Startups don’t grow like businesses. Not in the traditional sense. They don’t scale by adding headcount, expanding inventory, or renting more retail space. They grow by discovering, and then systematically proving, a revenue-generating system that works before it collapses. And yet, here we are, in 2025, with startup advisors, development organizations, investors, and even policymakers still trying to shoehorn startup growth into the same frame we use for laundromats and law firms.

This misunderstanding isn’t just a mild inconvenience. It’s the single biggest reason startup ecosystems flounder, public-private partnerships waste money, and cities fail to compete globally. It’s why I’ve spent years hammering the drum of marketing – not advertising, not branding, not demand gen, but real marketing: the discipline of understanding the customer so thoroughly that you can deliver growth by design, not luck. Startups don’t fail because they can’t build; they fail because they don’t know how to grow in a way that sells.

And the people helping them don’t know how to teach them.

That image is a joke by the way, hopefully that wasn’t lost on you

Founders seek funding too soon, have misplaced expectations, and drive their venture to the ground

That’s been my battle cry in the startup world. But lately, in working through legislation and economic development I’ve realized this problem is even bigger than startups. Our government doesn’t understand growth either. Just look at how we confuse small businesses and startups in virtually every statute, tax code, and subsidy structure. It’s not just unproductive, it’s actively harmful to innovation. If we want to build a durable economy, one rooted in sustainability rather than symbolism, we have to reframe how we understand growth at every level.

Thankfully, I’ve had the chance these past few weeks to talk with some of the smartest minds I’ve met on the subject: David, Daniel, and Nick at ThriveSide (they have a program here to consider) because they have an intriguing take that frames growth in stages, tied to reality, revenue, and risk, rather than vanity metrics and vibes.

Article Highlights

The Growth Delusion

Too many founders think growth is a goal, when in fact, it’s a symptom.

Growth is a result; something that emerges when the right system meets the right market. But instead of building systems, we chase leads and scale (more users, more funding, more headcount) without a blueprint. I recently that you ALL screw up your Go To Market Slide and the fact that every single one of you does so, is the evidence you’re clearly not going to grow – if you can’t even position your blueprint in one slide, obviously you don’t even have one. Advisors push revenue targets without regard to model maturity. Investors write checks for traction that hasn’t been validated. And economic developers hand out grants based on job counts, not business viability.

We’re measuring the wrong things. And as we all know, what gets measured gets managed. But if you’re managing headcount instead of customer conversion, or capital raised instead of capital deployed effectively, you’re building the illusion of momentum while burning cash and time.

It’s what ThriveSide calls the Growth Problem; an absence of a clear frame of reference for how to define and design the path to success. I like it.

Growth as a Stage-Driven System

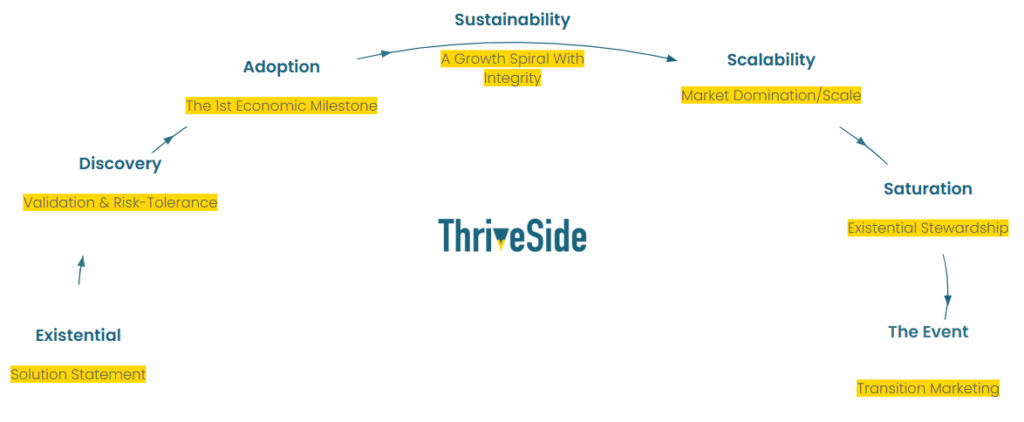

Think of your growth architecture it as a map that charts a startup’s progress; not from founding to IPO, but from idea to revenue-sustained success, on through saturation and political influence. One of the deeper conversations we’ve had is that while I’m trying to divide society’s blending of small business and startup, they pointed out that there is a point in growth (sustainability) where that divide really occurs because everyone needs to at least get to sustainability – they’re not wrong, I know you have no idea how, and so here we are.

