Article Highlights

Why Venture Capital Needs a First Principles Overhaul

Venture capital is broken. Not in the “bubble’s about to pop” and certainly not in the sense that so many are pissed off because they aren’t getting funded, but in the “founders keep getting bad funding advice from firms still operating on outdated, ineffective methodologies” sense. In the words of Khosla Ventures‘ Vinod Khosla, “You haven’t earned the right to advise an entrepreneur. Just because you got an MBA and joined a venture firm, doesn’t mean you’re qualified to advise an entrepreneur” sense. And in the someone-who-has-a-ton-of-wealth-or-went-to-the-right-school-is-suddenly-on-the-scene-as-a-VC, clearly, they know what they’re doing and have earned their role, sense.

Most VCs follow the same worn-out playbook drawn from what friends say, sitting in Demo Days, listening to the podcast about Lean Startup, and whether or not they had their coffee before their meeting with you, all justified by the made-up financials a founder put together seeming reasonable — you might call this the gut feelings and referrals with friends wrapped in a PowerPoint deck methodology. Few question whether their process is actually the best way to identify, fund, and grow companies because the math is sound: raise enough capital and the 2% management allocation pays their salary… as long as 1 investment in 10 delivers a 15X return, everyone is happy.

There is zero incentive on anyone’s part to improve upon the fact that 90% of startups fail (though we know why and can avoid those causes), evident in the fact that so many startup development organizations are desperately trying to put those practices in place, delivering better than average results, but none get direct support (funding) from investors because most are happy to keep doing what they’re doing themselves since it works just fine, for them.

Enter First Principles thinking, the mental model that strips a problem down to its most basic truths and builds back up from there; I just explored that, here, as it pertains to why project management methodologies applied to startups are actually causing start failures. Applied to venture funding, First Principle Thinking demands an overhaul of how investors conduct due diligence, assess risk, and optimize for startup success. And no, “spray and pray” isn’t a strategy (It’s an admission of incompetence).

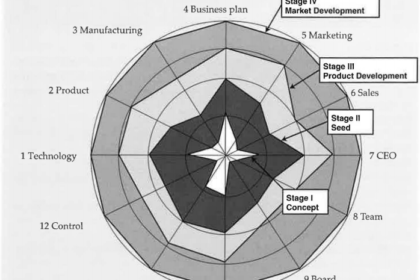

The Bell Mason Diagnostic (at the link there, as considered by Mandalore Partners and Mandalore IndustryTech Growth) offers an objective, systematic framework that actually aligns with First Principles thinking, providing VCs with a structured way to evaluate startups at different stages of growth. Instead of subjective guesswork, BMD forces investors to break down a startup’s capabilities—team, technology, market, product, funding—into measurable, stage-specific assessments, arriving at the fundamental truths that are paramount in First Principles.

And yet, despite having tools like BMD at their disposal, most venture firms resist true optimization. As Joe Milam, CEO of AngelSpan, bluntly puts it:

‘The venture industry seems to have avoided any steps to establish itself as a proper profession. There is no training required to become a VC, no ‘best practices’ to study, no oversight of the bad actors. There are no barriers of entry to become a GP of a fund. Even hairdressers have to go to school to become licensed beauticians.’ ‘This absence of standards – First Principles of Venture Investing – is the root cause of the many symptoms that represent what’s wrong with venture investing today.” – Joe Milam; AngelSpan

This is the core issue: VCs love to talk about “innovation,” but most are running an antiquated investment model built on inertia, not logic. If First Principles thinking revolutionized engineering, why hasn’t it done the same for venture capital? Oh and, by the way, James Clear, author of Atomic Habits, shares how Elon Musk’s approach to innovation and thinking exemplifies First Principles in engineering, and might serve as evidence of what we’re talking about being effective.

What the Bell Mason Diagnostic Fixes in VC Diligence

If we treat venture capital like an engineering problem rather than a “high-risk gambling” exercise, we can start applying structured analysis to the process. The Bell Mason Diagnostic (BMD) was developed as a way to decompose startup success and uncover compelling opportunities investors into objective, stage-appropriate factors. It breaks down the key dimensions of a startup’s development—from technology and market fit to management and funding—mapping out where a company stands and what gaps need to be filled before scaling.

