Asked the other day, having witnessed the success of WhatsApp, “how are these companies getting funded when they don’t have paying customers?”

It’s a good question, but frankly too, one that for many of us, actually doesn’t make sense. Most innovation gets funded without revenue so I’d ask in return, what makes you think you need revenue to get funding??

Given the decline in early stage venture capital and the increasing risk aversion that traditional capital sources seems to be experiencing, it’s not unreasonable to conclude why entrepreneurs increasingly believe that they have to have customers. The popularity of Lean Startup practically preaches that you need customers and revenue to validate what you’re doing and as Angel investors, not just startup founders, read those same books, naturally, they’re going to default to such a response when they, having just heard your pitch, are unsure. I’m sure you’ve heard such a reaction from potential investors, instead of simply saying no or not right for us, you get the, “Do you have any customers yet? I’d advise you to focus on revenue and securing some customers; come back and let’s talk some more when you’re further along that track.” These trends in the startup economy are causing entrepreneurs to think (believe) that they must have customers and revenue to get funded. Think about how innovation works though, MOST investment is in developments in which there are no customers nor revenue: real estate development, medicine, R&D, energy.

Article Highlights

Most Investment is the Result of Marketing, not Product

The reason famed economist Peter Drucker famously quipped that the only things that create value in business are innovation and marketing is that it’s true. And yet unfortunately, most entrepreneurs are being taught that marketing is a cost for which the return is leads/customers. Marketing is an investment. Marketing is the reason there is so much investment in those companies without customers. How do I mean? Consider those examples:

Real estate investors/developers are incredibly savvy investors. They know how to work the system, they play the politics, and strategically plan their developments such that real estate still delivers the highest return on investment in the world. Sure, that ROI is because of the unending appreciation of property value as demand will forever increase but appreciate that there are never (okay, rarely) failed property development investments. How on earth is that possible? They don’t have customers and revenue until the investment in the development is done! Surely, they need paying tenants to know that they should build an condo tower. Right?

Imagine being a real estate developer and starting a new project (your new startup) when you can’t get customers and revenue. How would you possibly justify that the investment be made? That it’s worth chasing your dream?

Real estate developers don’t just develop property where ever they can, for the sake of building it and hoping people will move in (as long as they can find the skilled technical resources to develop the land); so why would you?? But that’s what many startups are doing these days; as long as we have the developers, we can build the skyscraper and then get the tenants… why won’t anyone fund us!? Real estate developers do market research, study demand, evaluate infrastructure (roads, utilities, etc.), and consider the nearby “partners” (think businesses and companies that can employ people and/or attract people to occupy their development).

Having determined that there is a reason to develop, they fund it and get to work. All of that validation is marketing.

The same is true of medicine, R&D, energy, and other verticals wherein there are no customers until you’ve built the product or service. “Hey, let’s drill on the side of this granite mountain! I have a dream of making oil more accessible and cheaper by drilling in every mountain in America. We have the tools, and the drillers, and, I’ve been told, once we pull just one barrel out of the mountain, we can sell it and bootstrap our success!” Seriously??

How Startups Get Funded without Revenue

Are you just building something hoping to get customers who will pay you (move in to your new building) in order to convince investors to give you money?? Put yourself in the shoes of the investor hearing that pitch, “Sounds good. Come back when you have some of those customers and let’s talk some more when you’re further along.” Rats. But that’s how you’re pitching the company! Why would any investor take a risk on you when you’re selling a dream as though it can be sold?

Are you just building something hoping to get customers who will pay you (move in to your new building) in order to convince investors to give you money?? Put yourself in the shoes of the investor hearing that pitch, “Sounds good. Come back when you have some of those customers and let’s talk some more when you’re further along.” Rats. But that’s how you’re pitching the company! Why would any investor take a risk on you when you’re selling a dream as though it can be sold?

