Article Highlights

GENERAL STARTUP STATISTICS

- 69 percent of U.S. entrepreneurs start their businesses at home.

- According to the National Association of Small Business’s 2017 Economic Report, the majority of small businesses surveyed are LLCs (35 percent) followed by S-corporations (33 percent), corporations (19 percent), sole proprietorships (12 percent), and partnerships (2 percent).

- 51 percent of people asked, “What’s the best way to learn more about entrepreneurship?” responded with “Start a company.”

“Start a company.” Easy, right?

Small Business Trends aggregated a series of such data points and in their March 2019 release of the data, shared that and more… it’s the more the struck me….

Who’s starting businesses today?

- Gender:

- 73 percent identify as male; and

- 25 percent identify as female.

- Age Range:

- 50-59 years old: 35 percent;

- 40-49 years old: 25 percent;

- 60-69 years old: 18 percent;

- 30-39 years old: 14 percent;

- 18-29 years old: 4 percent; and

- 70+ years old: 4 percent.

- Education:

- High School / GED: 33 percent;

- Associates Degree: 18 percent;

- Bachelor’s Degree: 29 percent;

- Master’s Degree: 16 percent; and

- Doctorate: 4 percent.

- Ethnicity:

- White/Caucasian – 71 percent;

- Hispanic/Latino – 6 percent;

- Black/African American – 7 percent;

- Asian/Pacific Islander – 11 percent;

- Other – 5 percent.

- 82 percent of successful business owners did not doubt they had the right qualifications and proper experience to run a company.

As if you couldn’t from there tease out some already troubling observations, let me throw one more your way:

The most popular funding methods, in 2018, were according to Lendio…

- Personal funds 77 percent;

- Bank loan 34 percent;

- Borrowing from family/friends 16 percent;

- Other funding 11 percent;

- Donations from family/friends 9 percent;

- Online lender 4 percent;

- Angel investor 3 percent;

- Venture capital 3 percent;

- Crowdfunding 2 percent.

What does it cost to start a business?

It’s a straightforward enough question. We can refine it of course, to ensure we’re asking, “in the United States.”

What does it cost to start a business in the United States?

What is the fundamental risk that one must take simply to TRY working for themselves, potentially creating jobs?

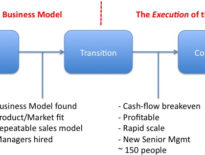

Before we go on, let’s be clear about what we’re asking… there isn’t just a fixed cost of starting a business, they’re a period to overcome so that the business you start might find success. That is, there are a number of months/years you have to plan to operate before finally finding enough success, no?

STARTUP FAILURE RATE

- Of all businesses started in 2014:

- 80 percent made it to the second year (2015);

- 70 percent made it to the third year (2016);

- 62 percent made it to the fourth year (2017);

- 56 percent made it to the fifth year (2018).

“Startup founders are in high-pressure environments, and we ask them to build these disruptive companies that will change the world, and yet we are not really providing support on this front. We’re putting all of it in a box for founders to deal with alone. And that didn’t make sense to us.”

Felicis Venture’s founder Aydin Senkut

Tying these varied statistics and thoughts together, one simple question struck me. One simple way of supporting the risk we’re all taking and the work we’re doing.

What does it actually cost?

Can you give us an accurate, ballpark answer?

What does it cost to start a business?

$30,000.

Sound right? I don’t really have an accurate answer and I’d agree, reading your mind a bit, that we’d all agree there really isn’t an accurate number.

Yet, $30,000 is the magic number the Kauffman Foundation found in 2018.

With that in mind though, here’s a list Fundera put together:

- Equipment: $10,000 to $125,000

- Incorporation fees: Under $300

- Office space: $100-$1,000 per employee per month

- Inventory: 17-25% of total budget

- Marketing: 0-10% of total budget

- Website: About $40 per month

- Office furniture and supplies: 10% of total budget

- Utilities: About $2 per square foot of office space

- Payroll: 25-50% of total budget

- Professional consultants: $1,000 to $5,000 per year

- Insurance: An average of $1,200 per year

- Taxes: Variable, but 21% corporate tax rate

- Travel: Variable

- Shipping: Variable

So… somewhere between $500 and $150,000

Uncertainty.

What does Business News Daily advise? SBA data which suggests as little as a few thousand dollars.

