Startup Funding Isn’t Broken, It’s Behind

Ready for a spicy topic likely to frustrate some friends in my criticism of good intentions? Let’s begin with a blunt but necessary truth: venture capital isn’t broken, most of it just doesn’t know what the hell it’s doing. The problem isn’t capital. It’s experience. And the startup ecosystem, especially outside of places where people worked on the internet-based economy on which we rely today, has been playing a dangerous game of telephone. One that has left a trail of misinformed founders, confused investors, and an entire culture of entrepreneurial theater designed to soothe the ignorance of those with money rather than empower those with ideas.

It is essential to recognize that startup funding isn’t broken, but rather, it needs a better understanding of the fundamental principles that drive successful ventures.

We’re living in the aftermath of an innovation boom that nobody finished explaining. In the past 20 years, we’ve seen a glut of books, courses, podcasts, and pitch decks all frantically trying to explain what a startup is, how to build one, how to fund one, and how to exit one. But a YouTube tutorial on how to skydive, most of it is being written by people who work in skydiving but have never jumped.

That image, by the way, is a depiction of hell from “The Garden of Earthly Delights” by Hieronymus Bosch

What happens when ignorance runs wild: when humans reject reason, foresight, and moral grounding

Startups, for all the jargon, are still pretty simple: Team > Market > Solution > Sales. That’s the formula. Has been since Fairchild Semiconductor, will be long after the latest SaaS-on-AI-for-blockchain-gamers implodes. I know you want to throw Funding in that mix, but it doesn’t belong, not until you’ve put in the work – and we know you aren’t putting in the work because most of the books, podcasts, and questions, pertain to what you should have accomplished through the work. Rather than reinforcing that simple, brutal truth (Team > Market > Solution > Sales), the industry has responded to widespread investor ignorance by building “solutions to overcome ignorance” -> buzzwords, acronyms, and frameworks designed to give the illusion of understanding:

- CAC (Customer Acquisition Cost)

- LTV (Lifetime Value)

- MVP (Minimum Viable Product)

- NPS (Net Promoter Score)

- Lean Startup

- Agile

- Unicorn

- Platform thinking

- Network effects

- OKRs, KPIs, TAM/SAM/SOM

- blitzscaling

- Blue Ocean

Most of these aren’t bad. They’re just being used to pretend understanding and then ask of you, the founder, questions that seem meaningful in order to hide ignorance. They were never meant for someone scribbling wireframes in a coffee shop. They’re the comfort blankets for investors and advisors who feel unqualified to evaluate founders on what actually matters: vision, traction, team, and marketing.

For example, a pre-seed founder getting grilled about their CAC. What CAC?? They don’t even have a consistent funnel yet. It’s like asking a farmer about the yield per acre when they’ve just cleared the land. But because someone heard others asking about CAC, they think that’s what diligence looks like. I have never asked a founder their CAC because if I don’t know how they would acquire customers, at what cost, and the marketing involved, I have no business pretending the metric means anything.

It’s not diligence. It’s cosplay.

The hard truth? Most startup investors today didn’t come from startups. They came from finance, consulting, real estate, or because they made their money elsewhere and want a piece of sexy community of startups. They weren’t at PayPal. They didn’t build anything at Google. And they certainly didn’t live through the cultural petri dish of Silicon Valley that taught us how internet-era innovation behaves: erratically, disruptively, and with a completely insane level of obsession.

Notice, I’m NOT saying Silicon Valley does it right or even better – my point should be very evident that decades of actually building the internet means that people who have been there (working on the internet, anywhere) are far more qualified in what’s possible in innovation in our “Information Age” than that Oil & Gas tycoon who wants to show up at Demo Day.

(I told you we’d be spicy and piss off some people but FFS come on, stop pretending you know how to scale an AI-based platform for video just so you can sit in the room; leave it to the people who know it and stop asking about Customer Validation as though their answer means something to you)

Founders, bless their hearts, try to meet the expectations of investors who dangle checks while asking about MRR; not because they’re ready, because they want funding. And thus, the theater of metrics begins.

We’ve become so enamored with books and buzzwords that we’ve forgotten what startups are for: solving problems that actually matter. Look around, there’s no shortage:

- CRMs still suck.

- Dating is transactional.

- Parental alienation is an unaddressed epidemic.

- Mental health is collapsing under digital pressure.

- We’ve optimized our diets into chronic disease.

