If cities were startups, Portland would be the one that never hired a PR firm, preferring instead to let its product (culture) speak for itself. For investors, that confidence has been both its charm and a challenge. Portland is inventive to the point of eccentricity, independent to the point of obstinacy, and so allergic to self-promotion that it sometimes forgets capital markets don’t fund mystique.

But make no mistake: Portland has all the ingredients of a high-growth ecosystem, so while I go right to the punch of criticism, it’s out of the love that I prefer to share in developing ecosystems, uncovering what we can do better while celebrating the exceptional.

Article Highlights

A City Built on Innovation and Ideals

Portland’s economic and cultural DNA goes back to the Oregon Trail itself (sorry Gen X, not the game that defined our childhood and established our fear of dysentery): risk-takers, prospectors, loggers, shipbuilders, and dreamers who literally bet their lives on unexplored frontiers. That streak of ingenuity persisted through the timber and shipping booms of the 19th century and the manufacturing and high-tech revolutions of the 20th. By the 1980s, Portland was already cultivating an identity as an early tech and design hub (one of the first to adopt another “silicon” moniker as the Silicon Forest) while maintaining its obsession with sustainability and livability; a cultural trait that became the city’s brand long before cities had brands.

It’s the kind of place where Nike was born in the trunk of a car, where Intel made Hillsboro farmland into one of the densest semiconductor employment zones in America, and where Tektronix quietly created the blueprint for what would later become Silicon Valley’s culture of spin-outs and garage startups. Even HP, Precision Castparts, and Columbia Sportswear have deep roots here. Today, Portland’s creative class continues that lineage through companies like Elemental Technologies (acquired by Amazon), Vacasa, Urban Airship (Airship.com), and Puppet; firms that grew out of Portland’s unique mix of engineering talent and countercultural spirit.

And the culture keeps compounding. As Rick Turoczy, managing director of the Portland Incubator Experiment (PIE) and editor of Silicon Florist, recently highlighted, Portland’s startup headlines are shifting from survival to scale. “Customer.io hits $100M ARR,” he noted, alongside Oregon Venture Fund raising its next round and the Oregon Startup Center rebooting, evidence that Oregon’s innovation economy is maturing into something more self-sustaining. The fires of early creativity are starting to produce sustained heat.

The Entrepreneurial Culture of the Pacific Northwest

What makes Portland’s founders distinct isn’t their obsession with scale or blitz-scaling but their obsession with craft, authenticity, and social purpose. Call it the Patagonia effect on code. Portland companies don’t just build; they build responsibly. A study from the Brookings Institution noted that Oregon’s startup density has consistently outperformed most of the U.S. outside of California, despite lower levels of venture capital. Why? Because founders here actually build sustainable businesses before they raise.

That’s where Duncan Miller’s critique of venture culture fits neatly into the Portland ethos. “Venture capital is glamorized,” he writes. “Founders are celebrated for raising millions before building anything real. But what if getting VC money early is more curse than blessing?” The city’s founders would nod in agreement. Portland isn’t anti-investor; it’s pro-customer. As Miller says, “There are two ways to start a business: customer validation or investor validation. They are not the same. One leads to a sustainable business. The other often leads to inflated expectations, misaligned incentives, and premature scaling.”

That’s Portland in a nutshell: slow burn over fuel dump. Founders here understand that “VC money is fuel; it makes things go faster. But if you don’t have a working engine, you’re just burning cash.” It’s why many of Portland’s best companies (like Wieden+Kennedy, Instrument, Treehouse, and Simple) were bootstrapped long before some of them attracted venture attention. Bootstrapping builds muscle. And if Duncan Miller’s axiom holds true that “Net worth ? groceries. Cash flow is king,” then Portland has long been a cash-flow city in a net-worth world.

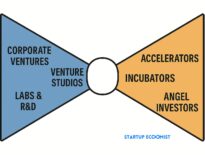

Portland Startup Infrastructure and Investors

Portland’s startup infrastructure has matured considerably over the past decade.

