For economic development professionals, community builders, and government officials committed to fostering entrepreneurship, it’s all too common to hear founders lament that a “lack of capital” is their most significant challenge. Yet, curiously, a lack of capital is rarely cited as a leading cause of startup failure. This disconnect points to a deeper, systemic issue in how startup ecosystems operate and how venture capital — or the perception of its availability — plays a role.

By the way, before we go on, let me clarify, Venture Capital isn’t just there to serve, it’s not available to start businesses, like you might expect of grants. Indeed though, venture capitalists serve 😉

Article Highlights

The Reality Behind Why Startups Fail

Startups fail for a variety of reasons, but research consistently shows that the causes are rooted in Team and Marketing issues — not capital. I’ve covered this extensively, particularly in an in-depth and popular article explaining how startups fail (so you can avoid these causes):

- Team: Poor leadership, inexperience, internal conflict, or a lack of cohesion can cripple a startup. A dysfunctional team often struggles to execute, innovate, or adapt to market demands.

- Marketing: Many startups misunderstand marketing, fail to prioritize it, or neglect it entirely. This leads to products or services that fail to connect with their target audience, limiting their ability to scale.

Startup Genome’s research reinforces these insights, showing that 90% of startups fail due to self-destruction, not external factors. Yet, founders overwhelmingly identify a “lack of capital” as their primary obstacle. If the root causes of failure are not financial, why is there such a pervasive belief that funding is the missing piece?

The Disconnect

If a lack of capital isn’t the main reason startups fail, why do founders consistently feel that it is? This disconnect suggests something is amiss within the community itself. Consider these possibilities:

- Few Investors Advising: A lack of engaged investors in the ecosystem means founders have fewer opportunities to receive critical feedback or mentorship. Without seasoned guidance, founders may misattribute their struggles to capital shortages.

- Inexperienced Investors: Investors who lack domain expertise or startup experience may provide inadequate or misleading advice, further compounding the problem.

- Misleading Investor Advice: Even well-meaning investors can inadvertently misguide founders by emphasizing metrics or strategies that are irrelevant to early-stage success.

In essence, when venture capital is not readily participating or is poorly aligned with the needs of startups, founders perceive the absence of funding as their biggest hurdle. This perception — whether accurate or not — reflects systemic challenges within the ecosystem.

Regional Barriers to Venture Capital Participation

On a regional level, several factors hinder venture capital’s availability and impact. These are challenges that communities can address and overcome, but only if they first recognize what’s at play.

Lack of Investor Awareness

Investors may not be aware of local startups or may undervalue the region’s potential. This often stems from insufficient marketing of the ecosystem itself. Here, how to market your startup ecosystem, explains how to do this drawn from effective communities throughout the world.

Economic Constraints

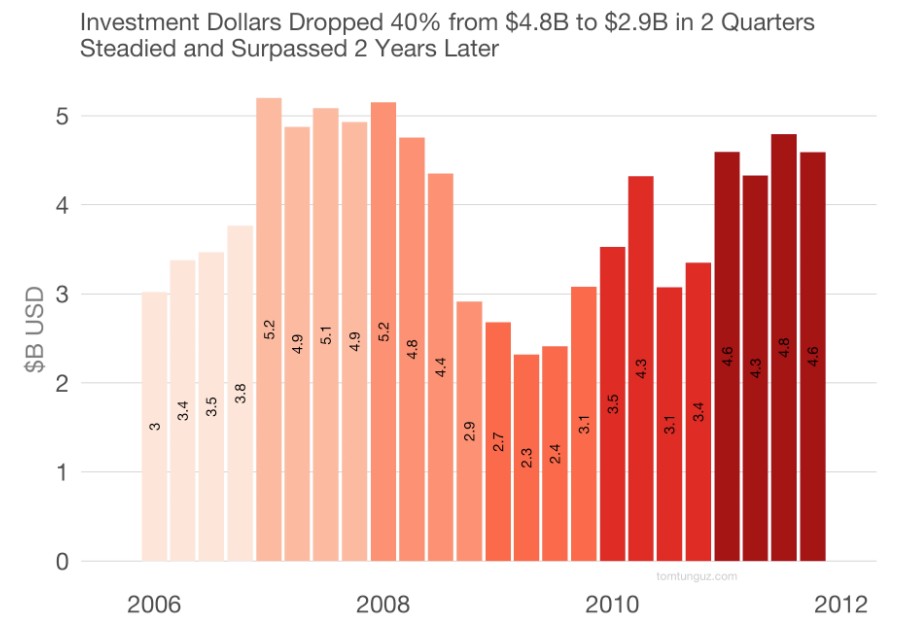

Broader economic challenges, such as limited local wealth or economic instability, can reduce the pool of available capital. This was evident in regions affected by the 2008 financial crisis, seen here in an assessment from Tomasz Tunguz, where venture capital investments slowed dramatically.

