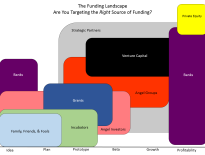

Of late I’ve been exploring, discussing, and working with Austin’s venture capital economy. We’ll not belabor the ongoing discussions of the state of venture capital, lack of funding, future of financing, and otherwise here; rather, what struck me as potentially helpful is a mere layout of where venture capital is found.

Certainly, before we can do that, we have to define what we mean by venture capital and thus, in this regard, we’re not exploring Austin’s vibrant incubator scene nor the meetups, events, and talks at which to connect with investors but rather what we might consider later stage venture funding. Picturing the landscape of Austin, TX, I think it’s important to understand where venture capital lives, literally. In turn, as entrepreneurs we might ask ourselves if we’re expecting funding to come to us OR if we’d benefit from going to where venture capital can be found.

Does where matter?

As is the case with any other business, a venture capital firm is an entity not unlike your own. A startup if you will, serving investors of their own (LPs) and bringing a product to customers (capital for startups). In that light you can appreciate how venture capital firms have a distinct market, they serve to address a problem with a solution, and they need to meet the expectations of those constituents so as to deliver an ROI. As such, they need to connect with you; VC Firms need to bring their product to market.

But unlike your business, unlike a startup introducing a new product or service to customers, we might consider that we have those definitions of a venture capital firm’s market backwards. That is, perhaps the investors are their customers and you, the startup founders, are the product. Intriguing, when you flip the idea of the role that a VC firm plays – rather than bringing the capital to you it might be fair to say that their primary focus is bringing a portfolio and fund performance to their investors. Considered that way, you can appreciate why they aren’t just catering to you, the entrepreneur, but rather you need to cater to them.

All that makes it sound awfully technical and impersonal so don’t read into my inference too much. Venture capitalists are certainly working to serve entrepreneuers and new ventures, and indeed invest as much time, if not more, in working with startups. My point only was to challenge our perception of them so as to embrace why where they can be found matters.

Austin’s downtown has exploded in the past few years, so much so as to cast an impression of Austin that may not be the complete picture. I’ve talked about this before, how NW Austin is home to most of Austin’s tech and startup history and thus remains a critical piece of the regional pie. It’s through that exploration of our history and tech economy that I’m driven by the impact of place and how mere distance drives economy.

Think about Silicon Valley for a moment (please, I know it pains us to do that). San Francisco itself is no where near the breadth of scope of the Silicon Valley economy as Palo Alto and Sand Hill Road (largely considered the epicenter of the regional venture capital community) is 45 minutes away. While we in Austin often think of taking a trip to California to raise capital in so too, frankly, do the entrepreneurs there travel – you travel to spend time on Sand Hill Road. Is Austin really that different? So, having distinguished separately how to think of early stage startup resources, let’s talk about venture capital alone.

Austin’s Venture Capital Firms

Regardless of how you embrace the idea, the fact is institutional venture capital (that is, firms built to fund companies, rather than Angel investors or networks/programs to help you) is found at the crossroads of where venture capital lives and works. So where in Austin is that found?

Meet the Bridgepoint office complex. Not exactly what you picture when you think of Austin’s Town Lake or popular West 6th (yes, I mean West and not East) but that might be where to visualize the physical center of Austin’s venture capital economy. A once home of Trilogy, which has played a significant role in Austin’s venture development, Bridgepoint isn’t where you’ll find most venture capital firms but with a few there, and the crossroads of the 2222 and 360 freeways, it’s essentially the centerpoint.

Meet the Bridgepoint office complex. Not exactly what you picture when you think of Austin’s Town Lake or popular West 6th (yes, I mean West and not East) but that might be where to visualize the physical center of Austin’s venture capital economy. A once home of Trilogy, which has played a significant role in Austin’s venture development, Bridgepoint isn’t where you’ll find most venture capital firms but with a few there, and the crossroads of the 2222 and 360 freeways, it’s essentially the centerpoint.