- Portland Seed Fund, a public-private micro-VC launched in 2011 that has invested in more than 150 startups including Wild Fang, Cloudability, and Madorra.

- Oregon Venture Fund, which manages roughly $300 million AUM and backs regional winners like Vacasa and Sila Nanotechnologies.

- Elevate Capital, one of the first early-stage funds in the nation led by a BIPOC founder (Nitin Rai), focused on women and minority-owned startups.

- Rogue Women, a fund born out of Rogue Venture Partners that now stands on its own with a focal point on women-founded companies.

- Cascade Seed Fund, focused on supporting early-stage startups in the Pacific Northwest, emphasizing hands-on mentorship and investment in diverse founders.

- Voyager Capital and Diane Fraiman, investing in the modern economy through AI-driven business solutions, software-driven hardware, sustainable agriculture, and supply chain in the Pacific Northwest and Western Canada.

- VertueLab, a climate-tech incubator partnered with the U.S. Department of Energy, funneling SBIR and STTR funding into sustainability startups.

- Portland Incubator Experiment (PIE), born from Wieden+Kennedy’s creative ecosystem, blurring the line between design studio and accelerator.

- Built Oregon, a non-profit venture fund that champions consumer product companies.

- Portland State University Center for Entrepreneurship and Business Accelerator, critical feeder programs linking academic research with commercialization.

- Metro Region Innovation Hub, where you can hear from Portland founders, learn from their experiences, and find tools

- Angel Oregon from Oregon Entrepreneurs Network (tech, food, bio), designed to support early-stage technology startups based in Oregon and Southwest Washington by offering investment-readiness education, mentorship with successful local entrepreneurs in their sector, and connectivity within the local technology community

- Technology Association of Oregon, professional networks aligned with job functions in the technology industry designed to help members build connections

Notable of the Portland Seed Fund is the Intrepid Oregon Fund (IOF), a new effort to address the challenge of IP commercialization (typical in Universities) that most of you are working through since licensing University IP is increasingly weighed as unnecessary. Anchored by a $4 million initial investment by Business Oregon through its Commercialization Gap Fund program. IOF will invest in early-stage companies less than five years old, in sectors that are primarily technology and science-focused such as digital health, healthcare IT, bioscience, medical devices, climate-tech, advanced manufacturing, advanced materials, and natural resources.

Even as this infrastructure expands, the lesson from both Miller and Portland’s own track record is clear: investment should follow validation, not precede it. “VC can be fuel on a fire,” Miller says, “but only if there’s a fire.” Portland’s founders have learned to spark the flame first.

The Economy Beneath the Surface

Oregon’s GDP has been growing at roughly twice the national average since the pandemic recovery period, driven by semiconductors, green tech, and advanced manufacturing. Intel’s $20 billion expansion in Hillsboro cements the Portland metro as a key node in America’s CHIPS Act supply chain. At the same time, the region is balancing one of the nation’s tightest labor markets with an affordability crisis; great for talent retention if you can afford to live here, problematic if you can’t.

The state government plays a hands-on role in entrepreneurship through the Oregon Innovation Council, Business Oregon, Oregon Growth Board, as well as Oregon’s Regional Innovation Hub strategy, each of which channels public funds or resources into local ecosystems. But as with so many public initiatives (looking at you Europe), the programs are often fragmented and burdened by red tape; a point repeatedly raised in national discussions on startup economic development policy. Government backing exists; efficiency, experience, and focus remain the missing links.

Meanwhile, Oregon’s startup community isn’t waiting for permission. As Rick Turoczy observed in his latest roundup, “OVF [is] raising their annual fund, Oregon Startup Center [has] reboots underway, and North Bank Innovations [is] seeking residents for The VIC space.”

In other words, the ecosystem is iterating in real time: founders, investors, and institutions adapting like any good startup would.

Applying the Six Considerations of Startup Economic Development

Drawing from 6 considerations Startup Economic Development, let’s assess where Portland excels and where it lags.

