I was just asked, What are examples of startups that tried to monetize too early? and my gut reaction was, “all that fail.”

Before you jump all over that blunt and obtuse, and too narrow, reaction, let’s explore…

Encourage you actually ask the question in the inverse. How or why are so many dominant and successful ventures where they are WITHOUT monetizing early??

The fact is that a “startup” is technically a venture in search of a business model. Meaning, since you’re asking about “startup,” likely every failure (or most at least), tried to monetize too early.

Ok, but what is a business model?

A business model describes how your company creates, delivers and captures value.

Or in English: A business model describes how your company makes money. (Or depending on your metrics for success, get users, grow traffic, etc.)

– Steve Blank

This topic caught my attention because there was just an article in the New York Times, Silicon Valley Is Trying Out a New Mantra: Make a Profit.

And I share that because it has fired off this incredible debate in startup groups that that notion is B.S.

Bear with me….

If you are starting a business that has a known model, it’s similar to others, etc. Technically, or at least arguably, that isn’t a “Startup.” Fair?

SOMETHING has to distinguish the difference between that completely NEW endeavor from a mere net new business. No? Some word has to distinguish them so even if you’re not inclined to agree that “startup” is that word, hopefully at least you can agree that SOME word has to refer to the distinction.

“That Word” doesn’t have customers (bold statement and I’m sure I just pissed off a bunch of people who want to argue that point). Startups are the stage of work where new ventures are CREATING new markets and customers.

Let’s get pragmatic.

If you start a new Accounting Firm, most wouldn’t call that a “startup.”

It’s known how to do that, the model is established, and anyone can expect that such a business all but immediately has customers and revenue.

So, “Silicon Valley is trying out a new mantra of profit”???

It doesn’t even make sense. Startups re-invest whatever revenue they have in continued development so as to compete, sustain, and figure out their model. Startup, by definition, wouldn’t focus on profit as it likely doesn’t even have revenue with which to do so (and shouldn’t focus on profit if it does!).

As an investor who has put capital into developing your startup, imagine how aggravated I’d be if I invested money but you’re blissfully taking the little money coming into the business and opting to be “profitable.”

Profit is for public companies and shareholder value.

The Times article is a sensationalist headline because the public perception of the day is how WeWork, Uber, and Facebook are screwing things up. The reality is that despite the love-affair with hating on such things, those companies effectively established, globally, the model in what they’re doing. They may be failed or faulty COMPANIES but as “startups” they were HUGE successes.

You can’t start a new battery technology, invest in the development of it, and be profitable nor even have customers soon!

Google, Facebook, Twitter… our new economy is littered with massive companies, successful startups, that didn’t have customers for YEARS. Heck, Amazon is barely profitable!

What’s an example in tech/innovation akin to our Accounting Firm example? Well, if you were to start a new Ridesharing Company, or Global Coworking Company, or even a Social Network, it would be reasonably fair to note that those are merely new businesses, not startups. TECH doesn’t make things “startup”- being in search of a new model and creating new customers does… well in those cases, the models have already been discovered and customers established, you’re simply creating a new business to do THAT (and anyone can expect that such a business all but immediately has customers and revenue).

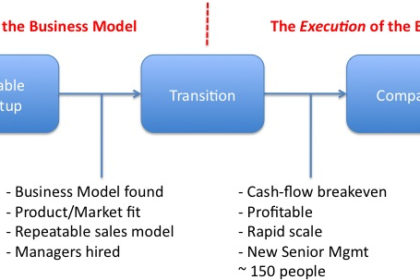

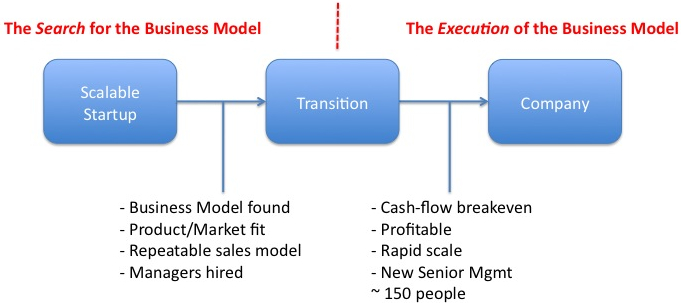

Thus, a “startup” is in search of a business model (at least, that’s how Steve Blank coined it). Meaning, they haven’t yet figured out how to sustainably and competitively have customers. Meaning, most that fail probably “monetized too early” (in some way).

