Highly risk tolerant and constantly fixated on doing things better, entrepreneurs tend not to be found running companies.

That’s not remotely a knock against entrepreneurs. Operating a company is a management skillset, it’s operational, it’s project based, it’s plan and execute…. and these are skillsets that, while valuable to a founder, are not typically consistent with Lean, Agile, Pivot, and other notions prevalent in a startup.

As a founder, as the entrepreneur, the most difficult transition you’ll make in your professional career is from early venture to operating company. Keep in mind the clearest distinction and definition of a startup is, I think, that which Steve Blank posited, “A startup is an organization formed to search for a repeatable and scalable business model.”

Article Highlights

Businesses and Companies are distinct from Startups

What are the reasons why some successful entrepreneurs have had difficulty in managing their companies beyond the start up stage?

There is a VERY simple explanation for this but it’s one that most people don’t like to hear because we all think we’re ideal to run our ventures forever.

Startups are NOT “new businesses”

Startups are temporary ventures in search of a business model.

As such, being in search of a model (because one doesn’t already exist), Startups can’t be run like “businesses” and rarely (if ever) become and remain businesses; in the sense of “small business” vs. “company”

With me? It’s a tough notion to wrap your head around but once you do, this struggle and the REASON for it becomes immediately clear.

A Company is a business entity owned by many people, shareholders. It isn’t owned by the founder, a business owner, nor partners; it’s owned by many.

A Business (or more accurately as I’m trying to get the idea across, a Small Business), is not that. A Small Business IS usually owned by few; maybe just the owner or partners.

Now obviously, these words get mixed up and misused. They mean different things. Try to focus not on the words I’m using but rather the intention and meaning I’m trying to get across.

At least we can agree, a Company is different from a Business, yes?

Starting a Business, odds are exceptionally HIGH that all you really need to do is what other like-businesses are doing.

Startups tend to become Companies because ….

Startups are a massive amount of risk, likely to fail. In order to help them NOT fail, they have to get lots of people involved and VALUED in ways beyond just making money. Because in the early days, they aren’t making money! That’s what Startup means.

A startup is no longer a startup when the model is figured out and working. At that point, it’s a company (usually; well rather, in fact, always as far as I can imagine).

Why are some entrepreneurs capable of evolving into companies?

I can almost always answer it with another question… Why aren’t Companies terribly innovative and disruptive?

Companies tend not to be well run by Entrepreneurs.

Entrepreneurs are highly risk tolerant and constantly fixated on doing things better; fixing things and disrupting things that work reasonably well in order to make them work far better.

Those are risks. Companies can’t afford such risks and disruptions. Companies often just serve their customers with what they have, their subpar solutions, because they’re good enough and because they’re what customers expect.

Regardless of WHY, the fact is, Companies tend not to be as innovative and entrepreneurial as startups for the simple fact that Companies are no longer startups.

Companies are run by people who excel in management, operations, service/support, and process. These are not the characteristics of Startups. These are not where Entrepreneurs thrive.

MOST entrepreneurs have difficulty managing companies beyond the startup stage because companies are run by executives, not entrepreneurs. Entrepreneurs tend to leave companies to start companies so that they can work in such environments where their skillsets and personalities as entrepreneurs, thrive.

What should most startups do as the transition to company? Appreciate the fact that most of that early team probably needs to transition to a team appropriate to the next stage of what that organization will be.

I want to invite you to join me in such discussions live and together.

Join me online here

Tha is for sharing this, Paul. I call it seasons of business evolution. And just like players on teams need to keep improving and changing to adapt to their evolving role on a team (most of the time), early startup folks need to as well, if they plan to stay for multiple seasons. Or become the journeyman who finds the same or similar role on a new team. Either is fine if the performance and enjoyment comes from it.

Some wonderful SportsTech analogies in that way of thinking about it – Different Leagues, what you do in the off season, positions people play, and how some can play different sports.

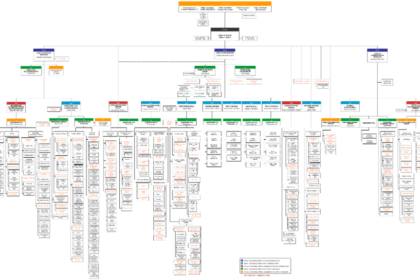

Really interesting read, thanks for sharing Paul. Love to take a closer look at that flow chart if you’d be so kind to share the study it came from.

It’s not a flow chart, it’s an open source org chart; I zoomed out and it’s a little blurry because it’s just meant to support the article, as a visual of the complexity in a corporate team.

I’ll see if I can find the original

It needs a Generalist on top. No matter what size.

Quite true for the majority but there are exceptions

This was a great read , loved how you broke down and differentiated the meaning of what is to be company or a start up!

Good read, I’ve had to learn to not work at a start up. A large organization is filled with fits and starts. A season where you work 80 hour weeks and a season where you are like… “Am I going to have a job”

Reminds me of my recent post about how startups dont’ have “Jobs” and how you can’t think of working for a startup as having a job. You might enjoy: https://seobrien.com/working-for-a-startup

(And I got your message, trying to coordinate a few things next week… maybe a happy hour)

The ones who do it right are the ones who turn over daily operations very early. Let someone else deal with HR and squeezing out profit margins. The entrepreneur is the one who should be focused on the second product.

