Spring time in Austin is always the most incredible season for entrepreneurs. Seeds are planted, bluebonnets rise, SXSW is in swing, and the world descends on the city to invent, innovate, and reach investors.

This year, it seems, the startup du jour is in VR; with upwards of 300 VR related sessions and panels throughout the renown Austin conference. Billions of dollars are flowing into Augmented and Virtual Reality; so much so that one would think raising money is as simply as raising your virtual hand and saying you’re doing something in VR. Troublingly, that’s how many seem to think, talk, and pitch.

I have a thing that needs money to get to market, can you help? I’m producing this widget and just need some working capital. Hey Paul, have you seen all the demand for VR? It’s the future, that’s where we work. Do you know any investors?

Are there really that many fundable VR “problems”??

You’ve read about the so-called 10 slide perfect pitch, you know the problem / solution statement and you love saying you are a Lean Startup, so let’s look at this from another perspective: how to actually reach Venture Capital Investors.

Article Highlights

How to Appeal to Venture Capital

I’ve given this talk with Galvanize, during SXSW, to Inventopreneurs, and soon more, as it really seems to be resonating. That fact, in and of itself is interesting; with all of the support for, advice about, incubation on behalf of, and articles showing how to pitch, maybe what everyone is seeking is an unconventional approach.

There are two books that I want you as a startup founder, at any stage, to read: Innovation and Entrepreneurship and Start with Why.

When I look to the list of the most popular startup books, I see a lot of books that suggest everyone is seeking “confirmation bias,” which is the tendency to favor information that supports our point of view:

- The Lean Startup, after all if we can’t raise money do we not want to be lean?

- Zero to One, a great book in fact, though written by Peter Thiel as though it affirms for us that since he’s done it…

- The $100 Startup, there’s that start a startup with no money idea again.

- Venture Deals, Brad Feld and Jason Mendelson’s great book, as we seek how those deals are done.

- Ben Horowitz’s The Hard Thing About Hard Things, because this is hard!

But I want you to read Peter Drucker’s Innovation and Entrepeurship, a book from 1985 – we are NOT reinventing the wheel here! Raising money ain’t broke, we don’t need to fix it. We need to Start with Why, the second book, Simon Sinek’s book not about startups but leadership.

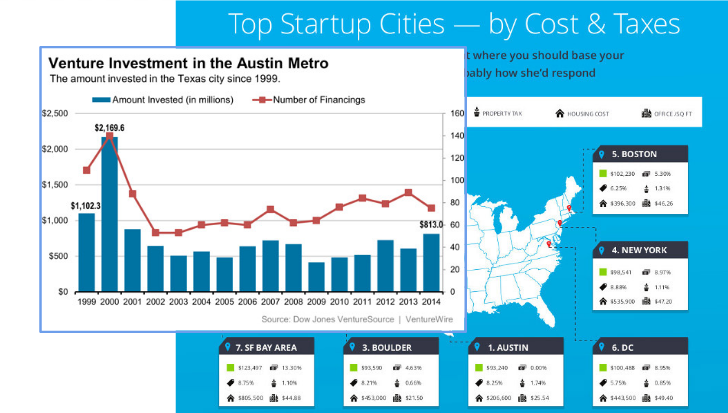

What venture investment trends show us when we look at the Austin metro over the past 15 years or so, is that investment, in spite of Austin being the “best place in the world for startups,” is growing slowly at best. That can be a good thing! But it doesn’t reflect the exuberance and a great many entrepreneurs are going unfunded. When we look at those popular startup books and combine them with Paul Graham’s famous list of mistakes that kill startups, I think we uncover that we’re failing to nail down what the market want’s by spending the time to figure out why.

What venture investment trends show us when we look at the Austin metro over the past 15 years or so, is that investment, in spite of Austin being the “best place in the world for startups,” is growing slowly at best. That can be a good thing! But it doesn’t reflect the exuberance and a great many entrepreneurs are going unfunded. When we look at those popular startup books and combine them with Paul Graham’s famous list of mistakes that kill startups, I think we uncover that we’re failing to nail down what the market want’s by spending the time to figure out why.

Screw the problem; think why.

On the left, the so-called “perfect pitch.” On the right, what 99% of your audience likely thinks as you’re conveying what’s in that presentation:

|

|

Now, take my point tongue in cheek but be honest about the number of times that you’ve spoken with a potential investor and note how frequently they’ve interjected to clarify, question, or just cut you short not because they want to be involved but because they aren’t convinced.

