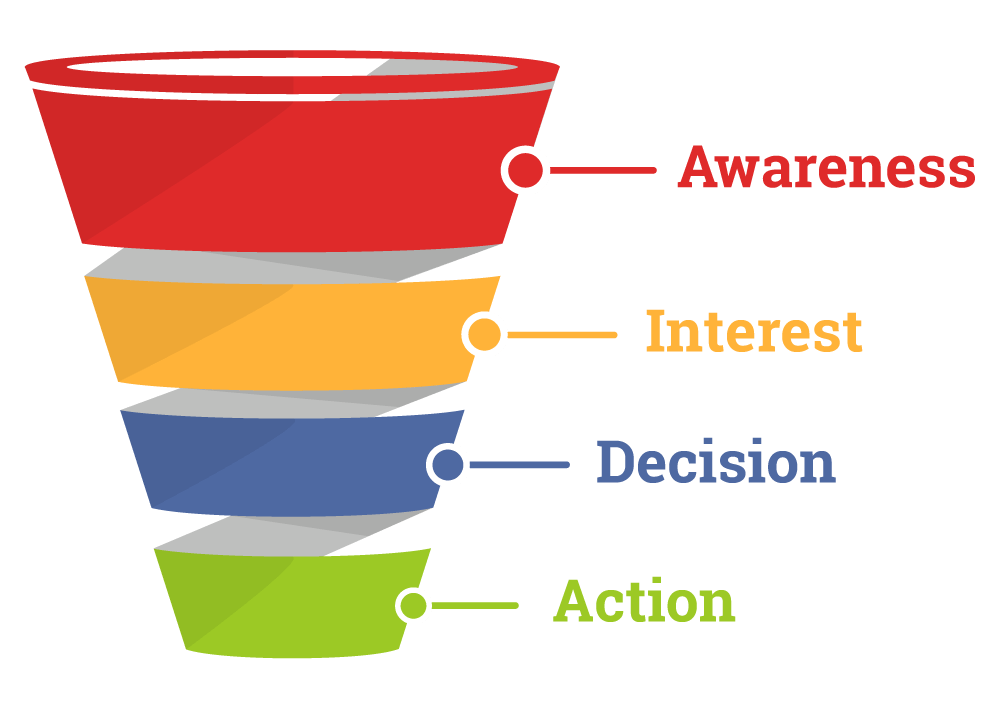

Businesses and startup founders learn early of a critical methodology in sales referred to as a funnel. Developing products and services, marketing is the process therein by which organizations get to know potential customers and then profile people so as to better understand the needs and motivations.

The goal, of course, being the conversion of people as buying consumers or business partners.

This funnel has consumed a corner of my mind since Mr. Johnson’s high school business basics class.

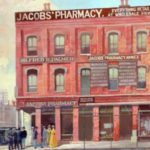

Around the turn of the last century, advertising executive Elias St. Elmo Lewis developed the idea of the funnel; first noting in The Western Druggist, in 1899, that the function of advertising was “to catch the eye of the reader, to inform him, to make a customer of him.” Little more than a decade later, his thesis developed, noting that advertising is meant “to attract attention, awaken the interest, persuade / convince.”

In time, studies of his work broke down this funnel into four stages: awareness, interest, desire, and action.

In 1951, St. Elmo Lewis was posthumously inducted into the American Advertising Federation’s (AAF) Advertising Hall of Fame.

These stages map the journey through which a customer goes when making a purchase. The model calls to mind a funnel because a great many potential customers are found at the top of the funnel in among this large set of people who are aware of what you’re doing and may have an interest in it some day. Only a fraction of everyone aware of something reach the point of that interest driving a decision and even still, those decisions need to be converted to an action for the business, a purchase.

Throughout most of history, this funnel made complete sense and helped businesses and marketers profile people and plan campaigns to meet the expectations of each piece of the funnel. The organization would work together to reach more people, improve the process of moving people from one stage to another, and to uncover new channels through which to reach others or introduce new products with funnels of their own.

