There’s a special kind of eye twitch that founders get the 37th time they hear, “We’d love to invest, but you need more traction.” It’s a vague hand-wave of a dismissal that sounds helpful, but is really just cowardice in a hoodie. And when you ask what kind of traction they mean, they blink like an animatronic on the fritz. Users? Revenue? Press? Partnerships? Alpha code on GitHub? A moon landing?

Let’s shut that down. Let’s talk about what investors mean by traction.

Let’s shut down, specifically, the investor or advisor who drops that word like it means something yet can’t explain it or act on it. This article isn’t a complaint. It’s a weapon and I want you to use it. It’s designed for you to copy, paste, share, and confront that guy, yes, that guy, who thinks “traction” is a substitute for knowing what they’re doing.

Article Highlights

- “Traction” is Not a Metric. It’s a Confession.

- Traction Means Toward 15–20x, Not 10,000 Users

- The “Traction Test”: 3 Questions to Flip the Script

- Your Real Problem Isn’t Traction. It’s Clarity.

- “I am Growing, Shouldn’t Investors Pitch Me??”

- What Investors Mean by Traction: Your Team Isn’t Enough

- How to Shut Them Down (and Get Real Help)

- Traction Is the Output, Not the Input

“Traction” is Not a Metric. It’s a Confession.

When investors say you need “traction,” and they can’t tell you what that means, what they’re actually saying is this:

I don’t believe your team is capable of getting to a 15–20x return on my money, and I don’t know how to articulate that, so I’m punting.

That’s it. It’s not about users. It’s not about revenue. It’s not about growth graphs in your pitch deck looking like ski jumps. It’s about belief, and if they don’t believe in you, they hide behind the word “traction” because it’s conveniently ambiguous. Like “synergy” or “fit.”

The evidence is hiding in plain sight: the focus is the team. It always is. Every GOOD investor deck starts with “team” (and the advisor or pitch deck templates that suggest otherwise that team is better near then end, are absolute bullshit because everyone is investing in the team, it’s not an afterthought, it’s the forethought – show me up front that you are credible and capable of what you’re about to tell me). But when “traction” keeps coming up as the reason for a pass, it’s because your team isn’t convincing them you can do the job. That’s the real traction: founders capable of going from now to a liquidity event. And if you can’t show that path with clarity, it doesn’t matter how many users are clicking around your MVP.

Traction Means Toward 15–20x, Not 10,000 Users

Let’s get brutal. Venture capital math is simple:

- If you want a $1M check, you need to demonstrate a credible path to returning $15M–$20M.

- That’s not a rule of thumb. That’s arithmetic. VC funds need those outcomes to cover their losses on everyone else.

Now, if you say, “I have 10,000 users!” they nod politely and ask how you’re monetizing. If you say, “I’m making $5K/month,” they’ll smile and suggest you bootstrap.

And don’t come at me telling me that VC is changing or should change, because a revenue bearing startup is just as valid as the one not-so. You’re missing the point entirely: Venture Capital is for startups that are NOT like traditional businesses – if you think you should get funding because you are pulling $5k a month, go talk to a bank.

Taction isn’t a vanity metric. It’s evidence that you can turn capital into dominance.

That might be revenue, sure, but it might also be partnerships with companies who’ll get you acquired. Or a team that knows how to blitzscale a new market. Or an early adopter channel that converts at 20% with a CAC:LTV ratio that makes angels weep tears of joy. That is traction; evidence of what YOU and your particular startup needs to overcome to accomplish the outcome. If you’re not offering that, stop talking about your users like it matters. Whoop de doo, some people like it, and you can sell!

The “Traction Test”: 3 Questions to Flip the Script

Here’s how you throw the BS flag on “traction”:

- What kind of traction are you referring to?

Make them define it. Growth? Press? Revenue? Hires? Ask for specifics. - How do I achieve that?

Force them to be useful. If they can’t coach, connect, or refer you to someone who can, they aren’t worth your time. - Are you willing to help me do that?

This is the nuclear option. Ask for support: money, intros, resources. If they ghost, you have your answer. And that answer is they didn’t know what they were talking about or are lying to you.

And if they fail at any step? Fire them. They’re not an advisor; they’re not an investor. They’re a commentator with a LinkedIn profile (which, granted, so am I).

Traction is what investors say when they don’t believe in your team, but won’t admit it.

Your Real Problem Isn’t Traction. It’s Clarity.

One of the most dangerous myths in startup land is that traction is linear. Get X users. Then Y revenue. Then Z valuation. What a load of sanitized, Silicon Valley-certified crap. If your pitch includes:

- “We just need $100K to finish the MVP,” or

- “$1M would get us to revenue,”

…then you don’t know what you need, and no serious investor will bet on your vision.

The difference between $100K and $1M isn’t just a zero. It’s an entirely different strategy, team size, burn rate, and risk profile. If you’re uncertain between those, you’re telling the investor that you don’t understand your own roadmap.

