Over the last couple of weeks, I’ve been pushing us to question traditional startup methodologies such as lean startup or how venture capitalists discern investments, through an exploration with you of First Principles Thinking and the Bell Mason Diagnostic. In fact, I’m not inherently a detractor of either, rather frequently advocating that founders need to pursue VC while teaching incessantly about validation and MVPs; what I am is a contrarian, observing that when something persistently falls short of what we should be able to expect, something must still be wrong.

And I know you feel me in that, as a startup founder yourself, you’ve followed the existing articles, used the templates, and read the books, you have your pitch deck and yet still, most are frustrated to find capital (and invariably, 90% of you all will fail and go back to a job). Something must still be wrong.

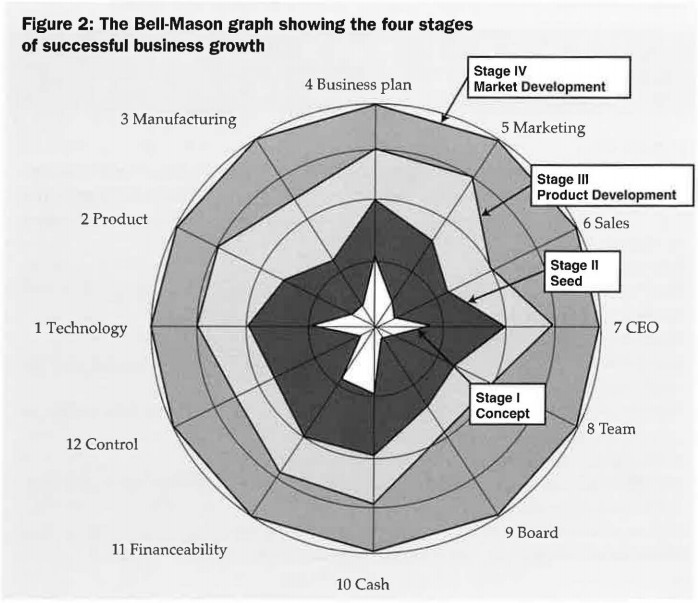

So, here’s the Bell Mason Diagnostic as typically displayed, the BSD (as we’ll call it), by the way, is a tested and accountable methodology for actually evaluating the value of and opportunity in a startup. Despite that, few use it, but this isn’t the article about that (you can read that here), I just want you to look at the diagnostic itself and ask, is there something wrong about it?

Bear in mind looking at this, I’m advocating for it. At the same time, appreciate that we know, definitively, what causes startups to fail. What makes my work as an economist and startup advisor valuable to most, is that I don’t regurgitate what you hear from most; I look at your work from the perspective of “what’s wrong?” and “does that explain how you could be more successful?”

The BSD works, but could it also illuminate some flaws in our conventional wisdom?

Let me clear, I don’t want you to look at that and try to figure out what IS wrong; I’m not saying something is actually wrong with it or that it’s broken, I’m asking you to question it.

I don’t think Lean Startup is wrong… Agile or Waterfall project management works… and how VCs invest, clearly, works very well, for them… and yet 90% of startups still fail. What we can best do for founders and entrepreneurs is question conventional wisdom because in innovation, we must orient our brains to the fact that everything can be improved – something is always wrong, or rather, could be better.

The BSD can be misleading. Here’s why… #1: Technology

And yet we know, definitely, technology is not what creates value or delivers investor returns. It’s oriented to make it seem to be the most important focus or priority, and that in turn causes entrepreneurs to perceive that that prioritization must mean something. #2: Product – but what is distinct of a startup from a new business? The product (solution) can’t be right, a startup is inherently a temporary entity designed to test, validate, and determine business models FOR a potential solution… yet this makes it seem like Product is also a more important priority.

I hate to say it to my Product Manager friends but bullshit. We know, with certainty, that Product doesn’t drive a startup, it’s not the most important thing, and in fact failing it and disregarding the actual most important things, will cause you to fail – 100% guarantee.

And again, as far as a diagnostic is concerned, I’m not refuting that investors need to assess the merit of the technology and product, I merely want you to observe that how something is presented can mislead people about what matters.

