That tired phrase has been responsible for more missed fortunes than bad timing or bad luck. It’s the refrain of cautious uncles, small-town bankers, and risk-averse executives who prefer their innovation the way they prefer their wine: aged, tested, bottled, and priced at a predictable markup. But in the world of entrepreneurship, that order of operations is precisely backward.

For the entrepreneur, belief comes first. Always.

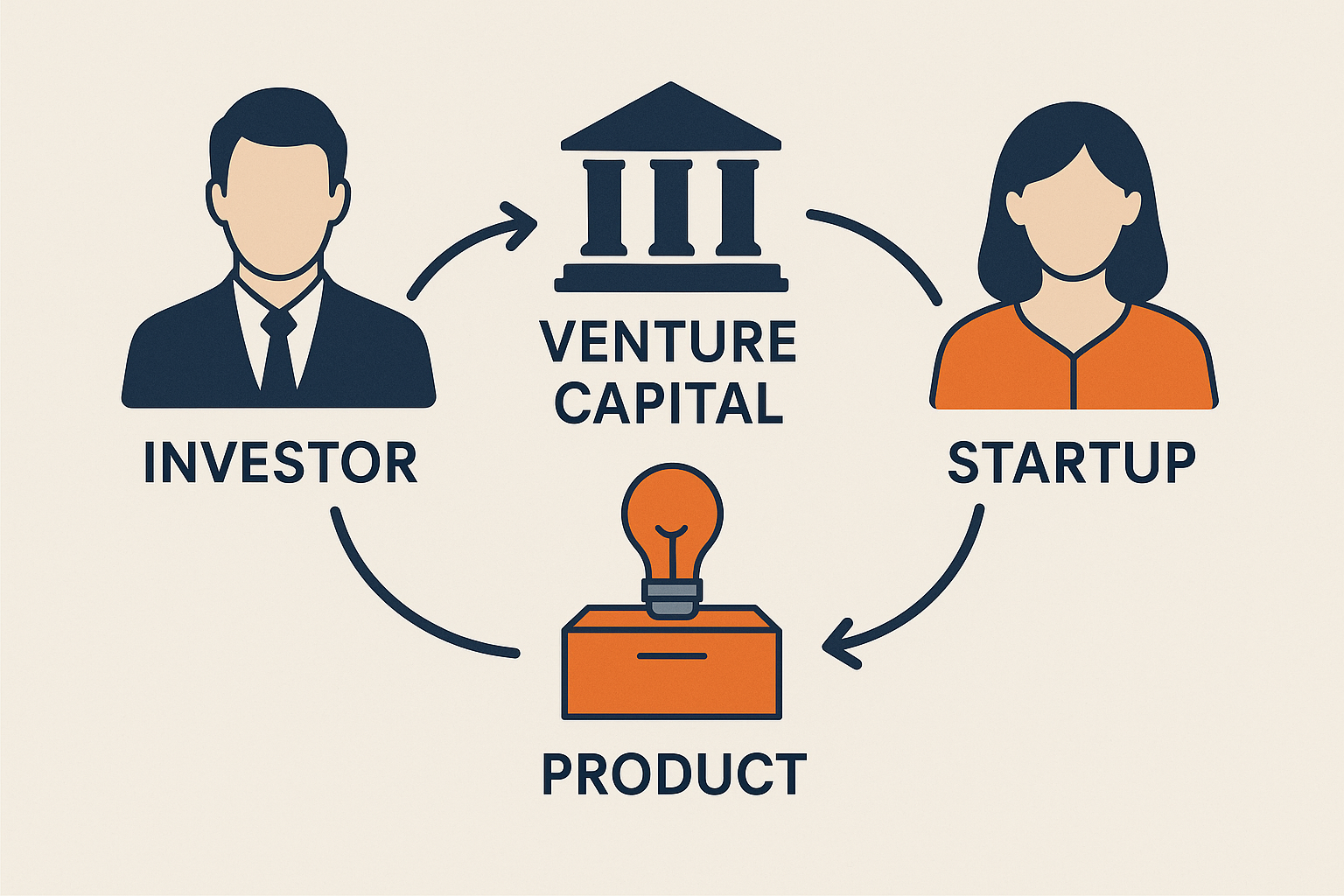

We’re in an era of innovation in which people in my work are constantly helping the economy understand distinctions – entrepreneur vs. business owner, startup vs. new business, angel investor vs. business partner – because it’s the distinction of what people are doing that better aligns talent, resources, capital, and programming, with the appropriate working that’s being done. Much of what contributes to failure is the waste and misdirection that occurs when economies and communities mismatch. That fact is what has us here, when I was asked if it was fair to say that what characterizes an entrepreneur is that mindset supersedes money.

No founder worth the name waits around to “see” the data before taking the leap. They’re compelled by conviction (often irrational, sometimes borderline delusional) that the world could be different, and they are the ones who will bend it. They mortgage homes, walk away from careers, and talk strangers into joining them in pursuit of an invisible opportunity. Belief, not proof, is the engine of entrepreneurship.

That rule applies even more to angel investors and venture capitalists.

Article Highlights

Seeing Isn’t Investing

The dirty secret of early-stage capital is that most people calling themselves “venture investors” aren’t. They’re spreadsheet hobbyists. I walked out of a dinner last night where the discussion among the investors was frustration with some of their peers pushing pre-seed founders to focus on revenue, to which I remarked, “the mistake you’re making is calling them peers.” Some investors want to see revenue traction, a working prototype, defensible margins, and a path to predictable multiples, and in many contexts, that’s completely appropriate (a new business). There is nothing wrong with that, except it misleads entrepreneurs who can’t (or shouldn’t). That’s buying proof, not creating it, and many things can and should but innovative ventures, startups, by and large are not yet ready to do so.

Early-stage investing is about betting on people and markets, not numbers. Marc Andreessen has argued that by the time you can see the traction, you’re too late.

