This is a country with the continent’s most stable democracy, solid credit ratings, one of the fastest-growing economies in Africa over the past fifty years, and the world’s largest diamond producer.

Having just released our research into why venture capital avoids regions of the world, my attention turned to Africa because the continent is arguably the most intentional about addressing that; my saying so is because a week doesn’t go by where an ecosystem builder or policy maker there isn’t reaching out, trying to fix the challenge of funding for startups.

Botswana punches way above its weight. But when it comes to startups? It’s stuck in the kind of economic limbo where angels fear to tread, and venture capitalists stay home, waiting for something… Family offices are known for only investing in “cattle/farms” as an asset class.

So how does a country that ranks higher than most of its peers in governance, economic management, and infrastructure still fail to attract meaningful early-stage investment? Starting with history, culture, and context, since it should be clear to you now that I’m adamant that its first about entrepreneurial culture, I grabbed Global Entrepreneurship Network Botswana Managing Director and PULASPACE General Partner, Mooketsi Bennedict Tekere, a “third generation entrepreneur,” and recently “exited” the position of Board Member Advisor for the Government of Botswana’s Botswana Digital & Innovation Hub, to help dissect why sufficient venture capital avoids Botswana and what can be done about it.

Article Highlights

History, Culture & Industry: Botswana’s Economic Story

Botswana’s story is the anti-cliché of post-colonial Africa. After independence from Britain in 1966, the country discovered diamonds and managed them prudently. No resource curse here. Botswana saved, invested, and turned its diamond windfall into schools, roads, and clinics. The Botswana Unified Revenue Service, robust sovereign wealth funds, and consistently low corruption (Transparency International ranks it among the least corrupt in sub-Saharan Africa) speak for the opportunity today.

Culturally, the kgotla system persists – traditional town hall meetings emphasizing consensus, listening, and measured action. That’s excellent for governance and civic cohesion, but perhaps less so for startup risk appetite. Unlike Silicon Valley’s “move fast and break things,” Botswana’s culture encourages cautious, communal progress. So, ideal or needs to change? Though different than California’s culture, keep in mind that it isn’t *that* culture that matters to investors, but distinction and a preservation of culture from history, inspiring people to do great things on behalf of their community.

Industry remains mostly in diamonds (~70% of exports, 25% of GDP), with tourism (world-class safaris), beef, and a modest financial services sector rounding out the economy. The natural capital is abundant. The institutional trust is high. Where my head is turning is Grit and Tough Tech (hell, diamonds as a brand??).

What’s missing? A diversified economic base, startup infrastructure, and a culture that celebrates scalable risk-taking even among the consensus and measured action.

Africa-Wide Venture Capital Trends: A Framework for Context

Before digging into specifics, let’s take a step back and see how Botswana fits into broader regional VC trends. According to Africa: The Big Deal, startups on the continent raised $1.4 billion in H12025, marking a 78% increase over H12024, with 238 deals of at least $100K and 39 rounds over $10M. These are strong indicators that African VC is alive, but extremely concentrated.

The bulk of these deals are funneled to just four countries: Egypt (31%), South Africa (26%), Nigeria (15%), and Kenya (12%). Sectors? FinTech leads (46%), followed by health tech (14%) and energy (10%). West Africa dominates deal volume since 2019, largely because of Nigeria. In short: VC in Africa is growing, but it’s not spilling into Botswana as much as it might and perhaps should.

“Botswana does not have any existing venture capital, that’s why I am pioneering this space in Botswana through the vision to raise a $25M fund but it will be domiciled in Kigali, Rwanda,” observed Mooketsi Bennedict Tekere. “Unfortunately, there is no incentive in Botswana or infrastructure to lobby the VC type capital to domicile in Botswana. Botswana has plenty of Private Equity firms which do not consider high risk digital businesses as part of their thesis or investment mandate. Botswana also does not have an “active” angel network community. It’s very unfortunate for such a wealthy country, that not a single tech vc fund exists that writes cheques to its own future. The government wants to do everything – there are examples: P87.7 billion of all pension funds in Botswana are investing outside Botswana. If any local investment the pension funds do not have any mandate for funding emerging technology industries or the new digital economy startups.”