This is why I mentioned Lean Startup, a perfectly effective methodology for some things, but I find that how it is presented (or who is presenting it) often results in founders hearing, prioritizing, or doing the WRONG things – and failing. Er go, 90% still fail.

How do most of you start a startup pitch? Let me just tell you this time since I see dozens every day:

- The Problem

- The Product

- or worse, your company name and tag line

Following me? We’re oriented to the wrong priorities and evident in your startup pitches, following those best practices of Techstars or Guy Kawasaki, fail you for the same reason.

Simon Sinek preaches starting with why, research about startup failure proves that the majority of you will fail because of the team or marketing, and Peter Drucker established that marketing and innovation are the only things that create value.

So, why are we leading investors in our pitches to focus on technology, the product, or a problem, which has nothing to do with the potential and likelihood of success in the venture??

Article Highlights

The Bell Mason Diagnostic and the Perfect Startup Pitch: A First Principles Approach

Roll with me here, this is a thought process I want you to go through with me, to consider why pitch decks suck. Building on my previous exploration of startup methodologies and how VCs invest, I want to propose that what we should be putting together in a pitch deck is simply EXACTLY what VCs SHOULD be evaluating in their investment decisions.

That is, use the BMD as the template for our slides. 12 slides.

So, I sit here, look at that graph, and find myself struggling to piece a couple things together, so for you to get on the same page with me, we first need to make sure we all appreciate how it works (and interestingly, we’ll uncover more evidence why it can be confusing).

The Bell Mason Diagnostic categorizes the 12 factors of startup evaluation into four sections—Technology, Product, Market, and Organization.

Here’s how the 12 factors align with those four sections:

1. Technology (Feasibility)

- Technology (#1 on the graph): The foundational tech innovation and whether it is viable.

- Product (#2 on the graph): The step beyond raw tech—how it transforms into a usable product.

- Manufacturing (#3 on the graph): The ability to produce at scale efficiently.

2. Product (Usability)

- Business Plan (#4 on the graph): The strategy behind turning the product into a viable business.

- Marketing (#5 on the graph): Defining how to bring the product to the right audience.

- Sales (#6 on the graph): Demonstrating real user interest and conversion strategies.

3. Market (Scalability)

- CEO (#7 on the graph): The leadership’s ability to drive market adoption and strategy.

- Team (#8 on the graph): The operational force behind scaling the company.

- Board (#9 on the graph): Governance and strategic oversight for sustainable market growth.

4. Organization (Sustainability)

- Cash (#10 on the graph): Financial resources to sustain and grow operations.

- Financeability (#11 on the graph): Investor confidence and ability to raise further funding.

- Control (#12 on the graph): Systems and governance to ensure operational efficiency and regulatory compliance.

See some things confusing already? I hope you do… we have a Technology section, that includes technology and product, but then we also have a Product section? And the market is about the CEO, Team, and Board, not customers??? Not Sales or Marketing, which fall under, inexplicably, Product??

It does make sense though, and this is why this Diagnostic is so powerful.

Let’s use some more startup friendly buzzwords and correspond them with one of the 12 factors in the Bell Mason Diagnostic:

- Concept & Vision ? Technology (#1): The problem being solved and the unique innovation.

- Technical Feasibility ? Product (#2): Demonstrating proof of concept and viability.

- Product Development ? Manufacturing (#3): How the product progresses toward scalability.

- User Validation ? Business Plan (#4): Market feedback proving product desirability.

- Product-Market Fit ? Marketing (#5): Evidence of traction and organic demand.

- Go-to-Market Strategy ? Sales (#6): Detailed strategy for acquiring customers.

- Market Opportunity ? CEO (#7): Leadership’s ability to capitalize on the market.

- Competitive Advantage ? Team (#8): How the team executes differentiation and market positioning.

- Revenue Model ? Board (#9): Business governance and financial strategy alignment.

- Team & Leadership ? Cash (#10): Financial planning and operational leadership.

- Financials & Funding ? Financeability (#11): Runway, burn rate, and investor confidence.

- Risks & Scalability ? Control (#12): The roadmap for mitigating risks and sustaining growth.