The funnel is still one of the easiest ways to learn and appreciate marketing today, for example, Disney runs trailers before movies in theater and teasers on Amazon Prime, creating awareness of the next Avengers film. But consider, that’s in fact NOT the awareness stage of the funnel… the movie industry planted awareness in much more subtle ways: the clip leading to the next film after the credits rolled at the end of the previous, leaked news on reddit, and our beloved actors dropping hints to Jimmy Fallon. Interest is generated by our teasers and trailers. As the film date approaches, commercials are aired, word of mouth encouraged, and more talk show hosts chat up our actors’ interest is steered toward a decision to see the film; now we know when and where it will play. Sure, it’s easy to think that decision was already made, but neglecting this part of the funnel is how some films seem to disappear into obscurity; people’s attention spans are brief and our focus needs to be reminded to act on our interests. And act we do, with news of the box office opening take, pictures from the red carpet on Instagram, and talk of the movie on radio and podcasts, we find ourselves at the bottom of the funnel taking action.

In 2014, David Edelman and Francesco Banfi, with McKinsey & Company, proclaimed The funnel is dead.

Today, I want you to consider that the startup pitch is dead.

Article Highlights

The Funding Flywheel

Edelman and Banfi called the end of the funnel as it’s been increasingly realized that the touchpoints of a brand with an individual are so great and varied (in large part thanks to the internet), that it’s no longer meaningful enough to treat the customer journey as simplistically as a funnel.

“The channel-surfing customer of today is often expanding the set of choices and decisions after consideration. Customers now are also often actively engaged with the brand – and their friends and peers – after they’ve bought the product or service using social media and the Web.”

– Edelman and Banfi

The touchpoints of a startup with an investor are so great and varied (in large part thanks to the internet), that it’s no longer meaningful enough to treat the investor so simplistically as someone you’re pitching.

“Without the ability to understand their customers, companies will find it difficult to be where their customers are,” added Edelman and Banfi. “Part of the reason that companies are having trouble understanding their customers is that customer behavior itself is complex.”

That’s when it dawned on me that marketing’s evolution from funnel to flywheel was as appropriate, if not more so, to founders’ relationship with investors.

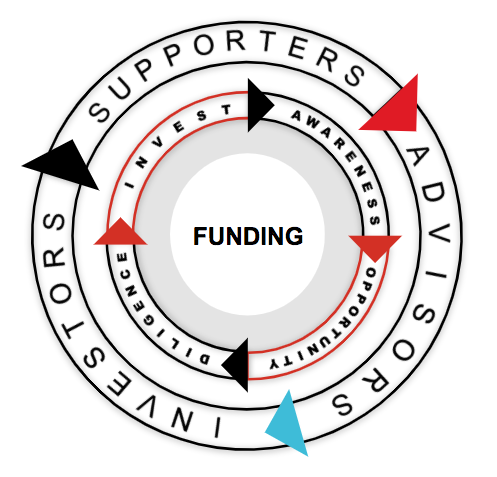

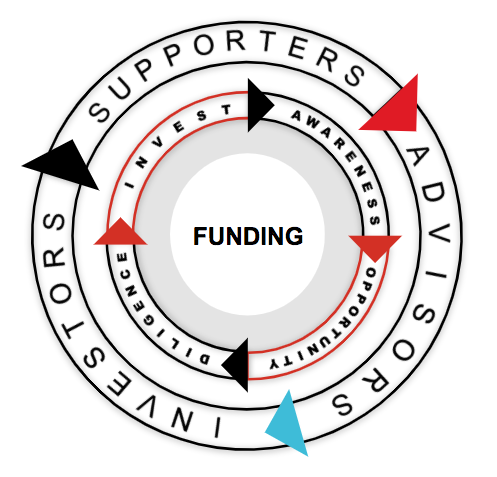

A flywheel is a rotating device that is used to build, store, and discharge energy. This cycle is not unlike what founders do as they cycle through the various stages of a startup.

The purpose of a flywheel is to provide continuous energy when the energy source is discontinuous. Indeed, your energy and that of your team and work, is going to wrestle through ups and downs; rather than perceiving your work as wins and losses, all of your effort is building and storing momentum that should be used to move you forward.

