Our year has started with a flood of curiosity about Venture Capital not just in how to raise funding but in consideration of how funds work, what it takes to get a job at a venture capital firm, and whether or not VC is broken or needs to change. Certain of 2022, given the recent years of innovation, entrepreneurship, working from home, and the “Great Resignation, the world is considering the role of venture capital.

Years ago, in a discussion of private equity, I shared an observation that Venture Capital Firms are rather like the philanthropists of our economy. That notion, then was met with some derision as it was the brief era in which Venture Capital was increasingly criticized for not funding everyone. Granted, Venture Capital is incredibly high-risk investment and not analogous to a non-profit, it seeks a return on that investment and indeed looks at financial metrics in consideration of an opportunity, and yet, more and more people have been awakening to the fact that Venture Capital has Social Impact. The notion as remained a bug in my brain, and in our experiences with things like Founder Institute’s VC Lab (exploring new models and investment theses in venture capital), it is increasingly clear that it’s a fact not without merit.

Hence, some context to what I want to explore with you here. That there is more to raising capital than a pitch deck and evidence of traction, because what Venture Capital investors are seeking, the reason they all invest in great risk likely to fail, is because their interest is far more than financial. They seek impact. And in appreciating that need for impact, we can better appreciate that raising money isn’t analogous to the Sales Funnel throughout you just churn contacts until you close your round, it’s more like a flywheel: a cycle with which, over time, your impact grows, and delivers greater value and opportunity to investors.

Article Highlights

The Funding Flywheel

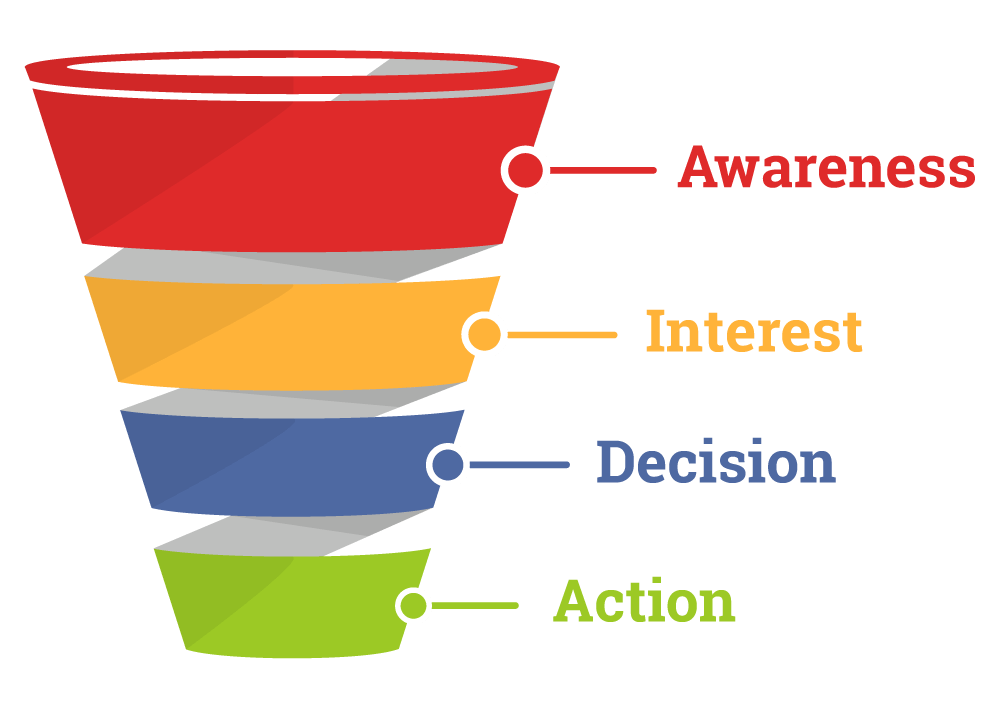

Businesses and startup founders learn early of a critical methodology in sales referred to as a funnel. Developing products and services, marketing is the process therein by which organizations get to know potential customers and then profile people so as to better understand the needs and motivations.

The goal, of course, being the conversion of people as buying consumers or business partners.

Around the turn of the last century, advertising executive Elias St. Elmo Lewis developed the idea of the funnel; first noting in The Western Druggist, in 1899, that the function of advertising was “to catch the eye of the reader, to inform him, to make a customer of him.” Little more than a decade later, his thesis developed, noting that advertising is meant “to attract attention, awaken the interest, persuade / convince.”