How then does Botswana compete with the likes of Mauritius? How does Botswana become the future Singapore or Dubai? How does Botswana become a digital economy or diversify without instruments to fund its future? Why would VCs come to Botswana?

Why Venture Capital Avoids Botswana

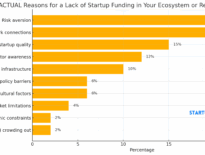

We’re going to draw heavily from the published results in “Why Venture Capital Avoids Your Startup Ecosystem.” Botswana checks too many boxes needing attention:

1. Confusion: small business vs. startup. The current policy focus is on micro-enterprises — bakeries, crafts, salons — not on scalable ventures. Grants and loans can’t substitute for VC’s risk-electric energy.

2. Broken capital stack. No cohesive funnel. A few angels, sporadic grants, but no pre-seed, no consistent accelerators, no repeatable deal flow. Without pre-seed confidence, Series A stays out of reach.

3. Misaligned ROI expectations. Entrepreneurs treat funding as a grant, government wants jobs, banks want collateral, and VCs want 20x returns. No one shares a baseline but that said, they shouldn’t – each needs to be investing where appropriate to their impact and expectations.

4. International friction. Lack of streamlined wire transfers, unclear equity laws, tax headaches, and regulatory opacity make Botswana a global VC challenge.

5. No sector thesis. Without identifying an area of concentrated advantage, like African EcoTech or that grit/tough concept, maybe leaning in on energy, Botswana remains invisible to funders hunting cold, hard patterns.

While off track from what draws venture capital, all of this can be addressed. Precisely why we asked the question why VC avoids regions of the world, to give local leaders and policy makers a direction to focus on what matters.

What Africa’s Data Tells Us: Where Botswana Falls Off

Even as continental numbers boom, Botswana isn’t part of the story. H12025’s 238 funded startups? None from Botswana feature. The hot sectors have VC velocity, but Botswana’s economy hasn’t built pipelines to existing FinTech, HealthTech, CleanTech, or EcoTech demand.

“Botswana’s startup ecosystem is not organized or mapped and there are no specific verticals of focus where startups, industry, universities are all trying to solve that domain i.e. Agritech, Cleantech, etc, it would be natural that Botswana being a country with sun all year round should be leading on renewable energy startups – but again no story there,” shared Bennedict. “Again Agritech, a country always teased for having 5 million herds of cattle and 2.5 million people yet only has one Agritech startup known since 10 years (Brastorne, MAgri – by Martin Stimela and Naledi Magowe – the only Botswana startup that has been mapped as having raised VC capital from the Google Black Founders Fund and InsurTech Alpha Direct by Arun Iyer – having raised significantly from VCs in the U.S; two successful startups Botswana has failed to mirror as successful models for new emerging industries). Why aren’t there more? A country with the highest spend of education and healthcare by GDP, should be leading the African continent of EdTech and Healthtech, yet zero results here.”

Botswana’s diaspora network is less financially mobilized for startup investment than, say, Nigeria’s. The ecosystem lacks high-profile exits or anchor investments that attract attention. Without a trailing VC unicorn or attention grabbing startups, Botswana stays off the heat maps.

With institutions like the Botswana Digital Innovation Hub and the Botswana Innovation Fund in place, it’s time to evolve the conversation—from simply celebrating impact to asking why venture capital still hasn’t taken root as robustly as one might expect. This isn’t unique to Botswana; around the world, cities with incubators, accelerators, and angel networks are grappling with the same puzzle: why does capital remain elusive for the entrepreneurs these ecosystems are built to support? As Mooketsi noted, it appears that none of the startups supported by these organizations have yet gone on to secure follow-on funding from angel investors or venture capital firms. It’s a moment to reflect on how these resources can more effectively bridge the gap between early support and scalable investment.