Delivering energy at rates beyond the ability of standard energy source, a flywheel collects energy so as to release it at greater rates; not unlike the acceleration a startup receives in a venture program or, when that funding is secured, and a team moves forward at a greater pace of innovation.

How your Funding Flywheel Works

If you’re familiar with the concepts of centripetal force, our flywheel directs energy at the center around which it’s moving and/or as momentum is applied to our center, a greater velocity is experienced as we move further from that middle.

centripetal force; noun: a force that acts on a body moving in a circular path and is directed toward the center around which the body is moving.

Raising capital, we might [over]simplify our approach to investors and rethink “funnel” along this flywheel.

- Awareness is still the right word to use in our Funding Flywheel and I’m sure you already contemplate how to connect with investors; how to create in them awareness (and interest) in what you’re doing.

- Opportunity is what sparks interest in investors and it’s opportunity that you must manifest in your venture. Whether that’s uncovering a Problem and Solution or validating a Product Market Fit, investors seek a use of capital that will create greater value in what you’re doing (and deliver a return) – an opportunity.

- Diligence refers to the familiar process of Due Diligence in funding; that investor’s decision is a result of doing diligence on you, your team, and your work. Their goal in the process is to get to know you and the startup, reduce risk, and familiarize themselves with how their capital will be put to work, beyond what the pitch deck informs.

- Invest as that is after all the action we’re seeking in this case. Act.

Marketing’s funnel is dead and so too should die your perception that this is a narrow process with an end in mind. Having secured capital does not mean you’re done, does it?

Modern marketers grew beyond the funnel as bright minds realized that so too does the customer journey continue. Some added Retention and Referral to the funnel, noting how our work continues as we support customers, serve partners, and can work with both to grow their interest in our business as well as how they spread the word about the products or services offered.

It’s paramount to appreciate foremost as a founder that your relationship with investors never ends (unless you choose to make it so or otherwise neglect them). Having received the action in our flyswheel, an investment, we keep the wheel spinning right back around to awareness as we create awareness of the funding itself, what it means, and as we publicize and promote our plans as a startup from here. That in turn creates greater awareness with investors and opens up new opportunities at greater valuation.

Pirate Metrics were invented by Dave McClure in 2007. AARRR, also known as Pirate Metrics, stands for acquisition, activation, retention, referral, and revenue.

Our funding flywheel spins.

And what spins at the extreme edge of the velocity we’re accelerating is not just securing the funding but the role that these stakeholders play throughout the stages of your startup.

Before being funded at all, our audience is investors. We’re creating velocity with, momentum with, the investors in whom we hope to create awareness and opportunity. As our wheel spins, some investors, before being our investors, become supporters. These are investors who take the time to have coffee, give a little feedback here and there, introduce you to others, and join your LinkedIn page or Facebook group. Such supporters are relationships that you’re developing with people meaningful to your venture, people who can and will get more involved, with advice. Some supporters become advisors and with even greater momentum, advisors become your investors; investors who keep spinning the wheel as supporters themselves, at least, some more so as formal advisors (Board Members perhaps), and with enough velocity, such investors will participate again in future rounds of funding.

Fundraising with your Funding Flywheel in Mind

Flywheels are acted upon by three fundamental considerations:

- How fast you spin it

- How much friction there is

- Of what and how it’s created (how big it is and how much it weighs)

The ventures most successful fundraising have a plan for all three.

As with any flywheel, its speed is increased by applying force where most effective and efficient. This is where shifting your point of view from a funnel really shines because as a funnel, your mind is probably fixated on “meeting investors,” “contacting investors,” or “pitching investors,” you’re at the top of the funnel, haphazardly trying to toss more into your process with that elevator pitch > 10 slide pitch deck > financials > term sheet being your funnel to close. That isn’t how it works.

If your startup hasn’t created much or sufficient opportunity, apply force there and get your wheel in motion: Create an opportunity, consider the diligence an investor would do on your startup, invest YOURSELF in some growth or attention, and investors will take note. If your startup has an opportunity, say you have a patent you can license, but you’ve not invested your time and effort into turning that patent into a commercialized venture, apply more force first there and get your wheel spinning.