In time, studies of his work broke down this funnel into four stages: awareness, interest, decision, and action.

Not an unreasonable way to think about raising capital, is it?

- Create awareness – cold email or get warm intros to investors being the work usually considered

- Spark interest – if you have traction, and a fit with the fund or partner, you pitch

- Decisions are made – you go through due diligence and term sheets are offered

- Action – an investor cuts you a check. Simple, right?

Throughout most of history, this funnel made complete sense and helped businesses and marketers profile people and plan campaigns to meet the expectations of each piece of the funnel. This is the most renown and celebrated process in marketing and sales! The organization would work together to reach more people, improve the process of moving people from one stage to another, and to uncover new channels through which to reach others or introduce new products with funnels of their own. All to close a customer.

It’s even obviously applied in our work in media.

- Disney runs trailers before movies in theater and teasers on Amazon Prime, creating awareness of the next Avengers film. But consider, that’s in fact NOT the awareness stage of the funnel… the movie industry planted awareness in much more subtle ways before then: the clip leading to the next film after the credits rolled at the end of the previous, leaked news on reddit, and our beloved actors dropping hints to Jimmy Fallon.

- Interest is generated by our teasers and trailers.

- As the film date approaches, commercials are aired, word of mouth encouraged, and more talk show hosts chat up our actors. Interest is steered toward a decision to see the film; now we know when and where it will play.

- And act we do, with news of the box office opening take, pictures from the red carpet on Instagram, and talk of the movie on radio and podcasts, we find ourselves at the bottom of the funnel taking action.

In 2014, David Edelman and Francesco Banfi, with McKinsey & Company, proclaimed The funnel is dead.

While a concept easily considered and explained, it neglects too much. How do we know what product to bring to market? What do we do when an audience doesn’t yet exist? Is that the end? Do we not continue to engage, support, and consume what has our interest?

Edelman and Banfi called the end of the funnel because the touchpoints between a brand and an individual are so great and varied (in large part thanks to the internet), that it’s no longer meaningful enough to treat the customer journey as simplistically as a funnel.

Raising Capital is NOT a funnel with a start and an end. The investors you want are on a journey with you and seek more than that close of a round or return on investment.

The touchpoints between a startup and an investor are so great and varied (in large part thanks to the internet), that it’s no longer meaningful enough to treat the investor so simplistically as someone you’re pitching.

“Without the ability to understand their customers, companies will find it difficult to be where their customers are,” added Edelman and Banfi. “Part of the reason that companies are having trouble understanding their customers is that customer behavior itself is complex.” If the connections I’m drawing here aren’t smacking you upside the head, replace the word “customers” with “investors”

Without the ability to understand investors, startups will find it difficult to be where their investors are. Part of the reason that companies are having trouble understanding potential investors is that investor behavior itself is complex.

“The channel-surfing customer of today is often expanding the set of choices and decisions after consideration. Customers now are also often actively engaged with the brand – and their friends and peers – after they’ve bought the product or service using social media and the Web.” – Edelman and Banfi

The funnel is dead.

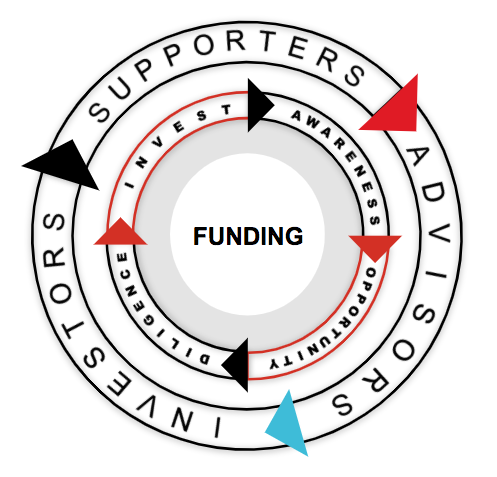

Think Funding Flywheel

If you’re familiar with the concepts of centripetal force, a flywheel directs energy at the center around which it’s moving and as momentum is applied to our center, a greater velocity is experienced as we move further from that middle.

Raising capital, we might [over]simplify our approach to investors and rethink a “funnel” along this flywheel. Here’s the funnel:

- Awareness is still the right word to use in our Funding Flywheel, and I’m sure you already contemplate how to connect with investors; how to create in them awareness (and interest) in what you’re doing.

- Opportunity is what sparks interest in investors and it’s opportunity that you must manifest in your venture. Whether that’s uncovering a Problem and Solution or validating a Market/Product Fit, investors seek a use of capital that will create greater value in what you’re doing (and deliver a return) – an opportunity.