- AI is eroding trust faster than Facebook eroded privacy.

- Childcare has no infrastructure to support it.

- Clean water is gone and what water remains is sucked dry.

- Social lives are behind screens.

- Government is administrative bloat.

- Forget privacy.

- Pharma has turned prescription into addiction.

- Do you want to put your parents in a nursing home??

- Most edtech is just video lectures with tuition.

- Startup ecosystems themselves are pretending, through coworking spaces.

The problem isn’t a lack of problems. The problem is lack of obsession: with solving, not selling. We don’t need more founders trying to get rich. We need people so personally invested in fixing something broken that they couldn’t stop if they tried.

And yes, that is what great founders do. They fixate. They build. They listen to their market obsessively. They test relentlessly. They don’t need 40 customer discovery interviews or a “validation” checklist, they can smell the problem in the air and refuse to breathe anything else until it’s fixed.

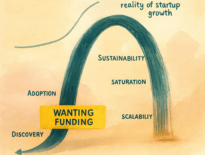

So why so many podcasts on validation? Because too many in the startup world don’t actually know what it means to build a startup. They’re explaining a dance they’ve never danced, watching from the bleachers, yelling advice based on outdated books and pitch competition templates. Call this what it is: a misalignment of comprehension. A gap between what founders actually need and what ecosystems, incubators, and VCs think they need. And in that gap, we find the real danger: the illusion of progress. Pitch nights. Accelerator demo days. Mentors who’ve never built anything. Advisors hoping to close business as a consultant. VCs asking about TAM before the product even works.

You want to “fix” startup funding? Great. Stop asking founders to explain CAC before they’ve sold anything. Stop forcing Lean Startup on someone who just needs to get a prototype in front of five people. Stop building playbooks for comfort and start cultivating understanding.

That means educating investors, not just founders. It means platforms and communities that train people to recognize real potential, not just pattern match to whatever Andreessen Horowitz wrote this month. It means rebuilding our startup support systems around outcomes, not optics. We’ve lost our ability to think critically in this space. People want templates. Answers. Certainty. But startups are the art of uncertainty. The truth is, there is no answer, only relentless experimentation until the market says “yes.”

So, the next time someone throws an acronym at you like a magic spell, smile and ask them what problem they have that an answer solves. Chances are, they won’t know.

Sharp and to the point! mic drop

This hits me right in the gut — in the best way.

As a founder, I have huge respect for VCs. We need them. They’re essential to getting bold ideas off the ground. And honestly, I hope to be one myself someday.

But wow, if even one VC (or associate) reads this and truly gets it… we’ll all be better for it.

Bravo Paul O’Brien for saying the quiet part out loud.

I’m emboldened with time… as everyone keeps complaining, and startup communities fall short of fixing their ecosystem, we need to be harsher about the circumstances because it’s the entrepreneurs who pay the price.

Thank you for sharing Lisa!

Paul O’Brien I couldn’t agree more. Thank you for being bold. I felt like I was reading a story about myself as a founder when I read your article. It was a bit freaky actually! I’ve been asked all of those things. And I often wonder if it’s just a punch list or a real desire to know. Anyway, thank you for giving the topic a voice. It’s appreciated.

I knew it was cosplay years ago, and I stopped participating. It was evident in Houston.

Dexter Bayack don’t I know it…

Still, potential there. Maybe I should do a hit piece on Houston

Thanks for sharing, Lisa M

Hear hear!

I’m lost in a sea of acronyms. Do you have a glossary to go with this article?

Don P. That was kind of the point

I think it’s important to point out that “Solution”=SOMETHING TO SELL. A Guaranteed Outcome that delivers a clear Impact, Benefit and measurable Value to a specific kind of entity (could be a person, group, business, government, etc.) in exchange for a specific amount of time, energy, money, etc. Too many founders conflate great technology or expertise with “this is what I sell” It’s not the same thing. And you don’t have a business unless you have something to sell. Period.

Nicholas Alter Absolutely agree. Crucial distinction. A solution isn’t just innovation or expertise; it’s the translation of that into something someone is willing to trade for value. That clarity (who it’s for, what it changes, and why it matters) is where most founders fall short, especially when they’re deep in love with their own tech.

I harshly go even a step further that a lot of what gets pitched as a “solution” isn’t even a clearly defined problem. It’s a feature in search of a user. Until there’s a guaranteed outcome for someone specific, it’s not something you can sell. And if you can’t sell it, it’s not a business, it’s a project.