See 12 slides yet? The rub is that the BMD itself orients priorities, the use of words can be confusing if not understood WHY they are applied the way they’re applied, and as a result, founders usually can’t speak to such a diagnostic, investors dig into the wrong things, and even if we have a team pitching with some of this in mind, or investors using the BMD, it’s likely being applied WRONGLY.

After all, who in their right mind thinks Market correlates with CEO?! Well, frankly, I do…

Let’s Roll this Back Together as a Pitch (and get to my point why we can tell your pitch is bad)

What the Bell Mason Diagnostic orients in our minds is priorities that tend to be consistent with how most founders do indeed pitch or prioritize. This isn’t a fault of the BMD, it’s an understandable correlation; that since most founders, books, and investors, prioritize or talk about the solution, the technology, and the respective product, it’s logical that the BMD (and most methodologies, startup-oriented platforms, and frameworks for the matter) do the same.

Let me digress a moment and encourage you to open this in a new tab and read it next – it should intrigue you to know that founders who are building startups trying to solve problems for founders, fail at a higher rate than most startups. Follow that? People trying to build solutions for founders, almost always fail. That’s telling. Again, since 90% of all startups fail, we KNOW that almost everything being advised now is still wrong.

Back to our exploration, the Bell Mason Diagnostic can set up a great pitch deck, in fact delivering directly to what investors should be seeking (and hopefully are), and here’s how it orients us:

1. Technology (The Feasibility Phase)

For early-stage startups, the primary concern most have is whether the technology is viable. So let’s knock that out by being direct about it in the pitch:

- A clear articulation of the problem being solved

- A fundamental breakthrough or innovative approach

- Technical feasibility, proof of concept, or a minimum viable product (MVP)

- Defensibility—intellectual property, patents, or a technological moat

2. Product (The Usability Phase)

Once a startup has a working technology, the next focus is whether it can be turned into a product people actually want. This section should cover:

- How the product translates the technology into something useful

- Product-market fit indicators

- Traction—user adoption, feedback loops, and iteration cycles

- The go-to-market strategy

3. Market (The Scalability Phase)

Investors now need to know if the market opportunity is significant enough to justify investment. This section should establish:

- Market size and growth potential

- Customer acquisition strategy

- Competitive landscape and differentiation

- Monetization strategy

4. Organization (The Sustainability Phase)

Great technology and a great market don’t matter if the team isn’t strong enough to execute. Investors will look at:

- The experience and composition of the founding team

- Leadership and organizational structure

- Financials—runway, burn rate, and funding needs

- Scaling challenges and risk mitigation

Sounds right, doesn’t it? This is loosely the order in which all startup pitch decks are laid out. Most elevator pitches focus on a problem and the tech that can solve it. Far too many startup meetings want to show off a demo of the great solution.

Almost everyone puts the team slide at the end of the deck, and it’s aggravating because no one should take anything anyone says credibly, or frame any opinions or questions, until they know who comprises the team – yet, everyone puts it last.

And it’s not wrong! Remember, Product-Market Fit – Marketing (#5): Evidence of traction and organic demand. The Product diagnostic actually isn’t show me the product or about the product, it’s Marketing and Sales

The 12 Factors and the Ideal 12-Slide Pitch Deck

Since the Bell Mason Diagnostic is the framework for evaluating startups, why isn’t every pitch deck structured around it?

If an investor is diagnosing a startup across these 12 factors, then an effective pitch should systematically present information in alignment with that diagnosis. A great pitch deck should be 12 slides, each corresponding to a Bell Mason factor:

Technology Factors

- Concept & Vision – Define the problem, your unique insight, and how your technology solves it.

- Technical Feasibility – Show proof of concept, MVP, or any technical breakthroughs.

- Product Development – Demonstrate progress in prototyping, testing, or building the product.

Product Factors

- User Validation – Showcase customer discovery, early adopters, and feedback loops.

- Product-Market Fit – Present evidence that users actively engage and want the product.

- Go-to-Market Strategy – Detail how you will acquire and retain customers.

Market Factors

- Market Opportunity – Quantify the TAM (Total Addressable Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market).