- Diligence refers to the familiar process of Due Diligence in funding; that investor’s decision is a result of doing diligence on you, your team, and your work. Their goal in the process is to get to know you and the startup, reduce risk, and familiarize themselves with how their capital will be put to work, beyond what the pitch deck informs.

- Invest as that is after all the action we’re seeking in this case. Act.

Marketing’s funnel is dead and so too should die your perception that this is a narrow process with an end in mind. Having secured capital does not mean you’re done, does it?

It’s paramount to appreciate foremost as a founder that your relationship with investors never ends (unless you choose to make it so or otherwise neglect them). Having received the action in our flywheel, an investment, we keep the wheel spinning right back around to awareness as we create awareness of the funding itself, what it means, and as we publicize and promote our plans as a startup from here. That in turn creates greater awareness with investors and opens up new opportunities at greater valuation.

And our funding flywheel spins.

What spins at the extreme edge of the velocity we’re accelerating is not just securing the funding but the role that these stakeholders play throughout the stages of your startup.

Before being funded at all, our audience is investors. We’re creating velocity with (momentum with) the investors in whom we hope to create awareness and opportunity. As our wheel spins, some investors, before being our investors, become supporters. These are investors who take the time to have coffee, give a little feedback here and there, introduce you to others, and join your LinkedIn page or Facebook group. Such supporters are relationships that you’re developing with people meaningful to your venture, people who can and will get more involved, with advice. Some supporters become advisors and with even greater momentum, advisors become your investors; investors who keep spinning the wheel as supporters themselves, at least, some more so as formal advisors (Board Members perhaps), and with enough velocity, such investors will participate again in future rounds of funding.

Fundraising with a Funding Flywheel in Mind

Flywheels are acted upon by three fundamental considerations:

- How fast you spin it

- How much friction there is

- Of what and how it’s created (how big it is and how much it weighs)

The ventures most successfully fundraising all three in mind.

As with any flywheel, its speed is increased by applying force where most effective and efficient. This is where shifting your point of view from a funnel really shines because as a funnel, your mind is probably fixated on “meeting investors,” “contacting investors,” or “pitching investors,” you’re at the top of the funnel, haphazardly trying to toss more into your process with that elevator pitch > 10 slide pitch deck > financials > term sheet being your funnel to close. That isn’t how it works.

If your startup hasn’t yet created much, or yet established sufficient opportunity, apply force there and get your wheel in motion: Create an opportunity, consider the diligence an investor would do on your startup, invest YOURSELF in some growth or attention, and investors will take note. If your startup has an opportunity, say you have a patent you can license, but you’ve not invested your time and effort into turning that patent into a commercialized venture, apply more force first there and get your wheel spinning.

As we spin, we’re going to encounter friction. Friction slows our flywheel; while you may still someday secure funding, you’re adding months to the time it will take, because of misalignments or pressures preventing your momentum. That licensed patent isn’t just an opportunity with potential, it’s a friction that needs to be released with the right agreements and terms; if that patent holder has restrictions in place: friction. Does marketing agree with and align with what your product roadmap is planning to release? Are you connecting with investors where they’re found or where you find convenient for your sake?

Our process of diligence in the wheel? Uncover and reduce friction.

Finally, and very seriously, appreciate the weight and size of your flywheel because this is a set of considerations that often makes founders question their sanity. Such as: More customers is actually a heavier flywheel.

Let me repeat that: More customers is a heavier flywheel. Why are established companies less nimble? How do startups accomplish what innovative companies with immeasurable resources can’t?

That oft cited advice that it’s all about the customer or that the customer is always right? In innovation, within startups, it’s rarely entirely true.

A heavier wheel requires more energy and momentum to spin. Customers come with expectations, demands, and bias; customers can mislead, and customers can distract.

But before you go doubting customers and thinking that I’m implying that you want a light and easy to spin wheel, appreciate too that a heavier wheel produces a greater energy as spun (that established company has far greater momentum because of customers – weight). Density of your flywheel creates a momentum that’s more difficult to arrest but likewise a wheel that takes more effort to spin. Support your wheel with an exceptional team, a competitive advantage, and operational excellence, and you have a wheel created with density that will perpetuate with more velocity as you get it up to speed. Your team spins the wheel and the place to first spin isn’t as a product or startup but with supporters and advisors connected to investors; as that wheel spins, the cycle of engagement about your startup spins more naturally and easily:

- Awareness : Promoting your work. Do you have a community on LinkedIn, AngelList, or elsewhere? Is anyone in the media, locally or otherwise, socializing what you’re doing? Are you networking at events or working away in isolation?

