Referred to by a couple local financing executives as “the best seminar they have been to here in Austin,” I recently had the honor of moderating a discussion of venture capital funding, thanks to the support and hard work of Texas State University’s SBDC and Frost Bank. Why so compelling?

That’s precisely the question we endeavored to explore and perhaps that’s why. Why. Why might your startup get funded?? Why should you seek funding?

Flush with advisors, incubators, and demo events, the attention on the Austin startup community would certainly suggest entrepreneurs here know how to get funding and indeed, the breadth and depth of events, advice, and consulting focuses on how to become an entrepreneur, how to validate your idea, how to start a business, and how to raise money. And yet, entrepreneurs here, as with much of the rest of the world, are finding significant sources of capital elsewhere. Something is amiss. Is the traction we’re finding with new ventures inconsistent with the expectations of investors? How are we struggling to raise the capital that we’re seemingly ready to serve?

Thus, with an esteemed panel and an exceptional audience comprised not only of startups but of much of the Austin startup investor community, thanks to Best Fit Capital Advisors, DC Venture Services, Covert Ventures, and Digitech VC, we set out to answer why this vibrant, innovative, and experienced startup community is feeling under funded. Interestingly, asking that question of Austin seems to have revealed the answer to the broader funding challenge; that getting funded is not a matter of what you’re doing and the customers that care but why.

To explore these questions we first have to be clear on what it is that we’re discussing…

Article Highlights

What is Venture Capital?

A challenge I’ve experienced in most startup communities is that venture capital is referred to in the generic sense rather than the specific source of capital. That is, venture capital is indeed funding for ventures in which there is an element of risk but, such capital comes in many forms just one of which is Venture Capital the likes of which one raises through a Venture Capital Firm.

My experience in Austin and Silicon Valley might best explain the distinction as in the Valley, I think given the exceptional cost of doing business, when entrepreneurs refer to Venture Capital they tend to mean only that which comes from Sequoia, First Round Capital, or Shasta Ventures while Angel or Friends & Family is synonymous with one’s seed round. Other sources, such as banks, private equity firms, and incubators are what they are. The cost there requires funding of greater significance and thus language is more purposeful and explicit; when an entrepreneur speaks of venture capital they mean hundreds of thousands of dollars invested in an entity that intends to exit at a valuation multiple times greater than it what it might be valued today. Their intention is to grow a company by divesting their ownership and ultimately being acquired or going public. We like to talk about the Valley in terms of Unicorns and billion dollar valuations but it is more important to look to the expectations of entrepreneurs and investors there in appreciating how such companies emerge. An entrepreneur there is seeking “Angel Investors” under distinct circumstances and when instead for example, starting what might be considered a small business rarely is the word “venture capital” heard. Why?

David Rose, CEO of the startup investor network Gust and an investor I HIGHLY recommend following, defined an important distinction in venture capital sources.

Angels typically invest smaller amounts of money (thousands to hundreds of thousands of dollars) earlier in the life of a company, at lower valuations, taking on more risk. VCs typically invest larger amounts of money (hundreds of thousands to tens of millions of dollars), at a somewhat later stage and higher valuations, with slightly less risk).

The bold highlight in that quote is my own as reading that definition, given my experience in Silicon Valley, I find myself asking of Angel Investors here in Texas: is that the role that you’re playing or does a startup community like Texas, where “customer traction” is common advice, reflect that investor expectations here are different? That Angels here either don’t take on risk that isn’t alleviated by customers OR don’t feel confident in local entrepreneurs/entrepreneurship and thus encourages customers to help validate risky new ventures?

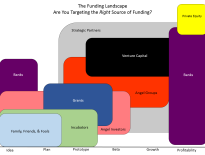

When we look at the sources of capital available to new ventures, we might draw a line down the middle and simplify our understanding of their expectations.

| Friends and Family Credit Cards and Ramen Bank Loans Crowdsourcing |

Angel Investment Equity Crowdfunding Debt Financing Venture Capital |

On the left, sources of capital that seek nearer term returns of some kind be that success by way of the philanthropy of friends and family or repayment of loans or crowdfunding. On the right, investment; by the very definition of those sources of capital, funds that seek a longer term return continent on your delivering greater value and an outcome that results in far more than repayment of financing. Having customers alone is insufficient to meeting investor expectations. Why then is it so frequently perceived to be important at early stages?