It’s built on one core truth: revenue is the only objective reality in business. Everything else is a hypothesis.

From that premise, we have seven stages of maturity, each with clear objectives, transition points, and required work. Here’s a take on what they’re delivering, with my own color commentary:

- Existential Stage – You have an idea. Nobody cares. Your job is to define a value hypothesis so tight it could cut glass. Identify a real audience on a critical path, define what your offer solves, and articulate a value proposition that could be tested tomorrow.

- Discovery Stage – Now prove it. Validate that your audience cares, and that your solution works. No scale. No fluff. Just prove that your offer delivers a Guaranteed Outcome: something repeatable, controllable, and worth paying for.

- Adoption Stage – Shift from proving value to building the infrastructure that delivers it consistently. This is where monetization programming replaces brute force selling. Nick shared what they call the A.C.E.S. model (Awareness, Consideration, Engagement, Sold) to guide customers through a journey that mirrors the internal process of the business.

- Sustainability Stage – Here’s where the real startups emerge from the crowd. Profitability becomes predictable here (and this is why I’ve pointed out that investors asking you about customers or revenue metrics, before you reach this point, is problematic). Here, customers become a community. You stop thinking like a founder and start thinking like an owner. Your venture becomes sellable (and therefore fundable) not just functional.

- Scalability Stage – Want to dominate? Good. But don’t break your model in the process. Retention, recruitment, and resource management become your new religion in what is called “controlled chaos” – the eye of the storm between product-market fit and market ownership.

Pause here – NOW I mention product-market fit?? Yes! How many times have I written that there is a ton of marketing work to do BEFORE product-market fit and that PMF does not mean you have customers. It exists around here, after you are sustainable, not before. - Saturation Stage – You own the space. Congrats. Now it gets political. Your success depends on navigating market forces, community stewardship, and keeping your model fresh before entropy sets in. This is the Netflix-trying-to-stay-relevant phase.

- Event Stage – A wild card that can happen anytime. A disruption, an acquisition, a collapse, a crisis. The test here is adaptability. What do you do when the game changes?

What makes this different from the usual startup lifecycle slides is that it’s revenue-centric, risk-responsive, and founder-controlled. No fluffy stages like “early stage” or “growth.” Instead, each level has a graduation point tied to validated business performance, not vibes, not headlines. They visualize it like this, and I love it because it’s very consistent with my push to get you off the mindset of exponential curves, or even the startup sector’s famously overused S-Curves, to instead think about building a flywheel – this is the curve of a cycle that you need to start spinning.

Why This Matters to More Than Startups

Here’s where I pivot back to the policymakers. This model doesn’t just fix how founders think, it rewrites how governments should support innovation.

If fully understanding innovation, by all accounts, every city should be experiencing explosive growth; but even tax reform, pushing for affordability, supporting a local incubator, or even startup-friendly rhetoric, we’re failing to distinguish between businesses that sustain jobs and startups that create jobs, opportunities, and industries. Startups that reach scalability or saturation are fundamentally different economic agents than mom-and-pop shops, and yet we lump them together in legislation, incentives, and tax code.

By the same token, it’s regulation and policy that actually handicaps and prevents entrepreneurs from breaking out beyond that Discovery – Adoption phase, because those that appreciate marketing and prioritize it can grow, it’s that policy now, more than market, prevents scale. Consider for example that if you’re an entrepreneur in HealthTech, Energy, Transportation, or even Real Estate, you will likely reach a point where you hit a wall because policymakers have put in place decisions that say, “you can’t.” Understanding these stages, collectively, can help us all steer ecosystems that are open to innovation, that draw venture capital investment, instead of killing the potential of growth.