- Opportunity : A fundable startup is one in which investors will be able to draw from it a return. Knowing what return you’re capable of providing is the place to start. Is your startup prepared to serve the expectations of a convertible note or are you still at a Friends and Family stage where those “investors” are prepared for the higher risk? What does an opportunity look like for Angel investors or bank loans? Are you developing the opportunity meaningful to Venture Capital?

- Diligence : Work backwards by understanding what will prevent investment and then overcome that. The due diligence through which any source of capital goes before funding you is pretty well established. If seeking a grant, can you meet the goals of that capital? Will the bank feel satisfied that you can pay it back? Will the check boxes on the due diligence list through which the Associate goes at Local Venture Fund prevent their funding you?

- Invest : Meaningfully put the capital to work by ensuring the investment of capital is not just cash in the bank, but a purposeful use of funds that spins our flywheel faster. And faster, keep the cycle going as we create greater awareness with that capital, uncover new opportunities, and remove the hurdles and other frictions that the process of diligence should uncover.

Notice how the cycle doesn’t end, there is no conclusion nor is there a start. You job is to come in at any point in the flywheel with least friction, most need, and most potential, and drive momentum. Start with Advisors or creating Awareness, make sure your MVP passes the muster of Due Diligence or build a more substantial community of Supporters – as each point on the wheel improves, put more effort into another consideration and accelerate.

With a flywheel in mind, we can approach the process of fundraising from any number of viable points on our wheel. Now, with this in mind, those blog posts, pitch decks, advisors, and incubators become meaningful in spinning your wheel so that you’re not just spinning your wheels.

Before I let you go, let me bring us back to my first point. Impact. Talking to an investor just to close capital and return value in their investment, is a very narrow view of impact. In a flywheel, that capital engages more supporters, creates new advisors, develops solutions and partners, and opens new doors to greater opportunity. Capital fuels experience and teaches the team who may not succeed this time but will likely try again. And the wheel spins thanks to the impact of Venture Capital.

A good strategy for creating attention flywheel during fundraising is to regularly post on social media at the same time doing outreach email to investors.

Engage with them by commenting and responding to their posts on different channels.

Yes! Great tip Riccardo Montis

It’s encouraging to see planned social impact as necessary for founders to raise funding. I see proof of product-market fit and a strong strategy for social impact as equal responsibilities of founders and the VCs who invest in them.

This trend also plays out on the other side of the equation as our society demands more advocacy from the brands they buy from. In today’s ecosystem, 87% of consumers are willing to buy a product or service based on a company’s advocacy and impact concerning a social matter. Customers want companies to take a strong stance on social change and they are increasingly being assessed according to their ethics. Companies that are listed on the World’s Most Ethical Companies list outperform the S&P 500 by 3.3%.

So, investors that require planned social impact and then help their founders create it, are in turn helping create more profitable startups and earning a higher ROI. It is really a win-win.

UX, education, and gender equity

This is a very interesting addition! A company should strive to do something positive while building their vision. It’s a great way to build a community around a product.

Funding for startups is increasingly tied to social impact. This makes sense, as strong social impact often shows a clear understanding of product-market fit and a long-term vision. Consumers are also driving this trend – they want brands with purpose! Studies show 87% of consumers choose products based on a company’s social stance. Ethical companies even outperform the market – those on the World’s Most Ethical Companies list beat the S&P 500 by 3.3%. So, VCs who prioritize social impact are actually helping create more profitable startups – a win-win for everyone!

Yes, When founders build social impact into their strategy from the outset, it not only attracts forward-thinking investors but also resonates deeply with consumers who want to align their spending with their values.

I wholeheartedly concur that each new business must have a distinct value proposition. They can successfully convey the benefits of business to potential clients and set their self apart from the competition by identifying the main issue that the target audience is experiencing and illustrating how their own product or service addresses that issue.

Great thought provoking concept here. One of the things I’ve been thinking about and have witnessed first hand is that the Y combinator based education/startup boot camp movement is still preaching a woefully out of date fundraising and investment model. So many cities have hopped on the bandwagon launching incubators and co-working spaces yet done little to build bridges to actual working capital or a true ecosystem for founders. On the flip side I’ve worked with startups who have landed all the investment bc they do have opportunity for impact only to find themselves over building a traditional sales team and an over built digital marketing automated strategy – subscriptions without connections or conversions. (SaaS sector looking at you directly)

I believe that driving impact will start becoming more in line with solving real world problems and bringing an audience along with it – or better yet actively involving them in it.