Wonderful point. Have you read Rocket Fuel?

Some of the best “entrepreneurs” are found within existing companies and organizations as “intrapreneurs” because there they can get the capital needed to be successful in the creation of new enterprises.

Charlie Jackson indeed! The right culture in an enterprise, and companies could be FAR more innovative and entrepreneurial. I think many of us are seeing Corporate Innovation (and Corporate Ventures/VC) as one of the greatest paths to opening up more resources to entrepreneurs in general. Many of the discussions and concerns about \support for startups, always come back to “how can we foster more in Corporate?”

So good.

The challenge sometimes lies in the intersection of the Venn diagram between Pure Startup and Going Concern.

It’s not like there’s a clear break between them, where you can clearly say, “Our Startup is complete. Now we begin our journey as a Company.”

The overlap, the gray area, where you are delivering value to real customers, but still in beta or with early adopters and it’s all still a bit squishy and pivoty… when some parts of the business model are fairly clear, but some are not.

Trying to both begin building the team and processes of a Company… while still experimenting and discovering… it’s an intense phase.

Or am I missing something that makes that part easier? ?????

Shelley Delayne I’d posit that it’s that phase, that gray area, where the culture of the company, and mission/vision, are paramount. It’s then that the “Team” tends to cause a failure; an outcome of misalignment, different priorities, and even different personal needs/objectives, that, had they been clarified from Day 1, could have been avoided.

I haven’t. If you suggest it I will add it to my list, although my list is somewhat full of farming and python coding books at the moment. I just googled it, sounds interesting.

Peter Sedese Quick and easy read. Recommend it. Precisely addresses your comment. Was transformative to me… realizing that distinction between entrepreneur and operator.

It’s a different skill set. You don’t hire a plumber to paint.

Thanks for posting

Antoine DUBOSCQ some interesting thoughts for adVentures (Venture Studio) here.

John Zozzaro probably should be a chat in here given our conversations with France. Tim Demoures, worthwhile, without much more than that hint that we should?

Paul O’Brien That’s my thought too when I first saw your post. The “R&D” unit should be this. Staff bitten by entrepreneurial itch can bring their ideas forward and if “approved” allowed to work (concurrently) within their current role-or take paid sabbatical. You will either lose or keep the talents. And, you can work out the “ownership” of the final product, much like a VC would do. I maybe wrong but Google has been doing this.

Paul I think empowering inside employees with budgets or some type of discretionary resource(s) they can apply to help achieve the company’s 5 year goal, could be super interesting.

Then fostering the new projects with internal testing and policy/procedure change within the organization or growing them into divisions or ventures – almost like what Google X was trying to do.

But I think especially for public companies, the short term reporting of financials combined with stakeholder success metrics being (mostly) financial, make it hard to create an environment where teams have the patience for long-term payouts versus short-term rewards.

I think this will change overtime though – just my thoughts from working at Apple corporate for a short time to startup world.

Google is a good model in the right direction Tinny Widjaja, that employees are encouraged in that direction; I don’t think it goes far enough though because that’s really just a reflection of the Silicon Valley culture in general and why it tends to be more entrepreneurial than most other places. It’s the right direction but doesn’t go far enough.

What’s missing is more formalization of that model that you’re implying…. keep or lose talent (how does that work, formally, so that PEOPLE can still benefit from their work; when a company doesn’t want it?) and so that a company can own part, without limiting its potential should be it be better off on it’s own and raising more capital from institutional investors?

Chris Gonzalez highlights the real challenge (opportunity); that companies’ risk tolerance gets in the way (and needs to be overcome in a formal way that enables corporate venture to scale with people who don’t work for the company).

That is why is so important to know exactly what are your skills and what is your passion, I gave a speech in Toastmaster about this in 2019. Are you a Business Owner? or a Self Employee? or a Employee? or an Investor? WE NEED EVERYBODY all of them are important and you can change overtime. The problem is that now a days are selling the fancy idea that entrepreneur is very “Cool” and that is like superman. I challenge everybody to look inside yourself for what you really like without letting yourself be influenced by what society wants to sell you; develop your passion for that goal, and once you have decided, assume the obligation to seek excellence on that path since your example will be the inspiration of many who are watching you. If you do not do it then no matter what your occupation is, the mediocrity will have reached you.

I think at the heart of this issue it’s the juxtaposition of the skills required to be “successful” depending on the size and stage of the company.

Established companies in growth mode or with product market fit, that are properly capitalized, reward management teams for things that would normally hinder an early stage / seed type company — I think mainly in the expansion of human capital and the business of doing business (HR, Legal, Risk avoidance, delegated team communication dynamics, changes in optics and expectations with bigger teams and stakeholders, ect)

If I had to pin it down more specifically, I think the struggle beyond startup starts to happen at 50 people or more in terms of headcount – but that’s my generalization, of course everything/everyone is different and circumstances can vary.

