“Perhaps one of the most important financial decisions a forest landowner will make is determining when to harvest timber.”

That, the opening of a PennState article exploring the financial decisions land owners consider in this use case, including how to determine and calculate when to maximize financial returns, prompted a thought about investing in property and how real estate investors and developers might better appreciate investing in startups.

Article Highlights

Seeing the Forest Through the Trees

Put yourself in the shoes of a City planner, a property owner, or real estate developer.

Driving through town, perhaps a booming town like where I live in Austin, TX, you see that dirt on the side of the road and know that it has potential.

You see a hastily crafted wood sign that reads “250 acres for sale — Zoned — Call for details”

To the left and right are buildings occupied, and behind our property you see some construction under way. Your mind immediately turns to all you know about that part of town: property values, turnover, traffic patterns and mobility, infrastructure, and more.

There the dirt sits; worth far more than the ground itself, when developed.

There is an aggravating question too frequently asked of startup founders, “how much revenue do you have?”

You pull over and take down the number on the sign.

You know the demand for space there, you’ve been in talks about the future of the area, and you know what it costs, roughly, to turn that into housing, office space, coworking, or multi-use. You can even calculate in your head what some build-to-suit scenarios might involve.

You call, and discovering what it costs to invest in the property, to buy it, you throw on top of your math, the various development scenarios and a $2M piece of property with another $5,000,000 invested, carry the 1…. easily becomes something worth $15,000,000, in your head.

You put in a second call to other investors and friends.

“What?” they utter. “$2 million? Why is this land on the market for $2,000,000 when it isn’t even developed nor producing any revenue??”

Investing in startups and property is more alike than different.

The Value of Trees

The return on any investment is inter-dependent on the underlying infrastructure.

- Is that location valuable?

- Will office space there be too expensive?

- Can we develop upon it with the features and benefits necessary?

And before you read on, thinking I meant those bullet points to refer to our property investment, know that those questions pertain too to an investment in startups and operating businesses.

What do startups need to think about? What do investors in startups consider?

- Is that location (industry, city, region) valuable?

- Will we be wasting money on office space or can it be spent meaningfully?

- Can we develop what we’re doing with the features and benefits of that space in mind?

WHERE businesses work matters. It is not just four walls and a door. Four walls and a door is little more than an expense. Whereas investing because of location, as you well know, makes a difference.

I’ve explored this quite a bit about Texas and other markets. That, for example, a cybersecurity startup and investment in Kansas just isn’t as meaningful as a cybersecurity venture in San Antonio, where a great majority of that experience can be found. Our MediaTech Ventures work, as another example, is largely in places like Austin, Chicago, and Los Angeles, Korea, Italy, and Colombia, because it’s there where economic development and property investment meaningfully and substantially impacts the very industry that’s thriving there in particular.

We’re all readily familiar with the important role space plays in our work, with the studio or venue space being paramount to the impact we have, but it’s the buildings and structures in the broader sense and the role that they play collectively that struck me.

John Zozzaro; MediaTech Ventures

And yet, largely throughout the world, cities are not working with BOTH property developers/investors AND industry, to meaningfully develop the places that matter.

Worse, property developers and investors are neglecting that the impact and investment that they can (and should) make as venture capital investors, is by mitigating the risk of investing in startups – working with industry to develop space that is more than four walls a door.

