Finding myself now through 3 cycles of the economy (more or less), working with startups throughout, I can’t help but observe and plead for people to raise their hands in philanthropy as mentors to entrepreneurs and would be founders.

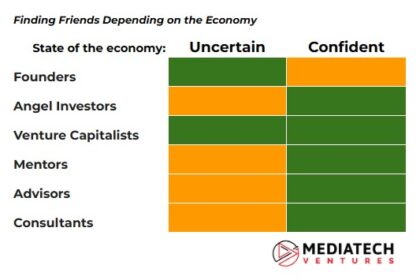

I’m no graphic designer but an idea struck me that felt best conveyed in a graphic, that depending on the state of the economy (uncertain or confident) we see a shift in the role people play in innovation, and that throughout, what’s needed most is mentors.

Before I share that graphic for a closer look, I want to define together the various roles that come to mind; I want to ensure we’re on the same page about what these mean:

- Founders

- Angel Investors

- Venture Capitalists

- Mentors

- Advisors

- Consultants

Now, I put those in that list, in order, on purpose. Without even aligning our definition of these roles, perhaps you can spot my pattern.

Top down is an assessment of risk tolerance and expectation of outcome.

Founders and Angels take the most risk in our economy, for the sake of innovation. Which is not to say that Advisors and Consultants don’t take risk, but assuredly, relatively speaking, they’re on the spectrum of supporting those preceding them in the list, and getting something for that (not at all critical meant in my saying that!)

As such, we find Venture Capitalists and Mentors in the middle, almost as if they’re the glue that binds together the list. Working with the risk takers to make opportunity available for the contributors.

Before you try to process entirely what my brain is playing out, let’s make sure we agree on what these roles are (or at least establish an agreement about how I’m defining them, so you can wrap your head around what mine is thinking)

Founders

Hopefully the most consistently understood, these are the people who start startups. What I want to make sure it clear in our understanding is that these are not the same as new business owners; starting a startup means starting a venture with no proven or known business model. Founders take unparalleled risk in our economy precisely because what they’re starting isn’t a known business but rather a new model, innovation, or solution, that will create new value and somehow make a more meaningful improvement on society.

Angel Investors

Individuals who invest in startups. Plural, startups. Someone who has invested in a startup (one) really shouldn’t be called an Angel (and certainly not a VC, but we’ll get to that) because the ecosystem knows that most startups fail. Anyone investing in one startup is essentially just handing money to someone to try something; it’s highly likely the money won’t be returned. Angels know this; Angel Investors have sufficient disposable wealth, to meaningfully invest in many startups (15 or more) so that their portfolio of investment is likely to deliver a positive return, overcoming all of the ventures that fail.

Venture Capitalists

The people who invest in and raise capital for Funds. These are the people managing a fund, and with that fund, they’re paid, as are the people in their employ to operate the fund.

Mentors

Those with startup stage experience who are voluntarily paying it forward by guiding other founders either directly or through programs such as incubators and accelerators.

Advisors

Anyone with relevant experience who will commit their time, reputation, experience, and network, to your venture, in exchange for some equity. Yes! Advisors earn equity and NO Advisors do not get paid.

Consultants

Get paid. Anyone who gets paid to help your startup is a “Consultant.” They’re not a mentor, they’re not an Advisor, and God forbid anyone who calls themselves an Angel or Venture Capitalist who wants to get paid (or get equity without investing)

On this list can we agree? Even if we only agree for now so that my next thought is clear.

In my chart, orange or green, green indicates when my experience has been that such people are most readily found and engaged. Orange, likewise, means that it’s in such times that these people are difficult to find.

Understandably, Angel Investors can be more difficult to find during times of economic uncertainty; after all, they’re working with their own capital and allocating it to startups, at any time, is risky.

And yet, VCs (good ones) know that there is opportunity in investing during uncertainties; hence, they’re actually easy to find and engage whether times or booming or desperate – IF they’re good VCs.

Why? Look at how I’ve characterized Founders.