LOVE

This is a truly dope article. Check out, Paul O’Brien’s “Startup Detroit: From Cranks to Code; How the Motor City Is Revving a New Engine” – learned some stuff myself about some of the history and current things going on in the Motor City. #Detroit #Ecosystem #Tech #Innovation #Venture #Investment #RenaissanceCity

Appreciate you sharing it! Detroit’s one of those cities where the past, present, and future are all colliding at once (in the best way). From Motown to mobility tech, it’s a story that keeps evolving. Grateful it resonated with you.

Keep looking for this emoji high-five in the reactions, because YES – all of this! I’ll even take your comments a step further. When I hear a pitch from a pre-revenue, just-barely-post-ideation founder, and they start throwing around TAM SAM and SOM with a whole bunch of zeroes, they’ve immediately lost credibility with me. Tell me how many customers you have NOW, how many you will have in 1, 2, and 5 years, and how much those customers will pay you to solve their problem. I am far more impressed with a founder that tells me a solid plan for getting the first 10 customers, then the next 20, then the next 100 – with data-driven answers as to how much each of those customers will realistically pay them – than I am with all those zeroes. Keep preaching Paul O’Brien!

Brooke Beeler I really should do a deep dive on that TAM/SAM/SOM slide soon. If your “Obtainable Market” is north of millions, with my investor hat on, I’m going to sit here and wait for you to do it — SOM means what you can do without me. SAM is where you frame what you can get with help.

Love it

Nicholas Alter Yes! Or, said differently, “Solution” = SOMETHING SOMEONE WILL PAY FOR (with addition from Paul O’Brien) that solves an actual problem, in a way that no one else can or has.

Paul O’Brien Once again, you’ve put words to concepts I’ve been trying to wrap my head around. As a relatively new angel investor, I’ve struggled to understand why some of my more experienced colleagues spend so much time and effort diving into metrics that, at the end of the day, are total guesses. But it’s qualitative, so I suppose it gives everyone the illusion of insight.

I’ve gradually gotten to the point when the main thing I’m looking for are founders obsessed with solving meaningful problems. That kind of obsession is obvious when it’s there. And it’s real – no guesswork required. But this approach often makes me feel out of step with my fellow angels.

What you’ve got me thinking about now is this: if you truly buy into the “team > market > solution > sales” formula (and I do), how would that change an investor’s approach to early-stage due diligence? I think the answer is that your due diligence would become way more focused on the founder and the team, and would start looking more like a job interview where you were hiring 80% for character and 20% for skills. I could be off-track, but I’m gonna keep exploring in this direction.

Michael Bob Starr yes!! Obsession, for years, not just to build something or make money, but I *need* to fix or do this. Most don’t actually have that, they’re attracted to entrepreneurship, need funding for a business, or with good intentions just hope they can.

End of the day? Obsession or not?

Paul O’Brien I also see many founders who are merely infatuated with the shiny new solution they’ve developed. They can make a product, so they did. Some of these solutions *are* pretty amazing; heck, I think a lot of them will probably make good money. But obsession (with a problem) > infatuation (with a solution), at least for me, and I will invariably pass on these deals.

cc

Joshua Sutton, CSPO more insight to that due diligence question

Spot on!

‘venture capital isn’t broken, most of it just doesn’t know what the hell it’s doing.’

Too true, what other industry would accept an investment success rate of well under 5%? VCs need to dramatically improve their performance or AI agentic investing (by LPs directly) will soon wipe them out. Founders are regularly reminded (by customers) of their weaknesses, it’s past time for VCs to humbly recognize theirs…. but I’m not holding my breath.

Steve Jennis Exactly, and that 5% “hit rate” is often celebrated as though it’s a feature, not a bug. In most industries, that level of performance would either force a redesign of the model or bankrupt the operator.

Part of the issue is structural: VCs rarely get the equivalent of a customer telling them they’ve missed the mark. Their feedback loop is slow, distorted, and buffered by fund size and reputation. Founders live in the market every day; investors too often live in a spreadsheet (or their perception).

Agentic AI investing could absolutely compress that gap but only if LPs learn to evaluate more than just pattern-matched decks and late-stage metrics. Otherwise, it’ll just automate the same misunderstandings faster.

Paul O’Brien There is a huge opportunity for an AI investment agent that can do better than a 5% hit rate (and for much less that 2&20). If I were an LP that’s where I’d be investing.