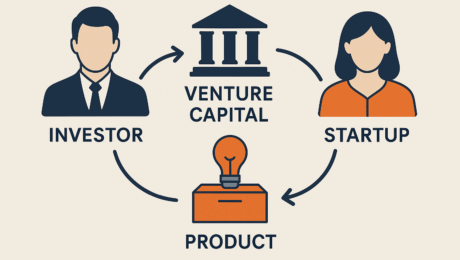

The Customer of Venture Capital Isn’t the Founder, It’s the Investor

Wednesday, 22 October 2025

Until Cities Get That Straight, Startups Will Keep Starving for Capital It’s a weird day when the world’s entrepreneurs sound like customers complaining about a bad product. “We can’t find funding.” “Investors aren’t taking risks.” “There’s no capital in our city.” You’ve heard it a thousand times; it’s the economic equivalent of Yelp reviews from

- Published in Economic Development, Raising Capital

“I’ll See It When I Believe It,” Entrepreneurs and Startup Investors Put Conviction Before Cash Flow

Thursday, 11 September 2025

That tired phrase has been responsible for more missed fortunes than bad timing or bad luck. It’s the refrain of cautious uncles, small-town bankers, and risk-averse executives who prefer their innovation the way they prefer their wine: aged, tested, bottled, and priced at a predictable markup. But in the world of entrepreneurship, that order of

- Published in Insights / Research, Raising Capital

Bootstrap or Raise Capital: How to Decide What’s Right for Your Startup

Monday, 01 September 2025

If you’re like me, it might have been Labor Day in the U.S., and it was a beautiful one here in Austin, not putting in any work is more or less impossible; besides, entrepreneurs throughout the world were working and so with the focus on work, I couldn’t help but put thought to this frequently

- Published in Raising Capital, Startups

You Don’t Need Traction. You Need to Understand Why They Say You Do.

Friday, 13 June 2025

There’s a special kind of eye twitch that founders get the 37th time they hear, “We’d love to invest, but you need more traction.” It’s a vague hand-wave of a dismissal that sounds helpful, but is really just cowardice in a hoodie. And when you ask what kind of traction they mean, they blink like

- Published in Insights / Research, Raising Capital, Startups

Your Startup Pitch is Bad; Let me Explain How I Know

Thursday, 27 February 2025

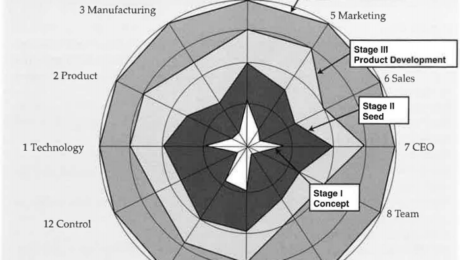

Over the last couple of weeks, I’ve been pushing us to question traditional startup methodologies such as lean startup or how venture capitalists discern investments, through an exploration with you of First Principles Thinking and the Bell Mason Diagnostic. In fact, I’m not inherently a detractor of either, rather frequently advocating that founders need to

- Published in Raising Capital

The Bell Mason Diagnostic and First Principles Thinking in Venture Capital

Thursday, 20 February 2025

Why Venture Capital Needs a First Principles Overhaul Venture capital is broken. Not in the “bubble’s about to pop” and certainly not in the sense that so many are pissed off because they aren’t getting funded, but in the “founders keep getting bad funding advice from firms still operating on outdated, ineffective methodologies” sense. In the

- Published in Raising Capital, Startup Ecosystems