Focus on creating and being able to sustainably and competitively deliver value. THEN you can derive value from the customers you create.

“Your job as a founder is to quickly validate whether the model is correct by seeing if customers behave as your model predicts. Most of the time the darn customers don’t behave as you predicted.”

What’s a Startup? First Principles. – Steve Blank

Paul, as always, straightforward and up to the point on this.

I feel one of my missions in life has become to save startups w big potential from two bit premature sales focus. Not that I do not love and value sales but it’s all about the stage, balancing moving parts of the org.

Paul, is this true for all sorts of startups? What about startups with a new sales concept for specialized products, services? Shouldn’t they reach the break-even asap before growing?

Yes! That’s my point. Something, some word, has to define the kind of new business that doesn’t yet have a model known. Yes? Fair?

So for the sake of discussion, let’s not call that “startup.” But we do have to call that something don’t we?

What discerns for everyone that a new coffee shop is NOT the same kind of new business as some AI you’ve invented? The coffee shop model is known; we can expect it to make money. The new AI’s model is not known yet, it can’t be; we should not *expect* that founder have customers. Fair?

And I wrote this because I’m getting burned out from experiencing a TON of advisors and “investors” (in quotes on purpose because they call themselves that but they’re really just wealthy people giving bad advice and misleading actual startup founders), who don’t make the distinction. “Why aren’t you making money yet? I’ll invest when you have customers.” Then stop f’ing calling yourself an Angel Investor!!

That service business knows its model. It’s a consultancy or agency, for example. Thus, not a startup, despite being new. Shouldn’t they break even before growing? Sure, yes, exactly. That kind of new business SHOULD. And thus it isn’t a startup, it’s a new business.

Interesting! It depends on the startup and I would argue that people are getting smarter. By people, I mean pension fund managers who buy IPO shares and are beholden to their shareholders. Lose trust in that type of exit and we are all in trouble. At some stage, you have to demonstrate that you care about expenses and have a path to profitability. You can’t just keep burning through cash to create the illusion of success and hope an IPO bails you out. There has to be some middle ground. Thanks for sharing.

And there are those in between, with something “new” but not rocket science. Was Amazon a startup or just a sales organization on the Internet?

Great point Brian; agree entirely with the intent in your thought. Yes, “at some point,” you have to demonstrate attention on expenses and profitability.

I’m trying to focus here on that it doesn’t depend on the startup. Or rather, it can’t. “Startup” literally means no model yet. Er go, no clear customers (not no customers, obviously, you might have some, some revenue) but once the model is discerned, that literally / explicitly means the business now has a repeatable / established customer model… And therefore isn’t a “startup.”

I’m being explicit about that, as Blank was, because I’m seeing A LOT of people (and particularly a ton in Texas) who aren’t drawing this distinction. They’re happy to blur lines & blend words. ‘It depends.’ No, it doesn’t!! (Explanation points with love). It’s misleading. It confuses people.

If you have a new business that has a model and can get customers, you don’t have a “startup.” Period. It matters because partners, advisors, investors, lenders, etc. can and SHOULD have different expectations of that “business” given that model being established. A “startup” does NOT know what the model is and thus SHOULD not have people expecting that it have customers (or revenue; certainly not profit). 🙂

Paul O’Brien I see! I’m helping a startup raise money right now. In doing so, I made an introduction to a contact of mine that is well-connected. In the short and sweet email, I stated that they are pre-revenue. Perhaps there should be a widely accepted word or term called pre-model, which means it’s an investable idea, but the team is still making tweaks (not a complete pivot). I read an article about Lambda School just yesterday. In the article, the founder talks about all the tweaks they are still making to the model. I guess you could say they are a startup that is pre-model. 🙂

Brian Teague pre-model is a wonderful notion. Might be some good thought leadership in exploring and promoting that

This is tough as now most investors first questions are asking about revenue…

Indeed. And I’m seeing that most “investors” are asking that for one of two reasons…

1. They don’t have a ton of startup exposure nor really actually invest in startups. These questions usually come from people with wealth who are willing to, and want to be at the table to consider, investing in startups, but they really want to be investing in businesses. An Angel (actual angel) or a VC wouldn’t even ask that of pre-seed startups; they’d have the experience to already know what the revenue model could be when no it’s time.