We have a conventional wisdom in startup ecosystems, that the people who matter most are the people who keep showing up. We know that startups are tough whether times are good or bad; thus if someone is truly passionate about serving entrepreneurs, they show up whether times are good or bad.

That notion applies to Founders just as much as it applies to investors, advisors, and consultants.

Founders who step up when times are uncertain, clearly aren’t in it to just try and cash in on affluent times. During *good* times, the ecosystem gets flooded with “wantrepreneurs” who, comfortable in a secure job, feel a bit more confident that they too can and should try.

The thing is, the startup world isn’t for try-ers.

Times will get tough, you will be wrong, and you will be met with seemingly immeasurable opposition and discouragement. Just in it to try or because you hope to be?? Good luck.

It’s the meaningful entrepreneurs and founders who are there when times are tough. They build and lead us out of economic uncertainty… And VCs know it.

Mentors, Advisors, and Consultants are tough to find in economically uncertain times while readily raising their hands when the economy is strong.

Mentors, sitting where they sit in my list, can change that.

And it’s this observation that fueled this article and my plea to Mentors to step it up.

- General Electric: 1892.

- General Motors: 1908

- IBM: 1911.

- Disney: 1929.

- HP: 1939.

- Hyatt: 1957.

- Trader Joe’s: 1958.

- FedEx: 1971.

Let’s work the list from Consultants to Mentors to explain why I say that and appreciate that I made the point that I think Mentors are rather like the glue that holds the list together (with VCs), because mentors teach, help, and contribute, with few strings attached.

It’s understandable that Consultants are soft during economic uncertainty and ready to jump into work when times are good. In fairness, it’s their livelihood. It’s work. Good times make it *seem* like startups will have capital while tough times have everyone looking elsewhere to ensure they make a living.

It’s reasonably understandable that Advisors behave the same way. After all, they’re likely still working, perhaps they’re executives in a company, and while they want to help startups, economic uncertainty causes the distraction of making sure their own livelihood is stable. Besides, Advisors earn equity, and if they perceive or fear that equity really won’t be worth anything, it’s hard to expect a great many Advisors waiting in the wings to support you.

We can, and should, expect more people to mentor.

Like Consultants and Advisors, I might speculate that it’s tough to find mentors when times are uncertain because they took are focused on ensuring their own stability but at the same time, mentorship is philanthropy in any event.

Mentors don’t get paid

Mentors don’t get equity

And if it’s during economic uncertainty that great founders and startups tend to emerge, it’s during economic uncertainty that the impact of mentorship could be far greater than at any other time. That, if you are passionate about and committed to helping founders, it’s during the tough times that your impact matters most.

Make a difference now, when times are questionable, because the founders active are more determined, and since times are uncertain, YOUR experience and impact mitigates those risks to a degree not possible when times are good. You have a chance, now, to be part of not only the future generations of leaders and great innovations, but the sector of the economy that will usher everyone back into confidence and certainty.

Get involved. It’s the people who keep showing up that matter most.

Message me if you want to get involved but don’t know where or how, I’m involved in dozens of programs besides which MediaTech Ventures is booming and the need for mentors from startups in our world is immeasurable, your experience would be invaluable.

Amen! As always, excellent analysis and conclusions. One thing I’d offer is that many Angel groups seem to not actually want startups, their evaluation and selection criteria more closely resembles those common to small companies. Just thoughts from a guy who for the last four years has been making laps around the ecosystem Bumping into a lot of different characters and being told no more often than not. Fortunately we found two true Angels.

I’ve had the same experience Scott, Angel groups are often more accurately deal flow for people who want to participate in the startup ecosystem but don’t get (or want) deal flow to actually do so.

I’ve frequently argued that people in Angel groups should pool together venture funds, or allocate the capital to Incubators and Accelerators where we have deal flow and outperform the average rate which startups fail.

In conclusion, startup mentors play an indispensable role in nurturing entrepreneurial success. Their guidance, experience, and unwavering support empower budding entrepreneurs to navigate challenges and unlock their full potential. Embracing mentorship can be the game-changer for startups, propelling them towards growth and innovation in the dynamic business landscape.