This might be among my most harsh criticisms of our economy, and I don’t write it lightly but rather because as time progresses, we can see more and more clearly how misrepresentation of focus, skills, and experience, actually harms entrepreneurs.

Article Highlights

Not All Failure is Created Equal

And more importantly, not all failure is worthy of your LinkedIn think-piece or your favorite startup podcast’s applause. Some failure is just (wait for it) -> failure. As in abject failure. As in should fail and in that just about anyone could have told you that it would fail. Not the kind that leads to insight, transformation, or even a good story, but the kind that was entirely avoidable if someone had just read the right books, called an appropriate mentor, or bothered to learn what the hell they were doing before setting up shop.

I was asked, “Why is failure in the startup world often romanticized, but failure in traditional small businesses is seen as incompetence?”

Seems like a reasonable question, doesn’t it? It’s a question I’m going to bet, you read and probably agree with or at least consider having merit. One of those, no such thing as bad questions, let’s encourage people to ask, kind of questions with which you might be thinking, “yeah… why is that??”

In fact, it’s the kind of question that reveals that our ecosystem is harming people, because the basis of the question itself is formed from misunderstanding (or being misled about) what these things do and mean. And yet still, the answer to the question isn’t just in semantics, it’s in economics, epistemology, and a fundamental misunderstanding that’s poisoning both our innovation ecosystem and our Main Streets.

Let’s begin where most of these conversations derail: by correcting the premise.

The question implies that romanticizing startup failure happens “often.” It doesn’t. In fact, Not nearly enough. And small business failure? It should be seen as incompetence. Harsh? Sure. True? Absolutely. Because when we flatten the distinction between startups and new businesses, we do more than misuse vocabulary, we actively undermine the economy by encouraging the wrong behaviors, celebrating the wrong outcomes, and misleading the next generation of founders into making stupid, expensive mistakes.

Startups Are Not New Businesses. New Businesses Are Not Startups. Period.

This is not up for debate. This is not some fuzzy boundary where it’s “helpful to be inclusive” or “everyone’s on their own journey.” No. A startup is a temporary organization designed to search for a new, scalable, repeatable, and competitive business model. It is not, by definition, a business. It’s an experiment.

A new business is just that: a business. A known entity with a known model; something that’s been done before, being done again, hopefully better or in a new market.

They’re not interchangeable. If you’re still unconvinced, you’re not just wrong, you’re dangerous. You’re not being helpful, nor supportive, nor inclusive, you’re misleading everyone. This is dangerous to entrepreneurs (all), dangerous to investors, dangerous to economic development, and yes, dangerous to yourself if you’re looking to be part of either world and don’t know the difference.

One Kind of Failure Is Tragic, and the Other, Necessary

When a new business, say a restaurant, a boutique fitness studio, or a local print shop, goes under, the autopsy usually reveals causes of death that are entirely preventable. Inexperience. Overconfidence. Ignorance. Stubbornness.

Be clinical. I said this would be harsh, but it should be said, I’m sorry if you don’t like it, but the reality is, technically speaking, these aren’t tragic flaws of a misunderstood genius; they’re warning signs that the person behind the business didn’t do the homework.

“But we ran out of money!” you cry. No, you didn’t. You failed to generate money. Which is different. Because thousands of other businesses with the same model do make money. If yours didn’t, it’s not the model, it’s you. That’s not being cruel, it’s being clear. Clarity, in business, is mercy.

Restaurants are among my favorite case study of this because I get personally frustrated when a restaurant opens and you just know it’s going to fail.

How many times have you seen a place open and within weeks you know it’s doomed? The prices are too high. The food is mediocre. The family running it is cooking for their own taste. They don’t advertise. They don’t train their staff. They’re closed Mondays and Tuesdays. It’s not the restaurant business that failed. It’s the restaurant owner. That is incompetence. And I don’t mean that rudely, I mean it literally, that’s the word appropriate; you failed to do what is KNOWN to matter.

Now let’s turn to startups.

Why Startup Failure Is Not Only Okay, it’s the Point

Startups are the R&D of the free market. They overwhelmingly don’t succeed, they discover. They’re how we invent new medicines, new ways of working, better ways of moving, building, thinking, or even feeling. When a startup fails, it tells us something. When enough startups fail in similar ways, it reveals the path to something that might actually work.