- Competitive Advantage – Position your product against alternatives and articulate differentiation.

- Revenue Model – Explain pricing, sales cycles, and monetization pathways.

Organization Factors

- Team & Leadership – Highlight the founding team’s experience, domain expertise, and complementary skills.

- Financials & Funding – Provide runway, burn rate, revenue projections, and funding needs.

- Risks & Scalability – Address key challenges and your roadmap for sustainable growth.

Why the Four Sections Matter for Storytelling

A startup pitch isn’t just a list of facts—it’s a story. Investors need a structured, compelling narrative that guides them through your startup’s journey in a way that aligns with how they think about due diligence. That’s why the four sections—Technology, Product, Market, and Organization—should frame the storytelling arc.

- Begin with the Tech – Investors first need to believe that what you’re building is feasible. Establishing credibility here creates a strong foundation for everything else.

- Move to the Product – Show that this technology is more than a science experiment; it’s something customers need.

- Make the Market Case – Demonstrate that the opportunity is worth their time and capital.

- End with the Team & Financials – Investors don’t invest in ideas; they invest in people who can execute. Show that your team has the experience, vision, and resilience to bring this to life.

And loosely, that is how everyone pitches. Coincidentally, consistent with the Bell Mason Diagnostic.

So, I’m going to tell you it’s wrong. That’t not the ideal story, that’s not consistent with effecftive storytelling, and it’s not even close to some of the fundamental principles of sales or influence (such as starting with why). Not that the BMD is wrong! That our orientation to it is wrong and that if we simply reorganize those 12 slides, we actually have the perfect pitch deck.

We know what causes startups to fail and it isn’t a question of the feasibility of the technology. Besides, if you want investment, you want it from investors who know what they’re doing, and the fundamental expectation you should have in that is that they know that something is possible. The question isn’t about technology, it’s about the team and market!

- Financials & Funding ? Financeability (#11): Runway, burn rate, and investor confidence.

- Risks & Scalability ? Control (#12): The roadmap for mitigating risks and sustaining growth.

Recall those too, when you’re putting together a financial model and have your ask, because that’s what we do, right? What BMD is actually saying about financials and funding is that it’s about your burn rate. Why do founders tend to perceive that investors want to take control? Because the diagnostic about risk and scalability is a question of mitigating that! It is about control, it should be, but founders are mistakenly conveying that scalability is simply having a Go To Market plan with some bullet points about where you’ll find customers.

Reposition everything, in 12 slides that explain what BMD wants us to overcome, but in the order that tells the more compelling story than technology first. Orient your pitch to explain to investors exactly what they should be looking into, such that if accomplished, they SHOULD be investing (as long as the terms are good):

- Make the Market Case – Demonstrate that the opportunity is worth their time and capital.

- Introduce the Team – Investors don’t invest in ideas; they invest in people who can execute. Show that your team has the experience, vision, and resilience to bring this to life.

- Begin with the Tech – Investors first need to believe that what you’re building is feasible. Establishing credibility here creates a strong foundation for everything else.

- Move to the Product – Show that this technology is more than a science experiment; it’s something customers need.

- Uncover the Financials – Illuminate what you can’t accomplish on your own and how funding will overcome that problem and create more value

Here’s your perfect pitch deck, still comprised of everything ideal as determined in our diagnostic and in what’s meaningful to investors, but framed so that it establishes first that you’re capable of overcoming what causes failure, then exploring what it takes, and wrapping up by reminding the investor what’s in it for them by helping you overcoming those challenges.

Make the Market Case

- Market Opportunity – Quantify the TAM (Total Addressable Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market).

- But keep in mind what this is! Not just that TAM/SAM/SOM chart you’ve been told!

- Market Opportunity – CEO (#7): Leadership’s ability to capitalize on the market.

- Can YOU get is that Obtainable market?

- Competitive Advantage – Position your product against alternatives and articulate differentiation.

- Remember what this actually is in BMD – Team (#8): How the team executes differentiation and market positioning.

If your mind isn’t already blown, I’m just gonna have to ask you to leave.