Uncertainty now manifesting as insecurity.

If we don’t know, if we can’t plan, we can’t conceive of starting.

Forget for a moment the actual cost.

Take a look at the statistics and let’s reach a more tangible conclusion.

HALF of all businesses fail in about 4 years meaning it reasonably takes you a good few years to figure out if you have a 50/50 shot. Overwhelmingly businesses are started thanks to personal funds and the 40 y/o plus, GED / Bachelor’s degree in most cases, means that starting new businesses is a direct result of people having the means with which to start them.

And even if BANKS were still there to close the gap for those who don’t have that personal wealth, Kauffman Foundation went on in their study to note that, “Large banks have become larger, and small- and medium-sized banks are disappearing. As one example, the number of small community banks totaling under $50 million in assets has declined 41 percent since the Great Recession of 2008, either through consolidation or closing. According to industry experts, the $30,000 in average funds needed to start a firm does not hit the vast majority of banks’ radars. Loans of around $100,000 or less are hard for banks to make profitably.“

$30,000 a year, if that’s the number.

Adjust that from first year costs including more equipment of legal investments required just to START, to later year costs being taxes, some staff, and more, it’s safe to say it costs a hundred thousand dollars to capably start a business with the few years it takes to get going… and banks aren’t an option for most, personal wealth is unavailable to too many, and investors, investors apply to the precious few applicable to funding.

Now, start.

Get started.

Trepidation, no?

Might we not ask and address if rather than it being a matter of access to the capital (which is of course ultimately paramount), if an issue we could first tackle is the tremendous disparity in KNOWING what it will cost.

Overcoming insecurity.

How can anyone capably assess taking the risk, saving the money, or seeking it from others, when the range varies from $3000 to $150,000 JUST TO START without being secure in the costs (risk) and potential reward.

And that doesn’t even explore the cost of doing business in place like Des Moines, Iowa vs. Austin, Texas, vs. San Francisco, California.

- We know we have a tremendous challenge in addressing how the economic challenges (wealth gaps) with which most struggle prevents people from starting businesses from which they might create wealth and enable others.

- We know the exploding cost of a college education, for those who can managing to get themselves to/through University, saddles potential entrepreneurs with debt.

- And we know Angel and Venture Capital isn’t the answer for the great majority.

Begging this simple question for which I don’t have much of an answer… how can we alleviate the insecurity of costs so that we might enable the majority to assess what it takes to start a business of their own, without the risk of unknowns putting them further in debt?

As an accountant I see many startup budgets, both before and after the fact, and almost never are they close. My dad, a commercial architect, told me when I was young to do the best you can and then add at least 10%. That’s often not enough for startups because of so many unknowns – especially to a neophyte. Greatest causes: real estate (design/build), inventory, Human Resources.

Moreover, it’s often a case of you don’t know what you don’t know. Therefore it’s not a deterrent to start, but often the reason for the failure. They run out of cash or financing resources before they’ve gained traction.

***Note: I’m speaking of average, everyday product and service businesses, not wanna-be ‘high growth’ high burn tech startups.

Couple thoughts… I get that you’re speaking of high growth / burn tech startups and not *necessarily* everyday product and service businesses but let’s explore that further…

“Greatest causes: real estate (design/build), inventory, human resources.”

Yes… unless not. Most startups in my growth/tech experience point out that you shouldn’t be spending money on such things at the start. And I’d agree with that.

Is that not reasonably true too of any other new venture? Do far too many starts spend too much money on space (they don’t really yet need), inventory (poorly planned to deliver), and people (who should be equity owners and not paid, early)?

Second thought is you’re precisely right, you don’t know what you don’t know. What I was feeling in exploring the idea here, and maybe I didn’t get it across well enough, is: How many don’t even start but could/should BECAUSE they don’t know?

Paul O’Brien To be clear, my professional experience is more with non-tech companies…and the few I do work with have been very good at ‘working out of their garage’ in the beginning.

And so, yes, I agree that startups should NOT spend on those sorts of things until they absolutely have to.

For the brick and mortar product/service types it’s often difficult (borderline impossible) to get a reasonable estimate to plug into a budget during the planning phase when a vendor knows you’re months away from signing.