Expecting startups to succeed is like expecting every lab experiment to yield a breakthrough. That’s not how science works. That’s not how progress works.

I get it, you don’t want your startup to “fail” as in end, at your expense, but what helps your venture find success are the terms we hear echoed throughout startup communities: tenacity, grit, emotional intelligence – because you DO want your startup to fail, and then fail again, and then try something else that fails – because there is no plan, there is no established model! You’re experimenting.

Despite that, what usually happens?

Small business owners, spurred on by startup hype, think their new dog grooming business is a “disruptive pet-tech venture.” Business Investors, accustomed to balance sheets and quarterly profits, try to jam startups into models designed for stable businesses. Economic developers throw money at “innovation districts” filled with lifestyle boutiques and coworking cafes. None of them are doing R&D. None of them stomach the risk involved in experimentation. None of them are startups. Everyone gets misled and remains. Good job.

That’s when it gets catastrophic – this is why YOUR startup ecosystem is likely struggling: when the lines are blurred, we start killing both species. We pressure startups to deliver revenue before market-product fit (yes, I wrote that backwards, you didn’t have an aneurism). We encourage small businesses to “scale” or be innovative, before they’ve even stabilized as can be expected. We tell founders to pitch before they’ve prototyped. We pretend protypes are MVPs. And we call every Shopify store and Instagram page a “startup.”

You might as well call a carpenter a chemist and ask them to solve climate change.

When I see a Business Plan Advisor or Small Business Banker invited to advise startups, I cringe. No, that’s not even accurate, I get angry, because WTF are you doing steering startups to operate like businesses!?

This Distinction Matters to the Economy

This confusion doesn’t just frustrate founders, in fact, it usually doesn’t frustrat founders because they aren’t entirely aware of the fact that what they’re being exposed to is bad. This undermines the entire economy. Startups are the future. They are our bets on what the world could be. They are where capital should be risked, talent should experiment, change emerges, jobs are created, and failure should be embraced. New businesses are the present. They provide stability, jobs, goods, and services in a known model. They are where discipline matters, where processes matter, where success should be expected.

Mix them up, and you get neither stability nor innovation. You get burned-out founders, wasted capital, and an ecosystem of smoke and mirrors instead of substance.

So yes, we should celebrate startup failure, because it’s what they do and the only people involved among investors, mentors, advisors, local organizations, or service providers, are those who know that’s what they do, absorbing the risk to find new opportunity – not start revenue bearing businesses! On the other hand, should criticize small business failure, because it’s avoidable, and businesses are failing it’s because you’re not providing to them the mentors, advisors, capital sources, and services, that understand their business.

- Inexperience – we don’t know how to get customers

- Overconfidence – we thought we could do it there

- Ignorance – obviously people there wanted our product. We don’t understand.

- Stubbornness – people were telling us that business model wouldn’t work, maybe we should have listened

New businesses can’t be allowed to make those excuses whereas startups can’t be expected to know any better, yet.

Startups are the Future; New Businesses are the Present

Grow up and learn the difference because if you refuse to or you disagree, you’re hurting people. If you’re advising someone to “just start a startup,” make damn sure you know what you’re talking about. If you’re running a startup, don’t take advice from someone who’s only run franchises. And if you’re in policy, education, or economic development, stop conflating the two.

Your failure to distinguish between a startup and a new business might just be the biggest threat to innovation in your city.

How to avoid this? Ask: Are you building something new, or are you just doing something again? Are you chasing innovation, or income?

And if someone around you doesn’t get this yet? Send them this article, sit them down, and make them read it twice. Or call me.

My podcast with Samantha Lewis we go down this exact rabbit hole and actually how AI is even changing the line venture scalable & a good business.

Short answer there are now going to be more good businesses

https://ecosysmetacognition.substack.com/p/ep-150-texas-innovation-ecosystems

Jason Scharf that and I hear she decided to call Austin a new home, yes? Fantastic news on both fronts.

Another great piece by Paul. A must-read for those of us in the startup industry and for the curious as well. Failure must be understood properly — and lines of distinction drawn between startups and other types of businesses. If we don’t do this, the consequences will be felt very uncomfortably.