This is exactly what First Principles thinking dictates: deconstruct, validate, rebuild.

Instead of relying on investor “intuition” or broad-strokes industry trends, BMD forces VCs to systematically evaluate startups based on the actual building blocks of a successful company. In this way, it shares DNA with First Principles thinking by removing assumptions and rebuilding investment decisions from the ground up.

Let’s look at how the Bell Mason Diagnostic aligns with First Principles thinking in venture capital:

- Breaking Down Complexity Into Fundamentals

First Principles thinking forces us to strip problems down to their essential components. BMD does the same, identifying a startup’s core strengths and weaknesses in areas like team capability, product-market fit, and financial strategy. Rather than a binary “yes/no” funding decision, it provides a structured roadmap for de-risking the company. - Objective, Stage-Appropriate Evaluation

The biggest mistake early-stage VCs make? Applying late-stage metrics to early-stage startups (if you’ve followed me for long, you know this about me, I’m an a****** about investors pushing idea stage startups to focus on customers, stop it!). Most investors expect product-market fit, scalable revenue, and solid customer acquisition economics before funding, when the reality is that pre-seed and seed-stage companies are still solving for those unknowns. BMD corrects this by aligning startup evaluation with its appropriate stage of maturity, ensuring that diligence isn’t just a generic checklist. - Iterative Improvement, Not Gut-Driven Bets

The worst-kept secret in venture? Even experienced investors don’t know which startups will succeed. The best way to compensate for this uncertainty isn’t more intuition-based bets—it’s systematic iteration based on measured progress. BMD allows investors to track whether a startup is meaningfully progressing or stalling, rather than relying on a founder’s charisma and a slick pitch deck.

The Bell Mason Diagnostic (BMD) by the way, is a structured framework that assesses a startup’s maturity and readiness for scaling by evaluating key dimensions critical to success. It systematically scores a company across four major areas—Product, Market, Team, and Business Execution—breaking these down further into 12 subcategories such as technology readiness, customer adoption, team experience, and financial stability. Each subcategory is measured against stage-specific benchmarks, ensuring that early-stage startups are assessed differently than later-stage companies. The diagnostic process involves a guided questionnaire where startups and investors score their performance in each category, generating a visual heat map that highlights strengths, gaps, and risk factors. The thing should be an app, by the way, and analytics and startup platforms should have this assessment built in and spit out, by default.

Most Venture Firms Are Failing at Optimization

Despite having access to frameworks like the Bell Mason Diagnostic, most venture firms still operate like it’s 1999. Milam argues in his piece “It’s Time to Professionalize the Venture Model”, venture capital has failed to professionalize in a way that truly optimizes for startup success.

The venture model today is riddled with three fundamental failures:

- Lack of Data-Driven Decision Making

Most venture firms still rely on gut instincts and pattern recognition, rather than rigorous data-driven evaluation. Milam points out that this is especially problematic at the early stages, where better diligence frameworks could significantly improve funding outcomes. He argues that structured models like Bell Mason should be the default, not the exception. - Misaligned Incentives

Traditional VCs don’t win by being right—they win by raising bigger funds. As Milam highlights, venture firms aren’t actually incentivized to optimize for startup success; they’re incentivized to raise more capital under management. This means that many firms intentionally overfund certain startups, creating artificial valuations that increase paper returns but don’t necessarily lead to long-term success. - Failure to Optimize Portfolio Construction

First Principles thinking would suggest iterative refinement in portfolio construction—funding companies based on stage-appropriate diagnostics, tracking progress with clear milestones, and doubling down on high-performing startups. Instead, most VCs still rely on one-size-fits-all investment strategies, often failing to stage-gate funding appropriately.

Milam puts it bluntly:

“Venture investors and limited partners must transition from ‘it’s an art’ to real risk assessment and underwriting methodologies that are transparent, defensible, and measurable.”