Now, take my point tongue in cheek but be honest about the number of times that you’ve spoken with a potential investor and note how frequently they’ve interjected to clarify, question, or just cut you short not because they want to be involved but because they aren’t convinced.

When an investor asks you about customers or encourages that your team has gaps to be explored it’s because you have failed to convey an opportunity related to the problem you think you’ve identified as a real problem, or that you’ve failed to convince anyone that you can actually solve it.

Talking to me about a problem and your solution is essentially a sales pitch and if you think about it, an investor isn’t buying your product. They actually aren’t even buying your business, they are buying into an opportunity.

Making the World’s Information Available

Did you know Google is the business of making the world’s information available? What does Google not say about itself? What didn’t they say about themselves in the early days of their inception? Granted, I wasn’t in the room but I was at Yahoo, in the trenches, when the world was changing because of search engines.

What Google was not was a solution to the problem of finding things on the internet. We didn’t have a problem finding things on the internet. Websites didn’t have a problem reaching people through the internet as AOL, Yahoo, Excite, and others had been solving that for years. Google uncovered the fact that there was an opportunity to make everything accessible. Everything: local listings, events, images, videos, etc. Opportunity.

Now think about your own mission; your mission statement. Consider too as you do that, the most elementary of lessons: Who, What, When, Where, Why, and How. As a business, the mission upon which you set yourselves in which you hope to convince others to invest their time and money, that mission isn’t to solve a mere problem but to do so sustainably – if you are merely addressing an issue or serving some customers, your mission simply isn’t fundable.

Your Mission Isn’t Fundable.

Ouch. But think about something for a moment and apply your business to those elementary questions. A Solution to a Problem is WHAT and HOW; prompting me to immediately conclude that either you are doing it OR that you have yet to capably do so. In either event, I’m left wondering where the need/opportunity for investment lies.

I have a search engine which will make it easier to find things on the internet.

Good for you. So do hundreds of other entrepreneurs. ahem, “how many customer do you have?”

See the pattern?

Google’s mission subtly refers not to what and how but for WHOM, WHERE, and WHY – To organize the world’s information and make it universally accessible and useful. Not HOW (index, crawlers, bots, SEO) nor WHAT (a search engine) but because the world’s information can be made universally available, to everyone, now.

Instead of questioning the merit of a solution, I instead want to know how effectively that has been accomplished and what more they need – investment.

The actual perfect pitch leads with two most important but elementary of points: WHY (since we start with that) and WHO (since team is most important to substantiating that you’ll accomplish that mission).

- Why

- Who

- What

- When

- Where

- How

Conveying your imagination to someone else

That’s what we’re doing isn’t it? If you’re merely starting a new business, in an existing, proven market, you can tell me what you are doing and I’ll want to validate if you’re capable – that you are serving some customers.

If instead, you are inventing something new and you have a patent or brilliant new innovation, what I need to know is how that works. Innovation without a market and business is merely an invention and a new business without actual innovation is merely a business that may succeed – neither does a fundable startup make. What and How doesn’t matter merely as much as Why and by and for Whom.

As you craft your pitch, to actual investors, you have to be brutal about your venture (as rest assured, the market will be) and if there is any point along your string of thoughts where you can respond to yourself with, “I don’t agree,” “I don’t understand,” “I don’t believe,” or “I know it’s not,” you are on the WRONG track.

Drucker, author of Innovation and Entrepreneurship, noted this back in 1985 and we don’t need to reinvent the wheel:

“Because the purpose of business is to create a customer, the business enterprise has two–and only two–basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs. Marketing is the distinguishing, unique function of the business.”

One without the other falls short. It’s really that simple. And notice, the WHY (marketing) is what distinguishes what you are doing from your competitors and a fundable opportunity makes.

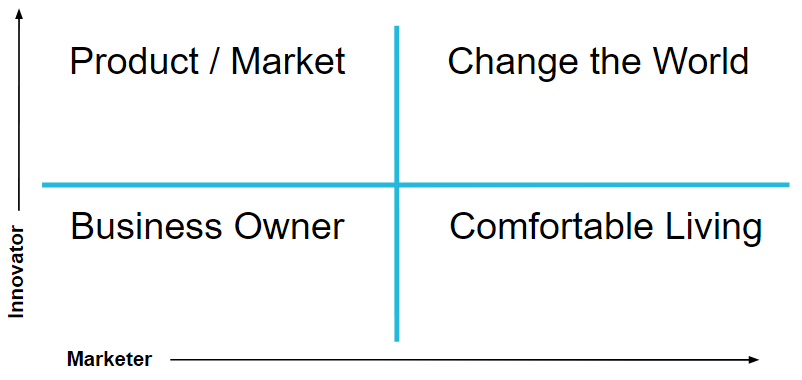

I plot investment opportunities on a 2×2 matrix. Think about where you fall. On the left, y-axis, note in increasing degree: Innovation. On the horizontal, the x-axis, note the degree to which the market is viable.