As we spin, we’re going to encounter friction. Friction slows our flywheel; while you may still some day secure funding, you’re adding months to the time it will take because of misalignments or pressures preventing your momentum. That licensed patent isn’t just an opportunity with potential, it’s a friction that needs to be released with the right agreements and terms; if that patent holder has restrictions in place: friction. Does marketing agree with and align with what your product roadmap is planning to release? Are you connecting with investors where they’re found or where you find convenient for your sake?

Our process of diligence in the wheel? Uncover and reduce friction.

Finally and very seriously appreciate the weight and size of your flywheel because this is a set of ideas that often makes founders question their sanity. More customers is a heavier flywheel

Let me repeat that: More customers is a heavier flywheel.

That oft cited advice that it’s all about the customer or that the customer is always right? In innovation, within startups, it’s rarely entirely true.

A heavier wheel requires more energy and momentum to spin. Customers come with expectations, demands, and bias; customers can mislead and customers can distract.

But before you go doubting customers, and thinking that I’m implying that you want a light and easy to spin wheel, appreciate too that a heavier wheel produces a greater energy as spun. Density of your flywheel creates a momentum that’s more difficult to arrest but likewise a wheel that takes more effort to spin. Support your wheel with an exceptional team, a competitive advantage, and operational excellence, and you have a wheel created with density that will perpetuate with more velocity as you get it up to speed.

With this flywheel in mind, NOW we can approach the process of fundraising with many of the tips and techniques with which you’re familiar or learning. Now, those blog posts, pitch decks, advisors, and incubators become meaningful in spinning your wheel so that you’re not just spinning your wheels.

- Awareness : Are you promoting your work? Do you have a community on LinkedIn, AngelList, or elsewhere? Is anyone in the media, locally or otherwise, socializing what you’re doing? Are you networking at events and working away in isolution? Get a CRM in place, something like FounderSuite is a favorite of mine, get to know this audience and create awareness.

- Opportunity : A fundable startup is one in which investors will be able to draw from it a return. Knowing what return you’re capable of providing is the place to start. Is your startup prepared to serve the expectations of a convertible note or are you still at a Friends and Family stage where those “investors” are prepared for the higher risk? What does an opportunity look like for Angel investors or bank loans? Are you developing the opportunity meaningful to Venture Capital??

- Diligence : Work backwards. The due diligence through which any source of capital goes before funding you is pretty well established. If seeking a grant, can you meet the goals of that capital? Will the bank feel satisfied that you can pay it back? Will the check boxes on the due diligence list through which the Associate goes at Local Venture Fund prevent their funding you?

- Invest : Meaningfully put the capital to work by ensuring the investment of capital is not just cash in the bank, but a purposeful use of funds that spins our flywheel faster. And faster, keep the cycle going as we create greater awareness with that capital, uncover new opportunities, and remove the hurdles and other frictions that the process of diligence should uncover.

I want to invite you to join me in such discussions live and together.

Join me online here

Dig, I like it. Makes intuitive sense. There was only one order of things that didn’t jive at first read…

Before being funded at all, our audience is investors. We’re creating velocity with, momentum with, the investors in whom we hope to create awareness and opportunity. As our wheels spin, some investors, before being our investors, become supporters. These are investors who take the time to have coffee, give a little feedback here and there, introduce you to others, and join your LinkedIn page or Facebook group. Such supporters are relationships that you’re developing with people meaningful to your venture, people who can and will get more involved, with advice. Some supporters become advisors and with even greater momentum, advisors become your investors; investors who keep spinning the wheel as supporters themselves, at least, some more so as formal advisors (Board Members perhaps), and with enough velocity, such investors will participate again in future rounds of funding.

I feel like you grow from supporters > Advisors > investors in regards to the process around momentum but understand you are trying to tell the story from the investor perspective

Also feels like the grease for the wheel is ultimately hours (elbow grease) rather than traction…but I think the novice investor does not value time as much as they value the amount of customer or pre-existing revenue, so I’m not sure what sits in between the wheels to accelerate the velocity in this analogy

Great points that warrant some clarity. Maybe a revision here or an updated take. Clearly, one of my goals achieved, an article that inspires some discussion and perhaps some panel talks…

Yes, our focus is for funding so to “the investor” as the initial audience; but you’re right, we grow from supports to advisors to investors and keep the momentum going just as accordingly there.