Mooketsi goes on, “Most startups in Botswana solve artificial problems, there is a serious lack of quality startups and solving real problems. This is caused by universities who fail to mentor and align students with practical innovation methodologies where we could be forming partnerships with MIT and Harvard to do R&D. Botswana needs help, it has to start with basics startup and VC 101. Economic diversification for Botswana is not an option anymore.”

So What Should Botswana Do to Fuel Entrepreneurs?

To stop being the polite kid in the venture room, Botswana needs strategic scaffolding; again, grounded in the “How Startup Ecosystem Builders Start Ecosystems” framework:

1. Founder-Led SDOs, Not vs. Government-Run Pet Projects

Botswana needs accelerators, venture studios, and incubators helmed by alumni founders, not line ministries or UNDP grants. Look at success stories like Ethiopia’s IceAddis or Kenya’s iHub: they succeeded precisely because entrepreneurs, not bureaucrats, drove them.

2. Founders Are the Product, Not the Customer

Charging fees or requiring equity up front kills momentum. Subsidize access via telcos, banks, or corporates, who benefit from innovation without overpaying for it.

3. Stand Up Actual Capital Infrastructure

Create SPVs and angel syndicates, onboard Botswana diaspora investors, invite regional VCs (e.g. Knife Capital, E3 Capital, Partech), and give them credible local GP partners to facilitate risk assessment and deal flow.

4. Align with Academia, Government & Media

Universities must support IP spinouts. Regulators must facilitate equity. Media must celebrate risk-takers, challenge gatekeepers, and raise visibility. Storytelling matters as much as capital.

5. Build a Sector Thesis: Botswana as Ecotech Mecca

Leverage natural biodiversity, sustainability credentials, tourism-infrastructure, and stable governance to own the “African EcoTech” vertical: wildlife conservation drones, blockchain-powered sustainability traceability, climate-smart agriculture, tourism-tech platforms, and bio-economy innovations.

6. Pipeline Inclusion Opportunity

Africa: The Big Deal flags gender gaps: female-led startups represent only 5% of Series B/C deals and raise 4% the capital. Botswana could leapfrog with women-founded EcoTech and AgTech funds, tapping both inclusion and specialization.

Botswana and Startup Purpose

Botswana doesn’t lack talent. It lacks a thesis.

It doesn’t lack capital. It lacks pipelines.

It doesn’t lack startups. It lacks a scaffolding to turn ideas into fundable ventures.

But here’s the kicker: continental VC is surging; $2.9 billion over 12 months, with rising deal flow in the first half of 2025. Botswana stands outside that growth curve. It needs to decide whether to be a spectator, or a player.

The Founding Partner of Pulaspace which comprises Ngwana Africa startup incubator, Spaghetti Valley Venture Studio, and VC fund Pulaspace Capital, Mooketsi Bennedict has spent over a decade supporting startups and building the innovation ecosystem in Botswana and Southern Africa.

Developing a pan-African fund with Ernest Bosha from Nigeria, Pulaspace’s platform currently has 1000s of startups in an investor marketplace and partners across the 4 regions of Africa with over 31+ innovation hubs – that puts Pulaspace at the heart of what we’re advocating. They are currently raising a $25M dollar fund to be domiciled in Kigali, Rwanda under the Kigali International Finance Centre and managed through a Delaware corp in the U.S. Any interested parties should get in touch here.

The path forward is clear: professionalize startup infrastructure, align expectations, carve out a signature vertical, and build the institutional scaffolding for VC to thrive.

Venture capital isn’t charity. It’s not going to come just because Botswana is polite and well-run. It will come when there’s a return to chase and a system built to absorb it. That means founders must stop waiting for grants. Government must stop treating startups like job programs. And investors? They need to turn their gaze toward Botswana by first expecting more from the ecosystem and financially supporting that work.

Great article Paul O’Brien and Mooketsi Bennedict Tekere! Very interesting take on the VC landscape for #Botswana. Curious to see what this will look like in the near future.

Adeo Ressi would like to hear your thoughts on how we solve this together.