I remember having casual interviews with potential cofounders and coffee meetings other entrepreneurial types. I quickly figured out who wanted to be part of a startup and who would not. First red flag “I’m an accountant.” Nothing wrong with being an accountant, but I already have one called GNU Cash that didn’t cost me anything but a few afternoons of setup time. Once I get some revenue maybe I’ll call you back. Second red flag: Not knowing anything about what I’m talking about, but being vaguely interested in joining me because it sounds like fun. Third red flag: “Well, I was looking at this other product and maybe we could do that too/instead.” Nope. Either we get this one going or we don’t. You want to do that product, fine, but we’re going to try this one first. When it fails maybe we’ll revisit your Me Too project.

Then there’s the “running my own business would be fun/freedom/flexible!” Sure, there’s that, but a startup isn’t for you. There’s a reason why burnout and divorce rate is high amongst founders. Get a nice franchise operation going and multiply through leverage so you can be hands-off in the long run. Your ROI is awful but predictable (especially if you borrow money), but your nights and weekends are more normal and you might even be able to homeschool the kids.

This is music to my ears. I write for small businesses – typically knowledge worker businesses – that are going from growing to scaling. I don’t write for startups or those businesses that are looking for investor backed rapid/hyper growth.

EXACTLY <3 And I’m constantly adding to my articles that my advice is not applicable to businesses. That’s much of what drove me to realize this and start writing about it – people trying to argue with me that my perspective doesn’t make any sense for their ridesharing app or their marketing agency — that’s right! Because I’m talking about startups, not your new business.

Paul O’Brien correct. She’s here now. Also covered in our convo

You quote this “They are not traditional businesses with known plans, they are R&D for the economy.” & you don’t think there should be more help IF the founder has validated to a certain point. I don’t mean every startup but, if you can prove to a point. Should there not be a government Founder salary for the experiment to create Country wealth and jobs?

Georgina Bowman yes… Maybe. Thing is, most don’t like the qualification that should be associated with that.

That, grants are and should be available to qualified researchers. Right? We’re not going to hand out grants to your neighbor to study COVID

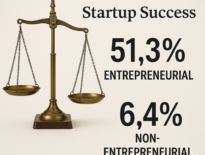

Thing is, there is research showing that certain personality types, certain people, make startups work and others who just don’t (dare I say, can’t). We also know that certain skills, age, and founding team sizes, along with those personality types, result in 90% or so of all successes.

So…

Perfect? No, of course not. But we can’t just hand out grants to anyone who wants to try, that’s unrealistic and unreasonable… Scientists get research grants, not everyone. Meaning, we could do grants for founders, but people aren’t going to like the fact that they don’t qualify, it will be considered unfair, and yet we know for a fact that it’s to such people where the grants would be effective. Could they be with others? Yeah, but then so too could your neighbor work out the COVID vaccine – that doesn’t mean the government should hand out money to everyone who wants to try.

Paul O’Brien think you missed the point! If the Founder (not me – any) can prove

traction and revenue (not much) at that

point the Founder must be on to something – why wouldn’t the government at that

point not want to put the Founder on a Government salary? rather tham they

loose the founder to a day to day job to

pay their bills. When the Founder who has

proved their onto something with no salary may produce the next 10 x 100 jobs.

Georgina Bowman oh I got you. I followed. Because revenue or traction are b.s. success metrics in startups. They’re part of what I write and talk frequently about, that those metrics tend to be asked about (or expected) when:

* Investors don’t get it

* Investors aren’t sold

* There is doubt

etc.

If you could hear our brains, it’s really, “eh… Nope, but I don’t really get it anyway so let me ask about and encourage revenue – maybe there is something, besides, it sounds encouraging rather than rude.”

Most of the advice that’s out there is based on the fact that most founders aren’t capable. So, prove you might figure out revenue (or whatever traction means), and maybe they’ll be on to something.

The research about fundable founders (like my point) is that there are people for whom questions of revenue aren’t a concern. You’re fundable because you’re that type of person.

Those people are, more or less, those scientists, who warrant grants

Paul O’Brien such a really interesting (and important!) article – thank you! I’d love to know more more about the personality types, age, skill etc you referred to that often result in greater (90%) of start up success. Do you have any previous articles on this (or might you write one for a future next newsletter?!).

Georgina Bowman No. There should not, at least not yet. Let’s instead start w/ the basics. Let’s have healthcare designed such that we don’t have to be enslaved to Big Inc so that individuals and families are covered. Perhaps also allow for unemployment for those who take the self-employed route. I don’t think we need the gov getting in the biz of deciding winners and losers. That’s Crony Capitalism and it’s part of the current problem with The System.

