It’s a question asked so frequently, in a variety of different ways, that it finally occurred that it would be a good discussion to have. Should you be raising money?

Of course the cop out is to reason that of course one should; you have revenue, customers, and you’re growing but you just can’t get to the next stage.

Clearly your priority should be seeking investors, right?!

The challenge in this question is that the answer is so nuanced that you really must explore what you’re doing, why, and what it means before you can begin to answer whether or not you should be raising money.

Article Highlights

The 5 questions to ask before raising capital

- Do you need funds?

- Is what you are doing fundable? (from where?)

- Will financing be invested in the business to scale it or are you just covering costs and growing a bit?

- Does that cap table adjust to support investors?

- Is there an outcome for investors?

Let’s look into these in more detail as I want to clarify what I mean by saying that I’m asked this question in a variety of ways. When you ask if you should seek Angel Investors, you’re asking whether or not what you’re doing merits raising capital that way. If you ask if doing a Kickstarter or equity crowdfunding makes sense, you’re asking if you should be raising funds but in an entirely different context. Asking what Venture Capital firms look for from startups, you’re asking if you should raise money from VCs. And the answers to every one of those questions, depends.

Do you need funds?

It’s easy to be rash and answer that promptly: yes, I’m short of cash. Whoops. Why are you short of cash? What are you doing wrong?

Considering the subconscious messages you send by asking for funds, you really have to consider that “need” must clearly align with the expectations of your source of capital. When you say you need funds to hire people, it suggests you can’t do what you’re doing or that you can’t attract people, or customers, without more cash readily available. While all of that may be true, and acceptably so, you can see how your need for people raises questions.

So sure, you need funds, but why? For what purpose? What are you unable to accomplish without a specific type of financing? Keep in mind that the source of that funding has different expectations. Kickstarter financing means you have to be doing something with which you can deliver a product; you can’t meaningfully kickstart a SaaS application if the $250k you’ll get from Kickstarter won’t result in a product you can give to those financiers for another year or more. For what purpose do you need funds? Begging our next question:

Is what you’re doing fundable?

No source of funding is free and clear of expectations. Even publicly available grants have expectations that what you are doing aligns with the purpose of that grant.

The first question, need, is paramount as you can’t explore this question without first being clear on that. Knowing your need, you can identify from where the funding should come… need money to buy supplies to get your product to market? Kickstarter. Do you have have or need equipment to start your manufacturing or production? Get a loan as your equipment serves as collateral. Do you need a team of developers or artisans to enable the dream? Hello angel investors.

But are you fundable? Your kickstarter will fail if what you want to bring to market is something no one wants (or more challengingly, you bring the opportunity to market without the panache of marketing to create demand).

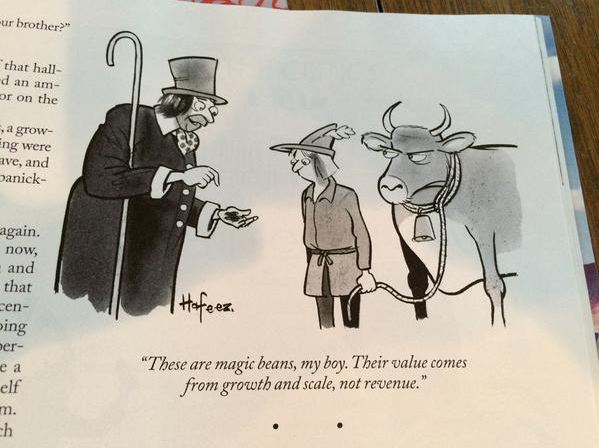

Where I’m typically involved/asked is with regard to Angel and Venture Capital sources so let me focus there for a moment. The advice with which far too many entrepreneurs struggle is that of having customers and revenue. Angels and VCs too ignorant to ask the right questions of your business or too chicken (yes I’m saying it) to tell you no, will advise that if you only had more paying customers, they’d invest. Bullshit. Investors (real investors) don’t invest in revenue; they invest in future outcomes relative to their present participation. How do they garner a Return on Investment that multiplies their money? Having customers and revenue, alone, is NO guarantee of that happening at all.

Seeking investment, you must explain, credibly, why the funds result in a multiplication of investor value. That multiplication is not just growth. Hiring one more person, for example (usually), is merely growth, as larger team adds the complexity and costs of management. Growth is a good thing but most investors won’t invest just so you can hire.