When Trees Mature

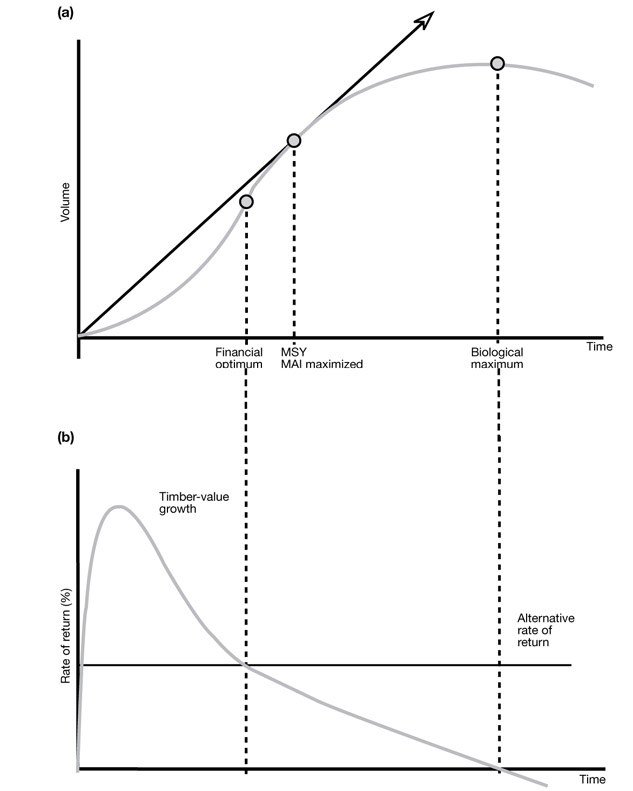

“In most cases, a forest contains both high- and low-value species. It is likely that some trees are growing faster than others. Factors affecting individual tree growth are competition among trees, sunlight, tree age, and soil conditions. Young trees generally grow faster in height than older trees, and they add relatively little stem diameter. Depending on competition, as trees get older and larger, annual height growth decreases, but diameter growth continues, albeit, at a slower rate. Eventually, average annual volume growth decreases.”

PennState Extension

City planners and property developers and investors look at dirt in precisely the same way that an Angel Investor looks at a founder.

“What? $2 million? Why is this land on the market for $2,000,000 when it isn’t even developed nor producing any revenue??”

What I saw in that PennState article about the timber industry is that rather than putting up a building, we can appreciate the idea through farming those trees.

The location matters, the kind of trees planted, matter. Your investment in that property will fail to pay off if you plant palm trees in Michigan. You know better than to plant trees that take decades to mature, when you can’t wait that long for a return.

Why are we putting up buildings without working with the most meaningful trees??

How do you decide to invest in the property knowing full well that it will take time for the trees to grow? Knowing that full well, eventually, volume growth decreases? PennState describes the distinctions between a startup and a company, and the investments made in them, through trees.

“What? $2 million? Why is this land on the market for $2,000,000 when it isn’t even developed nor producing any revenue??”

As we increasingly work remotely and from home, the development of that property should be about more than just four walls because no one really benefits from four walls. Cities are sitting on vast tracks of unoccupied but developed office space to which few will meaningfully return because it’s the wrong kind of trees in the wrong place.

We can invest in planning a city and developing property to bear revenue by planting the right trees in the right places… by working with industry to put the right resources and converge sectors in meaningful ways through property, so that entrepreneurs, new businesses, and investors IN THAT SECTOR, thrive.

The path forward through the forest is is there as long as we pull ourselves from being stuck in the familiarity that dirt developed to concrete, bears revenue, simply enough. That we pull ourselves from being stuck in the idea that that startups and new businesses immediately bear revenue when a cost of the space itself is a burden to overcome before they can actually even occupy the space. Being so stuck, we’re failing to find common ground, we’re overlooking that the most meaningful path forward for property development and investors, in support of and participation with startups, is to do what it does best – but to do it with the industry itself to plant the right trees in the right places.

“The route to a sustainable future is through social investment and entrepreneurship – community by community.”

Miles Fidelman; Social Entrepreneur and Policy Analyst, Protocol Technologies Group

Economically speaking, entrepreneurship is fickle. Fidelman’s observation of social investment is in civic infrastructure; the properties and purpose of that land… that a sustainable future of investments in startups and innovation, starts there, together, as a community.

Fostering a startup community requires an investment in the underlying ecosystem so that entrepreneurs can take meaningful, personal risks: strong job market, mobility, affordable office space, stability for investors, support of startup oriented education, and development of community – social investment, to provide that sustainability of an ecosystem within the community, that enables entrepreneurs.