- Culture: Of competition, potential, and creativity

Portland’s creative DNA is undeniable. From design to digital media to sustainable tech, it’s a city where ideas are currency. But creativity must coexist with competition to drive innovation – if that’s what is appealing to the city. Portland excels at collaboration but hesitates at conflict; it celebrates artistry but occasionally undervalues ambition. To evolve, the city could encourage competitive drive alongside its cooperative ethos, fueling potential without losing authenticity. The goal isn’t to trade kindness for cutthroat behavior, but to cultivate a culfaceture where winning ideas are tested, challenged, and refined in the open. - Capital: Reasonable wealth available

There’s money in Portland, just not always moving with startup velocity. The region benefits from family offices, exits from tech and manufacturing, and a surprisingly deep pool of affluent professionals. Yet as with Seattle’s early years, much of that wealth remains parked in real estate or index funds rather than startups (problems plaguing most cities). The problem isn’t capital scarcity, it’s capital courage. Oregon Venture Fund, Portland Seed Fund, and Elevate Capital prove that local investors can thrive here; the next leap is mobilizing more of Portland’s latent wealth into angel and early-stage investment. - Employers: Innovative companies as anchors

Great ecosystems orbit great employers. Portland has them: Nike, Intel, Columbia Sportswear, Adidas North America, and Daimler Trucks, as well as iternet era influencers Google, AWS, and ebay, eash larger than the wave of mid-sized tech innovators from Vacasa to Puppet. These firms don’t just create jobs; they serve as training grounds for intrapreneurs who later become founders and, importantly but often overlooked, as fallback when entrepreneurs need to return to stability in a job. Portland’s challenge isn’t a lack of employers, it’s deepening their participation in the startup pipeline through venture arms, procurement programs, and shared R&D initiatives. When corporate innovation and startup creation intersect, talent stops leaving and ecosystems mature. This is easily fixed with some collaboration and infrastructure that enables shared goals through common effort. - Governance: That there is little to no government interference

Portland’s public sector has long been engaged in economic development, but sometimes with the over-engineered complexity of its famous bridges. The best governments in startup cities don’t manage founders, they remove friction. Oregon’s tax incentives, innovation grants, and public funds are valuable, but entrepreneurs still find themselves tangled in slow processes and policy ambiguity. The city’s opportunity lies in deregulating thoughtfully: streamlining zoning for innovation spaces, cutting bureaucracy around small business formation, and focusing government on enabling infrastructure (startup platforms, mobility in transportation, housing), not running accelerators. - Talent: Access to startup-experienced people

Talent here is abundant, creative, and increasingly technical. Portland’s workforce draws from Nike’s marketing minds, Intel’s engineers, and Wieden+Kennedy’s storytellers. Yet what’s rare is startup-experienced leadership – people who have raised capital, scaled teams, and navigated exits. Programs like PIE are bridging that gap by connecting local founders with global mentors, but Portland still needs to import experience while exporting innovation. The more serial entrepreneurs the city attracts, the faster its learning curve shortens. - Promotion: Credible and distinct positioning of the city as a startup hub

Portland’s story sells itself, it just doesn’t do so much. The city is known for coffee, bicycles, and breweries when it should also be known for code, capital, and climate innovation. The regional narrative must shift from lifestyle to leverage: Portland as the place where sustainable products, ethical AI, and conscious capitalism are born. Credible promotion isn’t boosterism, it’s honesty about what makes the ecosystem distinct. As Rick Turoczy frequently reminds in Silicon Florist, Portland doesn’t need to imitate Silicon Valley; it needs to be confident enough to be Portland.

Portland’s potential isn’t theoretical, it’s structural. The city already has the culture, capital, employers, and infrastructure needed to compete globally. What it needs is confidence in its own model of sustainable innovation: less regulation, more risk-taking, and a louder, more credible narrative about the kind of future being built here. When that alignment happens, investors won’t just visit Portland, they’ll stay.