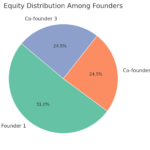

Same goes for your valuation expectations. You want to give up 20% of your company for that check? Why 20%? Because you heard that’s normal? Cool. I can argue for 40% just as easily, or 5%, depending on your stage, your team’s pedigree, your market defensibility, and yes, your real traction.

Random round numbers aren’t confidence. They’re a cry for help.

“I am Growing, Shouldn’t Investors Pitch Me??”

No.

That’s it. This really doesn’t need to be explained further, but let’s do so anyway: Why would they?? If your business is growing and profitable, congratulations, you don’t need VC. Go to a bank. You’ll get a loan on better terms.

Venture capital is for high-risk bets with high-return potential. If you’re not a bet anymore, you’re stable; hell, you’re probably not a startup, you’re a business – that’s what lenders and business partners are for. The reason investors are still saying “traction” even when you’re growing is because you’re not showing why your growth proves you can scale to $100M+ outcomes. They don’t want growth. They want acceleration.

And if you already have that? Then why are you still pitching them?

What Investors Mean by Traction: Your Team Isn’t Enough

When an investor says you need traction, and your deck emphasizes team, here’s what they’re really saying:

- You don’t have a marketer or CMO who knows how to create markets.

- Your engineers haven’t demonstrated velocity or experience at scale.

- You lack BD connections to distribution or acquisition partners.

- Your team doesn’t look like people who’ve done this before, or who even know what “this” is.

That’s harsh. But it’s real. And if you don’t recognize it, you’ll keep thinking “traction” means customer signups and getting ghosted by people who never understood your business in the first place.

How to Shut Them Down (and Get Real Help)

So, here’s what you do when you hear “traction” again. You reply with this:

Thanks for the feedback. Can you be specific about the traction you think is needed and how to achieve it? If you can’t, please don’t use that word, it’s misleading and lazy. If you can, I’d love to hear how you’d support it through intros, capital, or resources. Otherwise, let’s not waste each other’s time.

And if you’re serious about fixing this problem in your case, drop in the comments your:

- Elevator pitch

- Website

- Founding team and roles

Because there are people, myself included, who will tell you exactly what’s wrong, because we actually work with startups instead of pretending to be investors. I’ll do it with you, right here in these comments, not to tear you down but to fix this damn broken startup advisory culture that confuses empty platitudes for wisdom; by showing how easy it is to meaningfully advise a founder.

Traction Is the Output, Not the Input

Let me leave you with this: traction is what happens when the right team has the right plan and resources. It is not what gets you funded, it’s what gets you acquired.

If someone can’t help you figure out what traction should look like in your business, or help you get it, they don’t belong in your community. Literally, they do not belong in your startup ecosystem in your city.

So, the next time some so-called investor drops the T-word on you like it’s the mic, hand them this article and ask if they’d like to discuss it. If they get defensive, you’ve already won, and I’ve successfully exposed someone who is actually harming the startup sector. You’ve just outed another gatekeeper who doesn’t know how the gate works.

If you’ve been ghosted with “you need traction” and aren’t sure why, then I want to hear from you. Drop your pitch. Share your team. Let’s fix this, together, because the next founder shouldn’t have to unlearn this nonsense just to build something that matters.

Wow! Thank you Paul.

“”PitchDeck AOP Kulbava Vaultier””

AOP Robotics – Warehouse

second slide

whoa. So, there you go, already. 1. Elevator pitch.

And you want me to go through your pitch deck? Nope. Might sound like I’m being an ass, but I’m pointing out why investors can’t or won’t advise well. And you think everyone wants to go through all that? Or you think you put it together and it is concise and your best foot forward? Nope. I have 3 minutes of free time… I don’t have time to go through that when your elevator pitch should accomplish it all in 2 sentences. But I’ll look… come back and explain. See if you can drop an elevator pitch in reply while I’m doing that.

nevermind, I’m back. “We are an international team of visionaries building a better future. Our focus is Artificial Intelligence, where we develop affordable autonomous driving solutions. We have selected here a focus on automating the Manufacturing (production) Warehousing – a Rosetta Stone of today’s technologies.” OOF. My head hurts just reading all that. So, you do what that is a startup?? And why would anyone care?? That sounds like an engineering service provider (and by the way, if that’s what it is, know that VCs do not fund service businesses, ever, so there is your answer).

And your team is a CEO, a financial analyst (WHY???), a project manager (to manage what??), and a marketing lead (who, respectfully, looks very young).

The advisor is irrelevant, but you made him #2. So, you develop affordable autonomous driving solutions, and the only thing relevant on the team is a 25 year experienced computer engineer who in fact is the CEO, so not the team doing that.

If I’m an investor, I’d look at that and immediately say no. I’d advise you to focus on customers too, because it looks like you’re a client service company, seeking to develop software for car makers, so great, go do that. You’re not getting VC and I don’t see a team here capable of doing that well so I’m going to focus on the team and advise “traction” (but at least I can explain why)

Paul, great article!