THIS IS WHY people like me can look at most pitch decks in 2 slides, and already determine that a startup is going to fail. You don’t overcome those most important factors, you don’t lead with them, and you aren’t qualified, so really, nothing else you say is going to change that.

And notice, I didn’t yet include the Revenue Model from the Market assessment of the BMD, because the revenue model is actually asking, diagnosing, and presenting, “Business governance and financial strategy alignment,” which we’re not ready to show yet.

And don’t misunderstand, you’re not disregarding the explanation of the startup, or some problem solution statement, you’re starting with WHY YOU and your team – what’s the opportunity and why are you relevant to that??

Introduce the team

- Team & Leadership – Highlight the founding team’s experience, domain expertise, and complementary skills.

- What BMD is actually assessing and communicating though is Cash (#10): Financial planning and operational leadership.

- Leading with not just who’s on the team but your stake, your contribution, and your needs, sets the stage for understanding commitments, requirements, and who is really running things.

Begin with the Tech

- Concept & Vision – Define the problem, your unique insight, and how your technology solves it.

- Which is actually the problem being solved and the unique innovation. How can anyone believe you when you start with this whereas when we know that you can, now you set up the problem solution because you’re walking us through what you are going to do about it.

- Technical Feasibility – Show proof of concept, MVP, or any technical breakthroughs.

- Demonstrating proof of concept and viability

- Product Development – Demonstrate progress in prototyping, testing, or building the product.

- Again though, NOT actually just showing us because that’s not the VALUE in this diagnostic, what you want to actually show us to prove that is Manufacturing: How the product progresses toward scalability.

Move to the Product

Now, if you’re not following yet now the proof and value determined in the diagnostic is actually what you want to show to substantiate what it is that you think matters, you’re still missing my point, and this next set of slides should help as we “move on to the product” (but didn’t we just cover Product Development?? NO, we actually covered how you can scale that development to deliver it!).

- User Validation – Showcase customer discovery, early adopters, and feedback loops.

- Market feedback proving product desirability.

- MARKETING, not actually just saying the product is liked by users

- Product-Market Fit – Present evidence that users actively engage and want the product.

- This actually being evidence of traction and organic demand. DATA, likely from analytics.

- Go-to-Market Strategy – Detail how you will acquire and retain customers.

- That’s really it, there isn’t a different assessment here, this is literally what it is, and most of you fail to show that. A list of channels or marketing practices is not a GTM Strategy.

Uncover the Financials

- Revenue Model – Explain pricing, sales cycles, and monetization pathways.

- And the mistake you ALL make is just showing us the how you charge customers. That’s not a revenue model and it doesn’t prove anything.

- What does BMD actually diagnose in this? Business governance and financial strategy alignment. Notice, “sales cycles,” not just that you charge $49 / month. How long, can you deliver, how does the roadmap align with revenue and requirements?

- Financials & Funding – Provide runway, burn rate, revenue projections, and funding needs.

- Runway, burn rate, and investor confidence because now it should be clear that you can say and deliver what you have laid out but ALSO that to meet those revenue and market opportunities (and overcome risks) you a specific use of funds

- Risks & Scalability – Address key challenges and your roadmap for sustainable growth.

- Which again, is actually about the degree of control; the roadmap for mitigating risks and sustaining growth.

We’ve already had our ask, in slide 11, not in the last slide, and the last slide serves to remind investors that you are aware of the risks! (That’s a good thing) and that the controls you have (and that they’ll have), mitigate those risks and substantiate the investment.

Listen, look, if you’re not reeling with how much better this is, I don’t know what to tell you but I’ll also say this, what I just wrote was a lot. I’ve laid out a lot and it requires really understanding due diligence, the Bell Mason Diagnostic, the words used vs. what is actually being asked or proven, and more. This is my 3rd in a series of articles exploring the BMD so I’ve been chewing on this for weeks.

Here’s what I’m going to do to keep going in this for you. We’ll stop here. Read it again, ask me questions, or heck, call me an idiot so I can prove you wrong… I’m going to follow this up with a walk through of a pitch deck from what we typically see on the first try, through what is typically advised and why that’s better but still problematic, through to IF and HOW this is actually ideal. Stay tuned, and subscribe to me here so you get that.