In other words, venture capital is overdue for a professionalization revolution. The tools exist. The frameworks exist. But most firms refuse to optimize — choosing instead to operate on outdated heuristics and legacy reputation.

First Principles + Bell Mason = True Optimization

If you’re an investor and still making funding decisions based on what worked for Sequoia in 2005, you’re behind. The next generation of venture capital will be driven by First Principles thinking, structured diligence, and true optimization.

Here’s what that actually looks like:

- Applying Bell Mason Diagnostic as a Standardized Diligence Tool

Stop making seat-of-the-pants investment decisions. Use frameworks that provide structured, stage-appropriate evaluations of startups. - Iterative, Data-Driven Portfolio Construction

Fund companies based on measurable progress, not just “potential.” Track startup milestones and adjust investment strategies accordingly. - Aligning Incentives with True Startup Success and Compelling Returns for Investors

Move away from the AUM-driven model and fund companies based on real progress, not paper valuations designed to prop up the next raise.

Venture capital can be optimized. It should be optimized.

The insights on First Principles thinking and the Bell Mason Diagnostic are a breath of fresh air for venture capital Paul! We can foster a more resilient and thriving startup ecosystem by stripping down to core truths and rebuilding from there. This approach aligns with energy management and leadership principles, where understanding and optimizing foundational elements lead to sustainable growth. Let’s embrace these methodologies to empower both investors and entrepreneurs to thrive.

Very informative / Thanks for sharing!

Paul O’Brien – ” this entire system optimizes for investor survival, not startup success” – wow. not many people have the courage to say that – I wish more people in the industry would listen.

eh… with age and anger comes DGAF and being pissed off at how many founders and entrepreneurs fail not because of their faults but because of absolutely crappy startup development organizations, incubators, and accelerators, investors who have no business talking to startups, and consultants pretending to be advisors or altruistically helping founders.

LET’S GO, Paul O’Brien! Excellent piece and thank you for the AngelSpan, Inc. shoutout! Most don’t realize the power of the Bell-Mason… we’re glad someone with your audience size has brought some attention to it.

I also love point #3 in your post. You discuss how the Bell Mason Diagnostic fits with First Principles thinking in venture capital. The phrase “Iterative Improvement, Not Gut-Driven Bets” is CRITICAL to internalize for VCs!!

STOP pretending you know what a good deal looks like! Stop trying to predict the future! Instead, track a startup over time (using something like the BMD), and let the data tell you who is “good.”

Well done Paul O’Brien. Takes curage to go against the narrative. Thankfully there are more like Paul joining Dan G., et. al., and Paul has done a nice job here. And if this is interesting to you, look up the architect (along with Heidi Mason and Coopers & Lybrand, btw) Gordon Bell on Wiki. A ROCK STAR!

Well said, Paul. That’s why I run our fund as an operator with 40 years of angel, startup and business experience.

This right here…

“There is no training required to become a VC, no ‘best practices’ to study, no oversight of the bad actors… Even hairdressers have to go to school to become licensed beauticians.”

Paul O’Brien Next should be a write-up on the overlooked QSBS tax incentives – especially the original – QSBS Sec. 1244, ‘The Impact Incentive’. See https://bit.ly/380p7wT

Thank you for sharing this! I’m curious if there’s any data on the adoption of First Principles thinking within the industry. It will be exciting to see how these alternative frameworks can lead to more sustainable strategies for startup evaluation in the near future.

VC’s seem to often make decisions, especially in the early stages of venture, with their gut. Even though startups in that stage may not have financial data to use, there is still other data VC’s can use to inform their decisions, and the Bell-Mason framework seems like a great place to start. The real question is – can we use data from aggregated startup outcomes to validate the framework?

Is Step 4 (between Manufacturing and Marketing) labeled “Make Future-proof by having a well thought out, financed, and staffed strategy for assuring success in a Gen AI world?