Here again, Miller’s framework resonates. “When a founder gets validation from an investor, they often stop seeking it from customers. Money in the bank feels like traction but it isn’t.” Portland’s next growth phase will depend on avoiding that trap; staying customer-led while embracing capital as a tool, not a trophy.

What Portland Does Right and What Comes Next

Portland understands sustainability, community, and craft better than almost any city in America. Its next evolution must be from craft to scale, from values to valuation. What it might explore more is a shift to more structure: integrating global networks, measurable outcomes, and data-driven entrepreneur assessment into what has long been an artisanal ecosystem.

“Venture capital needs founders to survive, but founders don’t need VC to start. Get customer money first. Build strength. Then, if needed, bring in VC to turn a small fire into a bonfire.” – Duncan Miller

It’s precisely that disciplined, customer-first mentality that defines Portland’s future.

The question for investors is simple: Would you fund this startup called Portland? It has a brilliant team, strong IP, a cult brand, and an unparalleled talent pipeline. Its unit economics (culture and quality of life) are off the charts. What it needs is growth capital and go-to-market strategy and maybe a playbook for turning Portland’s authentic ingenuity into a scalable, investable economy.

“It’s a question akin to the journey that brought so many Americans toward the West Coast, a journey that involved a choice of paths. One fork of the fabled Oregon Trail led to the “get rich quick” promises of the Gold Rush in the Bay Area. The other led to homesteading and settling down to build a quiet and sustainable life in what would become the state of Oregon,” added Turoczy. “Neither of those endpoints has strayed far from that foundational ethos, even today.”

For me, Portland is irresistible because it embodies what entrepreneurship should be; driven by vision, values, and the willingness to experiment. It’s a city that takes risks for the right reasons. I want to help it build the infrastructure that translates that idealism into economic impact. If you care about sustainable growth, authentic innovation, and human-centered technology, you’ll find your people here.

So, investors, look at what’s brewing in Portland. You might discover that the next great American startup isn’t a company at all. It’s a city re-engineering capitalism itself.

I have my perspectives on Portland — admittedly often tinged with Rose City colored glasses. So it’s always helpful to hear how others perceive our startup community, for better or worse. Well worth the read. (And thanks again to Paul O’Brien for taking the time to share this point of view.)

This is a clear call for some Wieden pro bono work.

“It’s whether you’re ready for the kind of founders who build for customers first, capital later.”

Honestly, this is what I love most about folks building in Portland right now. To make it happen here, you HAVE to build customer first. And that’s what comes out of it are things of value and things that last.

Rick, I appreciate your openness to outside perspectives on Portland’s startup ecosystem – that self-awareness is refreshing. After reading Paul’s analysis, what specific aspect of his observations surprised you most, and how might those external insights influence your approach to community building moving forward?

Rick, exploring diverse startup ecosystems reveals unique challenges and growth opportunities.

Certainly in agreement!! Each point!!

Jeff Smith

Rick Turoczy I find, especially in our work, the supportive encouragement becomes hype that misleads. We’re serving the highest risk taking people, both entrepreneurs and investors; we have a responsibility to be honest about the gaps to overcome so we can tackle them together.

Paul O’Brien Careful, you’re stepping across that “Portland nice” line

Rick Turoczy i already stepped over the Austin, Texas line

Happy to be that guy

Great stuff. I never had a successful startup until I left Portland. Coming back a few years ago to try again and I couldn’t understand why the ecosystem hand’t exploded. My startup resembes Portland in never hiring a PR firm or decent marketing and hoping the product speaks for itself. Good reminders all around to keep at it.

Gregory Lind thanks for this as it frames something important, nicely. That, I went with PR firm on purpose, not marketing

Portland’s marketing is great! If that reflects what it wants to be. I really enjoyed digging in here because Portland is a little private and this is not well known; for what it is, people love it. That’s good marketing.

