Words tossed about so frequently in startup communities, it is easy to conclude they mean the same thing; that it doesn’t matter what such people are called, as long as you have some, you’re in good shape.

But is that really so?

Over the years, I’ve come to notice that startup communities collect mentors as though they are a precious resource. Young entrepreneurs pay to join exclusive organizations and communities to have access to mentors while institutions, incubators, and resources hoard them as though access to a certain pool of them is what you need (rather than having the right/ideal mentors and advisors).

While entrepreneurs, the public, and the press may not consider the difference, mentors and advisors are NOT the same thing. When you consider the interpretation of your audience, of your having one vs. the other, you can appreciate why it’s so important to surround yourself with the appropriate mentors and/or advisors.

Article Highlights

What is a Startup Mentor

Not making an understanding of the distinction any easier, is the very definition of a mentor: an experienced and trusted adviser. Thanks Merriam-Webster.

In Greek mythology, Mentor was in his old age, a friend of Odysseus. Odysseus placed Mentor in the charge of his son, Telemachus, when Odysseus left for the Trojan War.

Because of Mentor’s relationship with Telemachus, and a story richer than I’ll share here, the personal name Mentor has come to mean such a person who imparts wisdom to and shares knowledge with a less experienced colleague.

A teacher. No? Students have mentors. Young professionals are guided by mentors. Of course, even experienced executives have mentors. The role of those mentors is to teach. Even if you disagree with the role they play, as an entrepreneur, you must consider the implications of how your audience interprets what such word means to you and your business. Both positively and negatively, with regard to any of your audiences, from your customers to your investors, if you have and highlight your mentors, it suggests you are being taught, does it not?

The most successful entrepreneurs and startups are mentored. Everyone needs to be mentored by those with more experience and wisdom if they hope to avoid failing. What matters though is what you’re being taught, and what your audience is told as a result of who is doing the mentoring.

| Mentors aren’t typically seen as being part of the team. They aren’t “formally” involved, whatever that means. When startups raise money, they often highlight their advisors and even have a Board of Advisors. Have you ever heard of a Board of Mentors?

In my experience, your mentors should be so elevated above your own knowledge base that their very involvement in what you’re doing communicates sophistication. “What we’re doing is so incredible that I have to be mentored by Dr. Jeffrey Shuren (Director of the Center for Devices and Radiological Health at the United States Food and Drug Administration (FDA)” Wow. Mentors are experienced in your field to such a degree that they can teach you everything you need to know about the world in which you find yourself. |

Food for thoughtIs it just me or does Silicon Valley favors advisors over mentors, while other cities are flush with mentors? Perhaps, there, angel investors play the role of mentor, investing in what they know and love first, rather than in seeking the role of investor. |

What is a Startup Advisor?

Experienced professionals. You could debate with me of course but again, consider not what is your experience but what the word means; an advisor is the person actively involved in your world (not just with experience in) such that they can guide you through the work you are doing today. The inventor of the Walkman might be the ideal mentor as you develop the next portable music revolution but can such a person as effectively advise you on how to scale your business, develop the supply chain, structure your business model, or design your product today?

Startups succeed as a result of the right team; the people who are the best in the respective industry/market and can help the startup more proactively. Advisors are seen, to a small extent, as part of the team. They are promoted on startups’ websites, in pitch decks, and they lend credibility to your ability to succeed.

“What we’re doing is so challenging that Mark Neumann, Amgen Marketing VP is one of our advisors.”

The key distinction? Advisors help you succeed whereas mentors help you innovate and disrupt.

If you’re reading this and you provide these values, rather than seeking them, ask yourself, do you teach or guide? The difference is subtle but there is a distinct difference. Then, please, ask yourself, are you actually mentoring? Are you really advising?

How do you engage with an advisor vs. a mentor?

Chime in with me here. It seems that the role of a Mentor ends; for a period of time they teach and ultimately “class ends.” You’ve accomplished that for which you were being mentored.

Mentors, being more “academic” are serving entrepreneurs and therefore don’t get much/any equity unless indeed really playing the role of an angel investor. Mentors may remain involved in perpetuity but shift, it seems, to being behind the scenes, mentoring individuals rather than mentoring a grown company.

On the other hand, Advisors are more involved for the life of the company; effectively, though perhaps not actually. You are acquiring practical experience and timely know how in an advisor (at least, you should be) and thus they’re compensated, in a sense, with equity. As active professionals in their own right, advisors are forever motivated to see you succeed as your success is a reflection of their work on your behalf.

Does it really matter?