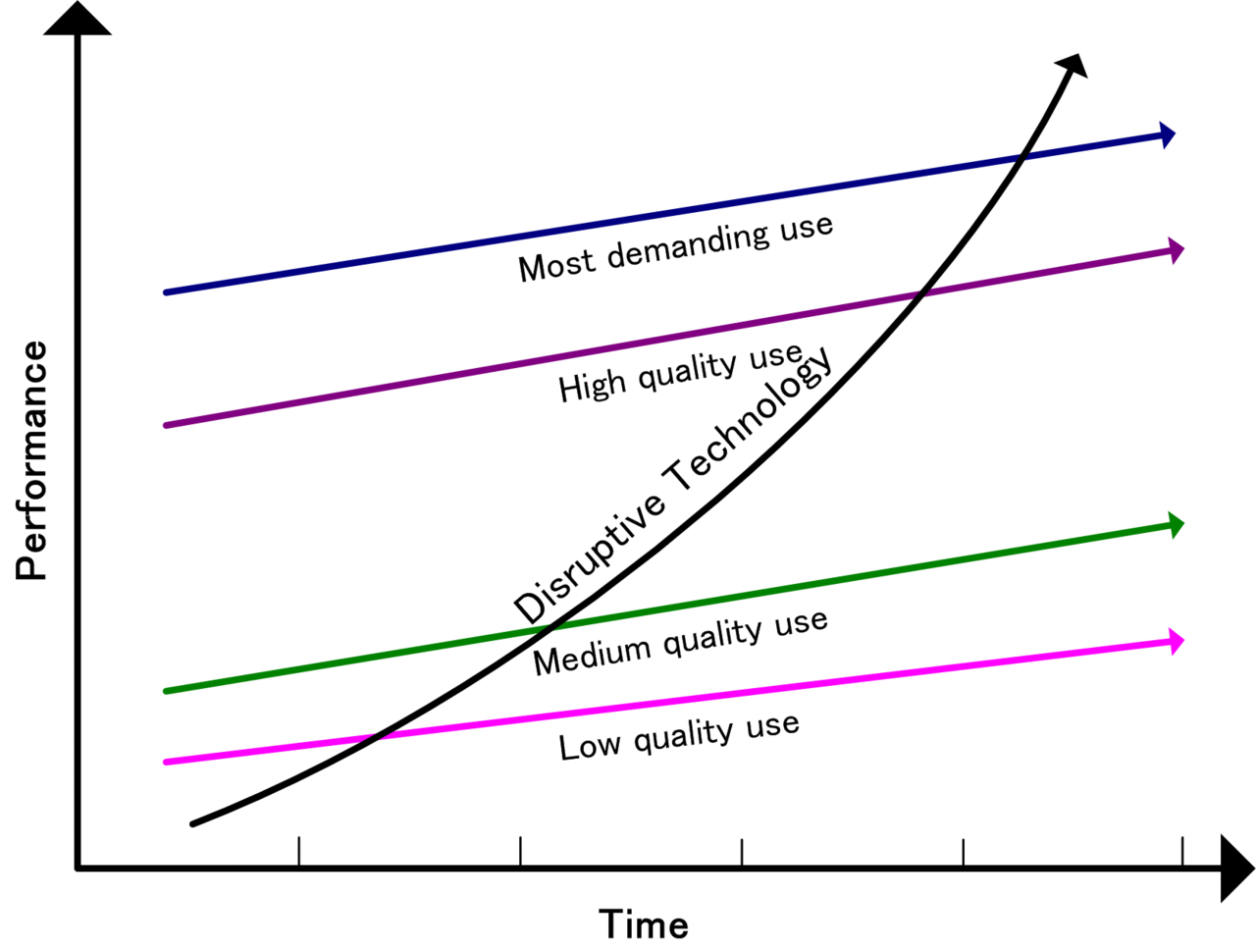

I love this chart to the right as it simply conveys what we’re talking about here. If you’re an investor looking at 5 different startups, in which one of those would you prefer to invest? Most demanding use is determined by customers but disruptive innovation requires knowing how to be disruptive.

Instead of building something customers can buy, shouldn’t you first do market research to understand how big is the market in which you’re working? Who are the competitors? How much market share you can achieve and at what cost? Wouldn’t it make sense to make sure there’s demand for what you’re thinking and figure out from where and how you can capture that demand? Does the infrastructure exist – does the media cover your industry/market, do the technologies and APIs exist to simplify what you’re building, and are the marketing channels significant enough that you can get people TO what you’ve built? And what of Partners? Not the BS, “we could partner or get acquired by Netflix, Google, or P&G!” Sure you can. Let’s understand who the real, potential partners are; those with whom you can foster an industry, customer adoption, PR, and share resources.

If you have’t done that marketing, you can’t raise money without revenue because you don’t have a business any more valuable than selling something. Businesses that sell something get loans. Startups that understand their potential to redefine and own markets, get funding.