You many want to take a look at ‘Danny Doesn’t Do Demo Day’… https://joe-26467.medium.com/danny-doesnt-do-demo-day-cdba6df12c0a

That’s great

Thank you for this Paul O’Brien! It seems that in your approach, the founding team is just as much the product as their mission, idea, and product/solution. Building credibility through their relevant expertise and track record helps convey that the market out there with the specific problem can indeed be capitalised by the given venture. The existence of the problem, the market, and potential solution is not enough. Did I understand that correctly? I think I’ll go digest this more properly

SangEun L. That’s rather exactly right

When it has been determined that team and market determines success or cause failure, it’s affirmed that what we’re really doing is establishing a fundable team capable of creating value in a marketing, by finding a problem and solution.

Why are pivoting or “fail fast” such common tropes in startups?? Because your problem or solution, as currently envisioned, is wrong – you need to change. And what’s fundable is NOT a set problem and the solution; because there can be no such thing, the market is constantly changing so the problems and solutions change. No, what’s fundable is the team capable of changing and delivering iterations to the market, creating value as they go.

In a sense, is SpaceX fundable because we needed to solve the problem of getting back into space and they envisioned using a rocket??

Absolutely not. I can see and set that out as my startup.

They were fundable because they can accomplish it while also being marketable as such.

Paul, what a tremendously helpful and timely post! Thank you for sharing your experience and helping founders cut through the BS. I’ll be re-reading your thought provoking ideas until they sear into my memory.

Thank you Dennis. I’ll be following it up with examples and a template because I know, for sure, I lost most people – I covered a lot there, but it seemed important in my mind to do so.

Karen Voci As the pitch deck is coming along… check this out.

Couldn’t agree more. The Bell Mason Diagnostic is what every accelerator should use as their curriculum. For numerous reasons (didn’t know it was purpose built for this reason, didn’t do their research, didn’t know the Lean Canvas was lifted out of the BMD, or just want to recreate the wheel for their own branding agenda) they have not. And their…let’s say…’uneven’ sucess is a reflection of it.

Sadly, their cohorts are the lesser for it…

This is a fantastic breakdown of how to elevate investor outreach! It’s not just about sending a ton of emails, but about being strategic, doing your homework, and building genuine relationships. Prioritizing fit over just chasing funding is key!

And leveraging AI to fine-tune your pitch deck can make all the difference in ensuring it resonates with investors.

I wish more folks didn’t start the deck the exact same way (I usually do!)

Interestingly, that’s a very valid point and worth an article. If you’re following the template, clearly you don’t have a creative, innovative, experienced, or distinct approach to what you’re doing. Which is not to say you absolutely don’t have those qualities, but that those qualities are rather paramount in a founder, and here you are following a script to try and get funding.

cool article mr seobrien

asking for a friend MaxMershiev short pitch advice: “AvareBiotech

Sperm analysis app & Fertility map. Let’s help our farmers and ranchers nationwide to increase their livestock production dramatically!”

ANY time someone wants startup advice in public, I’m in.

“Sperm analysis app & Fertility map. Let’s help our farmers and ranchers nationwide to increase their livestock production dramatically!”

Think about…. “I don’t care.”

What you have here is a great sales pitch, not a startup pitch. You’re explaining what it is and how that works (a bit) which is sales, not startup.

What I mean by that is evidence in my latest article: https://paulobrien.substack.com/p/why-incubators-make-you-practice (awesome coincidence)

What you LEAD with dictates what people think about it.

You led with Problem Solution style.

What you might try to get at is WHY (start with why

@simonsinek

, etc)

I can’t answer that for you, I don’t know the sector, but why would the average person (not your customer) give a damn about what you’re doing? Will it lower costs? Is there a birth rate crisis? Could it be funny… “Ever wonder why Men get their sperm count checked but no one cares about the cattle? Yeah, most people don’t wonder that either, but we do…”

A methodology I like:

Why

Who

When

Where

What

How

Notice, this pitch is at the bottom of that, and what is compelling to more is at the top and working your way down.