I love you. Never change brother.

Great insights, thank you. Interesting that the team is before the solution – makes sense. Without the right team, product traction fails. Thanks for the thoughtful post.

Christine Perkett it’s a pet peeve of mind because some people disagree with me.

My $.02, why would I take anything you say credibly, if I don’t even know that YOU know and have experience with what you’re doing??

Team up front says, “this is who we are, so pay attention and don’t question us, because we know.” (presuming that’s true)

Team at the end says, “thank you for listening, this is who is on the team.”

Great questions to define:

The Traction Test (use it immediately)

“What kind of traction are you referring to?” (Force a definition.)

“How would you recommend I get that?” (Force actual value.)

“Are you willing to help me do that?” (Force skin in the game.)

OK… Here is my elevator pitch:

Our cutting-edge, all-in-one marketing platform, driven by Artificial Intelligence, is designed to streamline digital marketing for anyone and any business.

Website: https://digitalaimarketing.soutions

Open for suggestions 🙂

Sounds like a business, not a startup. I’m going to expect that setting it up for email marketing, social media, banner ads, radio, Netflix commercials, or SEM, it’s going to automatically figure out what I should run, what it should cost, what to run, targeting whom,

and “streamlining,” do it automatically. Of course, it will also do the market research, the customer profiles, analytics, and optimization.

That’s incredibly impressive. And I doubt it’s accurate ?

BUT, based on that (true or not, it’s what it says, so let’s go with it because of how it can show how advising can work), I’d expect you have customers, you’re growing at 20% per month, and you have higher than average Retention and Referral Rates, and lower than average CAC. After all… since that is what it does, I’d expect you’re using on yourself and it’s proof of that accomplishment.

I’d not fund you.

And that’s where most founders say, “WTF?! But it’s going well!”

Precisely, sounds like it’s going well. So, something is wrong or go get a bank loan; scale it. When you then tell me it’s not 20% MoM, I’d react, “I figured,” and ask you to be honest about what’s really wrong.

Different track, I presume your messaging is off, and the implication it implies.

Hey Paul big fan of your writings.

Would you be willing to share feedback?

The elevator pitch is that training, tracking, and keeping up with your dog’s health changes is hard because frankly, we don’t speak dog. Those little mistakes add up. In 2025, 51% of all pet owners declined or skipped veterinary care due to cost. We now have a $20 billion dollar care gap. That’s why we’re building the Apple Watch but for dogs. nala is a smart dog collar and a smart dog harness that gives you a 360 view into your pet’s health.

The website is going to be redone (https://nala.pet). The actual pitch deck has visuals but I can’t share that here, where it might get indexed by a crawler.

Team

https://www.linkedin.com/in/zach–moore/

https://www.linkedin.com/in/laurensubers/

https://www.linkedin.com/in/moyukhc/

https://www.linkedin.com/in/arnold-scott/

Advisors

https://www.linkedin.com/in/gregseremetis/

https://www.linkedin.com/in/taylor-chastain-griffin-phd-05a5a2b3/

University IP / Research Partners

University of Cincinnati

https://researchdirectory.uc.edu/p/strobbpo

Rosenheim

https://www.linkedin.com/in/simonclausstock/

Thanks for the kind words (and love the mission). Quick feedback: an elevator pitch should aim to hook anyone, not just pet owners – you’re literally standing in an elevator with a random person and you want to convince them to at least want to talk more. Focus more on the universal why (empathy, miscommunication, care gaps), and less on the numbers up front; they belong in the deck, not the first impression. “We don’t speak dog” is great, build on that as the emotional core.

Website needs clarity. Right now it’s feature-first, not story-first. Lead with the problem you solve, not just the tech.

Top fold: Lead more with something like “Health and safety your dog deserves,” but gives no immediate context or pain point. Replace with a clear problem–solution–benefit statement.

Too many CTAs (“Buy now”, “Learn more”) without first creating emotional or logical buy-in.

Product description: Jargon-heavy (like “next-gen health tracker” – oof, what??), light on actual use cases. Use plain language: What does this let me do that I can’t today?

Visuals: Beautiful but lack storytelling. MAYBE a short video showing a real user experience (though I’m not a fan of video, many are).

Focus on emotional clarity, not tech specs.

Pitch, something like (and I hope you know from reading me that I am also clear to founders, NEVER take someone’s advice at their word, no matter how experienced or prominent they are; we’re all just trying to help – ALWAYS think, “this advice might be wrong, let me test it out”), “Most of us love our dogs like family but we can’t ask them how they’re doing. That disconnect leads to missed cues, delayed care, and avoidable mistakes. We’re building nala to close that gap: a smart collar and harness that gives you a 360° view of your dog’s health and behavior so you can understand what they can’t say. It’s like an Apple Watch for your dog, designed to keep them safer, healthier, and better understood.”