Everything is bigger in Texas, under the Lone Star. Real estate is as Texan as Oil & Gas, with even ranches here that are larger than some states. What recently struck me was the discovery that, according to the Bureau of Economic Analysis and National Association of Realtors, Texas Real Estate accounts for roughly 14% of the State Domestic Product. 14% of everything the State produces is a result of land, development, residential and commercial, construction, and related growth from ground to big sky.

Compare that with Oil & Gas, which is actually only 15% of the Texas economy, and you start to wonder why everyone still thinks of Texas first and often only as oil.

Article Highlights

On the Convergence of Industry

We’ve said nothing yet of tech and though Texas’ role in technology is substantial throughout the world, through brands like AT&T, Dell, and Texas Instruments, Texas is generally considered a Tech industry in a generic sense. With Texas Instruments Texas even in name, I’d bet you couldn’t find an average person on the street who can tell you why Texas technology for any other than generic reasons: low cost of doing business, a lot of talent, healthy economy. That, rather than the home of the Search, PC, or Mobile industries, Texas merely is tech, with Dallas and Austin leading a path as tech oriented cities (… let’s not belabor the recent Uber debate coming out of Austin which is trying to refute that).

Wherein is Texas’ dominance in innovation?

Innovation of course is born of the convergence of invention and market. Innovation without a market is merely invention and inventions sold can build businesses but rarely transform industries. It’s the culture and market of an ecosystem that turns businesses into economies through industry.

Somewhat confusing thought no? Think of it in the context an industry in another world. S. California and the film industry. Ever wonder why and how Los Angeles came to drive the culture of Western world for the past century? Why is that the southern region of California of all places, gave birth to Hollywood and why, though we have film studios elsewhere in the world and even brands such as Sundance and Cannes, film is still LA?

The first noted instance of photographs capturing and reproducing motion were thanks to Eadweard Muybridge in Palo Alto, California (interesting… where we often first think of technology, no?). Thus, California! But no, it’s not so simple. Thomas Edison was among the first to produce a machine to do this, the kinetoscope, by way of New Jersey and as a result, at one time, Fort Lee, New Jersey was the motion picture capital of America. The cities and towns on the Hudson River and Hudson Palisades offered land at costs considerably less than New York City across the river and benefited greatly as a result of the phenomenal growth of the film industry at the turn of the 20th century.

Film-making began attracting both capital and an innovative workforce, and when the Kalem Company began using Fort Lee in 1907 as a location for filming in the area, other filmmakers quickly followed. In 1909, the Champion Film Company, built the first studio and they were quickly followed by others who either built new studios or who leased facilities in Fort Lee New Jersey.

Thanks to New Jersey, in New York, the Kaufman Astoria Studios in Queens, was built during the silent film era and used by the Marx Brothers and W.C. Fields. The Edison Studios were establised in the Bronx and as film makers began seeking new sets for their stories, major centers of film production grew in Chicago, Florida, Texas, California, and even Cuba.

In many respects, this sounds like the growth of the technology industry from N. California, with the early semiconductor work on the eastern seaboard and in Austin, TX serving as those remote locations. Note though that from that early technology, to epicenter of tech for the better part of the last 30 years, N. California served a dominant role while other locations sprung up like the studios of the film era.

In many respects, this sounds like the growth of the technology industry from N. California, with the early semiconductor work on the eastern seaboard and in Austin, TX serving as those remote locations. Note though that from that early technology, to epicenter of tech for the better part of the last 30 years, N. California served a dominant role while other locations sprung up like the studios of the film era.