Perhaps we’re failing to communicate WHY investors should fund our ventures and thus the advice we’re hearing is consistent with what we’re building.

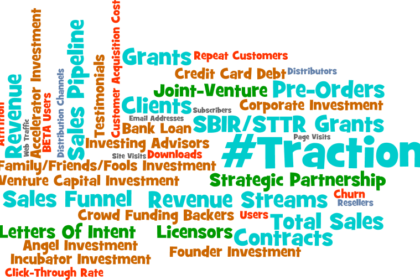

| Those thoughts were captured and communicated by way of the first couple slides in that Texas State funding discussion so let’s turn to them now to follow along (grab them here in a new tab if you prefer). To help us grapple with this question of why startups get funded, Texas State’s Paul Wright drove the development of the tag cloud you see above, a representation of the various forms of traction that should be considered.

Each of those measures of traction, from simply building the right team to securing various sources of revenue, represents an opportunity wherein investors might find a meaningful return and your job is to convey why, not how, that’s the case. Create CustomersIn the seventies and eighties, long before our love affair with Lean Startup and customer validation, famed economists were already explaining what it took to build successful ventures. |

[prezi url=”https://prezi.com/b_ygdgdcvj4v/” width=”550″ height=”400″ zoom_freely=”N” ] |

Peter Drucker, author of Innovation and Entrepreneurship often spoke of what creates value in business. He and many others have pointed out that the utmost importance of a risk taking entrepreneur (and thus that which is appealing to the right side of that venture capital source list) is not finding customers but creating them and thus securing the means to do so.

We need to be creating a return on investment, not merely serving a source a funding or financing.

We need to be creating a return on investment, not merely serving a source a funding or financing.

“Because the purpose of business is to create a customer, the business enterprise has two–and only two–basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs. Marketing is the distinguishing, unique function of the business.”

Think about that. Are you creating customers or finding them? Are you validating an idea with existing customers and trying to sell something to them? Is Marketing a cost only to be made when your MVP is ready and you’re in market in need of leads or is it an investment as important if not more so than the development of your product or service?

Laura Lorek, reporter with Silicon Hills News, captured an important consideration from one of the panelists of the day, Central Texas Angel Network’s Rick Timmins, “You’ve heard that so many times it sounds sickening but it’s true,’ Timmins said. “We will only invest in entrepreneurs we believe can do extraordinary things.”

Should go without saying given the recurring attention on Austin being the hottest startup community of the age, that we’re doing that. No? And yet, not unlike your community perhaps, startups seem to be struggling with capital.

David Altounian, assistant professor of entrepreneurship at St. Edwards University did a study published last year with the Austin Chamber of Commerce and Austin Technology Council, on Austin’s venture capital economy in which he concluded that, “Austin generates loads of seed money to fuel young businesses but lacks the Series A, Series B and late stage funding sources.”

In February of this year, Richard Bagdonas, a serial entrepreneur in Austin, wrote a post “The Dark Ages of Austin Startup Capital” highlighting a disparity between the impact of Austin entrepreneurs and the capital typically available to them. And then Mike Maples Jr., a partner in Floodgate, reported that his firm will not invest in any more Austin based companies like Favor because of the Austin City Council’s recent regulations concerning ridesharing companies like Uber and Lyft and short term rentals that can be booked through sites like HomeAway.

Huh. So does the local economy and characteristics often beyond our control determine whether or not we’ll get funded? Do entrepreneurs need to be able to convey WHY an investor should fund them in the context of said investors’ experiences, considerations, and expectations?

We have to communicate and we must start communicating the things that matter to investors keeping in mind that investors are not bankers. Luke Tucker, Associate with Sultan Ventures, pulled together 69 tips for entrepreneurs culled from the minds of successful founders and venture capitalists. To help us grasp what matters, I pulled the first few as a reflection of the disconnect between startups seeking funding for what they’re doing and investors looking for Rick’s extraordinary entrepreneurs:

- Don’t worry that someone will steal your idea, worry that no one will care

- Do something you’re passionate about

- Build something people want

- Solve your own problem

- Focus on markets that you can dominate early

I read that first remark with a realization. In Silicon Valley I hadn’t been asked to sign an NDA in a decade and now, in Austin for a half dozen years, I can’t count how many times an NDA is requested. That simple, seemingly irrelevant thing, a document which lawyers and advisors suggest is in your best interest, is hindering extraordinary entrepreneurs from reaching investors that matter. Entrepreneurs who struggle to raise money invariably lead by communicating what they are doing and how. They talk about a Product Market fit for a problem they’ve identified and wrap up with the traction they have with customers; proof that they’re on to something.

