Why Most Investors Are Wasting Their Time Ignoring Emerging Fund Managers

Wednesday, 12 March 2025

The most prevalent reason why I always raise my hand to speak, moderate, or host an event, is that while written content reaches millions or podcasting helps people see or hear your tone and passion, it’s only through live events that one can read the reaction of an audience, and in real time nuance the

- Published in Startup Ecosystems

20 Comments

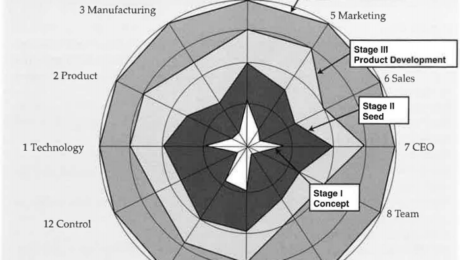

The Bell Mason Diagnostic and First Principles Thinking in Venture Capital

Thursday, 20 February 2025

Why Venture Capital Needs a First Principles Overhaul Venture capital is broken. Not in the “bubble’s about to pop” and certainly not in the sense that so many are pissed off because they aren’t getting funded, but in the “founders keep getting bad funding advice from firms still operating on outdated, ineffective methodologies” sense. In the

- Published in Raising Capital, Startup Ecosystems

Time for Congress to Reform the SEC’s Outdated Accredited Investor Definition

Thursday, 06 February 2025

Public policy isn’t just a framework for startups and investors, it’s a gatekeeper deciding who gets to play the game. And few policies are as restrictive as the Securities and Exchange Commission’s (SEC) definition of an “accredited investor.” This definition has long determined who can and cannot invest in private securities offerings (i.e. startups), not

- Published in Startup Ecosystems, Startups

The Rookie Mistake Investors Make Getting into Venture Capital

Tuesday, 02 April 2019

Venture capital investing is the riskier version of gambling in Las Vegas. Truly. 90% of startups fail. FEW are experienced with discerning any difference between those likely to fail and those not. What’s the rookie mistake in venture capital investing? Being a rookie. Without experience in startups, your odds are against you as much as

- Published in Insights / Research, Startups

On the Challenges Facing an Angel Investor

Wednesday, 14 November 2018

Angel investment is a distinct *source* of capital that it’s important to distinguish from “seed money,” funding from angel groups, venture capital, money from an incubator, or even an early investment from someone with later stage expectations. In my time in Silicon Valley, with New York, and in Texas, what is glaringly obvious is that

- Published in Startups