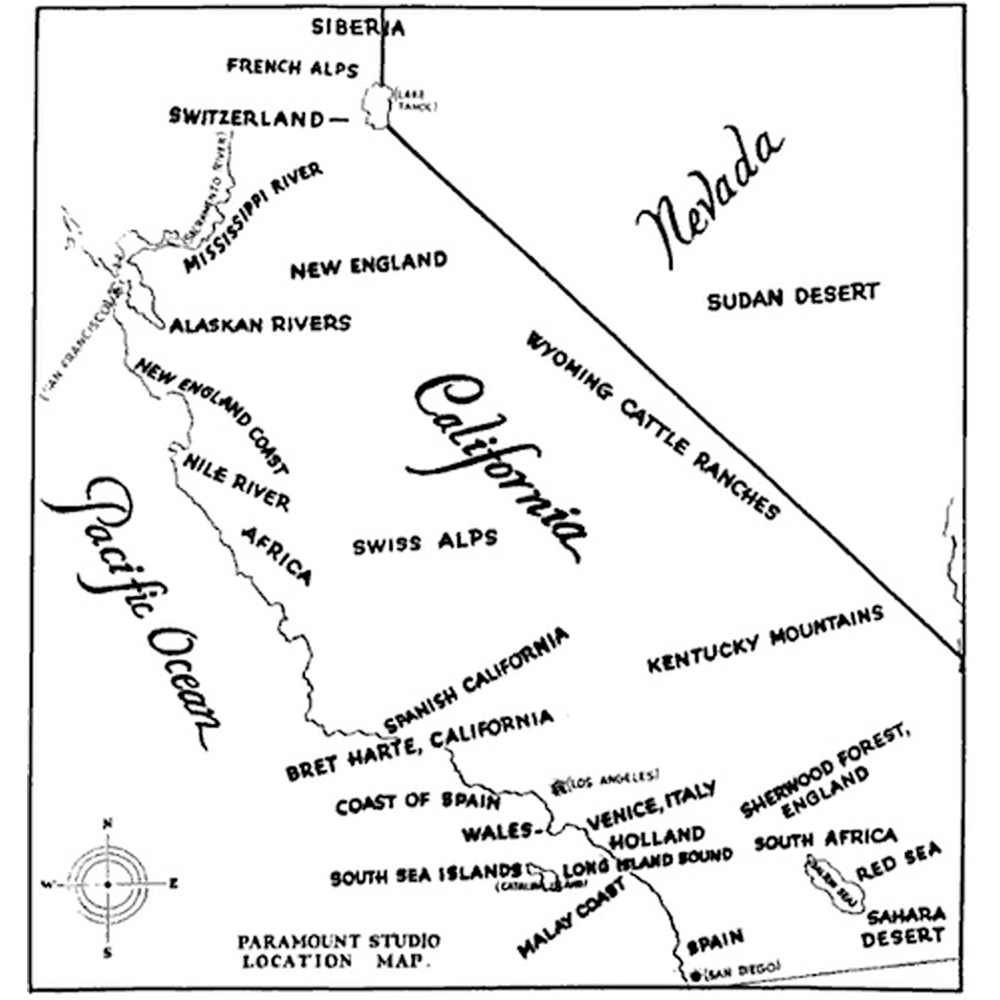

When that changed though, WHY S. California, is that patent wars in the early 20th century (yes, tech patent wars over the camera) pushed producers even further from the New Jersey and New York roots, back by sheer coincidence to the birthplace of the motion picture: California. Entrepreneurs seeking a better market for the development of their trade, fled from regulation toward a less stringent environment. Because of the favorable weather, cultural appeal of reaching the coast, and the varied geography of S. California, Hollywood was born. Take a look at that map, real estate made Hollywood possible.

What on earth does that have to do with Texas?

Regional industry drives economy and such industries are born not of entrepreneurship but market: The proximity of Detroit to midwest shipping enabled the auto industry, the density of and cultures of New York immigrants fostered banking and finance at the point closest to European centers of wealth, New York, the market of LA served our entertainment industry, and Palo Alto gave rise to technology.

Or did it? What technology in particular is it that we’re so inclined to think of as being thanks to Silicon Valley?

“Technology” is a misleading term in the context of grouping like businesses. The wheel, after all, is technology; as is the car, radio, and Uber app. Each though was born in a different part of the world. Everything is in technology so the question we should be asking of Silicon Valley is not why it is our technology industry, because that’s not accurate, but rather WHAT tech oriented industries are significant there? search engines, social networks, internet infrastructure, the PC, etc.

The market of Palo Alto gave rise to much of the technology we know today because of the characteristics of that market: military investment, progressive University system, and relatively wealthy region of the world… thanks in part to the far older industry of gold.

Bottom line, that market gave rise to our information age in working to distinguish itself, just as film had done, from the print and the existing computing industries. Yes, Silicon Valley developed through distinguishing itself from computing (which was really born in Europe and Pennsylvania before the semiconductor moved it to Hewlett and Packard’s garage). Silicon Valley birthed the internet.

Think about the implication of that. What are the market charactistics of that environment? Military pressured development of cheaper, better, faster data exchange. The reasons for it being there, unlike LA’s geography or the ranches and oil rigs that rose in Texas, we’re as geographical as they were cultural. And now, that technology exists.

From Tech to Texas

All of that roundabout narrative to get to a punch line. What of technology in other industries?

I recently explored how Big Data is actually finding its market through Texas. That the significance of our education, healthcare, employment, and other economies is turning to that information infrastructure to disrupt old established industries with new ways of dealing with data.

Having written that, my thoughts turned though to the idea of capital and from where the capital comes to fuel each of those industries. Detroit was fueled by the transportation barons of old, for example, who made it one of the crossroads of the midwest and funded the auto industy. Begging the question of that deployment of technology in traditional Texas industries…. from where does the capital actually originate?

15% of the economy is in Oil & Gas and 14% of the Texas economy is in Real Estate.

Does it not follow that, perhaps more than energy, Real Estate & Technology are uniquely Texan territories?

With an exceptional amount of land, wealth therein, massive immigration, sprawling development, and more, what better market is there for innovation through Real Estate Tech than Texas?

Texas Real Estate Tech

Before moving to Texas, my wife and I spent a couple weeks in Dallas and I’ve had the pleasure of getting to know Blake Burris and Trey Bowles; both then, and even now, entrepreneurs through real estate. Burris introduced me to coworking from a house while Trey was building The DEC in the side of a strip mall. Both catalysts of Dallas entrepreneurship.