The industry knows your trees and as those skyscrapers grow from the ground, at your expense, a future in which property development increasingly converges with venture capital, is a future with a better return for everyone. Let’s do it.

I want to invite you to join me in such discussions live and together.

Join me online here

Fantastic article and certainly thought-provoking! I think the million-dollar question is: how do we get there? Is it a plea to the city development office, local reps/councilmen? Who foots the initial bill toward paving the forest and who profits if it succeeds? It sounds in-part like a public/private partnership, but those bear the heavy risk to the private sector should they fail to pass economic or government feasibility. Who takes the first step toward building a partnership among the trees? Where does the partnership end, or does it blossom and bear more fruit? Excellent idea, but arduous in implementation.

Great read… it will be interesting to see how this all plays out the next several years. There will be some office landlords that choose to embrace new revenue models because they have to. Some won’t change because they won’t have to. Some won’t change and b/c of that their business will die. Office leasing won’t ever be entirely the same, but it’s not going away in a city like Austin, that’s very clear. We may enter a scenario over the next decade where property owners are waiting on city zoning policy to effectively influence the value of properties. I could see an environment where landlords and venture capitalist overlap . Own the asset, give free or discounted rent to your portfolio companies and help them grow.

I kind of think that a lot of the future has to do with rebuilding the commons – for example by investment in land trusts, coops, etc. And, in particular, intergenerational investment – investing in infrastructure that will generate income, and represent assets that can be passed on to the next generation.

To elaborate, I think of the electrification projects during the New Deal era:

– The Hoover Dam was built by private companies, funded through 30-year bonds, all the Feds put up was a little public land, some water rights, and the supervising engineer – everyone made out well, and a self-supporting public utility fueled most of the growth of the Southwest US

– The REA provided LOANS to rural coops & municipalities to create cooperative & municipal electric utilities (still does, and provides loans to municipal telecom projects as well, sometimes)

Seems like a proven model to rebuild our infrastructure, provide some good investment opportunities for retirement portfolios, and some opportunities for those who will build new infrastructure. (Personally, I’m thinking that I’d like to build a utility coop to serve our rather large condo complex, along with a couple of neighboring developments. We already own our sewage plant, and maintain our roads – if we have to rebuild our energy plant for a post-carbon world, might as well own it.)

California had the gold rush, Texas had the land rush. History repeating itself?

Wow. Couldn’t have put it better than Paul O’Brien. As a new Austinite, I’ve lots to learn and be grateful for here. But so much opportunity. Sounds like there still is time. Let’s giddy up y’all! #Texas #seedcapital #nextgen

Well said, and lengthy!

I love the passion and conviction conveyed in your writing! Well done!

Bay area was the firestarter for the internet and amazing computer tech we are using for this conversation.. given that this kind of excellence did not just suddenly exist from zero, you look at the foundation and see 2 heavyweight education institutions that reach for the stars Berkeley and slightly further away Stanford.

Berkeley has always has had free education for lower income, and had Fenmann for his later years.

I believe that combinations created the firestorm of tech we see today, and if texas wants to keep that ball rolling, and for the long term, then more investment in higher end education, options and chance for everyone is absolutely essential, or the foundation will break.

Shaun Lamont very well said and agreed. The approach to innovation and IP, at the University systems, is notably different and remarkably relevant.

I think I follow the premise…however, developers already take a lot of risk….1. Land risk 2. Market risk. 3. Entitlement and Zoning risk. 4. Lease up risk…..all in order to achieve a 6 to 7% yield on cost. Why on earth would they want to take on tenant credit risk by filling their buildings up with start up companies with high failure rates? The answer is they won’t and the banks that lend on the developments won’t either. This is the problem that WeWork and co-working companies aimed to solve and have for the most part.