- Amazon was laughed at for losing money selling books online. Jeff Bezos didn’t raise money by proving profitability; he raised it by insisting that everything could be sold online. Investors believed before they saw.

- Tesla nearly went bankrupt multiple times. Rational bankers wouldn’t support such a thing, while Elon Musk convinced backers on belief that electrification was inevitable.

- Airbnb? Investors rejected them repeatedly because “no one would stay in a stranger’s home.” The ones who said yes, said yes on belief, not ARR.

Conviction precedes cash flow. It always has.

Between Mind and Money, Which One Matters?

Don’t misunderstand me: money matters. It builds prototypes, pays rent, hires talent. But to put money ahead of mindset is to mistake the fuel for the driver.

The most important resource an entrepreneur has is not capital, but cognitive resilience: the ability to persist on belief when the evidence isn’t there yet. Angela Duckworth called this grit, “passion and perseverance for long-term goals. Venture research backs this up: the Kauffman Foundation has shown that entrepreneurial persistence, not initial funding, is the strongest predictor of eventual firm survival. We have the psychological studies that show that certain types of personalities are more likely to succeed.

Money is abundant (yes, it actually it). Ideas are plentiful. But the mindset to see opportunity where others don’t, and to hold belief long enough to make it visible, is rare.

That’s why the cliché of “I’ll believe it when I see it” is fatal to entrepreneurs. If you wait for the world to validate you before acting, you’re not an entrepreneur, you’re a manager of what already exists. The true founder operates inversely: “I’ll see it when I believe it.”

What Startup Investors Do Differently

This inversion is the litmus test between venture capital and everything else that masquerades as it.

- If you need the proof before you believe, you’re not a venture investor. You’re a lender or a late-stage buyer.

- If you can believe before you see, you’re actually fueling innovation.

And in fairness, we don’t mean blind faith. Conviction-based investing demands pattern recognition, market insight, and hard questions. The best VCs are betting on people, markets, and timing, not on spreadsheets pretending to forecast certainty ten years out because we KNOW that the capable entrepreneur has the experience or the methodology to deliver that pattern recognition, those market insights, and to take on the hard questions.