Jonathan Greechan, add this to our agenda

This is very interesting, Paul. Someone else told me about Botswana. As someone from the diaspora who’s exploring VC in Africa, this is great info. Appreciate you and Mooketsi Bennedict Tekere!

A very insightful and honest piece

Thank for this powerful reflection, Botswana’s stability is both a blessing and a curse. Innovation thrives under pressure, but here, bureaucracy and heavy government reliance dulls urgency. I love how you termed tech programs/start ups as “pet projects,” its sadly extremely accurate. We only succeeded by intentionally looking beyond Botswana, no one funded us until we proved regional relevance. The state of affairs is quite unfortunate.

Thanks for co-authoring this, Paul O’Brien. It seems the most valuable insights often do not come from being told what to do, but from combining expert frameworks with shared experience and peer learning. Botswana needs the help!

Thanks for sharing, Paul

This was very insightful and moderately alarming but also encouraging to know that there’s hope for Botswana to improve it’s VC landscape with experienced leaders not sitting on the sideline but taking charge ? thank you for Mooketsi Bennedict Tekere and Paul O’Brien for sharing this . It’s well written

Beautiful article, only wish for the powers that be to read n understand the impediments. Doesn’t help much when such brains are removed from a position that could afford them ability to influence from within. Do not despair Mooketsi, someone in power will see the bigger picture someday. Congratulations on the article.

Gobusamang Dempsey Keebine in most of my work, I find that the people who need to hear it most, won’t. Makes for an interesting set of questions…

Is it because they don’t know what to do so they avoid the exposure?

Is it because they don’t actually care and just pretend to?

Is it because they get what they want merely by making it seem like they’re trying? Their goals are not what we think?

Fully agree

what we need to develop in Africa is the exit ecosystem for companies that will give a path for investors to cash out. Today that path is almost non existent.

Tailored ecosystem design, unlocks venture capital.

Aligning policy with scalable innovation, attracts investment.

Really great piece, Paul. You’ve captured what many of us on the ground have been feeling for a while. If we want to see real startup growth in Botswana, we have to make it easier and more rewarding for people to invest. Right now, there are no tax breaks or incentives to support those willing to take early stage risks. And without proper employee share schemes, startups can’t compete for the kind of talent that drives innovation.

It’s not just about funding, it’s about building an environment where both investors and teams feel it’s worth the leap. Thanks for putting this on the table and i hope it stimulates policy reform over time.

Tomi Davies Fadilah Tchoumba Botswana’s ecosystem could certainly benefit from your insights.

Kagiso E. Mpa it would good to hear your thoughts

Great analysis Mooketsi Bennedict Tekere Paul O’Brien

—it’s refreshing to see such a candid breakdown. Botswana has all the ingredients for a thriving VC ecosystem, yet clearly the dots aren’t connected. The shift from viewing startups merely as job creators to scalable engines of growth needs urgent attention. Your point on creating an “EcoTech Mecca” leveraging Botswana’s strengths in biodiversity and renewable resources stands out particularly. With visionary alignment between entrepreneurs, academia, diaspora, and policy-makers, Botswana could swiftly move from sidelines to spotlight. Hope key stakeholders take note—there’s enormous potential waiting to be tapped.

Iyinoluwa Aboyeji Great startup ideas aren’t born – they’re built. How do we disrupt this into a mission?

Ephraim Modise TechCabal Moonshot by TechCabal TechCrunch The future of Venture Capital is changing very rapidly, and the mainstream media is starting to take notice.

What if Botswana has all the right pieces for a thriving startup economy, but they’re stuck in the wrong places?

This is brilliant, and exactly the systems-level insight Botswana needs right now.

What Vumbua is proposing isn’t just mapping; it’s metacognition for ecosystems. It’s how we think about how we think (and connect) across roles, resources, and roadblocks. That shift from describing activity to designing connectivity is the missing layer I tried to highlight in Botswana’s Startup Paradox. And it’s precisely what most well-meaning initiatives miss.