The problem with ‘first principles thinking’ for early-stage investors is that it only leads to bootstrapping by founders…. and thus no role for VCs. Getting turkeys (pun intended) to think about Thanksgiving is a challenge.

Steve Jennis working on exactly that thought for my next piece

…maybe more founder should bootstrap longer, not be so eager to give away equity. As soon as you get on the VC hamster wheel the expectation is that you keep running faster and faster.

Jan E. Odegard All founders should bootstrap for longer… as the only time they have the negotiating leverage to get a fair deal from VCs is very late-stage.

Steve Jennis It doesn’t have to Steve, if investors understood and used an overlooked tax incentive to stimulate investment into early stage companies. QSBS Sec. 1244, what I’ve labeled ‘The Impact Incentive’ was passed in ’58, updated in ’78, but has been forgotten about by investors since. If early stage venture funds (and accelerators, angels, etc.) would incorporate 1244 in their selection criteria, along with other proper risk-management practices (diversification anyone?), more $s could get mobilized for more diverse business models, entrepreneurs, and regions around the country. See https://bit.ly/380p7wT & https://bit.ly/4gcyg64

Joe Milam I don’t really care about incentives for investors, only what really benefits founders. Taking any VC is most often a mistake for 90% of founders, and for 99% of early-stage founders. Bootstrapping until VCs are desperate to invest in you is the only way to get anything like a balanced deal.

Paul O’Brien, looks like this newsletter caused a stir (& I take responsibility for my comments in the last ?), and as you mull over your next piece, I would love for you to keep this momentum i.e. what is it that is at stake here? VC returns? Impact investment returns? Startup ethos success? Or simply a future where inefficiencies are replaced by a simple neural response retraining of success of ethos = 1+2+3+ new wealth, empowering my foundational approach, either ways. Better to show and tell, than just hypothesize. Appreciate you!

Santhosh Anand appreciate your points but would ask that you also appreciate that you note that people have different strengths and weaknesses; that our roles or titles rarely reflect that well. What I mean by that is that I am not a VC, I just know for a fact because of my work as a marketer, economist, and having been advising founders for 30 years, that VC is broken because of the ineptitude and lack of methodology within.

I don’t work for VCs… if they want to pay me, I’m happy to help them fix this. I usually work for ecosystems (governments), and I’m going to tell it like it is, so that founders, mentors, advisors, and other stakeholders, learn not to accept crap from investors and startup development organizations that clearly don’t know what they’re doing.

For my part, what’s at stake here is that 90% of startups fail, and that’s a horrific % because we know (definitively) what causes most failures, yet very few people put a stop to what perpetuates those failures (among many things, what I’m exposing here). I referred to someone like Joe Milam in this article because while it’s not my focus to dive too deep and fix this in VC, it is *his* work.

I want the crap removed from ecosystems. This is some of a lot.

Steve Jennis I appreciate your perspective, and with the current funding environment and typcial funding practices I would largely agree with you. And I agree with Paul’s premise that the venture model needs changing. So within the ‘Is vs. Ought’ framing, the venture funding process ‘ought’ to fund early stage startups in a way that allows for more efficient funding and more entrepreneur-friendly cap tables.

I’m working on my pitch & this gives me such a clearer idea of how to frame it. Thank you. The application of First Principles thinking & the BMD make much more sense than the typical advice I see for startups.

Question for you. I’m a social enterprise. Where do you see measures of community impact or Social Return on Investment fitting in pitches?

John Barton you want to be a case study with and develop it publicly? I’m working on my next pieces already, tying it to pitching. We could make one of those about sharing your version, a typically improved (advised) version, and then this approach?

As for social impact… hate to say, or frankly, I don’t hate to say it because it’s been established to be the case, it doesn’t have bearing. It’s part of your story, sure, but it has zero impact on funding (despite what some claim or what “social impact investors” propose) because at the end of the day, you still have to hit the SAME financial accomplishments. Fail that, and you fail, and if you fail, it doesn’t matter what you’re trying to do.

I’m reminded of an old saying from my time in Silicon Valley, the greatest social impact startup in in history (at the time), is Microsoft, because they changed the world and couldn’t accomplish anything else at all without that success.