Great post, important topic!

There’s also massive trust required between founders and their investors. Some investors have no qualms about switching executive leadership within a company after it makes the jump from startup to actual company. Some investors pride themselves on being founder-focused and back entrepreneurs who will run their companies from inception through multiple decades. This takes massive trust between founder and investor and I can only think of one fund in Austin (Gigafund) where that core ethos is not only actively promoted but also proven in their track record of supporting founders through growth.

Paul O’Brien Agree this model works better with tech/Silicon Valley mentality but not with “conventional” corporates. The “selection process” is skewed toward the corporate’s strategy (fair enough because they are paying their salaries). The finalists should be tiered. The committee should include vetted 3rd party VC/cohorts that are prepared to “house” certain tiers that are not (directly) aligned to corporate strategy. Guess the corporate HR challenge is how to ensure employees continue to “perform” within their corporate roles. And the corporate Finance challenge is how to ensure the “ROI split” between the VC and corporate (once the startup starts making $$).

Paul O’Brien – once again, Spot On. In my last startup (Audience), I voluntarily transitioned from Founding CEO to CTO, once we figured out what the sustainable business was (2-mic noise suppression chips for cellphones). Just like you said.

So Paul, who are you? Are you a VC? A tech transfer guy at Arizona State? Is Media Tech Ventures a VC firm?

I do what’s considered venture development; bit of a hybrid between economic development, venture capital, and startups.

We (I) work with companies and cities, governments, to put startup programs in place. We teach founders, either in media or, globally, to develop into the United States. And we work with VC/PE to more meaningfully invest in MediaTech.

It’s not a typical job and we’re not a typical organization so that question of “how do you make money” is always answered with “lots of different ways.” It’s somewhat valid to think of us more like a holding company doing a variety of things. Our own dev/tech team is moreso in data science and platform development; building what fuels the points above.

Our customer is best characterized as the investor, in a broad sense (public, private, and corporate). And our product is startups, lowering the rate of failure and macro-economically delivering higher rates of return.

Do a bit of one-on-one consulting; primarily when directly relevant to what we’re doing.

Most recent example of our impact is we just graduated 18 startups from Colombia, 14 of them are formally expanding into the U.S.

https://www.linkedin.com/feed/update/urn:li:activity:6809200730436620288/

Paul O’Brien – Very good, thank you for the thorough response. Looking at your posts, it is clear that you have the knowledge of the VC industry to be a VC if you wanted to. But you have a founder-supportive mindset that is not at all typical of a VC; I would say that it seems antithetical to being a VC. But with your firm being called MediaTech Ventures, it sounds confusingly like your firm is a VC firm.

I think you might be the first person I have ever seen like this.

“If it walks kind of like a duck, and talks like the smartest, nicest duck you have ever seen…. Nope, that’s not a duck.”

Lloyd Watts Given all the demand and talk of VC needing to change, or be more accessible… I’d put me in that camp of neither just talking nor hoping but rather, making it a reality.

Being a VC typically requires having the wealth to stand up that partnership. I’ve never found that having the wealth makes one ideally suited to actually allocating the investments; there are a handful of VCs (people) well known because it’s clear that they really understand startups and get involved in developing entrepreneurs. I’d like to think that that’s the signal that that’s the better way forward: understand startups and develop entrepreneurs, in turn being more capable with funds. Rather than just trying to launch a fund, we’re trying to develop how to do it better.

Besides, “ventures” means a lot of different things 😉 The name is accurate, we’re ventures in mediatech; lots of them. And even if confusing, because of that name, we have more deal flow and impact more startups, in media, than most VCs…. enabling us to try to make it better.

Geez. I thought that running the company (as opposed the startup) was the easy, more exciting part! But yes, it’s a valid point for sure. Although to play devils advocate, there’s got to be some entrepreneurs who are displaced manager types that are forced to start companies due to a lack of compelling management career opportunities (or a layoff), who would be most at home in a company post startup phase.

Mark Biw you remind me that I’ve been wanting to explore more that notion of starting something out of necessity more than desire. Great points.

Wrote a bit about it here: https://seobrien.com/the-mental-health-burden-entrepreneurship

Paul O’Brien Thanks and it’s a great topic! Would love to read what you have to say on it. If your read between the lines a lot of companies are started out of necessity. I personally think it’s good to start out of necessity, rather than desire because who can tolerate the pain of entrepreneurship without being driven by the necessity to see something through? There’s many choices and off-ramps in life. Sometimes not having options is a good thing: Generally, that’s the problem with highly intelligent founders as well: They see so many possibilities, and attractive “exist” scenarios to greener pastures. There’s always something greener. If you look closely, some of the largest companies have been founded by people who were heavily doubted. People nobody thought would be successful. There’s a strong motivation that comes from proving people wrong that people who were never doubted tend to lack.

Perhaps they should read Crossing the Chasm by Geoffrey Moore circa 1991.

100% Good one

Hey, I’d love to catch up about NYC Media Lab. Good later this week?

Chart is way too small to read Paul (or is that your point)