Certain types of businesses, with various future outcomes, are appealing to different investors. Having revenue simply means you can service debt and your job is to deliver and communicate how investment creates efficiency and step functions that result in more value than you are otherwise able to deliver WITHOUT the investment.

Will financing be invested in the business to scale it or are you just covering costs and growing a bit?

Appreciate the next question now? Are you using those funds to invest or are you just covering the costs involved in growth?

As a marketer, let me explain what that means from my point of view. No investor will ever give you money to hire a marketing manager or spend it on Adwords. If the Marketing Plan in your Investor Pitch is as simple as saying you are going to do some content marketing and Facebook ads, you’re done. You don’t deserve investors’ money because all you’ve done is outline what are obvious, expected, operating costs of doing marketing for any business. Damn right you going to spend money there, duh; that is NOT investment in the business.

Needing to adjust the cap table to close a brilliant CMO or Sales executive. Needing to invest in marketing automation infrastructure to increase your engagement and Word of Mouth rates. Needing to rebuild your working, functional UX (you already are creating value and growth!) to capitalize on Google and Mobile; something that will cost $200k but result in 200% more business <- THAT’S invest-able investment in your business.

Does that cap table adjust to support investors?

This is always a tough one but a question answered simply with three more:

- Are you the sole or majority owner? Are you prepared to let go?

- Can you sufficiently let go of equity to give investors the equity they need relative to the valuation established? Company valuation isn’t a finger in the wind, you are setting a value with investors and that value, relative to their investment, means they get X%

- Can you let go of MORE? Here’s where the rubber really hits the road and you need to be prepared to manage early investors. In order to raise capital in the future, you need to be comfortable with dilution: all of you, including your initial investors; those from whom you are seeking capital now.

Work through those questions and keep in mind, there is no right answer, you can fall on either side of the question but your answer determines, no, dictates, where you go from here.

If you are the sole or majority owner you can likely secure Angel funding but it’s far less likely that VCs will ever be interested. They fund teams and companies, not sole proprietors.

Is there an outcome for investors?

Certain types of businesses, with various future outcomes, are appealing to different investors. Having revenue simply means you can service debt. Yes, I repeated myself. That statement needs to be burned in your brain.

In a sense, we’re talking about your Exit but I want to encourage you to consider that all of the advice you’re hearing from people more credible than me, that you need an exit strategy, is wrong. Not because you don’t need one, but again because of your language and the expectations set. Investors don’t want you to have an out, they want you to have an outcome.

Not Exit. Outcome! Almost every startup book and advisor you talk with says you need an exit strategy, I get that. I work in marketing, communications, and economic development. You know what “exit” says to investors? Subconsciously. That you’re willing to get out, that you will get out if you fail to achieve the expectations you’ve set with those investors. I don’t want to partner (invest, advise, consult, or otherwise) with someone who would exit. I want to partner with someone who has outcomes in mind that result in MY deriving value. Exit can mean fail. Granted, an outcome might also be failure but the negative connotation of exit implies risk whereas an outcome, a result, of what we’re doing together is value created.

Be in the business of creating value and investors will want to participate. But before wasting your time seeking funding, make sure you’re clear why you need the funding, from where, and whether or not you can deliver to the expectations of that source of capital.

It depends on the person’s short term situation and what they really want to achieve long-term. (ie lifestyle business, acquisition,etc).

I love the blog posts that come from everyone asking the same question. Those are the best

Sharing with my women veteran/milspouse entrepreneur group.

Great article Paul. Couple questions:

1. Do you have any blogs on dilution specifically on setting up the infrastructure prepped for future dilution?

2. With various outcomes, does the investor want to know all of the “negative” outcomes thought through on the SWOT analysis or focus on positives?

Paul we should definitely do a blog or do a podcast episode on “funding a brand” vs. tangible product. Is it riskier or more safe?

Is it riskier or more safe relative to which of the two likely results in more value?

Thanks all. Great input. Dimetri, answers to your questions:

1. No, dilution is a great topic and one much more nuanced than I’m capable of addressing effectively. I think. Worth exploring though.

2. I believe yes. The better part of fundraising is the aversion of risk. You can’t close a deal but simply conveying that what you’re doing is working, could be worth a lot more, and will have an outcome for you; you have to convey that it won’t fail. Sure, perhaps you won’t meet the preferred outcome (that never happens), but you are aware of the possibilities good and bad and have a plan for them such that you won’t just walk away leaving the investor with nothing.