Grow Up About Growth

We need to get serious about what growth really means, because vague aspirations won’t build thriving businesses, resilient economies, or sustainable communities. Showing me that S-Curve in your pitch deck and asserting that that’s how it will look for your startup, is merely pandering to people who don’t know better.

And yet having had some wonderful talks with these guys, I also now want to advise that you stop chasing scale before sustainability, and that’s a pivot for me because I’m always advising “scale.” Advisors and incubators: stop pushing pitch decks before product-market fit – which means figuring out the blueprint for growth at least to sustainability. Investors: stop treating pre-revenue companies like lottery tickets. And legislators? For the love of impact, start distinguishing between high-growth startups and corner stores. They’re both valuable, but they’re not the same.

We need shared language, actionable diagnostics, and policy frameworks that understand growth as stages — not a straight line.

There are few things I promote but just as I got behind Founder Institute when I found that most programs were failing to capably teach founders to launch, since you all keep asking me about sales, growth, and validation, at least talk to these guys about what they’re doing – they will solve that for you, here.

Talk to me, what stage is your company really in? Are your policies built to support growth, or just to say you support business? Maybe it’s time we all stopped pretending we understand growth and startup building systems that actually do.

I’m still amazed by how much terrible advice is out there. Most of it’s completely useless, and confusing for new founders.

I think it’s because real success takes 5-7+ years to prove out. By the time people realize the advice was wrong, the “expert” has already moved on to peddling the next framework. Your take that growth is a symptom, not a goal? Exactly what founders need to hear. And yes, investors asking pre-revenue companies for metrics is absurd.

Thanks for cutting through the BS. Hopefully takes like these help save a lot of founders from chasing mirages.

I feel similarly about VC, both to startups and in ecosystems – you don’t SELL TO the market, you build what it wants. Growth & Capital are consequences of doing what you should be.

This is great…I also find Stages 1 and 2 can be a feedback loop. Stage 2 might bring you back to Stage 1, and then back to Stage 2, before you move forward to Stage 3.

Yes!! Push things forward but not too far. Don’t try to scale before you’ve proven adoption. Don’t expect the business to be sustainable if you haven’t yet discovered how.

BUT you can creep ahead to the next stage: Did what we discover work? Adoption should be easier. If it’s not… you were wrong.

Great article Paul, thanks for sharing this!

This reframes what most founders and even some investors get wrong.

Growth isn’t a phase you enter, it’s a system you prove.

Too many startups confuse early enthusiasm with validation, and confuse hiring with traction. A stage-driven framework rooted in revenue and risk is exactly what the ecosystem needs to separate real momentum from noise.

Founders don’t just need funding, they need clarity on what they’re actually building toward.

Shane Senha Exactly. That line “growth isn’t a phase you enter, it’s a system you prove” captures the heart of what we talked about shifting.

What I’ve seen, over and over again, is that we reward startups for noise: funding announcements, team expansion, vanity metrics. And that reward system fuels a loop where the wrong things are mistaken for progress. A founder gets some attention, hires fast, maybe even lands a few logos; but without a repeatable, revenue-driven model, they’re just decorating a house with no foundation.

This ThriveSide model forces us to ask the hard questions at the right time. Are we solving something essential? Can we deliver that solution predictably? Can we withstand volatility, not just raise around it?

Funding without clarity leads to burn. But clarity (on stage, on risk, on what actually constitutes success) creates the conditions where funding accelerates what’s working instead of delaying what’s broken.

Appreciate your insight. We need more people reframing the conversation this way.

“But if you’re managing headcount instead of customer conversion, or capital raised instead of capital deployed effectively, you’re building the illusion of momentum while burning cash and time.” I feel like I need to get this as a tattoo. If we can get founders and leadership teams to adopt this model, we can eliminate so much failure, wasted effort and lost money.

This is an incredible write up Paul. Thank you for taking the time to understand what we have built here with this model.

Nicholas Alter Agree Paul always shares meaningful intelligence to the startup sector – Congrats Nick- I welcome a coffee chat- when you have time..thanks

Nicholas Alter thank *you* for something that finally gives founders (and the people trying to help) a real diagnostic tool instead of more platitudes. I couldn’t help but reflect on my article the other day about how metrics and buzzwords have become the tools investors use to hide their ignorance. We don’t need to know CAC or TAM/SAM/SOM – we need to see real growth driven by closing business.