You have to admit, there is a reason startup pitch decks highlight such people. And even if you don’t consider there to be a difference between the words, does your audience agree? Are the people supporting the work you are doing teaching you based on experience or guiding based on know how?

It matters if only because you want it to matter!

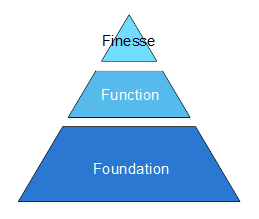

- You are being mentored by those who give you a serious competitive advantage by offering sage experience that enables you to do something no where else being done.

- You are being advised by those who know what you need to do, how, and through whom, in order to be successful. Your advisors ensure you don’t make mistakes that cause most new ventures to falter.

Investors, want both.

What then is the ideal mentor or advisor?

Well that’s a topic for another post isn’t it? Suffice it to say, whether or not you have mentors or advisors is as important to what you’re doing as who they are and their experience. Do they know your industry? Are they well connected? Are they startup veterans or corporate executives? Will they actually do some work for you or are they available for a call or coffee?

I’ll get around to some thoughts on how to find the ideal; in the meantime, I’ve shared some thoughts on what you need to be doing to get the right marketing person engaged, it’s probably safe to say that attracting the right mentors and advisors is the same as attracting the right talent to your team: enjoy and good luck!

Typically the advisors have some equity stake and mentors are lurking to try to see if the company does well to go for the kill. Its a game within the game.

I think that’s a fair read. I’m intrigued by the supposition that Silicon Valley doesn’t really have mentors in name as true mentorship is found through the angel investors (who know your industry, market, etc.). If that’s a fair perception, what does it say about ecosystems flush with mentors?

Means there’s not enough interesting startups. Supply demand mismatch.

Amen Chris Palmisano. Mentors in Silicon Valley are called peers. We don’t have a great collaborative network. Hence, the disparity between pretenders and contenders.

Tough question. My answer is “all of the above” to keep it ambiguous 🙂

The ideal situation is to have a mentor, who then puts cash in, helps you get to a point that a round can be raised, helps you raise that round, and rightfully earns advisor equity, a board seat, whatever. That’s when you know someone is emotionally invested in the team and business while providing direct domain experience. score.

Interesting portrayal of the subtle differences. What I get from the post is that a mentor gives industry experience while the advisor gives operation/execution experience. I always find it as a bad signal if there’s a successful “mentor” or “advisor” whose not also an investor. I don’t think that’s the difference most people think about. I wouldn’t really put any “mentors” in a pitch deck and only advisors who are also investors. If you put “advisors” into a deck who haven’t invested…it begs the question, “why haven’t they?”

I think that it is necessary for any venture to attempt to avoid paying the significant tuition that is often associated with learning solely from experience in the market. That being said, so many “mentors” and “advisors” are a complete waste of time and money because their interests are never truly aligned with that of the venture.

For example, I have a pro bono startup client that has a decent idea and the ability to generate a good amount of publicity because of her connections. The person that introduced her to me is an “advisor” of sorts so I have tied to stay away from the business side of things and focus almost solely on the legal aspects of the startup. In my initial interview with her, she told me the very limited scope of her vision and it sounded like a good place to start and somewhat realistic. However, after a few weeks of meetings with advisors (including my contact) her scope was expanded to include international expansion, big events and complex logistics. That idea will now die the slow death by meetings because the advisors had their own visions (and financial capabilities) which simply do not match that of their client, and all that there is left to do is to meet about this over and over again until she gives up and goes back to work at her day job.

If you can weed through the garbage and find good people who can actually create synergy and provide valuable services, and you figure out how to compensate those people in a manner meaningful to them, then having mentors and/or advisors will certainly increase the viability of any venture. However, if, as a startup owner, you figure out how to pay someone and hope they make it all work (because they somehow made something else work), without actually putting a lot of time and effort into picking and facilitating that relationship, then it is more likely that your venture will fail even more rapidly. ?

for what it is worth, I tend to think of them as different…an advisor (in my head) helps me with particular (typically individual) domain expertise where a mentor “transcends” an individual domain and helps “guide” the conversation about my growth as well as the business growth and what I want out of the experience (and what I want others to experience) vs an advisor ‘teaching” me how best to protect my IP or how best to go to market or how to best handle my tech architecture, etc.

put in another way, if an attorney is THE best at IP protection for a small startup software (app) company ( http://www.storiesetc.com/ , he/she can be my advisor…they can be a lousy human being and I don’t care as much…but a mentor has to be a human who possesses qualities I admire…

There is a lot of talk about “mentors” around town. They use the wrong word to describe the relationship.