We settled in Austin but still, the role of real estate in the Austin tech and startup communities remains foremost. Where matters. Years ago I was heavily invovled in Austin’s early coworking community which then, and now, served to foster technology and innovation and when Capital Factory opened downtown, entrepreneurship found a more concerted home and a catalyst that has driven more real estate by way of Galvanize and not one but two We Work locations as well as a dozen more properties working to foster entrepreneurship. The evidence doesn’t end in Austin as I got to know Nick Longo who, with one of Texas’ most significant tech companies, Rackspace, put geeks on the map in San Antonio, Luis Escobar and VenturePoint‘s network of properties, and, not long ago, Peter French, Clayton Thomas, and team (whom I’ve not yet met) started the transformation of San Antonio’s Houston St. into ground zero for S. Texas technology. Meanwhile, the DEC has flourished and with an eye to the importance of proximity, Dallas’ Techwildcatters, The Grove, Level, and The DEC moved to a part of Dallas along with Dallas Fort Work, Kowork, and Workstyle along the urban rail, and started the greater transition from a property to entrepreneurship to that of real estate developing industry.

Now, I’m not intentionally excluding Houston, I just don’t know the narrative there as intimately so let me look to Marc Nathan, Kirk Coburn, Michele Price, Blair Garrou, and others to lay out the past and future of Houston’s geography and technology.

But those work spaces aren’t the point at which I want you to arrive. Having painted a picture of the role real estate plays, look back to that question of venture capital. Throughout Texas, an exceptional number to technology angel investors work through real estate with Acquila, Cielo, SkylesBayne, DEN Commercial, CBRE, and Colliers names recognizable to tech professionals. Not just as real estate brokers but advisors, sponsors, and local champions of growth.

But those work spaces aren’t the point at which I want you to arrive. Having painted a picture of the role real estate plays, look back to that question of venture capital. Throughout Texas, an exceptional number to technology angel investors work through real estate with Acquila, Cielo, SkylesBayne, DEN Commercial, CBRE, and Colliers names recognizable to tech professionals. Not just as real estate brokers but advisors, sponsors, and local champions of growth.

Why? Because a root of the Texas economy is real estate. And as we have been doing with other industries, technology is coming to roost.

Yesterday, the Austin Business Journal announced “Austin tech company scooped up by PE firm.” That headline was a little lackluster; that company, Accruent, makes Real Estate Management Software.

In San Antonio, Rising Barn is building micro homes while Mass Venture first introduced Texas to crowdfunding for real estate. Texas isn’t just home to the obvious real estate ventures but RealMassive, Smart Home Hero, RealSavvy, Leaseful, IdealSpot, Dwelo, Homads, Kasita, of course HomeAway, Aldea, Datafiniti, and the work Bradley Joyce is doing to incubate real estate technology and in particular, his efforts with Skyrise. More than that, because of the constructure and land, Texas is home to SmartTouch Interactive, RealStarter, MatchDwell, Balance Development, TurnKey, Real HQ, LeaseBuddies, GroHomes, LightHarvet Communities, Plum, Robin, Tuffwerx, Gridmates, Renovate Simply, LookNook, LawnStarter, and Renew, ApartmentRatings.com was founded in Texas, as was Vast!

And what is the implication? Hopefully it’s apparent – Our path to venture capital, our experience in innovation, and our demand for technology is through real estate; from the bricks and mortar that accelerate entrepreneurship to the demand for data about dirt. An industry is not as broad as “technology” but nor is it as narrow as what you might think when one says “real estate.” Texas is the Real Estate Tech industry, as no where else in the world does the collision of capital, experience, ambition, demand, and supply exist from an audience so experienced with real estate that it’s demanding innovation. From smart homes to smart building, Texas tech is real estate.

I want to invite you to join me in such discussions live and together.

Join me online here

Just going to leave this here https://datafiniti.co/str-sxsw/

TurnKey, Real HQ, LeaseBuddies also.

Leaseful.com in Dallas too 🙂

@idealspot is one ATX Seed just funded too

Homads – Austin based! We’re currently out of Capital Factory. 🙂

I think Apto started in Houston and moved to Denver.

Go TX RE Tech! Honored to be in the mix!

Awesome topic you landed on Paul.

GroHomes is another company out of Austin, TX that is bringing tech to Texas real estate. We are making home ownership more accessible earlier in life, by offering a sequential building system that is flexible with a homeowner’s budget and space needs.

http://www.grohomes.com

http://www.AldeaApp.com in Dallas as well

YES, Apto started in Houston. We hosted their founder Tanner at Startup Grind Houston last year the day before they publicly announced their latest seed round as reported. Too bad since Tanner told us all that night during Startup Grind that we could not have broken the great news on our watch.

https://www.bizjournals.com/houston/blog/2015/08/exclusivecommercial-real-estate-tech-company.html

MatchDwell

Homads.com is another Austin born start-up for sharing housing in terms of sublets.

Thanks for the support. We think Texas is the best place to be for what we are building!