I plot investment opportunities on a 2×2 matrix. Think about where you fall. On the left, y-axis, note in increasing degree: Innovation. On the horizontal, the x-axis, note the degree to which the market is viable.

Now appreciate that those can be subjective concepts but plot yourself just the same as I then want you to start plotting everything else in your market even in loosely similar contexts – your competitors (as it were).

At the upper limit of innovation you have not just a new invention but something truly disruptive of an industry or experience in society. At the far reach of a market plot isn’t growth nor your customer traction, it’s an indication of the market – is it substantial, is it attainable, is it competitive?

When you balance those series of questions about your market and degree of innovation, you can plot whether not you are a local small business owner (lower left most) or next big thing.

| I’ve done that in a rudimentary example in the slides I’ve used to share these thoughts so as to make a point clear: drop off anything in the lower two quadrants as an existing business type, even a substantial one, isn’t likely fundable by VCs. Period. If you aren’t innovating, you aren’t capable of creating multiples on the valuation of your business (being worth more than a customer paying you) and thus are very assuredly perhaps successful, well paid, and thriving, but that isn’t nearly as likely to appeal to investors as is something innovative. |

With the bottom lopped off, hopefully you remain in the upper two quadrants either as a Product / Market fit kind of startup OR the type that Changes the World. On the left, the Problem Solution statement oriented business that fits itself nicely into an innovation for an existing market. If you can clinch a market with an innovation, you have a huge company! Here in Austin, we can think of what Dell has accomplished – who wouldn’t have wanted to invest in Dell? But that’s not the same as an innovative company that so understands the market as to keep innovating and reinventing markets – on the upper right quadrant we have companies that are both Innovative and resulting in completely new Markets.

That’s the golden quadrant for investment and while you can certainly get funding if you are little less innovative than others, or less capable in a market, you can see how those two factors alone establish where you fall relative to others when it comes to the fundability of your business and why investors, without confidence in your ability to excel in BOTH cases, will question you.

Why is the Opportunity resulting from Innovation AND Market

Now, believe it or not, the clinch in the pitch is just before our close: Why, Who, What, When, Where, and How. With what do we close? How this works, how you can help, how your investment will matter, how we’ll achieve a return on your expectations. The close though happens just before that as how is essentially a matter of due diligence on the part of the audience to affirm that they are a good fit for the opportunity conveyed. What matters most before the close is WHERE.

An opportunity establishes that the investment is ideal based not just on where the company is based (you’ve heard the inaccurate conventional wisdom that investors will want you to move to be based near them?) but with the firm in question. Our venture is ideally matched with your firm (where) because…

An opportunity establishes that the investment is ideal based not just on where the company is based (you’ve heard the inaccurate conventional wisdom that investors will want you to move to be based near them?) but with the firm in question. Our venture is ideally matched with your firm (where) because…

Let’s take a step back and briefly cover these talking points:

- Why – opens your narrative addressing one or more of the following point as they relate to the audience – Unless your WHY aligns with the expectations of the investor, you’re done. Investors are NOT looking for lean startups, unicorns, nor customers.

- Because we need capital for the following reasons

- Because we’ll achieve the return you’re seeking

- Because this is going to happen and we’re the people that will make it so

- Who – Us, validation that we can. For said market; them.

- What (not how) – Explain what it is! “Like X for Y” is an awful way to communicate as it presumes that people know X and Y.

- When – Now, BECAUSE. This is where you provide a sophisticated competitive analysis that proves that you know the market.

- The market dynamics that make the investment ideal.

- Why hasn’t this been successful before?

- What’s evolving today that gives you a competitive advantage?

- What’s coming that will result in your having a first mover advantage?

- Where – Here, BECAUSE. With you BECAUSE.

- How – Besides the points characterized previously, keep in mind that the Marketing is what distinguishes you so what matters perhaps most is not how it works and how the investor can help but how you will establish a market share.