Outstanding point, Paul. Focus on innovation and disruption first if you want to maximize your company’s ultimate impact! Thanks.

Here’s another dimension to the argument where the real estate analogy doesn’t hold true. For those who have worked in a field of knowledge, healthcare delivery for instance, it was reported in the 90s that 92% of successful ventures were based on people who worked in the trenches and have deep knowledge of the problems that need to be solved with innovative ideas on how to solve them. They build a model spending their own money, then move to advance the model of v1.0 which was on the market but offered free, to the next advanced version. The fact that they believe in their solution, tested it in the market with satisfactory customer response but didn’t make revenue, why are investors afraid to invest in this kind of venture? If the innovation is a First-in-Class, First-in-Kind product solution, and it can be attested to by professionals working in the particular field of knowledge, say diabetes, which global epidemic hasn’t even been touched by existing so-called market leaders products, isn’t there the intelligence to see that for investment?

There isn’t venture capital anymore, its banking.

@Bob coming from brick & mortar and service based background it’s taken me some time but I am finally understanding what you are saying. @Gerene, timing may have been the root cause for your experience. Health, Edu and GovTech are all finally making their way around and are ripe for (dare I say) disruption. @Paul the timing of this article couldn’t have been more perfect for me and my team – pleasure to meet you at Frost Tower. – Excellent Read

How to get funded without revenue?

#1> Start your company in SF/SV.

#2> Move your company to SF/SV.

#3> Get investors from SF/SV

And what Paul said….

🙂

This is the best damn article I’ve read on this topic. So many nuggets of information that could be discussion on their own.

I have designed a new building system based on injection molding plastic molds to cast the building blocks in, have registered the design and done all the design drawings, business plan, market research and am ready to launch, but need $100 000 for the tooling and working capital. Where do I start looking for funding?

Johan, a few places:

1. Public and government grants. A lot of money in government support for such things

2. Corporate support. What companies would license or use this? Can you get it prototyped for less than they can?

3. Banks and other sources of lending. Most founders don’t like hearing this but overwhelmingly most startup capital comes from our pockets… and by extension of that, lending

4. An Angel Investor. NOT a business investor (anyone who expects customers or revenue) and NOT VC (which is suited to later stage; well beyond the prototype). Find an individual with exceptional wealth, who likes this sector and understands the engineering. Seek their investment by way of a Convertible Note or Equity ownership in the company.

What about the food industry? I am a 43 year veteran in food service and have registered a trademark in order to franchise in the next couple of years. I have everything in place from registration to EIN to employees ready to work. I have a five-year business plan and was set to open Pre-Covid. Everything is professionally done except for our Food Truck it needs 6000 dollars to finish. I need working capital and feel like I’m on a treasure hunt, even though we were set to open in April 2020 Covid took the funds we had in order to live through this past year. I have an LLC and tons of brand new equipment for catering and the food truck. I also live on the coast in a town that gets over 4 million tourists every year. I have new food ideas and great customer relations skills, people love my food. How do I get help? PPP won’t work and like you said everyone says no revenue no money. What can I do to show I’m anxious to work and satisfy guests? I love cooking for the benefit of full tummies and happy people, that’s what makes me happy I love the smiles the praise, and the fact people come back just to eat something I make because they love it. This is what I do!

The catch there Eugene is that a new business, a restaurant or good truck, isn’t a startup in the manner explored here. It’s new, yes, but new doesn’t = startup.

Startups don’t have or know the business model. A food truck does. Because of that, because the model is known, your sources of capital are friends + family, debt, and banks, for the most part. A business partner could be viable.

Investors seek substantial returns (20x) on their investment, in order to offset all the losses among startups. Established business models just don’t deliver those kinds of returns.

Absolutely agree with the insights here! In the dynamic landscape of mobile app, web, and software development startups, it’s crucial to prioritize innovation and disruption. Startups should emulate the approach of real estate investors who strategically plan their developments based on market research, demand evaluation, and infrastructure considerations. Understanding the market size, competitors, and potential market share before building a product is essential. This article sheds light on the fact that, similar to other industries, successful tech startups often secure funding by showcasing their potential to redefine and dominate markets. For those interested in practical tips, check out this insightful guide on creating a job board website: How to Create a Job Board Website.

https://attractgroup.com/blog/how-to-create-job-board-website/

It offers valuable insights for navigating the challenges of the tech startup funding landscape.