Interestingly, given all the debate and frustration regarding Austin’s traffic, that centerpoint exists because of our infrastructure. When you look at the regional distribution of Austin’s tech and startup companies here, you see that outside of downtown (not highlighted there) we have a concentration of innovation at the intersection of the 183, 360, and 1 freeways. Accessible from downtown by way of the 1 (Mopac) you have to note curiously why tech companies aren’t littered along that freeway but rather up and down the 360; the outer loop of Austin. Where matters.

| In my time here it goes without saying that Austin is an ecosystem of collaboration and collision. Always willing to make an introduction or connect personally with entrepeneurs, those that drive the economy forward are those that connect. It goes without saying though that that time spent is not without costs so you’ll find in Austin that the those collaborative collisions occur efficiently through coordinated coincidence. Yes, the poet in me is coming out. Simply put, WHERE is your time best spent? Working in data science and engineering? Your time is best spent around Galvanize and their new campus on the west side of downtown. Working in eCommerce you might find yourself in NW Austin more than anywhere else as you’ll find Bazaarvoice, BigCommerce, Volusion, and more in the region.

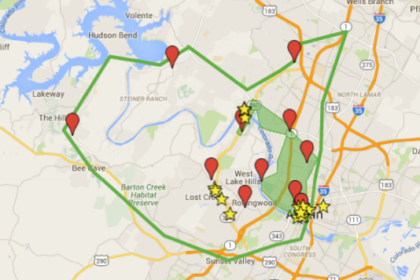

My time spent most frequently with the venture capital community I work to support is along the 360 cooridor. To help show that, I’ve plotted the landscape of not just institutional venture capital firm offices but the coffee shops and restaurants where you’re most likely to coincidentally collide; places like 360 Unos, Lola Savannah, Triannon, and Mozart’s. In the map to the right, for the sake of our visual representation of the venture capital ecosystem: Yellow stars are firms and Red pins are meeting places. As a bit of a heatmap, I’ve roughly highlighted wherein the density of such meetings take place and then more broadly circled the range of where you’re likely to most frequently engage potential investors. |

Notice how the characteristics of the region, roads, tech, entrepreneurship, and wealth, result in an odd density of venture capital collisions and how the money and the entpreneurship pull one another along the Mopac and 2222 freeways between 360 and downtown.

As an entrepreneur you might ask yourself if time is well spend along those corridors connecting with S3 Ventures, LiveOak, ARCH Venture Partners, Guggenheim, G-51, Duchossois, Triton Venture Partners, Silverton, Vista Equity Partners, Arena Growth Partners, Next Step Capital, Tritium, ATX Seed, Diversity Fund, and Recurring Capital. And that’s by no means an exhaustive nor up to date list; merely, a representation of where to think about your time spent.

More than that perhaps, as a startup ecosystem, you can see why infrastructure, costs, economics, and history matter and for Austin we should be conscious not just of of where but why and how our economy of entrepreneurship is thriving.

GREAT info, THANK YOU!

Interesting. Next, we need a map of the locations of all of the companies that have been financed during the past couple of years.

Yes! Hey Joey Martin… I think I mentioned something along those lines re: the map you made of Houston smile emoticon (and I didn’t know we shared an ASU history!)

It’s something I’ve been working on in Houston for the past two quarters and will continue here for as long as I can. Reg D filings require an address, which is what I use for the sourcing.

Oh man, I bet a graph model/visualization of this stuff would be neat.

know anyone who could/wants to? Lots of folks have discussed it and have data points.

or you know we could just shrink the bike lanes and expand the road width

This would be great. I would also have a box for out or region.

Unfortunately there is no venture capital in Austin, Texas. A nice thought and idea though. Imagine the possibilities if there was.

Bah it’s here just unwilling to make itself known

yes; because it isn’t here

Most Austin start ups are seed ventures or off shoots of other cities stuff. Which is cool and good. Sometimes that’s best.

Austin is too small of a metro area with a lot of competing objectives to be a huge VC hub. But again it doesn’t matter that much. Money doesn’t have to be local.

Man you’re stealing the thunder of my next article

Great insight as usual , thanks so much

Many points to discuss and or argue

Being heavily involved with both investors and start ups around the Austin area , I can see the next cluster of yellow stars developing around The Domain area as highly probable

Great article. I think Knotowski has a point. Serial entrepreneurs may do a seed round in Austin then head to the coast for the A & B.

First timers typically do the accelerator & angel thing then seed fund route.

Either way your A and definitely your B are likely to come from outside Austin… For now at least.

There is more ecommerce in Austin – Magento is here as well.

Ha, I think I’ve done a tech deal of some kind at every one of these places except Unos 🙂 Austin Java (on Parkway Ln/12th) is no more though. It’s a shame… I saw all kinds of stuff happen there. I wrote my most popular open source software there while the Favor founders regularly sat next to me building the biz they sold to HEB. I met 2 cofounders there and regularly ran into the TechStars folks when they opened up the ATX branch.

There were also a lot of deals made at Monkey Nest and Cherrywood Coffee.