the word.

Walmart like Costco offshored US manufacturing to China. That worked for decades, but China inflation is now US inflation, and shifting production even further south, will only maintain price competitiveness for a very short time, at a higher logistical cost and does nothing for quality control. Given the logistical challenges, and the bulk business model, Walmart is a four turns a year business. You cannot do entrepreneurship on four turns a year. A capital intensive cash flow poor business model is not fit to support innovation, product diversity and a startup ecosystem.

Walmart will hit vendors with chargebacks a calendar year in, and automatically deducts 2% for returns whether there are returns or not. They have a no questioned ask return policy, you can use the product, and return it when done, no questions asked. You can afford it if you are a mass merchandizer with a football stadium sized warehouse in China, not if you are an innovator coming up with innovative product. If the product proverbially does not shift a pallet per store every week, Walmart will have absolutely no compulsion, moral or otherwise, not to pay you, or kill you with chargebacks and other ridiculous charges. The only reason a small manufacturer would want to sell to Walmart, is if they wanted to self harm.

Once you agree to do volume in exchange for lower margins, you kill all prospects of alternative distribution channels. You cannot compete with Walmart, so Walmart Brands must accept they are captive and expendable on short notice. They are glorified “house brands” with minimal brand equity.

Regardless, Walmart does volume only of broad product categories, innovation is nowhere contemplated.

Walmart adds nothing to the equation, kills entrepreneurship, bludgeons new entrants, and destroys any prospect of being able to grow any business by way of cash flow. Walmart is a prosperity death zone, where innovation, entrepreneurship and personal innovation and ambition cease to exist.

Last but not least, Arkansas is not a multi ethnic multi cultural multi religious community. It’s white Northern European for inclusionary purposes, but mostly Deutsch Protestant and the rest they keep in reservations (or across State lines). Don’t underestimate the cost of cultural homogeneity.

Last but not least, I like every one else, shop at Walmart, there is no argument to be made against the business proposition.

Again, thanks for the great post(s) and sharing the knowledge.

Marco, love the rigor. Right about one big thing: trying to build a new consumer brand by launching straight into big-box retail is like entering a heavyweight fight when learning to box. And I use that analogy because we entrepreneurs learn along the way, we roll with things and take the hits as we figure things out; doing that here has risks.

Bentonville’s startup upside isn’t “put your widget on every shelf in week one.” It’s that the region functions as a systems testbed; a dense, living lab for supply chain software, data products, packaging innovation, category analytics, returns optimization, and healthtech workflows. Entrepreneurship here isn’t forced to play only the “one pallet per store per week” game. There are three other doors founders can walk through:

Marketplace-first and omnichannel

Walmart is rapidly expanding its third-party marketplace, seller tooling, and fulfillment services. That’s a very different economic model than mass planogram retail. The seller base is growing fast, and Walmart is courting sellers with logistics, returns handling, and even cash-advance programs to compete with Amazon. That’s not the death of entrepreneurship, it’s an on-ramp.

B2B behind the shelf

The most interesting companies here will never have a UPC on a product. They’re routing trucks, predicting demand, reducing damages, automating content, fixing reverse logistics, and making stores and DtCs smarter. That’s exactly where investors are leaning; operator-led funds (many in NWA) specialize in supply chain and smarter commerce because the buyers and data sit next door.

Policy-backed health + whole-person care

On healthcare, the bet isn’t “sell supplements at endcap.” It’s the Alice Walton–backed re-architecture of care delivery: medical education, whole-health integration, and community health operations. That creates a pipeline for healthtech pilots and talent, not a battle for shelf space.

Ironically, or coincidentally, this is why I’ve shifted professionally into policy work. Are most important sectors of the economy are hindered by bad policy or ignorant policy making. If we can fix that, we can accomplish meaningful chang in healthcare.

On your cultural point, Bentonville isn’t a coastal melting pot though it’s very clear people are moving there. That’s a signal about where community leadership intends to steer culture as the region recruits national talent.

So, let’s reconcile your (valid) indictment of big-box economics with how founders should actually play this market – I never said this is the ideal CPG / Retail products startup market, I said supply chain…

Never start on the shelf. Start off-shelf – marketplace, DTC, wholesale micro-tests – then earn retail when your data proves velocity without discounts doing all the work. Walmart is a pathway for the right SKUs at the right stage, not an origin story.

Perhaps, Walmart is a Series A stage goal. But because of that, the ecosystem surrounding COULD meaningfully serve all founders.

What I’m thinking for the most part here is that shelves are a lagging indicator. In Bentonville, the leading indicators are trucks, tickets, and telemetry.