The point is, The System – surprise! surprise!! – is designed for more Big Inc and less for fostering new ideas, new biz models, etc. We need to change the foundation of The System, not have gov getting in the picking winners & losers.

Rebecca Burford Going to refer to mine but trust, I’m not trying to self-promote, everything I write comes from other works (it’s just that what I’ve written is easy to recall):

Oxford work is the most definitive. So much, I’ve been engaged with some VCs about building a Fund and due diligence process built upon what was uncovered here –

https://seobrien.com/success-as-a-startup-founder-a-desire-for-variety-and-novelty-an-openness-to-adventure-reduced-modesty-and-heightened-energy-levels

22,000 startups… 80% confidence that the cause of success, 8x greater than otherwise, is that the founders have these personality qualities

To a fund, merely figuring out how to invest based on that consideration, sets up a greater return than anything else

Dive into Advisors and Investors by personality types

Advisors : https://seobrien.com/the-myers-briggs-personality-types-that-make-ideal-startup-advisors

Investors : https://seobrien.com/the-personality-of-your-vc-matters-ask-investors-their-mbti

Lastly, some work with the Bell Mason people to uncover how/why personality types in PM, cause success or failure: https://seobrien.com/your-startup-methodology-is-whats-failing-how-the-first-principles-approach-beats-lean-agile-and-waterfall

Powerful distinction between startups and small businesses, noooooooo doubt about it

Enjoyed this. Besides ignorance in the difference between the two pursuits, having observed this the last year or so. There is also a persistentt tension between those startups willing to stomach the risk to experiment on the frontiers in pursuit of true progress, and economic pragmatism.

Like orgs with resources that set limits on the financial or economic risk they’re willing to take to meet some agenda or status, so they bet on “blurred” but actually safe or trendy models that are incrementally “better” methods, to check boxes rather than match the actual nauseating risk to maximize the potential for progress.

re: Not All Failure is Created Equal

I’d like to add that in either case, in any case, some failure is necessary part of the process. It’s part of the evolution. If we don’t have – startups and non-startups – failure then we’re not learning. We’re not bubbling up, we’re sinking to the bottom**.

Yeah, it sucks to be on the wrong side of failure. But that fact is, in my past, in your past, in everyone’s past there is an ancestor who failed (read: died) so that we could be here to today.

** Note: This should not be confused with the idea that that should be entire segments of the population being marginalize as “necessary” (for Capitalism). When the tied rises, all boats should rise. But in order to make that tied rise, occasional someone(s) will have to take one or more for “the team”.

Mark Simchock 100% agreed your last point because I’m constantly trying to wrestle with the negatively construed connotation.

Are we saying some people just can’t or shouldn’t be startup founders?? Well… yeah…

Notably, because companies only work because most people aren’t founders/entrepreneurs.

There isn’t enough of the negative side of entrepreneurship exposed. People see the cover of WIRED magazine and dream of being like that… no one ever sees that MOST people like this struggle financially, socially, and mentally. Such people are outliers, not aspirations. Aspire to be a CEO, Doctor, Scientist, or Astronaut… these people are like this because they can’t NOT be and while it’s sexy and appealing, it’s not without great cost on their part. The real heroes are the people who put in the work, exceptional at what they do.

Paul, you hit the nail so squarely on the head that you shattered it! Thank you for making the critical distinction between startups and businesses. For companies that are innovative, the blurring of the lines between the two is the source of much pain and frustration. Maybe some of that will improve because of your article.

Much thanks and appreciation to you!

I have to vehemently push back a bit Paul O’Brien (respectfully of course). Over my 35 years of experience, I absolutely believe a start up is in fact a “new” business.

The term “startup” refers to a new business in the early stages of its operations. Startups are founded by one or more entrepreneurs who want to develop a product or service for which they believe there is demand. They are incorporated, licensed in a particular state and recognized by the IRS as a new business.

Semantically, it absolutely is a new business and your article tried to separate this from a “newer” business but for me, you missed the mark. It is an actual “type” of new business or small business.

David Rosenberg Yes, but the point Paul O’Brien is making is not all small businesses and/or new businesses are startups. So yeah, of course a new startup is a new business. But a new business is not always a startup. In fact, 98% of the time someone says “startup” they should be saying “new business.”