Thus, talking point is lack of pricing transparency in traditional vendor businesses, which tech (SaaS) businesses have been very good at.

On the psychological side, I still see too many owners/founders spending too much largely because of perceived necessity – either for brand image or a “fake it until you make it” attitude.

Lastly, I believe you’re right that many don’t start at all because of unknown costs, or assumption of extremely high cost. Again, budgeting is hard for most people, and even in today’s world, good information in this regard is hard to find.

Those who don’t start – fear of the unknown, analysis paralysis, or combo of both.

Way off!

Paul O’Brien BTW, I have a pet peeve of the angel/VC industry that now seems as appropriate a time to mention as ever. I wish the lot of ya would fill the gap between traditional bootstrap/bank financing and only looking for unicorns. It seems like FinTech was trying to do this but stopped. I get the allure of high risk – high reward and large market size, but I work with several businesses that have grown regionally and get hit up by franchise consultants all the time. They would have been great investments, but we’re only talking low 7 figures.

Hans Enriquez care to elaborate?

David Krewson “I wish the lot of ya would fill the gap between traditional bootstrap/bank financing and only looking for unicorns.”

My experience, the problem is actually more the other way. I’m very used to VC participating in that earlier and less stable stage; $1MM investments, etc. That “gap between,” if you will. Challenge I see in Texas, that I didn’t see on the coasts, is that we have small businesses, related advisors, and business investors, talking to VC as though VC is appropriate to such businesses. And with so much of that, people start to feel like (and say) VC doesn’t support such things.

Thing it… it doesn’t. VC = equity and exit.

There’s no gap there. It’s that businesses that aren’t C-Corps and can’t/won’t exit, don’t apply to Venture Capital.

If those aren’t part of the equation, or viable, VC just doesn’t play. I’ve never seen VC only interested in Unicorns…. FWIW… that’s a perception.

It’s rather like saying you wish banks would give loans to the gap in those businesses without collateral nor revenue. Except… that’s not how bank loans work.

Paul O’Brien the original plan only cost X but as the plan evolves and you learn what you did not know. The cost of doing business goes up. When you learn and decide it’s time to grow, the cost of growth goes up. Usually the original plan changes, evolves, or just pivots. Each change and adaption costs money. It’s almost like changing majors in college. The additional time and cost of education goes up. When I first started … 5k was all the money in the world. Now 5k covers some bills. I couldn’t even afford a bookkeeper or CPA back then. And by the time I truly got a sense of budgeting and the cost of the doing business. I realized how I had not planned correctly. Banks and traditional lending was not available. had to figure out how to generate revenue, grow the business and still eat. So … when someone creates a startup budget or cost just multiply that by 3 or by 10 then you might be close. This does not count the cost of mistakes . Learning cost money too. Sometimes the entrepreneurs do not even know what business they are in and must evaluate what actually makes them money. 80/20 rule.

The uncertainty is the risk and where there is risk there is reward. Dont be afraid to start ! It’s now or never and in the digital economy. Anyone can start a business for little or almost nothing. But…. what will be the cost to stay in business..once you have passed the bootstrap stage. Eventually the entrepreneur will need capital to grow. The question is… will they have access to it?

The biggest issue around this I have seen is smaller business owners don’t understand the concept of advertising — at all. They don’t understand it is an investment not a cost. They don’t do any form of advertising to the degree needed. A very smart customer taught me this in a simple statement- advertising and higher rents paid for a better storefront location is like buying your sales. The more you pay the higher the sales.

Holy crap this is helpful, thank you!!

The statistics in your article do not surprise me. 30 years ago, at 16, I heard my dad talking with my uncles, ‘ I love college-educated people. They make great employees.’. They all laughed. They were and still are all high school grads with successful businesses.

Unfortunately, this made a big negative impact on my desire to go to college! Ha

But I have started 3 businesses, and work for myself in my current one since 2007. I do not think you can solve the insecurity of cost. That fear will either stop you or not. If you have an idea and the ability to get kicked off, you will fear the unknown and not start or you will fear those unknowns and start anyways; imagining that if you work hard enough you will succeed and overcome.

I guess there are even those superpower people without fear.

We can’t solve the insecurity of costs but we could certainly reduce the uncertain costs. The single greatest burden on economically challenged communities is the fact that start up costs even number in the hundreds of dollars.