An effectively pitched startup isn’t eloquently communicated so much as it is effectively developed, such that your startup is in fact a viable venture. Pitching from the perspective of a problem and solution fails to address many of the questions that actually matter such as Why Now (when)? Why there (where)? and Why you (who)? Don’t fail to clinch funding for your venture simply because you’ve failed to establish that your venture is in fact fundable.

If you have questions, drop me a line here; I love to mentor. If I were you though, I’d add your questions in the comments below as if you’re not now ready to talk openly about what you’re doing, you’re a long way from being fundable.

Your experience and perspective in this piece definitely resonate. Thank you again for everything. I couldn’t be more excited to go out and build

Wow. What a great post! Thank you for putting so much effort into this.

The world is crazy about virtual reality but soon we are going to show them the actual reality

Good stuff Paul.

Lots of wheels get (re)invented.

The framework and sequential steps of a thoughtful startup life cycle is another. Each accelerator claims their own ‘secret sauce’ of guidance to startup success, while Gordon Bell (creator along with Heidi Mason and Coopers & Lybrand of the Bell Mason Diagnostic) just smiles.

In total agreement

Blnded Media would love to get a guest blog post from you Paul O’Brien

Paul — Best read that I have come across on Medium in a long time. This has content that Medium has been missing, so good on you!

In New Zealand, people often communicate with ‘What’ and every single person who calls themselves a start up mentor does exactly the same, which as you have stated (and as I have experienced) does not work.

I would love to repurpose this and share with my network if you’re ok with that?

Nice article Paul!

Mike, Naji,

I’d be honored. Let me know what you need from me

Hi Paul, this is awesome and totally formative! I am a student at Fordham University building a startup.

We recently won our school’s Pitch Competiton and are being flown out by Fordham to SF this weekend as a result.

We have landed meetings with a few big angel investors and I feel a bit unprepared…

Any chance you can help?

Awesome news Anthony! Congratulations.

Happy to do what I can (though by this weekend might be tough!). Here’s another line of thinking that might help: https://seobrien.com/write-effective-pitch-email-angel-investors and from there you can drop me a line directly to see if we can’t manage a time to chat soon. Send me your pitch deck and at the very least, late a night perhaps, I’ll get back to you with some thoughts.

Paul, this is really great stuff. Well presented. Thanks for writing this. So much to chew on here.

Hats off to you Paul. I must admit that I’m as impressed by the article as the back and forth with the comments below 🙂 It’s nice to interact witth a human being 🙂 Thank you.

The beauty of this article is that you’re a marketing guy addressing how to sell the fund-raising “product”. I so appreciate that you’re advising clients on the human realities of deal making. It is so easy to get lost in the technical stuff and data and lose sight of the what truly engages people whether investing in a start-up or buying a good cup of coffee. I think it was Twain who wrote, “Nothing new under the sun, hardly.”

Thanks!

Be On-Purpose!

Kevin

Wonderful point Kevin, I’d not thought of it that way?—?the human realities of deal making.

I’m also a ardent student of P. Drucker. More than that quote in the article, your point reminds me of what he noted in Management (1973),

“There will always, one can assume, be a need for some selling. But the aim of marketing is to make selling superfluous. The aim of marketing is to know and understand the customer so well that the product or service fits him and sells itself.”

Which is to say, I strive to show entrepreneurs that it’s in fund-raising that selling is particularly futile. Investors aren’t buying. You either have an opportunity pertinent to them or you don’t. Job #1 of the entrepreneur fund-raising is marketing so as to develop and present the right opportunity to the ideally suited audience.

Great info as I’ve just started down this path. Self funding a website re-launch (www.LandHub.com) and CoStar just bought our biggest competitor so looking for investors and tech partner.

Completely agree about Drucker’s “Innovation and Entrepreneurship” I think you can get away with watching Sinek on YouTube . Drucker also wrote about “the theory of the business” which is Google-able in shorter excerpts. Awesome advice.

Someone could / should do an entire series on Drucker’s observations, a podcast or something, revisiting and updating all of his work for today’s online and remote era.

I fear what he showed is being lost to time; society is neglecting so much of what we already know.

I love this idea. I’d include Mintzberg, Porter, Jaques, Bossidy and 1-2 other amazing thinkers. Would you mind if I did that, and maybe tie it into Austin’s startup scene somehow. Something like Best Business Thinking…

Do it! Hey, we don’t socialize and share ideas here because they’re proprietary or secret! Discourse is what helps the world figure out how to work together to do things better.

Ping me if there is a way to help or you need that recurring guest who tweets a lot!

Looking forward to reading more. Great blog.Really thank you! Really Cool.