Damn me for missing the elbow grease analogy! That deserves a chapter in the book… let’s co-author it 😉

This is a much better model for startup fundraising (and traction) than the funnel, which is for established, repeatable sales processes. It takes the focus off getting investors to say yes too early and entices them to get involved deeper and deeper.

As I learned in Techstars: If you want advice, ask for money; If you want money, ask for advice.

Cheers Jason Goodrich! Great point about Techstars that I’d neglected; indeed reinforcing the idea here.

We use a similar approach in philanthropic fundraising and I always wanted to overlay the approach with for-profit and startup strategies to show where the for-profit world could learn… you’ve done BRILLIANT work here, Paul O’Brien. Love following your thought leadership! ?

That is awesome to hear, not just because of the “brilliant” (thank you incredibly for that). It’s awesome to hear because as I was finally drafting up the piece, it kept striking me that non-profit fundraising probably did this better than startups; and that we merely neglecting learning between the two because of the business models and audiences from which we’re fundraising.

One of the more intriguing things I observe (as an outsider to founders seeking funding) is that “Meaningfully put the capital to work” piece. I love how you frame it re-feeding the flywheel, curious how often that actually happens in practice…

Paul O’Brien let’s do a series on this!!

Would love to have you join me for a virtual event with a Bunker Labs! Now I’m stoked… have a ton of notes on this I’ve put together over the years that I’ve just been sitting on. Timing is everything ?

Interesting concept – the flywheel that is….as related to raising investment.

Would love to hear investors point of view, specially the VCs, as well.

While I was reading your article I couldn’t help but try and draw a parallel between the flywheel notion and the notion of Sprints in software development.

The definition I quote:” A sprint is a short, time-boxed period when a scrum team works to complete a set amount of work. Sprints are at the very heart of scrum and agile methodologies, and getting sprints right will help your agile team ship better software with fewer headaches.”

The above concept could be extended to any project …. an agile scrum master may say 🙂

In reality though the Investors follow a process driven by goals( their thesis), short listing and DD, and end results.

This process very much needs to be a flywheel, powered by the latest gen Nvidia professor, per your analysis as right now it seems like an effing loaded up mule going uphill !

Note that NFX have created something called The Brief to speed up the first meeting with investors : https://www.nfx.com/post/the-brief/

Just a side note: The earlier the stage of a startup the higher the risk and that is why the return on investment multiples are higher, for early stage startups. For later stage startups revenue data / EBITDA starts to be pivotal assuming that the startup story ( product : market ) aligns with the area / sector of investment that the investor focuses on.

Will have to get back to this …. in the am …. watching the View now with my girl 🙂

Love it. I can see how some people make larger circles of influence over the funding journey and thus create larger acceleration towards awareness, support, advice, relationships, and eventually, finding.

Ooo great thought to put more consideration to Andr Pi, yes, in the process, we’re creating larger circles. Might be something to an analogy of needing a bigger flywheel as the venture grows.

Another great read that brings great aha moment-thank you!

More to come this time. Want to do a whole series about HOW to do this. Thanks Tinny Widjaja Stay tuned.

This is a good explanation

The long game is difficult for people to be passionate about in an industry that values furious motion.

Always a sound reminder Annie Joey Lanier Hardy: people tend to want to raise money now, soon; heck, it take a few weeks just to trade emails and book meetings. Now factor in nearly 100 meetings with investors (a reasonable average) plus the fact that they DON’T just invest in business metrics (they want to get to know you), you’re always looking at 6 months +/- to raise money from investors. And that’s not accounting for the time in between that has to be spent on the business creating value.

A couple of CTAN investor friends of mine talked about how they want to meet investors early, before they’re raising money, so they can get to know the founders and the company and watch it grow. It just takes so much time. It’s not for everyone.

Isn’t this what every business does

Paul O’Brien how is this a revelation or news to anyone? Aren’t all companies doing this process consistently?

You really think so? That every business is/does?