As Chris Dixon of a16z put it, “The next big thing will start out looking like a toy.” If you wait until the toy has a business model, you’ve missed the next big thing.

Founders, invert the lens. Don’t just take anyone’s money. Pay attention to how potential investors respond to you.

- If they ask only about revenue, churn, and cash flows today, they’re buying comfort, not building risk.

- If they ask about how the world is shifting, how you’ll recruit, how you’ll pivot, they’re operating in belief.

Your first filter isn’t who has the biggest check. It’s who shares the conviction that makes the future visible.

Belief Shapes Perception

“I’ll believe it when I see it” is for spectators. Entrepreneurs and real investors flip it: I’ll see it when I believe it.

Belief shapes perception. Belief precedes execution. Belief makes the invisible opportunity visible.

And if you’re raising money, here’s the uncomfortable but freeing truth: you don’t need everyone to believe. You just need the few who do.

“I’ll see it when I believe it.” Thanks for this reminder, Paul O’Brien!

Mindset matters most.

Thanks for a perspective that connects me to the energy I needed.

Absolutely! Thank you for sharing that!

Nice post. Works well for recruitment too. Those who see it, get it (done).

Steve Johnson love those kind of comments that give us perspective. Thank you. I bet it does.

Paul,

Interesting perspective on mindset versus money. I have found that conviction builds not just companies, but predictable revenue systems that investors trust. How do you see founders applying this belief paradigm to gain investor confidence and scale sustainably?

Ian Feder conviction isn’t just energy, it’s architecture. Founders who apply this paradigm well don’t stop at passion; they translate belief into a system that others can rely on.

The bridge to investor confidence comes from showing how mindset informs execution: how your clarity of vision becomes a repeatable process for customer acquisition, retention, or market entry (almost ALL that I meet, fail this). Investors may not need every KPI on day one, but they need to see the scaffolding of belief turned into a predictable system.

In my view, that’s where sustainable scale comes from (which is kind of David Daniel’s thing so pinging him); not money first, but belief disciplined into frameworks that make growth inevitable.

Spot on Paul! Entrepreneurs belief and passion in their mission is the driving force!

Susie Coelho was thinking more of that driver vs. fuel thought I had…

A determined driver without fuel will get out and push the car. A fueled car without a driver isn’t going anywhere.

This! Yes thank you Paul – this is spot on. Particularly when you can’t get a spreadsheet person to “see” what you have in your head because nobody else is doing it this way yet. And you don’t want a money person to trample on our idea because you don’t know about SAM or market penetration because you are just trying to make the thing real. Thanks but no thanks… We’ll keep plodding away in the trenches and buy ourselves the 2 years everyone says it takes to turn a startup into a viable business. Your articles are thought provoking and interesting and give us the oomph to keep going!!

Nikky Gibson I’d push people to be inspired through understanding what it takes, even more. The people who succeed are the ones who don’t think it terms of time; they are fixated with the problem and will fix the problem whether it takes 2 months or 20 years.

This is so true, honestly its all explicitly clear as I have began raising pre-seed funds for my company Everything African of £50k. You can clearly tell with investors asking the two different questions you mentioned in this article.

Babatunde Ajose yep!

A business investor calling themselves an Angel or VC, is still a business investor.

Paul O’Brien ha! I was thinking of mentioning a feeling of inevitability… then you slammed it at the end of your comment here. Hats off.

I liken it to when a vision fully crystallises (as some parts remain fluid and unclear… so you just have to have that strong belief you can and will navigate in due course).

Great post moving from idea to Product-Market-Fit where further funding, new

believers are needed definitely don’t fit the standard figures of MRR etc. But, once you find the next believer and backer

you keep them close.

Money is ALWAYS important, but imho mind is more important

Georgina Bowman those believers stick with you for life.

Absolutely. In real estate development, I’ve seen capital come and go—but mindset determines whether a project survives the inevitable delays, cost overruns, or market shifts. Money funds the build, but conviction finishes it. Without the right mindset, even unlimited resources can collapse into half-finished deals.

Investors won’t fund it until they SEE that you BELIEVE it!