Hi! I’m working at a tool that enables founders to accelerate their growth plan towards investment readiness. Check out http://www.pitchago.com and take the initial assessment to reach some great insights and let me know what you think. Wud love your brutally honest feedback!!

If possible concentrate on generating awareness and revenue instead of finding a VC. MySmartRenter gets approached by a few VC’s a month because we innovated the instant confidential “landlord credit background screening System” (landlord authorization not required) which protect renters, off-campus students from scams, nefarious landlords before they apply/disclose any information as a safety precaution. Everyone who rents deserves to know who they may rent from first. We’ve been featured in Forbes, Boston Globe, Lifehacker and more before we started marketing.

Concentrate your energy on your business and VC’s will find you. A good VC knows how to search for opportunities.

Well written and on point…thank you for sharing.

Cheers Fred Pierce and great to hear from you! Part of a series in progress so the nod is wonderfully appreciated.

Paul O’Brien no worries…always happy to see someone “Walking The Walk”….

Brilliant analogy of the flywheel Paul O’Brien . I never even considered fundraising as a funnel really, just something to do.

But it makes so much sense. As Founders, we must have multiple flywheels running. Company, Customers, Investors.

Neil Beekie I love the fact that it’s multiple flywheels. Cheers my friend

I think we’re still moving from awareness to opportunity, so the pitch is on the way… sorry couldn’t resist

People underestimate just how much influence pursuing investors has on the product & business. It’s very easy to fall into the trap of changing direction to get investors onboard and lose focus on your real customers.

The longer you can defer seeking investors the better.

Same token, every investor says “you should have talked to us yesterday” referring to how founders wait too long to start the relationship (and it’s hard to plan and design a venture with investors in mind if you haven’t first spoken with them to know what matters to them).

Paul O’Brien very true, engaging early and getting an understanding of what they look for helps later on. The ideal time for both sides IMO is when you don’t need to do a lot of changes to the core product/business model to get investors excited to invest.

When the time is right it won’t be a lot of work to get investors to understand what the opportunity is and your ability to capture it.

Hello Paul, I love the impact of the flywheel concept in the context.

I would like to ask for clarification.

1- The sales models and their application in business strategies, already consider retention as a sub-strategy while referral is the bonus you have from those clients retained.

2- In my knowledge, MVM can be considered very similar to incumbents’ marketing research which includes competitors, targets identification and definition of the customer’s persona. And it happens before starting to produce significant prototypes and after-market-tests, where it is further refined and adjusted,

Why do the two points above look either new ( 1) or executed with a wrong prioritization(2) for New ventures? What am I missing here?

Sales models and applications really can’t be determined in startups. Some of the worst advice to would-be entrepreneurs is found among the “focus on customers” kind of perspectives, not because they’re wrong but because it’s easily misleading.

In Blank’s classic definition of startup, “temporary organization used to search for a repeatable and scalable business model,” we can better appreciate a fundamental FACT that searching for a model means we don’t know what it is. We can’t *know* the customer. We can’t prioritize sales yet, because whatever sale/customer we have, it likely wrong (or at least misleading).

“When a business model is repeatable, it means you can reapply the same practices repeatedly to create predictable results, be it revenue or user growth.”

That said, yes, retention or referral are valid secondary or sub-strategy metrics. We need to figure out who they are, how to convert, how to monetize, etc. first, then we can talk referral and retention.

I think what you’re studying would reveal that the metrics aren’t wrong, they’re either prioritized poorly, misunderstood, or prematurely tested.

1. Prioritized Poorly – you can’t focus on that if the rest of the model is flawed

2. Misunderstood – is the data you have good or bad? Do you know why? A referral to bad customers is wasteful. A poor retention rate with people you shouldn’t be or don’t want to support, isn’t a bad thing.

3. Prematurely Tested – focusing on and optimizing, such metrics when you have few customers (low sample size) means you’re likely to be optimizing for the wrong things or distracting your focus from what still yet matters more.

This is a great perspective on how fundraising has evolved beyond traditional pitch-based approaches. The analogy of a flywheel really resonates—momentum and network effects play a huge role in attracting capital today. It’s no longer just about a compelling business case but about demonstrating impact and leveraging digital reach to engage investors. Curious to hear more about specific strategies you’ve seen work well in this flywheel-driven approach!