I’ve watched too many great ideas get buried under the weight of performative progress all while the core offer remains unproven. We talk so much about “traction” but rarely ask traction on what? (which reminds me too though – I skewered VCs for asking about “traction” by telling founders to throw it back at that – “what kind of traction and why would that prove to you that what we’re doing is worth it?”).

Your model gives us a shared lens; one that ties action to stage, and stage to earned maturity. If we embed this thinking across accelerators, advisory boards, even public policy, we won’t just reduce failure. We’ll build founders who know how to win for the right reasons.

John Del Bello Thank you so much. Nick and the team have built something genuinely transformative here, and I’m just glad to help unpack it.

Paul O’Brien hit the high notes again!

“We need a stage-driven model of growth rooted in revenue, risk, and reality. Not vibes. Not jargon. Not “traction” that can’t be traced.”

Reminds me of my rant that metrics are just buzzwords so ignorant investors and advisors aren’t exposed for being ignorant.

“What’s your CAC?”

Why the hell would I know?? Why do you dare? What does it help you solve by knowing that??

—

Not jargon. Just results: growth and sales.

Business schools don’t come close to this. I doubt entrepreneurs waste time earning an MBA. Bill Gates didn’t waste time finishing college. Zuckerberg evidently completed the first three steps you gave while college.

Most business schools still teach 20th-century management theory to people trying to build 21st-century companies. Startups don’t need MBAs; they need models that reflect *reality*: uncertainty, iteration, and the risk/revenue equation that defines whether you survive the next 12 months.

I just dropped into a heated debate on LinkedIn where people were arguing that you can teach (and make) people entrepreneurs. You can’t, you can only enable those who are to thrive.

What Gates and Zuckerberg had wasn’t just vision, it was clarity on the Critical Path. They weren’t just building tech, they were solving something urgent, valuable, and compelling enough to pull the market toward them.

There is a model here that gives us a way to do that on purpose; by *opting in* to a smarter framework for how real growth works. Appreciate the energy in your comment – it’s well past time we start teaching founders what they actually need.

Management theory, of whatever century, is about how to efficiently run an enterprise during and after the second phase of Ichak Adizes’ Corporate Lifecycles. The first phase belongs to entrepreneurs.

Well educated MBAs with the right attitudes (and humility) can serve entrepreneurs; I have done so as a consultant. But I am not an entrepreneur. B-School teaches caution and conservatism. Entrepreneurs are neither. Entrepreneurs are gamblers, some destroy their success by continuing to gamble, some settle down or sell to managers.

Repeatedly you have said entrepreneurs are born, not the result of education. My experience is you correct, Paul.

Thanks for sharing, Paul

This definitely highlights what a mentor of mine Timothy Armoo talked about in his keynote talk during the hashtag#UKBBirms2025 last month about systems being the most important growth factor in business which I personally resonated with.

Building a validated system has helped my startup Everything African, though still in the adoption phase, to have predictable revenue stream every month, even with small numbers, as that can definitely be built upon to grow to higher figures and scale with it also.

Babatunde Ajose Absolutely love hearing that, and you’re spot on. What Timothy emphasized, and what you’re proving with Everything African, is exactly the point: systems are the growth strategy. Too many startups chase numbers instead of building the machine that produces those numbers consistently.

The fact that you’re in the Adoption phase with predictable revenue is a sign you’re doing the hard part right, validating before scaling. That’s the foundation investors should look for, advisors should reinforce, and founders should celebrate. Small numbers don’t mean small success; they mean you’ve found signal in the noise.

Appreciate you sharing this. Keep going and maybe connect with Nicholas Alter or Daniel Perumal because they have a lot more programming worked out to establish and move organizations through these stages. That’s exactly the kind of clarity and control this model is meant to support.