Lots to unpack here. As we address the metaphor of land development and tree farming, I believe Shaun Lamont has a good eye for the concept of long term investment in communities of founders. As is the case with forestry, the best crops are stocked by very old growth. But as a function of investing, planting, nurturing and harvesting a forest, that strategy is difficult to sell to venture capital. Why? Because the forest takes hundreds of years to mature. Venture capital is likely the wrong fit in that analogy. However, making an investment in old growth, harvesting, and replanting a new crop (like say cannabis) might have an appeal to that class if investor. In that scenario, the smart money would come from a bank though. The loan is repaid through the harvest of the old growth asset and the business is built on the efforts of the tenant farmer who plants a faster growing crop with higher yields. But in this case location or highest and best use would likely be on a rural tract. Funny enough, that may even be the case for a tech startup in these times. But I digress. I believe what you are actually getting at, is the fact that VC in Texas tends to write checks that are too small and don’t factor in enough runway unless they are able to partner or syndicate with other investors. Because of that unwillingness to invest in companies who are not showing revenue, the onus falls on the founders to find more effective, albeit slower, routes to profitability. The problem is that they often lose their IP along the way to other organizations building on their hard work with quicker pace. Sometimes it is better to invest in an established forest than it is to plant and wait out the natural process of growing from scratch.

Fabulous article Paul O’Brien you always see the forest! I especially like how this article relates to the increased number of tech startups, tech giants, and investments that are happening right now in hypergrowth mode. Look at the trees being planted in Texas right now, a similar sign was placed by state leadership that simply states Open For Business, reinforcing that Texas will work with each tree to help them grow, succeed and become a part of the rich landscape that is our vast Texas forest. This is a partnership and an opportunity for each city benefitting from this tech investment to now look inward at infrastructure, education and focus on this growth…all while keeping the forest alive and thriving. After all, the WHY was to plant their roots in these cities for the culture, education, live music, outdoor activities, community…and yes, even its weirdness. Austin, Houston & Dallas the land rush is real and real estate has never been more exciting, even in a pandemic! Homes, land, commercial, and investment properties are in demand with the footprint of each community expanding…and Texas has room for more! It’s our time, let’s embrace the benefits together. A best practice is to partner with local leaders, support local businesses, invest in their growth to reinforce the WHY as this will keep the cities alive and thriving.

Austin, Texas and elsewhere in the lone star state, rode out 2008 like it never even happened.

One of the reasons I love what I do! I’m able to build the future and plan things from scratch. It’s extremely gratifying and exciting!

Love this

So true! When you think of neighborhoods, parks, universities, and other real estate investments, what a way to plan future forward! Real estate investing from the ground up is the ticket!

Parks, neighborhoods… Investing in the aesthetics of where we live, is what makes us all mindful in life and at peace with the world around us. Far more favor that than more pavement 🙂

I love the thoughts behind the article. I’ve seen plenty of startups have to struggle with space not suited to them. I know of lots of medical device and space device startups near me (its my profession). Most of them can not find office buildings with clean rooms and labs. Most of them can not find building with clean room buildings with attached large office space. “Build to suit” is expensive. Startups come and go, but building a building to house “the 2 most common startups in the area for which generic office space won’t work” is something I wish more developers did.

Very very interesting article Paul O’Brien

Waiting to see the ‘clash’ of traditional TX politics and State Govt leadership with the influx of new people from CA & other progressive areas that drive innovation. Progress= moving foward not backward!

[…] key: the density of collaboration. These aren’t passive tenants leasing office space – something I’ve pushed hard before for property developers and city planners to appreciate. They are co-developers in real-time R&D. Companies like PSI (Progetti Speciali Italiani), […]

[…] Adelaide has undergone a culture shock. A repurposed hospital complex, Lot Fourteen, now hosts more than 56 resident startups and over 700 employees focused on deep-tech, space, and defense. It’s curve-jumping faster than a rocket stage reaching orbit and exactly what economic development offices and local officials need to be doing in repurposing existing property for innovation. […]

[…] kicker? Venture Studios don’t even need that much from public partners. A lease on a building. A grant to co-fund prototype development. Access to procurement pipelines. This isn’t a blank […]