Put another way, if your pet barks, do you still call it a cat? Of course not. Well, the misuse and abuse of “startup” is effectively calling a barking pet a cat. Obviously, Orwellian language is never a good thing.

David Rosenberg I welcome the pushback. It’s from all the push back that I’ve come to discover how serious a problem this is. I didn’t write this article lightly, and it isn’t my first on the matter.

A startup is unequivocally NOT a business – it is a temporary venture in search of a new business model.

A business, new or established, is something using an established business model.

Or, if we should continue pushing back and forth, let’s not debate, instead, tell me, what should we call an operating venture that isn’t like other businesses and doesn’t yet know how their business model is going to work? What word do you want to use to refer to what that is, distinct from a new business?

I don’t care what we call them; they’re not the same thing. Which is to say, you can believe that’s what is called a startup, but the problem is that the experience of business owners, franchise owners, bankers, business investors, and business consultants, getting involved and guiding actual “startups” (or whatever you want to call them) is a leading cause of their failure.

It’s not even new vs. newer. A startup is absolutely NOT like a new business – a new business knows how it works, a startup does not.

Great point—context matters. In startups, failure often signals experimentation and growth, not incompetence or poor judgment.

A few years ago I was the CEO of a medtech startup at a networking event held on a rooftop looking over a little city.

While chatting with a young recruiter I mentioned that I lead a startup and her face lit up. “We have another startup here as well” she said excitedly as she lead me, wine glass in hand, to another person and introduced him: “This is the incoming site lead of Edwards Lifesciences, a startup as well!”

The guy and I stared at each other, speechless. Me a CEO of a 5 person spin out from the local university and him an employee of the 10,000+ company from California opening a new site in Ireland.

I looked at the recruiter wondering where do I start explaining things, but she was so happy and frankly I’d never have finished my wine if I did. The site lead seemed to have made the same decision. So we let her move on.

The night proceeded with multiple people from the startup ecosystem, public funders, consultants, saying the same thing to me: oh we have another startup here, Edwards Lifesciences….it was surreal.

That incident lurked in the back of my head for a long time. Over the years since then I met a lot of people who confused startups with a new small business or a new site or as is common in the Middle East, a replicate of a startup model in a new region (e.g. Kareem for Uber, but I admit this area is murky)

Enter the article below. Knowing what a startup is by the whole ecosystem matters. It impacts funding and supports for the real startups, and real startups are so important to support correctly. They grow the economy, they cure cancer, they enable thoughts to travel the globe in seconds. They are the reasons our lives are as they are today.

P.S. My definition is: A startup is a company that makes a product or service that does not yet exist. That is why it is so risky. Also, that is why it is so impactful.

Please read below. And thank you Paul O’Brien .

Thank you for spreading this!!! Because I find it both amusing and frustrating that even as I explain it and have support, people *still* say we’re wrong

Preach this!

It’s quite simple: if you put new businesses, corporate innovation, Anne startups in the same room – they will not well support one another! They’re not the same thing, and by blending them, though your intentions might be good, you’re harming them all with misinformation from the others.

The more and more I read this, it’s spot on.

I don’t think ecosystems spend enough time tapped into the science of a startup.

It’s 100% R&D and that requires a different mindset and different resources than the next chicken joint.

I fully agree that it is essential to differentiate between different types of new businesses and to understand their wider role in the economy.

I couldn’t, however, help feeling that part of the problem here is unclear language and definitions. I say that as a founder of several start-ups, some successful and some failures, but I was never aware of this

definition (although the definition is perhaps more important to sponsors / supporters than to the target entrepreneurs).

For me the term start-up only suggests newness but says nothing about a wider mission relating to innovation and risk taking. Would it be worth considering clearer terminology such as ‘innovation start-up’ which is less likely to be confused with a new business simply replicating establish models.

Somebody had to say it! ?? it’s important to know the difference. Enjoyed this read!

Paul, this is a great message to get out. I’d like to give the insight you have to the rest of the Austin but I don’t have the time to do it for the rest of the world but maybe for T4. We could also record it, at the speaker’s approval. So… can you present on the 25th?

Absolutely love this! Such a powerful distinction that doesn’t get talked about enough.

Clear definitions can save so much time, money, and energy for everyone involved.