Paul, your final words are kinda scary. I dont disagree with your shift in definitions of stages of growth-although your sustainability stage seems to go beyond market-product fit. But your final challenge of shifting from scale to sustainability indicates that perhaps investors and the innovation ecosystem aren’t doing their jobs across the board in supporting founders with effective resource allocation. My perspective has always been startups arent necessarily supposed to be efficient at early stage. Sacrificing thorough risk mitigation for a chance at outsized growth. Are you challenging startups to take on a different nature? If so – what is that and over the long run is that good or bad for disruptive innovation? Maybe im being dramatic…

Aaron, you’re not being dramatic at all, this is exactly the conversation we should be having

To clarify, these aren’t my definitions. I’m interpreting the work of Nicholas Alter, Daniel Perumal, and David Daniel at ThriveSide, who’ve done incredible thinking around mapping a company’s journey. I’d love for them to chime in; your point about early-stage inefficiency and risk-taking is valid and very much accounted for in their framework.

On the Sustainability Stage specifically, I don’t think it goes beyond product-market fit, I think it corrects our common misunderstanding of it.

Too many founders treat product-market fit as “we have customers.” But not all customers are the right signal. You can attract the wrong ones, or land a few through unsustainable channels, and suddenly it looks like traction. but it’s a false positive.

Real product-market fit must be sustainable: repeatable, scalable, and durable enough to weather some chaos.

That doesn’t suppress innovation; it protects it. I hate seeing founders pushed into customer acquisition before they’ve proven a system. Customers aren’t clarity, they’re noise until that signal aligns with value, delivery, and long-term behavior. Only then can you call it fit.

But what about the Cluelys of the world where they raise on hype and hype turns into growth? I feel like Cluely is going 7,6,5,4… in your sequence of stages… their last challenge will be to prove that people should care, that their product/company should exist after all the hype(r) growth plateaus

Adam Lupu I think that’s the danger this model is trying to expose.

Cluely isn’t alone; we’ve seen this with plenty of companies that raise big, scale fast, dominate headlines, and only then try to figure out if they’ve built something that actually matters.

They’re effectively going 7,6,5,4… backward, and sure, hype can simulate growth (sometimes it even creates growth; momentum begets momentum), but without a validated, sustainable system underneath, it’s just inertia. When the hype fades, what’s left?

Their framework doesn’t say you can’t grow that way, it just reveals the risk. You’re borrowing credibility from the future. And if you haven’t proven your Guaranteed Outcome, understood your Critical Path, or mapped your real customer value, you’re eventually going to hit a wall.

That’s not a death sentence, but it is a test. Can Cluely (or any company in that mode) go back and retrofit sustainability after saturation? That’s where the Event Stage becomes a reckoning. Sometimes it leads to reinvention. Sometimes collapse.

The model just gives us the language to see it coming and maybe help founders avoid that kind of backwards journey in the first place.

This is the best article on Marketing applied to Startup (& Turnaround) business thinking I can recall reading in a long time. Just to hear a clear differentiation between marketing and advertising is a breath of fresh air.

Thank you for that Paul O’Brien. This reminds me of how Dr. Philip Kotler lays out the 3 stages of marketing: Entrepreneurial to Formulated to Intrepreneurial. (Thank you Dr. Kotler for the work in your writings, which I still refer to after 25years since first being exposed to them by my teacher, mentor and friend Dr. Imran Currim … thank you Dr. Currim for starting me on a path to a marketing mindset.)

This article evokes visceral questions for me: What value are we delivering? Does this really impact our customer? Do they know or care? How are we helping them see the value, understand the promise, and decide about the offer? How are we getting 1-yard closer to the goal line than our competitors in every area we choose to compete? (It only takes 1-yard to win!)

The world around us is simultaneously 1) hyper transforming and 2) hyper saturated in advertising. Confusion, Fear, Uncertainty, and Doubt seem to abound everywhere. How are our customers adapting to the convergence of these change forces & uncertainty & risk in tech, society, generations, politics, etc.?

More than ever, we need marketing minds in every strategic discussion to deeply, intimately understand our customers and adaptively think through their needs / wants / fears/ hopes and to be designing the value, the offer, and the value delivery system, for right now.

Adding to Paul’s comments on the ThriveSide team … Nicholas Alter David Daniel and the team are exceptionally bright minds, competent advisors, and very good people. I know them, I respect them, and I work with them at every opportunity. Definitely check them out.