Just like we actually teach founders they have to do marketing before building an MVP: don’t build for endcaps. build for endpoints. Which is what? Where data, logistics, and care actually flow.

If we agree that entrepreneurship requires alignment (team, market, and capital) then Bentonville’s edge is customer proximity at the systems layer, not a retail shelf.

Bentonville: Capitalize on anchor demand without over-fitting to it; import pre-seed capital where the flywheel is thin; and use narrative assets to recruit the founders who want to build the hard, unsexy stuff.

Paul O’Brien “It looks awesome! Our plan was to host the Heartland Festival, a tech event based in Bentonville as the main city. Unfortunately, we couldn’t get enough backing at the time. Take a look at our initiative!” We were even suggesting a speed train called the Heartland Velocity

Enrique Ortiz working on a few mid region things. We might want to chat.

Paul O’Brien “Sure, we can chat. I just attended a meetup with Devon Laney, President of Gradient: Tulsa’s Hub for Innovation’s and mentioned the project. I’ll be in Tulsa next week for several meetings and can send you short PDF.”

Enrique Ortiz yeah, we should definitely talk. Tulsa is developing with a few people.

https://open.substack.com/pub/paulobrien/p/from-texas-to-tulsa-how-innovation

Serafina is a true treasure, world class.

Bentonville is certainly using all of its resources to take advantage of – and build upon – an amazing situation!

Donnie Crain yep, well said. And entrepreneurs and investors follow opportunity.

This makes me wonder how many great ecosystems are being held back by just one missing piece. You see in some Founder Institute programs. Some chapters have exceptional founders and strong mentors but not enough investors. When those founders are connected to a wider network of investors to learn from and maybe even raise from, the picture changes completely.

Daniyal Ashraf for sure, my thought exactly. You saw the video we just put up? Cities could (should) be making sure founders reach the *right* investors, wherever they might be.

Cities tend to still treat startups like small businesses, which is to say, any investor could be relevant because it’s a business; and therefore the Local investors are sufficient.

That completely misses the fact that “startups” aren’t. The founder needs the investor with a thesis in what they are unique in doing.

Pairing world-class arts institutions with startup growth is an unexpected strength that draws people in. That blend of creativity and commerce gives Bentonville an edge.

Mark Leaning, PhD it’s astounding how few realize this. Cities hear the demand is for “tech” and the need for STEM education, and that’s true, we need that, but that isn’t entrepreneurship. That’s a workforce capable of technical jobs, many of which are just as easily and more affordably filled remotely.

Enabling the entrepreneurs and investors *in* tech, what you need to do to foster startups, is found in the culture: risk tolerance, creativity, and passion. That’s not tech, it’s art.

The Walton Family has also invested over $100M in developing trails and turned Bentonville into Mecca for mountain biking. It’s created a vibrant local economy with a cool vibe.

Michael Girard most cities disregard that it’s this that fosters startups. Most chase “tech” or STEM because we’re told startups are in tech. This is one of the worst characterizations of startups in the last 30 years…. startups are temporary ventures in search of new business models (innovation not tech) and they are found in every sector. What that requires? Encouraging creativity, fostering risk tolerance, and removing barriers to entry and participation. Bentonville is doing the right things to ensure it isn’t just a tech city similar to every other out there fighting for distinction as a place for entrepreneurs.

Excellent read.

Thanks Dane. For sharing too, as it appears your audience is who needs to hear this more. EDOs and Cities are really falling short of helping startups and investors, not for lack of trying but because it’s such a different world that almost all of their “normal course of business” is wrong for this side of things. Good intentions can cause harm when Economic Policy applied to businesses or companies is applied to entrepreneurs with little more changed than an event title or calling something an accelerator.

I have a colleague there – Donna Thomas – and sounds like a super active and connected space. I hope to check it out at some point.

Same, that, I’m due for a visit

Yes, I see your point. There is little between a shrink-wrapped box of Quickbooks and a full SAP supply chain implementation. Oracle and Microsoft offerings are just as obtuse, and nobody in their right mind is going to hire consultants to build out a solution, you can grow a business with. I will say… I am surprised neither Fedex nor UPS came up with any initiatives that would allow third parties to steal some Amazon business. Similarly third party warehousing is mostly concerned with shrinkage and people actually showing up to clock in. Lots of opportunities to explore…

What you’re describing is the missing middle layer of the modern economy: the space between websites and billion-dollar enterprise stacks. That’s precisely where new value is being built.

The logistics majors could have owned it. FedEx and UPS networks sit on the richest behavioral data in commerce, but they never turned that visibility into platforms founders could build on. So now, that vacuum is being filled by startups stitching together workflow tools, visibility layers, and micro-SaaS that live in the cracks between QuickBooks and SAP.