Risk Aversion

Investors in certain regions may shy away from high-risk, high-reward opportunities like startups, preferring safer investments. This is especially true in areas where economic recovery is slow but troublingly true when your “venture capital investors” are really traditional business investors masquerading as angels.

Lack of Startup Quality

Startups that lack competitive advantages, experienced teams, or the means to create real market value struggle to attract investment. This perpetuates a cycle where founders blame a lack of capital, while investors cite a lack of viable opportunities.

Limited Network Connections

Strong ecosystems rely on robust networks connecting founders, investors, mentors, and other stakeholders. Weak networks limit access to capital and resources. Most ecosystems, particularly even where I reside, suffer from silo’d networks which limit access. There is a network effect in healthy ecosystems, one which you can foster if you break down the barriers and value participants.

Poor Infrastructure

Regions lacking synchronously competing and collaborating incubators, accelerators, or coworking spaces, fail to provide the support systems startups need to grow and secure funding.

Regulatory or Policy Barriers

Restrictive regulations or unfavorable tax policies can deter investors and hinder entrepreneurial activity. For example, my friend Joe Milam over at AngelSpan is tackling the tax implications in startup investing, and simply put, capital gains taxes often play a significant role in where venture capital is deployed.

Market Limitations

Small or stagnant regional markets may discourage investors who seek scalable opportunities. Without the potential for substantial returns, venture capital avoids these regions.

Cultural Factors

Social or cultural resistance to entrepreneurship or risk-taking can stifle innovation and investment. Areas with entrenched industries may resist diversifying into technology or innovation sectors.

Crowding Out by Alternatives

When grants, government programs, or other funding sources dominate, they can inadvertently “crowd out” venture capital by reducing the perceived need for private investment.

Addressing These Challenges

The good news is that these barriers are not insurmountable. Communities can address and overcome them through strategic interventions:

- Educate investors on the region’s potential and startups’ viability.

- Strengthen networks to connect founders with experienced mentors and capital.

- Build infrastructure that supports entrepreneurial growth.

- Advocate for policy reforms that encourage investment.

- Foster a culture of entrepreneurship through education and community engagement.

Importantly, these are actionable steps that economic development initiatives can take. Unlike simply lamenting a lack of capital, addressing these root causes creates the conditions for venture capital to thrive.

Solve This

If we accept that a “lack of capital” is more symptom than cause, then it’s imperative to dig deeper into the real challenges facing startup ecosystems. This is the work I do, contact me — helping communities study their gaps, identify their barriers, and develop strategies to attract and activate venture capital.

We also want your input because we’re studying the leading causes stifling venture capital. Please take a moment to answer this one question: What do you believe is the primary reason for a lack of startup funding in your ecosystem or region? Your insights are invaluable as we work to make entrepreneurship accessible and sustainable.

Let’s reframe the conversation. The issue isn’t a lack of capital; it’s the systemic factors that make capital seem out of reach. Together, we can create ecosystems where startups thrive, and venture capital serves its intended purpose — to fuel opportunity.

re: “misaligned teams and poor marketing.”

Throw enough resources (read: money) at these and you can certainly mitigate them. On the other hand, the likely irony is that the founders who believe they need money more, are the same ones who have team a/or marketing issues that can be fixed without money.

Mark Simchock I find that money (from sponsors, cities, or grants), misplaced, more often contributed to this problem than helps.

Paul O’Brien As they say: “Scarcity breeds innovation.” That applied to money. It even applies to regulation (as in, it’s a restriction, deal with it). If you can’t overcome scarcity, then you’re playing the game all wrong.

The core problem is that VC marketing attempts to persuade naive first-time founders that ‘raising’ is a short-cut to success. Experienced founders know that VC is only a win-win for later-stage scale-up acceleration – once PMF has been proven. Early-stage VC (before proven PMF) is just a short-cut to failure 95% of the time. The only reason VCs promote it is for access to cheap equity and deal flow so they can play their game of one winner paying for 20 losses. They don’t care about the 20 founders losing everything. So don’t worry about local start-up funding, bootstrap until you find PMF and then (with the appropriate growth potential) you’ll have access to funding nationwide. They will be calling you.

Fostering innovation ecosystems isn’t just about startups, it’s about creating a collaborative infrastructure that empowers entire communities to thrive.

I actually think the more people complain about lack of funding the more funding/mature the ecosystem is. Places where people don’t even discuss VC rounds or business funding programs are the areas where very little funding actually takes place.

Mark Biw interesting. Why do you think that’s so? And though, in my time in California, people didn’t cite a lack of funding. It’s certainly disproportionately absent where it seemingly should be present.

Paul O’BrienWell checkout from the Midwest to Appalachia. Barely any funding and barely any discussion of it. Maybe complaints of lack of capital simply don’t fly in the most funded place on earth (SV)?