Let me cut to the chase:

MOST are businesses selling you services, using you as their product, to promote their brand while leveraging the word “accelerator.”

As you consider such programs, head into them first being clear about what Accelerator means and validate that they actually do that.

Then look to what the founders and Directors of the Accelerator are doing on a day-to-day basis. How much are they working for you or for themselves? That’s a difficult question to discern through, as their work on the Accelerator can (should) be work on your behalf…

Is the work they are doing actually resulting in the impact an Accelerator should have on founders and startups?

And that question is a bit of a trick question. *oof, this isn’t easy, is it?* Keep in mind, startups FAIL. It’s kind of their thing. Startups fail so that established companies don’t have to take such risks, and in doing so destroy jobs and shareholder value. So, that being a role of startups, that means that in Accelerators, startups WILL fail. Measuring the effectiveness of an Accelerator on their rate of successful startups isn’t really fair; and yet it is….

What then do you look for in making sure Accelerators are actually working for you???

Just so my thoughts are explicitly clear: Accelerators are incredibly valuable resources in our economy. The challenge we have is that many (way too many) are just selling you services (monetizing YOU) – office space, developer resources, a private network of mentors (for which you pay in equity), paid classes – or even selling you the “service” of developing you as a Product… which they then leverage to attract more sponsors, underwriting, etc.

So, are they actually working for you or are you working for them?

To answer that question you might tease out what’s valuable about Accelerators from what’s not valuable (or even detracting from your experience). Here’s the list I’ve experienced worth some merit; I’d love comments/feedback about whether or not you think I’m missing anything.

Most Valuable in a Startup Accelerator

- Dedicated team space in an environment with industry peers. Access to the other pertinent resources: conference room, teleconferencing, places for calls

- Directly booked meetings with VCs and Angels with a brief provided by the accelerator so that the meetings aren’t cold starts

- Advisors more than mentors – People who are executives in companies that are pertinent; former founders and CEOs of related companies. Mentors teach; ideal for incubators. It’s time to go, need that advice and connections.

- Set up of industry or regionally relevant stories with the press wherein the startup or team is pertinent

- Meaningful corporate connections and partnerships – less so the typical startup resources many companies make available through every program

- Low/No cost access to the other Human Resources the startup might not yet need full time: Legal, Accounting, CFO

- Valid and experienced criticism with advice and direction

- Unlimited scope networks. Advisors, investors, and partners ideal for my venture are almost certainly NOT within the close circle of the Accelerator. Google and LinkedIn are our friends – you CAN find and meet them on your own – the Accelerator should be making the right connections where ever they might be.

Least Valuable in a Startup Accelerator

- Cattle call mentor or “investor” office hours

- Pitch events that are just showcases for the accelerator brand

- Only shared workspace coworking; particularly if it’s a generic program and we’re all sharing space together and aren’t even doing similar things

- Misleading intentions or lack of clarity –

- Is this really an Accelerator or is it more like an Incubator?

- Are the people running it actually involved and working with us out there promoting their thing?

- Be completely transparent about the business model. Is the Accelerator really working on behalf or selling us office space?

- Classes from agencies and service providers… eh. Startup dedicated and experienced consultants are great, executives who have and do specifically what we’re covering are helpful.

- Negative and unproductive feedback, a mere “no” or “focus on customers” platitudes aren’t helpful

- Limited scope networks. Is this a member club where the only advisors and investors who we’ll get access to with the Accelerator’s help are close confidants, friends of the family, and worse: anyone paying for the privilege

I want to invite you to join me in such discussions live and together.

Join me online here

Like the distinction between Accelerator and Incubator.

Yep, I’m a big proponent of that. Both are valuable but they aren’t the same thing.

Should you expect industry specific expertise?

Great question. Put to everyone.

I do. Unequivocally. An incubator is where founders become companies and there industry experience is invaluable but necessary? How to structure a company is how companies are structured.

But in an Accelerator? Company ready to go! Sure… that FinTech CMO’s experience is valid in advising a marketing strategy but we (the BioTech company, for example) should have figured that part out already, what we need now is the BioTech CMO’s advice.

Took at peek at what you’re doing Jay Fraser, very cool. My perspective in this sense… Incubator is how to build and run New Dominion Enterprises. Now it’s time to Accelerate the business of lithium ion battery technology – people that do that are more valuable than just any expertise.

By the by… you should meet Jennifer Cao (https://www.linkedin.com/in/silicon6/)

I need to update the profile. We now have ID’d manufacturing supply for the launch through pre-scale volumes with access to large suppliers. So people with industry specific input is what we need (having said that, my co-founder is one of the expert scientists in the field and the inventor of our products).

Thank you for the referral.

Great rundown!

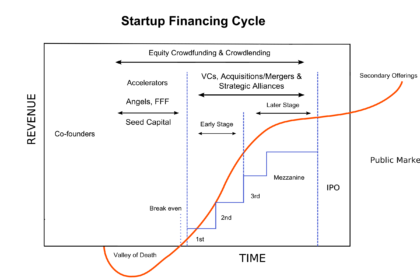

Great chart Paul

Timely!

How effective are accelerators and incubators compared with not using them? Does the effectiveness change during the life-cycle of a startup? I have always been more of a fan of startups where the founders remortgaged their homes and went for it with total commitment, rather than those that spent months looking to convince others to fund them.

Frankly, I think that “mortgaging your home” is naive and unnecessarily involves the innocent bystanders (wives and family) in the risk that an entrepreneur is willing to take.

I am sure that was just a slip and you meant husbands, wives, and family. Majority of the startups I know have been started by women, and solopreneurs. I know that is not common experience and I don’t know why it is that it has worked out that way with me. There were no “innocent bystanders” since as you may imagine it was a joint decision. IMHO that is probably the main difference between the west coast and Austin and why the VCs are not here but Angels are.

