Years ago, Peter Thiel provocatively proclaimed in the Wall Street Journal that “Competition Is for Losers” and I recall loving the headline not for the negative connotation implied, but for the play on words that you’re going to lose if you set out to compete.

“The airlines compete with each other, but Google stands alone. Economists use two simplified models to explain the difference: perfect competition and monopoly. “Perfect competition” is considered both the ideal and the default state in Economics 101. So-called perfectly competitive markets achieve equilibrium when producer supply meets consumer demand. Every firm in a competitive market is undifferentiated and sells the same homogeneous products. Since no firm has any market power, they must all sell at whatever price the market determines. If there is money to be made, new firms will enter the market, increase supply, drive prices down, and thereby eliminate the profits that attracted them in the first place. If too many firms enter the market, they’ll suffer losses, some will fold, and prices will rise back to sustainable levels. Under perfect competition, in the long run no company makes an economic profit.”

– Peter Thiel; Zero To One

This is why startups are what? By definition? Not what others are doing.

Startups are an efficient and exceptional application of innovation and marketing.

Innovation is doing something distinct and new. Marketing is knowing what everyone else is doing and differentiating your experience to create value and customers.

Meaning… don’t just do what they’re doing.

Not, “avoid competition” in the sense of going out of your way to not be known by them. Instead, “avoid,” as in having anything directly and literally the same as competitors; if you’re just doing what other startups (or established companies) are doing, you’re making your own risk undertaken more difficult.

Startups are not the same as “new businesses.” A new business has direct competition; a new business is the type of new venture that has a known model and is set out to do what others are doing. A new accounting firm or a new consultancy is a new business; heck, even a new ridesharing app or adtech platform is technically just a new business, not a startup. Why? Because they aren’t innovative, they can replicate what to do – they are literally direct competition.

A startup is a new venture in search of a business model. Meaning, there isn’t a model for you to replicate and follow. There isn’t literally direct competition; if there was, you’d just be another of that.

Don’t misunderstand any of that to mean you don’t have competitors. Of course you do. No startup is actually free of competitors (something too many founders think and say); the encouragement here is to make sure you are distinct, different, and that you carve out your niche rather than just following the crowd and doing the same thing as others.

Thank you! #iLongsworth

Finally! A definition of “startup” that I can support and more importantly, use in meaningful conversations with others about what it takes to succeed as a startup.

Welcome to the never ending debate with people who think every new business should also be called a startup 😉

Paul, it actually is worse than that. I’ve heard people call companies with billion-dollar valuations startups. I had a conversation with Bob Metcalfe a while back about this. My conjecture was that the media will call any company that was not spun out whole from another company or created through mergers a startup. That makes General Electric, Ford Motor Company, and US Steel startups, even today.

Well said Christopher Piedmonte; that’s why I’m such a stickler about these words. Google isn’t a startup. AirBnB isn’t a startup. Heck newer, Uber isn’t a startup.

Pretty straightforward to me so I’ll never really grasp why so many need to debate this:

* No known business model = startup

* Known business model = new business, business, or company

I can agree with the first part of this: avoid competition.

I cannot agree with this: “Startups are not the same as “new businesses.”” But they are. At the end of the day, we are all selling a product or service in hopes that we receive more than we spent on it.

Startups are businesses. Sometimes novel businesses in an ecosystem that is really fun to be a part of but they are still businesses.

Do you distinguish a new gym opening in your neighborhood, from an AI that detetmines what food you should eat based on your workouts?

It’s okay if you do, just curious.

I think the distinction is important in society. One knows how money is made, how it’s operated, and the other does not.

And no, not all startups are focused on selling products or services in hopes of receiving more than spent; many are just investments in proving an innovation or establishing a market share. Once a model is determined and sufficiently proven, most such startups intentionally seek an exit

Paul O’Brien, in your gym/AI question, is the company that owns the AI making money somehow? Do they need customers? Do they have to pay people and therefore want to bring in more money than they spend? Are the investors looking to do an exit based on NPV or EBITDA calcs? Do Assets = Liabilities + Shareholder’s Equity in both situations?

And an investment implies an expectation of return of more than the money put in. Thanks for supporting my position! 😉

And a model isn’t successful or sufficiently proven if it isn’t bringing in money. And it won’t exit if it doesn’t make money. I could be wrong on that one. Do you have an example of an exit of a company that isn’t making money? That wasn’t used for parts…

“and a model isn’t successful or sufficiently proven if it isn’t bringing in money.”

Agree to disagree.

And of course I agree with the position on investors. Noting I said implies otherwise.

The most famous exit without making money is probably Instagram. They also acquired Beluga with no revenue. And some others

GroupMe was acquired for close to $100MM (I don’t recall), no revenue.

Every Apple fans favorite Siri has no revenue.

For the AI scenario, all great questions but still doesn’t answer mine 😉 what differentiates the known business model venture from the one unknown? Maybe put it another way, how should we refer to new ventures that can’t follow what others have done? What would you call those?

Startup is a fine word. They’re still businesses.