I’ve worked with startups for close to 20 years my friend, hundreds of them every year. Almost none of them do this. It’s overwhelmingly about “how do I find/meet investors?” “How do I pitch?” “What is the term sheet?”

Founders tend to think more directly. What do I need to do to accomplish X?

In my experience, it’s the companies funded and scaling that do this to an extent, usually without realizing it.

Paul O’Brien ah well that makes sense why I have trouble relating to issues that most start ups have become i never had any of these issues.

Saved this one & will be implementing. Needed this. Thanks Paul O’Brien.

Love this concept! I have also contemplated the efficiency of the current funding model thinking there must be a better way. Here it is, my weekend study material.

Cheers Kristin Davidson! Truth be told, we’re going through a lot of Fund Model research and economic development work in various ways throughout the country and so it is that very question that helped push me to get this early version of the flywheel idea out the door.

Come back to me after your study; we’re still studying too and I’d love to hear what you’re thinking!

Paul O’Brien done right, it snowballs.

James Dickey Precisely… that was the other notion I was playing with in my head before getting excited about the flywheel

Absolutely, I will keep you updated. I was set on fundraising then decided to bootstrap my current venture. So happy worked out this way. Necessity forcing ingenuity produces some interesting results! ???

Interesting perspective. I’m going to have to dig into my “Turning the Flywheel” monograph and think about his further.

Think on and let’s talk! Lots of inquiry and encouragement to flesh this out more. Cheers Jeff Eversmann

Thanks for this! Gunna start brewing some coffee and dig into it

My pleasure. Save me a cuppa

Interesting, likely true, but puts me off.

In other words, we must be popular and friendly to investors so they eventually come to us more easily and naturally. We must become large swirlpools, saturating attention, for investor-handshakes to magically come to us as if we are not looking for them.

That is, become a PR geek of sorts plus worry about (beuraucratic?) background checks that investors will likely make before coming onboard.

I haven’t even started reaching out for investors, actually. I’m still researching about it and the adequate approaches, that’s why I found this text. I usually love your texts, posts and ideas on startups, Paul, and I take it you’re simply being honest about this bit on the flywheel here. But what bothers me is that I don’t particularly want to be BFF with investors, I want them to realize I have a treasure pot waiting to be uncovered. Since that might be too boring for them and they apparently have heard too much of this in the form of bluffs and other rhetorical devices, they’d rather (to put it figuratively and according to the flywheel) meet me and like me while attending to social events by chance and eventually find my project so inspiring or attractive, after hearing about it from so many different channels and in so many different occasions, that it is just irresistible. This sounds less rational and more emotional. Less focused and more comfortable for investors as they feel they’re socializing, surfing social networks and doing business simultaneously or doing business and assessing opportunities while being adulated by some kind of eye-catching, ubiquitous investor-directed advertising. (Do investors have so few sincere friendships that they long for this type of experience? No,) I guess they just receive too many pitch decks to examine and simply decide to filter them however is more pleasant and according to luxurious or superficial social criteria. Either that or they are only fond of startups that are popular, good-looking and photogenic since the early stage, with strong online presence.

Saying that pitch decks play basically no role previous to attracting investors through some other indirect means of pervasive PR almost equates to saying “if you want to find them, don’t look for them, let (or make) them find you”. That seems so little assertive that it frustrates me. Basically, we’re back in high school drafting strategies to hook up with girlfriends, looking for more passion than reason. Only this time it’s business and not sex drive that’s involved (or do I repeate ?myself?). Sure it takes a lot of social / PR competence to achieve that which you describe and that in itself is a great test of proficiency and resourcefulness, but still…

I guess this comes from someone who thinks his startup has strong enough legs that it should’nt need so much make-up and fancy dressing to be seriously considered by venture capitalists. I guess that, too, might be an exception, unfortunately.

But out of all this, what really puts me off is that it means I shouldn’t try to pitch to The Paul SEO’Brien!

Or should I, man?

Anyway, thought this perspective would be worth knowing.

[…] a look at this flywheel. I love flywheels, having used them before to explain how to raise capital or how to develop an […]

[…] The Funding Flywheel […]

[…] The Funding Flywheel […]