Ataollah, it wasn’t really a “slip” but a late night personalization of my comment. That said, I believe that remortgaging your home is a fools game.

Of course, that could also depend on the type of business and entrepreneur. If the business is a retail venture where the relative risk is low(er), then perhaps. If you’re in a higher risk venture, I seriously doubt the wisdom of risking the roof over your head. PLUS the value of your home might also be weighed against the funds required. If my co-founder and I “did” leverage our homes, the yield might get us through the first 6 months of effort.

Remortgage does not necessarily mean risking your home. I would not risk any of my money investing in a business where the directors are hedging their bets. If you do, you are smarter than me I suppose. Good luck to you l.

If you don’t have all of the information, you shouldn’t judge.

And again, refinancing our homes wouldn’t get us very far.

Do you think I was referring to your particular case? To be crystal clear, I was not. If you think it’s a fools game to remortgage your home if that will fund your startup instead of spending a year raising money then I defer to your ckearly vast knowledge on the topic. For my own meager startups I have only once raised 500K in funding and it turned out to be a Fool’s errand. Other people may have different experiences. I am just giving my opinions on the subject if you don’t like them don’t take them nobody’s forcing you.

“Clearly vast knowledge?” So yes, I read you commenting about my particular case. I need to raise 7 figures.

Yes, typos happen, and married women start businesses too etc. such is life. I wish you the best of luck.

Typos? That wasn’t the point of my restating it.

I’m done. Thanks

Good overview and recommendations Paul. The one thing I would add is that “if you have seen one Accelerator, then you have seen one Accelerator.” Meaning there is A LOT of variability out there and founders and entrepreneurs need to do their homework. I strongly recommend the ones that have specific industry focus and expertise over these mega catch all ones that claim to do everything but are masters of none. As someone who runs arguably the biggest healthcare accelerator in the country (TMC Innovation Institute ) I am obviously a biased supporter of these programs for companies looking to hone their pitch, their business model and go to market and expansion strategy and rapidly grow their network, connections, channels and customers in regions they would have a lot of trouble accessing but for the Accelerator’s roots and network. That being said, most ask companies to give up somewhere between 3-7% equity to participate in their programs. Better make sure the value meets what you are giving up and you can quickly see the stacking problem should a company want to do multiple accelerators around the country.

Excellent points. I thought that my company was being accepted by one. Then I asked a couple of questions. Now I’m not so sure that we were accepted 🙂

Thanks for the great analysis Paul, filled with great info and options. I’d just add that it’s important to check up on the accelerator to ensure it’s not a fraudulent or predatory organization. Things to watch for include: accelerators asking you to sign IP or disclosure agreements, inconsistency regarding their legal status as an organization.

Be on the watch for bait-and-switch strategies where they are first an accelerator and then once you build the company or product, they claim ownership using threats, intimidation, and heavy handed legal tactics.

Be on the lookout for various “innovation” studios that fit this bill.

Well said, I believe most people don’t do their research before applying to accelerators. Startups see these opportunities as a way to “speed up” their go to market or scaling capabilities, although that is the end goal. “Should we run through an accelerator or bootstrap?”

Thank you for your guidance i was looking for this similar information and was in dilemma that should i join startup or not but after reading you post that doubt has been cleared so once again thank you an cheers to this article.

Interesting you don’t differentiate here between top-shelf accelerators (YC, Techstars, …) and a wide array of varying institutions that resemble these brand names more or far too often less. I think your advice is sage, but most essential depending on the variance between YC and Z.

Also… I am contemplating either (a) going straight to a “true seed” ($2-$4M) round with my new venture Viva and its MVP model which is break even > marginally profitable from Day 1, or (b) if I think the brand and exposure will be a net assist in the pursuit of (a) (in other words, going it alone is a bit tedious or needlessly annoying), pursuing YC, which is far more equitably accessible these days through the increasing reliance on the free and open Startup School as a pre-accelerator validator. (e.g. they encouraged me to apply last cycle based on my Top-10% results)

I never would have had the audacity to take this approach my first go round, but also my first business + model, though rooted in a space where I had inherent domain expertise, was simply not as exciting and “obviously” venture scale as Viva. So I’ve learned to apply my desire for “social impact through venture scale” in a hot market.

I don’t differentiate Michael, between top tier and not, because I’ve found over the years that it’s the words used to describe them, that are inappropriately applies, more often than them actually distinctly different based on a tiering or size.

Most “Accelerators” in name (THEY call themselves Accelerators), I wouldn’t consider accelerators. They aren’t accelerating anything. Maybe they’re more classes, or incubating, or a network of mentors, or a community of some investors, but if the startup isn’t scaling/growing/optimizing, WITH the work of the program – it’s not an Accelerator.

We’re explicit in MediaTech Ventures, that we’re NOT an Accelerator. We teach, we work on, and we precede later stage programs. Period. No confusion. Now, is that an incubator or education? Yeah… so, specifically what should we call it? Not entirely sure; but I know what it’s not.

Join an accelerator if you want investors to share losses in valley of death or accelerate to the next level with their guidance and connections.

Sage, simple, and accurate advice. Well said

I learned a lot from the ladodgers accelerator, we were able to compensate an all star team, make it convenient. Found a way that didn’t work, but it lead the way to the next that did.

Awesome advice! I was lucky enough to be a part of Dogpatch Labs back in the day (NYC c. 2011). It wasn’t the highest form of accelerator, but it was amazing.

As time has gone by and entrepreneurship continues to boom, I’m finding I’m even more passionate about clarifying things. It’s tough to break in, connect, or startup, if everyone is making things confusing merely by having different meanings behind their words.

So true! It’s a tough “sport to learn” when you are just starting out!