The GroupMe purchase was a strategic business decision by MS. If they had not been purchased, GroupMe would’ve still had to compete against every other application out there and coming out. They would’ve needed more than just a long line of investor cash to keep the lights on.

Siri was designed by an AI company as part of its product offering. It was intended to be purchased by someone, in whole or in part.

And and as far as the IG purchase, CEO Kevin Systrom had said that Instagram’s goal is to become a self-sustaining business.

So, while it’s cute and fun to make no money in hopes of a big exit, the ultimate goal is always to make money unless it’s a nonprofit but even those require funding. One of your previous posts even talked about the industry moving towards VCs investing in revenuing businesses as opposed to the old method of unproven ideas.

Startups are businesses.

If you read _Zero to One_, though, you know that he meant it: he’s always in pursuit of a monopoly. He says so.

PS: How do you format in Facebook posts? I’ve tried everything.

Yeah and that his view of monopoly is merely establishing that niche from differentiation. My quote in the article highlights his perspective on what economist consider a perfectly competitive market. The airline industry. Where, for the most part, everyone is just competing on price as the near identical competitors have nothing else to differentiate.

His point is that “startups” should avoid that.

(How do I format…?? I don’t know, just an option I have LOL)

Oh, you had me until you brought the airline industry in. They’ve all been bankrupt for decades and propped up by government backing.

Lydia Musher yeah… “government bailout” is a whole other ball of wax. I’ve been in some substantial discussions explaining support for the “controversy” Palihapitiya sparked.

I’m not saying I oppose all government support (I like flying), just that the airline industry is in no way a good example of functioning capitalism.

All companies were at one time startups? When did they stop being startups? Small businesses are not all startups? The difference is in the letters UP. Startups aim to scale UP?

Bob, so the component of planned significant, even exponential, growth would make a good addition to a potentially useful definition.

I like where you’re going with this. It goes along with the same sound advice that startups should have business hypotheses, not plans. And along the same line, we need to encourage more mature startups to step into their business shoes. Once they can confirm their hypothesis and repeat it with success, then they can create a business plan. That doesn’t mean they stop trying new and innovative things, but there has to be has to be a moment where a startup realizes they made it. They’re viable and growing. It doesn’t mean they won’t seek further funding, but those rounds will be focused on scaling and new initiatives, not life support. I think it’s a really positive step to have a good definition of a startup, but it would also be helpful to define when stage ends. When startups hang on to that designation after they’re shipping product and raising B or C rounds, it can result in a company version of Peter Pan syndrome. Although, I’m sure current circumstances has woken some folks up.

Great points Courtney Brock and very much so agree. Trying new and innovative things does not a startup make; IBM, Google, and Apple are a few great companies (not startups) trying new and innovative.

The stage ends, it seems, when the model is sustainable, repeatable, and competitive.

So why the heck do I need a competitor slide for a 10-slide deck?!? I could put something so much more useful there!

Ah but you do! It’s a question of the differentiation (good and the bad)

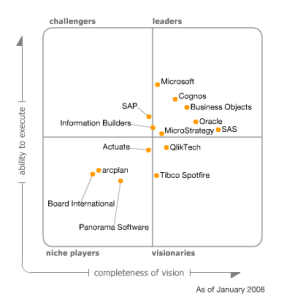

Based on Zero to One, the goal is to build your own monopoly. Competitors convey the status quo and your slides shows how you’re different and transforming a new opportunity that you can dominate and monopolize (investors like monopolies).

The other advice often given is to use the competitor slide to show what people are currently doing to solve the problem you’re solving, if there is no direct competition. That is, effectively, the competition.

Love him or hate him “Zero to One” is a must-read.

I think both love and hate are a good sign. Seems almost everyone who has tremendous impact experiences a bit of both.

What’s that saying about breaking a few eggs? 🙂

“A startup is a new venture in search of a business model.”

Respectfully disagree. A startup is a business aiming to explosive growth.

When Thiel says: “Competition Is for Losers” is because he thinks if you are not a monopoly, you are a loser. He has said so several times.

“No startup is actually free of competitors”. I agree fully.

If there is a planned zoom meeting to discuss these topics, I’d love to be part of 🙂

Competition? Having it is so overrated 🙂

Glad I’m not the only one seeing through the startup mislabeling. I once worked for a 10-year old company that still called themselves a startup. I think it’s just a ploy to get noticed. Building a true startup is hard, and I would even say scary, precisely because the business model hasn’t been proven yet.

Brian Wiles exactly, this: precisely because the business model hasn’t been proven yet.

Brian Wiles, this is the kind of corporate Peter Pan syndrome that allowed WeWork to get as far as they did. Maybe you could call it “late-stage startup behavior.” When 10 year old companies are still calling theirselves startups, it’s time for a quick gut check.

Perhaps related? Don’t focus on/worry about competitors.

Instead, focus on customers & innovation & execution & removing obstacles to adoption. If you do that, the competition isn’t an issue.

Most of the time, doing nothing/status quo is the most formidable competitor.

“Most of the time, doing nothing/status quo is the most formidable competitor.” So incredibly well said and not repeated enough. Most startups die because the act too slowly, or not at all.

[…] Meaning… don’t just do what they’re doing […]