But (or, and) if it’s NOT getting what it needs or wants, say for example, more VC attention, then marketing needs this assessment and PR needs to step up their game (so to speak); there is work to be done and Portland deserves the attention

Sam Eames

Thanks for posting this, I love the West Coast and want the whole sustainable and startup ecosystem to grow (especially in the PNW), and your discussion of VC has some good nuance to it. I’d also say founder education in just how massive an opportunity for TAM needs to be, to be venture fundable could be helpful. $1B is TINY, $10B is small, $100B is where it starts to get interesting…. Most startups I see ain’t venture, many of them sadly don’t know it. 😉

Michael Waggoner a challenge consistent in most cities. Everyone thinks they’re fundable because they have revenue; frustrated that they’re not fundable because they do.

VC is scale and exit more than customers and growth. It’s frustrating that so few are saying this clearly so that founders know.

Good outsider take on Portland startups… community’s strong, scaling needs work!

Vikas Girigoswami thank you

Yep, that’s my hot take.

Paul O’Brien – Amazing overview and article. Thank you for shining a well-deserved light on Portland! There are so many of us working to raise the profile of our founders and investors. We’ve got everything we need except maybe a North Star and some better tax policies. I’m working on a plan to address both.

As a former Portlander, I concur, I concur.

Allen Guthier would love to learn more about what you’re thinking re: tax policies. cc Joe Milam have had some nice conversation about existing tax considerations too often overlooked.

As a data analyst, I love metrics from steady growth… bootstrappers win here!

Honored and grateful for the PDX love, Paul, and you absolutely get it.

Portland is rich in passion, creativity, and engineering talent. What it lacks in shameless self-promotion, it makes up for in quiet purpose. My own post embodied this by demonstrating it before talking about it. It’s working, and that’s why now I’m vocal.

Six months ago, Joseph Cole and I made the shift towards bootstrapping Rose City Robotics. We left the pitch deck circuit and focused on revenue, outcomes, and real customers.

I still believe it’s “venture scale” and that AI will enable a bootstrapped unicorn. It’s just not “venture backable” and that’s by design.

For now, I’ll stay on the investor side of the VC world and keep building my own business with customer funding.

Appreciate you stitching this into something both honest and hopeful.

Paul O’Brien another thing I find in Cleantech is that many founders don’t know their main mission is to make money, which you’d think would go without saying. 🙂

Michael Waggoner I suspect a challenge in CleanTech is similar to what I was chatting with Kedar Iyer about in AgTech, that impact and end user don’t easily align.

I’m the end user of energy or food, so I’m the one who creates demand for innovation, but I’m not the customer nor investor. I find with startups in both sectors, a challenge is that the work being done might be brilliant impactful, but, “I don’t care.” (Which is to say, if the end user doesn’t care, it makes it harder to get the capital excited – customer or investor)

Paul O’Brien Allen Guthier The ‘OG’ QSBS tax incentive is QSBS Sec. 1244. Most don’t even know it has been on the books since 1958! Happy to chat Allen Guthier. Also take a look at https://bit.ly/3zTQEB2 & https://bit.ly/3Sp8nX8

Thank you for sharing the write up, Rick Turoczy and appreciate the insightful perspective, @Paul O’Brien. How do we best elevate the value proposition of the local startup ecosystem to attract right investment to sustain the community ethos and grow meaningful impact.

Gaby Orwick if you’re asking, I find that coalition building is now more important than PR. Which is to say, the answer used to be: get the word out more, with national headline, magazine exposé, etc.

But that doesn’t work as it once side, and social media (alternatively) is handicapped unless you have audience or budget.

What’s working now in many cities is coalition building with national or global organizations. Partner. Extend your footprint and your voice(s) through the organizations doing that already and purposefully.

Paul O’Brien thank You, and such great validation for the direction of several recent local initiatives like Blueprint Climate and Powerize Northwest Consortium. Look forward to building on that momentum and making real change happen. Appreciate You!

Michael Ulwelling Ben West Angela Jackson Katherine Juengel Kirsten Midura, MEnv Justin Zeulner Kevin Scribner