A mentor is someone who provides the mentor side of the mentor-mentee relationship. Mentors shouldn’t invest in their mentee’s company as it changes the relationship. A mentor goes with you from company to company. People have mentors.

Mentors pick mentees. I was lucky to have a mentor in my life for many years. His mentor was the original director of marketing at Intel and his mentor was Andy Grove. Mentors normally have one or two mentees that they work with. If someone has a bunch then they are not a mentor.

An advisor on the other hand is someone engaged by the company to help them make strategic connections and help them from a strategy standpoint in a particular area. Companies have advisors. Not all advisors make good investors. An advisor stays with the company and helps the executive team. Advisors almost always get stock option grants. I highly recommend that you offer them stock options with a promissory note so they can take the 83B election and not have to pay up front or get hit with taxes to help you.

Pick advisors that can leverage their professional networks to bring a good bump to the company’s valuation and/or revenue. They will benefit from their stock options.

Very well said Richard. Precisely my concern: using the wrong word sets the expectations and risks sending the wrong message.

Paul – this is just using buzzwords for buzzwords sake. The fact that these organizations in town talk about all the “mentors” they have for companies is just silly and detracts from what they really have, which is investors. Their investors may want to take an active role with their investment in the company, but that doesn’t make them a mentor. There are three main types of investors:

1. Actives – they call you with opportunities and try to get you headed in a direction. These tend to be professional investors.

2. Passives – they give you money and go away. These are the weekend investors.

3. Newbies – they give you money and when things go wrong they call you once a day. When things go right they call you 3 times a day. They make it tough to do work as you are constantly fielding calls from them. They should be managed appropriately.

You nailed it Richard Bagdonas. Great advice on the 83b election. That’s exactly how I do it and it makes the expectations very clear.

Ultimately the origin of this discussion became relevant to me, as a person who has been building a brand for five or more years and learning as I go along, just like everyone else, the issue was who to look towards. The advisor and mentor role are similar, but ultimately they are not only hard to find with the right fit and skill but the time it takes to nurture a relationship.

Most people I find want to be a high-level advisor, they can look inside if you let them and can say xyz is wrong fix it and walk away. Most people, especially without any vested interest will not get their hands dirty and help you work through those issue. This is why I believe I value mentors more, not only because of their experience they bring but because I see them as a personal coach for a founder instead of an advisor for a company. This is a deeper connection and lasts for years. I agree I believe the mentor ultimately has to choose to want to take on a mentee. Usually a mentee looking for a mentor has this unleveled relationship where the mentor feels like they have to give more and there is no upside for them.

I believe that there are three types of mentors. The first one is the type of mentor you see from afar and follow their path anecdotally. The second one is a mentor who is similar to you and is doing or has done something along the lines you have done and can build a strong relationship, they may be 2-3 steps ahead of you. The third type of mentor is one who is unexpected and in fact in a totally different space that you are in, one that while unrelated you end up finding new and innovative ideas to carry into your way or working. This type of mentorship I think to me is the most valuable, not because they know all the answers to the your company problems but because they help you frame the problem in a different perspective, and allow you to questions your existing beliefs. They push you to your limit and force you to re-invent yourself and the company to you can be better. This type of mentor is one I seek. How this compares to an advisor, I see an advisor as more strategic and tactical. They are the SME and specialists who know their space better than anyone else and yes they are looking for a return or an upside.

Can advisors turn into mentors? Sure, but is it wise to turn in mentors into advisors and ultimately investors? That depends on the dynamics but managing that relationship can be tricky.

Thanks Paul for getting me to think a bit more on this and coming up with some solutions I will share with you later on how to address this issue.

Excellent post, as usual Paul. You know I try to keep things very simple, so, simply put: I believe that one should mentor individuals and advise companies.

Mentoring is a 1:1 relationship – very similar to how Richard eloquently described it. It is guiding an individual through a phase. This could be how to start the business, how to validate an idea, how to build a team, how to raise funds and manage investors, etc.

Advising is typically working with more than one individual at a company since it usually focuses on how to set goals, set a strategy or execute efficiently. To do these things right, and have buy in from the team, it is vital that as many of the team members are part of the process so that there is a varied view, lively discussion and commitment to the overall plan.

Compensation for mentors and advisors will vary – depending on the situation and phase the person or company is at. I choose to offer pro-bono mentoring to first time entrepreneurs and young professionals because they have the most need and don’t have the funds. The 83B election suggestion Richard provided is excellent!

I look forward to your follow-up post on how to match ideal mentors / advisors!