Nothing more than proof that they’ve found some people who will buy and product or service that they care nothing about. How do we change the narrative? How do entreprenuers convey that they’re doing incredible things to the ideal sources of capital attuned to those things? How do entreprenuers first ensure that they are doing something in which they’re passionately and personally vested regardless of what potential customers tell them??

Start with Why

“As an entrepreneur, you’re really a little messed up, honestly…” shared Casoro Capital CEO Yuen Yang during our discussion, “Basically, we’re borderline crazy to begin with because we perceive risk differently, we perceive life differently, and we perceive our passions and things differently.”

Yung by the way was first Shark Tank guest to raise a million dollars on the show; the highest investment offer ever from investor Kevin O’Leary. Why is something incredibly difficult for most of us to convey. We understand and can communicate what we do, that is after all what we’re selling and what we know. Critically in an organization, someone, if not us, has to know how we do what we’re doing and thus naturally how becomes part of our narrative. Particularly with unsophisticated investors who are inexperienced with the product, technology, or model that we’re developing. But it’s the WHY that motivates co-founders to commit to one another, markets to shift to opportunities, new customers to be created, and investors to see opportunity.

Christie Barany and Courtney Turich, co-founders of Monkey Mat rounded out our panel of entrepreneurs and they proved to us the impact of this passion. Having invented a simple solution to an everyday problem that they had both experienced and in which they were both passionate and committed to bringing an innovation to market, in 2014, they added investors Lori Grenier and Mark Cuban to their team and secured the round of funding they needed to start to scale.

1. Why you? Why do you care?

2. Why will the market want it and why will it work?

3. Why do you need venture capital?

4. Why is this an opportunity for investors?

Why takes a little of that crazy as, as Simon Sinek (author of Start with Why) put it, “why is not about making money; that’s the result.” Can you think that way? Talk to me about what you’re doing in a way that isn’t about making money. Tell me why.

There is No Way to Prove Traction

It’s a bold statement but what I want you to consider is not that literally speaking, there is no way to prove traction but rather, that what proves an opportunity to investors depends. Texas State’s incredible advisors, Peggy Richmond, Mike Breck, Donna Taylor, and Dick Johnson rounded out our discussion with a thought provoking exercise that I’d encourage you consider doing within your own team.

We asked attendees to grab a post-it and place it on the wall indicating the amount of funding they are or have sought and the evidence of traction that they have at a given, relative stage. From entrepreneurs seeking $10,000 to established companies raising later rounds in the millions, the answers were as diverse as Paul Wright’s tag cloud. All valid signs of traction: securing grants or partnership, discovering cost per acquisition metrics, or capably defending a share of the market they’d hoped to achieve. Some with revenue at various stages and many without. Each fundable by someone, somewhere.

Evidence of traction comes in many forms and the traction you need to convey when raising capital is a matter of the purpose behind your raising capital, from whom, and why any investor would care. It all comes down to the simple yet elusive question of why.

Paul O’Brien I can’t make it. Will you ask two questions to the panel? 1) their perspectives on “playing not to loose vs playing to win?” 2) their perspective on growth vs scale (I am totally borrowing this from you!). I suspect there will be different answers from each category of investor (I hope) that may help entrepreneurs understand the right fit of investor for their company. Thank you.

Love the first one. Second one goes without saying I’ll explore but people tend to get hung up on understanding the difference so we’ll see if growing vs. scalability makes sense to people and is easily addressed… either way, that discourse will prove valuable

The second one has totally changed my perspective. I really hope that difference can emerge in this and other conversations. The two questions are completely tied. Thanks Paul O’Brien for making these sessions happen!

After living in both San Francisco, New York, and Austin, I can say that Austin startups make more financial sense yet more funding go to California startups. I am not sure if it is a tax write-off strategy or something or the gold rush for the next unicorn or Facebook. While Austin typically doesn’t have the hockey stick growth, they are businesses. What I have seen in SF are mostly tech people building tech things for other tech people within the bubble. I’ve had term sheets from both California and Texas. For some reason, Texas always have the worse end of the stick. Maybe Texas is too traditional investing in older startup. Look at all the semiconductor investments by Austin Ventures. They’re not really around now are they?