Wow. I speechless, and that’s rather impossible to cause

thank you

ThriveSide, we should dive deeper.

Your welcome Paul O’Brien… we all need to be a little speechless on a routine basis. If not, then we have a clear indicator we’re not being challenged outside our own bubbles … and we ALL have bubbles and blind spots. So, to that end, let’s help each out of our bubbles and shine lights into our respective blind spots!!

Awesome write-up by Paul O’Brien about my good friend Nicholas Alter and what he and his team have created at ThriveSide. If you’re a startup and feeling a bit lost on your growth journey, I HIGHLY suggest you check out this article. It provides a helpful breakdown of what growth really looks like and how you can achieve sustainability. Give it a quick read, I promise you’ll have a few “a-ha’s”!

Really appreciate you sharing this, and I’m so glad it resonated. Nick and the ThriveSide team have created something that goes far beyond frameworks; it’s a way to bring clarity and control to what often feels like chaos for founders. If even one “a-ha” helps a startup stop chasing noise and start building sustainably, we’re doing our job.

Let’s keep pushing this conversation forward; too many great ideas get lost not from lack of talent, but from lack of traction that actually matters.

Michael, The startup world has a short memory and a long trail of recycled frameworks that never had to prove anything. Success plays out over years, but bad advice moves fast and loud, usually from people who’ve never had to survive the middle.

What I’m trying to amplify is clarity through fog. Growth isn’t a goal, it’s a consequence of getting the fundamentals right: solving a real problem, delivering a real outcome, and doing it in a way that scales without burning the whole thing down.

If this helps even a few founders stop chasing vanity metrics and start building something sustainable, it’s worth every word. Appreciate the callout.

Thanks for this sharp and much-needed perspective. You nailed a core issue: we still don’t fully understand what startup growth really means. Startups don’t grow like traditional businesses – they iterate, validate, and pivot until something works.

Treating them like legacy businesses in trades, retail, or public services misses the point. Startups operate on different dynamics and a very different risk-impact curve. Growth isn’t the goal – it’s the outcome of a repeatable, scalable value system.

I especially appreciate the idea of framing growth in clear, measurable stages – not vanity metrics or headcount, but actual traction, sustainability, and market fit. That shift in mindset is critical for smarter policy, better funding structures, and real innovation impact.

In a time when resilience and innovation are key, we need to stop lumping everything into “business” and start enabling what truly drives new value.

Hermann Doppler That distinction you made between traditional businesses and startups is where most confusion (and wasted support) begins. Startups aren’t smaller versions of legacy businesses; they’re experiments in search of a repeatable, scalable system. Until that system exists, there is no “business” to scale.

What I think this framework does brilliantly is give us a language for that messy process, one rooted in risk, revenue, and reality, not vanity, headcount, or “momentum theater.” And you’re right: that kind of clarity doesn’t just help founders, it’s foundational for designing smarter public policy, better investment strategies, and real innovation pipelines.

If we keep blurring the line between startups and small businesses, we’ll keep misallocating resources, misjudging risk, and misreading success.

I like it Paul — I’d suggest even the term flywheel is pretty packed with jargon and BS at this point. At a basic level a lot of folks don’t really understand what they need to build a machine that eventually has a virtual lever they can pull and out come revenue (or w/e key mechanic the product/service needs). And until you know what machine you are building, how the machine should work — and seeing it actually work consistently, it’s not (growth, g2m, etc) sorted.

Christopher Mismash good point about “flywheel” and though it’s a favorite of mine, we do need an even clearer lesson and message.

On the one hand, the word is correct in most cases. It is a flywheel. On the other hand, that word has been fully absorbed into the startup hype machine, and really does not mean what it is supposed to mean. One framing I try and use to help land the point when I speak to founders is through the lens of acquisition. I say why would someone buy you. Eventually the answer is, well, we made something that they can take and scale. Then I say, ok, so does your machine run in a way it can scale through nothing more than volume? If not, why?

I…have nothing to add here. Ditto Paul’s response.

Nicholas Alter thanks for saying this because this was the center of my concern. Every day I see prompts reminding me how important it is to just have a 1v1 conversation with founders, so that the mission doesn’t fall out of efficacy and this article was definitely one of them.