Very insightful – I haven’t thought of the juxtaposition of mentors Vs. advisers before. I also attribute the “schooling” or entrepreneurs as a modern form of personal development / artistry of the self.

This post gives me a topic that I would like to contribute to: “The Sustainability of leadership”. Ergo- How we truly “Pass it on”.

My first SXSW panel was a short talk on “The Life-cycle of an Entrepreneur”… which is part of a series I’m privately exploring that has to deal with my Theory of “Purpose Economics”…My philosophy and way of doing business is rooted in the “Big Picture” or to be precise: reaching personal and societal self -actualization.

Fantastic post Paul.

Hi Paul,

Hope you are having a great July 4th Holiday.

Read your article (couple of times). Found it very interesting and ‘definitional’ in content. You raise great points about the differences between Mentors and Advisors (my experience outside of Silicon Valley) are not necessarily considered. Agree with you that the terms Mentor and Advisor are often used interchangeably. For example, Jumpstart Foundry in Nashville is a mentor-driven accelerator and the mentors that take equity position after the company graduates are known as ‘equity mentors’; however as the Company grows and recieves additional funding, some of the ‘equity mentors’ convert to ‘Advisors

and are listed on the web site along with other Advisors. These later stage Advisors, as you describe in your article, are more keeping the business on the ‘track’ then really creating the ‘train and crew’ and laying the track.

In my personal situation I believe that I am a mixed mode of Startup Mentor and Advisor particularly helping companies validate their concept as a commercially viable concept (ie What is the Customer PAIN? Does your idea resolve the PAIN? What will the Customer potentially pay to make this PAIN go away?) and getting early WINS. However, I may not have the Advisor ‘cache’ as Joe Smith Sr VP of Marketing for XYZ company for listing on their web site in subsequent rounds of funding.

I am intrigued as to any comments you receive particularly the potential impact of the concept of Mentors Vs Advisors in the eyes of the Investor. Specifically, is there a correlaiton between having Advisors on your Team vs Mentors as your company proceeds with later investment stages? Is it more valuable to have ‘cache/Branded’ Advisors listed for a B or C Round Investment versus retaining the Mentor who helped you build and bring the disruptive idea to Market?

Love the topic and hope you write more to stir the THINKING of Austin.

Although I’m speaking from the other side of the table than most of those commenting here, as a first-time entrepreneur that is actively seeking wisdom/experience/guidance, I wholeheartedly agree with the notion of the ‘mentor:individual’ vs ‘advisor:company’ distinction described above.

At various stages in my previous career, I had the good fortune and privilege of being mentored by a few key individuals that directly contributed to my professional success. But of much greater importance to me, and I suspect to them, was how they contributed to my growth as a person.

At times they were my teacher. Other times they were my coach. And when they sensed that I needed a stern father-figure, or an empathetic pastor, or a patient psychologist, then that’s what they’d become. The line defining whether the root of a particular issue or challenge was professional or personal was summarily and jointly ignored, because we both knew that nothing ever really lives 100% on one side or the other. And that worked, because my trust in them was absolute.

I wouldn’t expect much, or any, of the above from an advisory relationship. Not because whomever is inhabiting that role wouldn’t or couldn’t be those things, but because it’s not the nature of that relationship at that time. That’s also the reason that, while I’d certainly pay for an advisor, the introduction of money (in the form of fees, investment, or whatever) into a mentoring relationship is something that I would personally not be comfortable with. I don’t want questions about interests/motives/agendas, imagined or not, popping up in my head. And once a dollar were introduced, I know that they would.

So I’ll continue to seek mentors that are in it for the joy and satisfaction they find in mentoring, and that expect nothing other than that I pay it forward when the time comes.

Great topic Paul; I learned a lot, and appreciate the opportunity to contribute.

Great post and and an interesting comments thread. Thx!

I think there’s an urgent need to clarify & professionalise the role of mentor. Even when it’s delivered largely pro bono, it is often being bundled by an Accelerator as an overall proposition for which equity is handed over.

The ethics & standards need to be raised significantly.

At Pivomo we offer one of the first online training & Accreditation programmes for start up mentoring. It’s pitched to those who are really passionate about what they do and is part of their continuous learning.

As part of this programme we highlight the difference roles mentors often have to play, including the advisory mentor, the coaching mentor, the syreategic mentor and so on. We help participants attend to the professional competencies and boundaries as they cross these roles.

All too often, mentoring can either become overly directive and disempowering, or even worse, cheerleading and misguided.

As your post suggest, mentoring is a role of great significance and should not be handled lightly.

Happy to share more if any interest.