Thanks for your experience Will, this is precisely what we have been and will continue duscussing! Why, if Texas based startups do indeed make more financial sense, are investors still heavy on the coasts??

First, how do you define financial sense as traction and opportunity mean a lot of different things to a lot of different people?

Besides that, the only logical explanation, that which we’ve been uncovering, is that that financial sense isn’t what investors are seeking or understand OR entrepreneurs are still falling short in other measures.

Maybe we need to understand how to achieve hockey stick like growth (scalability as I put it – cc. Bart Bohn). Maybe traditional investors simply aren’t there yet and if so how can we develop that? And no, many older companies are no longer around but perhaps that’s a critical factor to consider too… are they gone because of regional economics driving failure or are they gone because of exits driving investor ROI? Perhaps we’re failing to understand what happened and exploring investor opportunity in light of that.

Likely, it’s all of those things and more hence the need to elevate the sophistication of startup funding discussion from What to Why.

Can y’all elaborate on this growth vs scale concept? Or email me about it?

Chris I try to use the word scalability instead of scale as I’ve learned that’s a bit of why people get confused. Start with the thesis about the flaw in customer validation, that anyone can find customers; with enough effort, Sales can drive growth. Is that fundable? The point of these discussions with Texas State is to explore that and the implications.

Of course, growth is fundable but such growth is traditionally/typically funded by banks. Investors seek multiplied valuations that come from things like operational efficiency, market dominance or at least a defend-able corner, team, opportunity, optimization, and scalable growth – not just growing but the know how, ability, and evidence of that ability to grow exponentially. Showing you can acquire customers, proving you can grow, by no means means you can scale that growth.

This is why economists such as Drucker harped on the fact that Marketing is not customer adoption but the most important and distinguishing investment in business. Marketing, not advertising nor Sales, is the practice of scaling growth; knowing the market and how to optimize the business.

Too many entrepreneurs relegate Marketing to a budget line item with linear expectations: X spend = Y return and in a startup, that only proves that you know how to acquire some customers. That proves that you know how to service a round of financing; not that you know how to build anything worth investment.

Thus the challenge. Today’s economy has perverted Marketing because traditional marketers still can’t grasp digital/tech and online marketers are abandoning the core tenants of Marketing. Business owners are hiring people who are effectively no more than sales professionals with a marketing title and new ventures struggle to scale. Investors, who don’t understand how to do it (nor should they), defer to Lean Startup principles and keep encouraging that in lieu of the evidence of the exponential growth potential they’re seeking, founders should focus on customers… and we find our economy in a vicious cycle in which very few things break out and drive real supply for significant sources of venture capital.

Scalability is NOT easy. There is a reason few ventures actually find significant success but if we don’t demand scability, fund it, and teach it, than startups will continue to merely chase customer growth and while they will (may) find success that way, they’re far less likely to achieve valuations appealing to most venture capital investors – perpetuating the cycle.

Some older thoughts here: https://seobrien.com/growth-architect and https://seobrien.com/startups-getting-funded-without-revenue

Bart?

This is great. I very much agree. The most common feedback ATI entrepreneurs get from early stage investors is to “just go get a few more customers.” The result of this advice seems to be that by focusing exclusively on incremental revenue generation, the startup is prevented from focusing on figuring out the mechanism for scale. If that can be figured out, the company is positioned for exponential valuation increase, not linear.

Several *excellent* points here, Paul. Thanks. Maybe my takeaway is a corollary to those you shared. Even if an entrepreneur does have the answers to all an investor’s questions, he/she has to know the right sequence and focus with which to present them. We probably have been leading with the ‘how’ and the *customers’* ‘why’ more than the investor’s distinct ‘why’. Next time we go looking for funding we will apply this.

Back with a question (or several). Digging in on the distinction of VC versus angel aims regarding risk, do you think there are any meaningful differences in the *kinds* of risk that are relatively more or less concerning to either group ? Do all kinds of risk really get combined into a risk against ROI in their minds ? Do you think that is more true or more scientific among VCs ?

Paul O’Brien you always have great advice

Appreciate greatly hearing that Mai Chaudhary ! Thank you. All we can ask of anyone is that they try to help best they can ??

You’re on a roll. I am so damned happy with these scoops.

Thanks Steve. I increasingly find in most startup advice, that it’s upside down or backward – which is not to say that it’s wrong, but that when founders preach conventional wisdom, while struggling, it’s usually because they aren’t seeing it from another point of view.