In the midst of the next startup bust (apparently), entrepreneurs are seemingly struggling to raise capital now more than ever.

A very frequently asked question I’m hearing, sounds something along the lines of, “should I just take the terms of the local incubator?”

But what troubles me in such questions more, is not the desperation leading founders to secure terms under questionable circumstances, but the frequency with which variations of that question reveal that we aren’t always raising money from the right places.

From Where Should One Be Raising Capital?

Struggling to raise capital, step 1 requires that you step back from the noise and rethink your approach. Are you raising capital from the right sources?

As capital continues to constrain, through the inevitable 2017 economic collapse, now more than ever you must make the most of your time. Questions such as that headline, if you should be raising capital through an incubator or Angel investor, is a question that reveals you’re not.

As capital continues to constrain, through the inevitable 2017 economic collapse, now more than ever you must make the most of your time. Questions such as that headline, if you should be raising capital through an incubator or Angel investor, is a question that reveals you’re not.

What’s the difference?

From where matters. We’re over simplifying, but think of two different groups of the providers of that which startups need. Then think of those two groups in a progression from ideation to exit. Those groups look sort of like this:

Startup service providers

- Mentors

- Advisors

- Freelance

- Incubator

- Consultant

- Accelerator

- Agency

Startup capital sources

- Friends and family

- Debt

- Angel investor

- Crowdfunding

- Venture capital

- Private equity

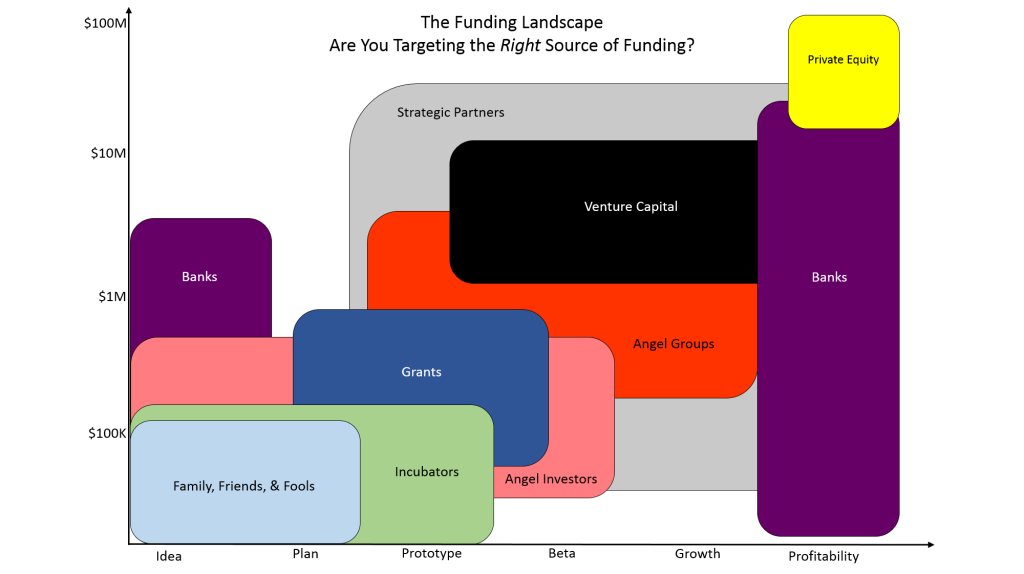

Now though, appreciate that not only is that progression NOT so black and white so you get the idea of why where matters but consider how you may be struggling by missing the alignment of your needs with what those providers offer. Technically when it comes to funding, we need more of a complicated matrix such as this one I whipped together with Texas State Advisor Paul Wright. Debt or advisors are certainly applicable too at later stages but then again, something like an incubator is not. Think of those lists as hinting at when in your development those things become valid but that they can remain so for whatever period of time is appropriate. There is certainly overlap, Angel investors, for example, should also be thought of as one of your seed stage service providers in that you should be drawing investment then from folks who know your space and can help in some way (be that as advisor, informal BD, etc.).

Now though, appreciate that not only is that progression NOT so black and white so you get the idea of why where matters but consider how you may be struggling by missing the alignment of your needs with what those providers offer. Technically when it comes to funding, we need more of a complicated matrix such as this one I whipped together with Texas State Advisor Paul Wright. Debt or advisors are certainly applicable too at later stages but then again, something like an incubator is not. Think of those lists as hinting at when in your development those things become valid but that they can remain so for whatever period of time is appropriate. There is certainly overlap, Angel investors, for example, should also be thought of as one of your seed stage service providers in that you should be drawing investment then from folks who know your space and can help in some way (be that as advisor, informal BD, etc.).

A ha! Yes, service providers blend with capital sources such that one begets the other and perhaps you’re struggling to raise capital because of a lack of credibility, experience, or capability by way of those helping you succeed.

Blended together, our resource list from start start to exit would look something like this:

- Mentors

- Friends and family

- Debt

- Advisors

- Freelance

- Incubator

- Angel investor

- Crowdfunding

- Consultant

- Accelerator

- Venture Capital

- Agency

- Private Equity

But blended our list is a little overly complicated and confusing… what if you need a freelance professional now? Couldn’t you raise from a crowdfunding source from the get go?

This is a way in which to help realize why you’re struggling, not a hardfast rule to how it works.

An easy way to keep this progression in mind and why it matters, is that one usually begets the other; or is only applicable at that later point.

Asking friends and family for money, without a mentor, is certainly doable but inadvisable as I’d think your family would prefer you have some valid guidance. Consultants and part time Execs are invaluable and often overlooked resources because “they cost money” but they’re far more impactful than earlier stage resources given their specific role and attention; merely, at a cost that’s different from other stage resources.

Yes, EVERYTHING in those lists costs something, it’s just a question of how and your ROI.

Thus, final thought. Many try to distinguish those service providers much more stringently. After all, isn’t an Advisor completely distinct from a Consultant?? Isn’t an Agency completely different from the Accelerator that says it wants to help?? Isn’t an Angel, Venture Capital? Think about it in terms of mere capitalism for a moment and appreciate that no, they’re all just businesses that provide services. The only differences are the form of engagment, the degree of experience/specialization, the stage, what you get, and the way in which they get paid. Make no mistake, you’re hiring an accelerator (not getting accepted) and you’re hiring a mentor (even though they may be freely available) in that there is always a cost if only of your time, attention, maybe some equity, or in their giving you bad advice.

So when seeking funding, ask first how you’ve invested in your business and ask if your investments are consistent with the expectations and costs of the sources from which you’re seeking venture capital.

Another great piece by Paul O’Brien.

This is very helpful. Thank you

Or should I just launch my own cryptocurrency instead

Reminds me. Flip one of these NFTs (bid starts at zero), need to make sure you’re on the show we’re producing 🙂

https://bitclout.com/nft/5115ca9f570012f8d36cdc7bdcc8cd511fc53c088efdc93e6bfe2d2c54b3edf9?tab=posts

Shit has just actually been that crazy. I’m working on a TOP SECRET book project with @WhiteChocoHashy @mskDAO @page_dao @artistjcowan @wippublishing and a few others… tentative mint date is 11/8! You can help us market if u wanna! $PAGE

wonder if it’s about #Hashmasks

@mskDAO @TheHashmasks @majorart_eth

Nah, you should just bootstrap and build/go to market with light speed acceleration using AI. 😉