Paul O’Brien Uh…yeah?! That would be incredible. Thank you for offering! What timeline are you thinking for your project?

I don’t think you’re wrong about social impact, certainly in the US, but I’m not sure that’s true globally.

Even in the US, up until recently EJ measures focused on Community Benefit Agreements — requiring a measure of social impact.

John Barton yeah, though I just wrote a piece about Europe that was pretty popular, explaining why that greater access to capital without investor expectations, is why they languish, relatively speaking (and that is related to why social impact oriented funding, or goals, fall short).

Might be available perspective to you

? https://seobrien.com/why-doesnt-europe-have-a-silicon-valley

All that said, still, YES part of the story, not the ROI. We’ll play that out in our expose your pitch and it should make sense.

Timing, send me your deck as of today. I have a other article related to this coming first; we’ll do this as a follow up explaining that. So… Week after next publish? Maybe sooner if you can keep with me on the advice and changes so I can them in the article.

DM me, I have another idea we might throw in the mix. We can work it timing.

John Barton You can keep your focus on the potential economic success of your idea while also attracting Impact investors vis awareness of and the (potential) messaging of how ‘The Impact Incentive’ might be available to potential investores in your company. See https://bit.ly/380p7wT

Joe Milam Interesting. I’ll take a look. Thank you!?

One of the flaws I see in developing Social Enterprise is we haven’t fully defined what the term means. That allows for a wide range of experimentation & innovation, but also results in a limited understanding of how to measure effectiveness (meaning impact).

John Barton Agreed. I heard the best definition of an Impact startup at a sophisticated Impact conference sponsored by the Milken Foundation (there is LOTS of noise in the Impact space as you know).

Definition of an Impact Startup:

#1 – Committed to Transparency

#2 – Committed to Measurement

#3 – An authentic intention to Impact

When a quetion from the audience surfaced, #3 was the focus. When describing their company as looking fairly typical of a tech startup, but was launched in Baltimore to create some progress in startups in Baltimore, the CEO asked ‘Are we an Impact startup?’

The answer from the panel head; ‘For the people of Baltimore you are.’

And that is the point – Impact is in the eyes of the investors…similar to what is a worthy charity for support. It’s what matters to investors.

That’s why the Impact Incentive is so powerful to mobilze capital – it makes your venture (should it qualify) as a better investment than a charitable contribution, regardless of the degree of Impact the investor perceives.

And most Impact investors GIVE a lot of money away each year to charities…

Take a look at a brief webinar on QSBS and how to message it to investors – https://bit.ly/2AYC9NH

Joe Milam Ahh. Perfect. And that’s it exactly…not every investor is going to care. Which is fine, and true for lots of reasons unrelated to impact (location, industry, ROI, etc).

But if we don’t measure impact then we’re also not actively giving investors the chance to fund based on Social Impact.

And then there’s the flip side: identifying investments that would have a negative community impact — though I’m afraid that’s the harder sale.

John Barton Agreed, though there is a growing body of work labeled Philosophy of Technology. While still in its infant stage really, has really gotten steam with the development of A.I., it is an important input into the conversation. https://en.wikipedia.org/wiki/Philosophy_of_technology

“You haven’t earned the right to advise an entrepreneur. Just because you got an MBA and joined a venture firm, doesn’t mean you’re qualified to advise an entrepreneur.” Damn.

Randy Paris in my experience, it’s absolutely valid. We can’t help founders be successful if we don’t remove from our ecosystems the bad advice and inexperienced mentorship. 90% of startups shouldn’t fail, that’s ridiculous; we know how they fail so improving that average is simple – not a guarantee of success, but a removal of all the failures because people are disregarding the known causes.