2. In defense of investors asking about revenue… people are starting things, and calling themselves startup founders, that really actually SHOULD have revenue. Being tech, an app, or some such doesn’t a startup make. If you’re building the next event calendar in town, rest assured, that’s not a startup. As “entrepreneurship” has caught national attention, we have a LOT more “startups” that are really just good old new businesses. And so we have a lot of these people who are launching an app or site, that clearly should be making money, but since they’re being led to believe they’re a “startup,” they want to raise money. Hence investors being right in saying, “show me the money!”

Could a factor be that there is a lot of pressure and startup theatrics by the entrepreneurial support ecosystem “ESO’s” influencing this behavior?

Paul O’Brien Glad you like it! We can take it a step further and create our own language using acronyms. A posting on Angel.co can go something like this. PR (pre-revenue) PMST (pre-model still tweaking) startup seeks long-term partnership with investors interested in … 🙂

Paul O’Brien Please enlighten us?

When is a startup not a startup but just another business entering an existing space?

For example say PlutoTV or FuboTV. Were they just another OTT play entering an established market dominated by YouTube? Thus needing to demonstrate revenue?

Or were they an actual OTT “startup” entering a new but still developing market and not needing to have revenues prior to an investment?

How are you drawing the line?

Daniel Thompson gotta give us a tougher scenario than that 😉 They’re clearly just another OTT play entering the market. Unless doing something completely distinct, in need of figuring out the model.

No? They acquire streaming rights. The tech exists. They acquire subscribers. Possibly add advertisements. Pretty straightforward.

To be clear, IF doing something different, requiring figuring out and establishing that model, they’d be a startup. But otherwise, just because the business is tech oriented, or new, doesn’t make it a startup; it’s no different than starting a restaurant (in a sense); you just replicate the established model.

“Existing space” isn’t a consideration. All startups and new businesses are technically entering some existing space. That’s consistent with the notion that there really is no new idea… Everything is a derivative of something else so they’re entering some space.

None of this either means VC is or is not involved. Atmosphere comes to mind, recently raising $10MM (if I recall correctly) to bring their streaming service to life. VC seeks exits and outsized returns; that TENDS to be found more in “startups” because they create new models, that disrupt markets or which others want to acquire.

Paul O’Brien Alright using that definition then SpaceX would not be a startup. Correct?

The business model is already known. The tech is already known. They had customers waiting to get payloads into orbit before they even started.

Daniel Thompson I don’t know of anyone calling SpaceX a startup anymore. Even the media refers to it unequivocally as a company. It’s coming up on 20 years, I can’t think of anything that was still a startup after so long.

Getting payloads in orbit doesn’t change it’s state, that’s merely doing the work to fulfill the market. The business model wasn’t known in 2002, the tech was, mostly, and yes, they had demand. It wasn’t a startup for long; all they had to do was prove they could do it and start establishing the model.

Paul O’Brien Yes but I can hear it being said to the new AI founder in your example: “Its just software” You either license it, sell it as a service, or give it away with Ads on it. Nothing new here. Call us when you have revenue.

If you have a repeatable, defensible, scalable business model, you’re done being a startup.

Overwhelmingly more often than not, that sale is unsustainable. Just because someone can sell that AI to someone, doesn’t mean they have a business, business model, or fundable opportunity.Grain of salt, particularly beyond the coasts, and in our part of the world, most investors shouldn’t be calling themselves Angels or VCs. There is a lot of crap in this part of the world where people with wealth have no idea what you’re doing, or grasp of if you can, and they’re really only seeking business investments that make money. Tell them to piss off…. and same token, you shouldn’t be raising seed/Angel money from people who aren’t passionate about what you’re doing – that’s just asking for trouble.

On the other hand, often such advice is valid; perhaps they’re not doubting that it can make money, perhaps they’re doubting that you can. “Call us when you have revenue,” when coming from Venture Investors who know better, is a nice way of saying “no thank you.” That doesn’t mean it’s what you should do; it’s their way of saying, “find some money, we’re not interested.”

Some other perspective; Sales != Marketing. https://seobrien.com/the-disconnect-between-sales-and-marketing

Getting funding without revenue: https://seobrien.com/startups-getting-funded-without-revenue

This is an interesting flow chart. When a #startup, it’s curious that Twitter was too late…but the opportunities exist with #AR, strategic partnerships and a paradigm shift in digital marketing and shopping. Remarkable #innovations often surface in recessions. #Metaverse #AI