Too often, ecosystems throw more accelerators, events, and workshops into the mix thinking “more ingredients = better recipe.” But if founders don’t know which role to talk to next, and funders can’t see the pipeline forming, no one can act. Visibility is viability.

Botswana doesn’t need to manufacture potential, it needs to wire the circuit. And from what I see, Vumbua and Pulaspace are building the switchboard.

Let’s go from ecosystem inventory to ecosystem intelligence and let Botswana be the model of how to do it right.

I recently attended a strategy meeting on AcFTA hosted by Ministry of Trade. When it was time to debate, all the comments were coming from government officials. As you alluded on this article, my intervention was why are non business people drawing a strategy for business people. This has been the culture for decades, probably from independence. If indeed we want to transform and diversify our economy, why do we still rely on a paternalist structure of technocrats which tells us it knows best and excludes us from the decision-making process…reducing other stakeholders to a cog in the system. We have to up ante on policy formulation and not rely only on civil servants & politicians for information. Those in power have to realize that ownership of a state is a shared initiative.

Exactly, policy without practitioner input is just theory. Until founders, investors, and builders are at the table, we’re not designing strategy, they’re drafting fiction.

Government has overcrowded the private sector in Botswana for the longest time. That killed innovation, entrepreneurship and created an environment where people depended on government for everything even the so called private sector. The tender economy sapped the drive to push boundaries and make things happen to a point where VC investors would find it attractive to come and put their money in Botswana. The culture of government freebies too destroyed the spirit of entrepreneurship.

Well put, Paul

Dr Lone Nthobelang (Ph.D.) , MBA, BA(Hons)

Laura Kinnard, MBA thank you for the tag. It’s an excellent article Paul O’Brien .

What about coal bed methane gas as a transitional form of energy from coal to green energy??? Kalahari Energy Botswana has been trying to get this project off the ground for over 20 years, with little or no VC! Botswana needs to make VC MUCH easier in order to gain traction…

CBM is a perfect transitional asset, but 20 years of struggle shows the deeper issue: it’s not about the tech, it’s about the system. Until Botswana streamlines VC pathways and aligns risk with opportunity, innovation will stay stuck in neutral.

An excellent article which clearly differentiates the requirements for start ups versus small businesses.

Very informative article!

Paul Wilson, Jr. Lets go to Botswana and build a Ecosystem…

Absolutely! We can engage the ecosystem that’s already there and help it to grow! I met the co-author of this article Mooketsi Bennedict Tekere while at the Global Entrepreneurship Network conference in Indiana back in May, and we had a great discussion. We should all jump on a call to discuss how we can connect.

Paul Wilson, Jr. Did my article actually connect people and start something!? YES!

That’s exactly the kind of momentum entrepreneurs need; organic connections becoming real collaboration. I’d love to jump in too and help align the pieces for growth. Let’s make it happen?

Very insightful article.At the back end a lot of questions come to mind.On culture, to what extend is entrepreneurship embedded in our culture?Are our legal frameworks conducive to attract VCs?This here article is a muse for an entire thesis!

Botswana’s beaurocratic maze is the mammoth hurdle.

This was such an insightful and probing read. Going forward I’ll be eagerly following and learning whatever I can about venture capital and what it will take for Botswana to actually act on it.

Wow! I went to Botswana ?? about 10 years ago and it looked nothing like that! I saw the nature and sights, not the big city.

Important reminder that venture capital follows scalable frameworks, not stability alone. Botswana’s EcoTech potential is undeniable if the right scaffolding emerges. Paul O’Brien

TechCon Global True of everywhere to an extent. We should be putting the same principles in place in San Diego

Really glad I found this article I’ve been searching for something like this to understand why the startup culture in Botswana hasn’t yet truly taken off. It’s encouraging to see someone lay out the gaps (capital structure, sector focus, risk appetite) so clearly. As someone building in this ecosystem, it helps ground what feels abstract into concrete levers that need pulling.

Get connected with Mooketsi Bennedict Tekere

Happy to connect him if you want to DM me