It’s the same gap Bentonville (and every logistics-dense region) can turn into advantage: founders here see those cracks up close. They’re surrounded by the pain points of mid-market operations that are too small for SAP and too complex for Shopify.

That’s the next frontier: not replacing the enterprise stack, but right-sizing it.

Remember when I talked about bringing The Blox here? This place is special. Would love to meet up the next time you’re in town. We’re due for a catch up!

I stand by my advice, best thing they could do is produce different shows in major cities with local hosts ?

I’ll message you so we can!

Proud as hell that within 8 months of selling a product we got Higher Innovation into Walmart! What we’ve got planned with them is so exciting.

The stewardship of Bentonville’s business, social, recreational and economic resources over the last 50 years is unmatched. I expect graduate programs in community planning to use it as a gold standard case study.

Hi Paul O’Brien — one missing item: healthcare technology, especially Fire and Emergency Medical Services. Tom Jenkins is tugging an entire, nationwide, ubiquitous industry forward — and doing so with his trademark humility even though he really should take bow after bow (but he won’t).

Then there is the Arkansas Hospital Association (Lyndsey Dumas Gilbert , Bo Ryall ) which continues to push every intellectual envelope with respect to emergency care and preparedness, collapsing silos that should have been collapsed eons ago and showing the rest of the country how it’s done.

Then there’s Brandon Morshedi, MD, DPT, FACEP, FAEMS, NRP, FP-C, CCP-C — count the letters after his name!!! Pretty much says it all: 3/4 Midwestern tech geek masquerading as a doctor, flight medic, etc.

For an overview of some of what is going on, here’s my article from JEMS: Journal of Emergency Medical Services, coauthored with Chief Jenkins. It’s only gotten more interesting in the interim. Rob Coppedge / Echo Health Ventures are doing cool stuff in Arkansas but they aren’t the only ones.

https://www.jems.com/mobile-integrated-health-and-community-paramedicine/mobile-medicine-in-wide-open-spaces-or-healthtech-in-the-heartland/ Jeff Frankel

Jonathon Feit The work that Tom and the Arkansas Hospital Association are doing in Fire and EMS is a perfect illustration of what we’re seeing across the region: whole systems innovation, not just startup activity.

You’re right, healthcare here isn’t about another app, it can’t be, anywhere; it’s about rebuilding coordination, readiness, and delivery in places where the margin for error is measured in minutes. The fact that so many are experimenting in Arkansas speaks volumes about how open the Heartland is to real change.

I’ll make sure to highlight this thread in follow-ups; we’re in quite a few talks related. It’s all a reminder that “innovation” in the middle of the country often looks less like Silicon Valley and more like systems quietly getting smarter.

Thanks for the JEMS link, that piece belongs in the canon of how emergency medicine is becoming one of the South’s most consequential tech sectors.

cc Autumn Manning

Paul O’Brien whenever you visit, hit me up! I moved to bville in March.

Adam Perschke awesome. Might be soon!

Paul O’Brien this is a really good analysis. I would love to see this kind of energy settle on the Houston ecosystem. Proximity to your point earlier this week would be something we need to mitigate for. A lot of ideas are floating around and the we need to elevate the capital risk tolerance mindset.

Nigel Singh, PMP, CTP I’ve had a couple conversations with Rice Alliance for Technology and Entrepreneurship about a coalition of parties that could together pull this off. It’s not hard, we need intention, commitment, and collaboration.

According to William Gravell they are #2 in growth the last few years behind Williamson County.

Bryan Eisenberg I just wrapped up my study of Washington D.C. so on the whole. and from what I hear of Williamson County, they may be crushing in growth, but Bentonville and D.C. are about to boom in this regard. In Texas… Houston *might* have the potential but they need to follow these coalition playbooks too if they want to make it work well for entrepreneurs.

Here’s the D.C. take:

https://www.linkedin.com/feed/update/urn:li:activity:7382165973413388288/

This article by Paul O’Brien It is one of the most actionable and valuable posts I’ve seen on LinkedIn in some time.

If you work or live in a municipality that is seeking to grow economically, this post is for you.

Howard, been pushing as hard for us to do this in Texas, for years. Different culture. William Leake, how’s your end of week to chat about this?

We also have Oklahoma catching on, nearby, and if we all play our cards right, Texas / Oklahoma / Arkansas is a powerhouse in innovation (cc Peter Mullen)

[…] Phoenix works to lead in BioScience, just as Bentonville could lead in Supply Chain, Tulsa might lead Rural Tech, and Chicago could be Industrial Innovation, the opportunity isn’t […]