Randy Paris With your education, experience and current activities you will appreciate the overlooked opportunity that is ‘The Impact Incentive’. The first tax incentive (cir. 1958) to stimulate private investment into early stage startups, it has been virtually forgotten by the venture industry, accelerators, and angel investors. Greater awareness – and an overdue modernization (last time was ’78) would mobilze more $s for more startups around the country – particularly from Impact investors, as the tax benefit/deduction is a better write-off than a 501c3 contribution. See https://bit.ly/380p7wT

Adam W. Barney Couldn’t agree more. And we have. Gordon Bell – the principle architect of the BMD – is an investor in our best in class Investor Relations for Startups service. We licensed the BMD to structure the reporting and operational tracking our service delivers. You may want to take a look at https://bit.ly/3fY5gQB

Joe, it’s fantastic to hear that you’re leveraging the Bell Mason Diagnostic in such an impactful way! ? It’s all about creating frameworks that truly support startup success. Your approach sounds like a refreshing shift towards more structured and meaningful investor relations. I’m looking forward to seeing how this evolves!

Thanks for sharing Paul!! And fully agree.

We created playbooks to prevend 80% of the mistakes. Happy to chat.

Marc Wesselink We may want to compare notes, as we built a playbook and platform to execute on an optimized venture fund strategy. The combination of your tools and our could be interesting to explore. Take a look at the First Principles which went into the design of our platform – https://bit.ly/3UoRYDF. And btw, Gordon Bell is an investor in our company and we licensed the BMD to structure the reporting & operational tracking of startups, which is part of our platform.

Paul O’Brien, in addition, in the capital supply chain, VCs are but mostly middlemen for funds raised in the market through their warm referrals. They do not accept cold emails from founders or others, and literally run after a panel. Their ivy and faux exclusivity is their popular source of truth and the greatest blocker to innovation. It goes all the way up the capital chain in the economic market hence the current state of instability and mediocrity despite innovation always breaking these barriers and more. It’s far worse in developing economies like India where their gold standard is this root cause error.

Then there is just egregious calibration of ‘impact’…this is an endless cycle. Ask me about the history of this all. Hah!

Santhosh Anand You may want to also look at https://bit.ly/3UoRYDF

You nailed it, Benjamin Bral! The Bell-Mason framework is a fantastic tool for assessing startups beyond gut feelings. Leveraging aggregated data from past startup outcomes could indeed validate its effectiveness, offering a more structured approach to early-stage investment decisions. It’s all about evolving with the times!

Adam W. Barney The amazing thing is that early-stage VCs have a <5% investment success rate yet have made no attempt (to my knowledge at least) to relate outcomes to their own decision making process (gut feel or otherwise). How their LPs let then get away with this is beyond me. Maybe they have secret analyses, but if they only confirm that 5% is the best to be expected from human VCs then maybe AI agents need to replace them overnight. No wonder more LPs are investing directly to keep the 2/20 fees for themselves. VCs have some explaining to do to justify their continued existence – or is arrrogance, hubris, and verbal fluff all they have?

Benjamin Bral Read Gordon’s book – ‘High Tech Ventures; The Guide to Entrepreneurial Success’. They took a scientific approach to design, architect and back-test the model over thousands (now 10s of 1000s) of companies. It works. The Lean Canvas was lifted out of the BMD around the BMD milestones to find product/market fit.

Benjamin Bral Gordon Bell – the principle architect of the BMD – is an investor in our best in class Investor Relations for Startups service. We licensed the BMD to structure the reporting and operational tracking our service delivers. You may want to take a look at https://bit.ly/3fY5gQB

Ronald Horn

Informative.

10-4, hut! Your space must and will be protected.

Really interesting call out!

Ironically I see ambition as one of the top reasons entrepreneurs fail. They see certain businesses being glamorized, often the third, fourth or fifth business of more experienced entrepreneurs after a decade or more of learning the ropes. And they want to skip the learning phases and jump right into the billion dollar company builder phase. Well it’s just not how things work for all but a few that fit into an elevator. There’s no shortage of avaricious ambition but there’s a shortage of pragmatic ambition.

love this! this is how I think about it. what vc in texas do you think represents this the best?

What’s your take Joe Milam?

Ian, I don’t think any apply it, but I could be wrong

cc AngelSpan