Article Highlights

Until Cities Get That Straight, Startups Will Keep Starving for Capital

It’s a weird day when the world’s entrepreneurs sound like customers complaining about a bad product.

“We can’t find funding.” “Investors aren’t taking risks.” “There’s no capital in our city.” You’ve heard it a thousand times; it’s the economic equivalent of Yelp reviews from startups that believe they’re entitled to be served. And I’m concerned, because in a strange inversion of logic, cities, accelerators, and economic development offices rush to solve the wrong problem. They’re not fixing the product. They’re fixing the reviews.

We’ve somehow forgotten that venture capital is itself a business, with customers of its own. The customer of a VC isn’t a founder; it’s a Limited Partner (LP). The pension funds, individual investors, endowments, and family offices that fund the funds are the paying clients. Venture capital firms, like any other business, have to deliver a return to their customers.

The “product” they’re selling to LPs is the startup.

So, when the startups in your city aren’t getting funded, it isn’t because investors aren’t available, it isn’t that investors are cruel, or the system is broken, or the government hasn’t hosted enough “meet the VC” nights with deli plates and Hello My Name Is stickers. It’s because the products (the startups) aren’t good enough to sell and that is in part because the ecosystem needs work. Why startups struggle to get venture capital funding is because the way you’re supporting the ecosystem isn’t working.

The Product Feedback Loop Nobody Wants to Hear

Every time founders lament the lack of capital, they’re giving feedback. But it’s product feedback, not customer feedback. The customer (the LP) isn’t buying. And the customer isn’t buying because the product (the startup) AND your market aren’t offering value commensurate with the risk.

If a car company blamed consumers for not buying a faulty vehicle, we’d laugh. But in startups, we treat it as noble suffering. Founders and cities rally behind “capital deserts” promising networking events, demo days, and warm intros, instead of facing a simpler truth: if capital isn’t flowing to your region, your product isn’t compelling enough.

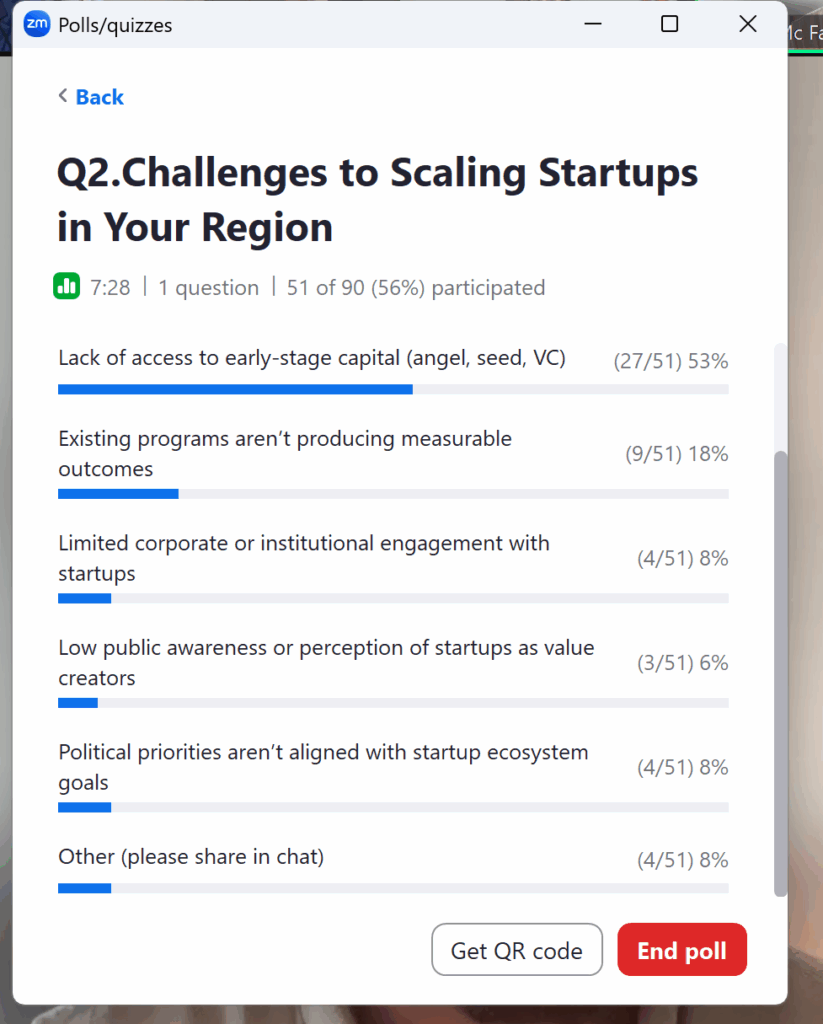

I just hosted an economic development event and in our discussion of startups, we polled the audience asking the challenges to scaling startups in your region. The majority conclusion?

Lack of access to capital (We’ll be writing up the talk and sharing the video shortly, make sure you’re subscribed here if you want to get it). Now, I share that, because that’s the opinion of local governments and economic development offices. We lack access to capital. And yet, this has been researched, the primary reasons venture capital isn’t sufficiently available in a city are risk aversion, lack of a network, and startup quality – follow? You don’t lack access to capital and you’re addressing the wrong problem if you think it’s merely making investors available.

The Real Market of Venture Capital

Venture capital is a two-sided market. On one side are investors (LPs) seeking returns. On the other side are startups seeking capital. The venture firm sits in the middle, much like a wholesaler. It doesn’t manufacture startups, it curates them, packages them, and delivers them to its customers, who are the investors buying exposure to risk-adjusted innovation.

If LPs aren’t reinvesting in funds that focus on your city or your ecosystem, it’s not because of some national conspiracy against your address. It’s because the funds haven’t proven that product-market fit works there (product-market fit, a startup sector term meaning that what a startup offers fits what the market values). If venture dollars aren’t flowing, it’s because investors don’t see scalable startups worthy of that flow – and that’s not alone founders’ fault: it’s your ecosystem, the startup programs, the mentorship available, and more.

Cities Are Treating Venture Capital Like Tourism

Economic development offices are throwing money at “venture capital attraction” programs as though venture funds are visiting tourists; bring them in, show them the sights, tour the innovation hub filled with local character, let them shake hands with some founders, and maybe they’ll leave a few dollars behind. It’s the same thinking that turned startup accelerators into ribbon-cutting ceremonies.

But capital doesn’t show up for good hospitality. It shows up for good economics.

Cities shouldn’t be hosting investor summits; they should be building markets that serve founders and mitigate risks; the kind that generate the data, customers, and confidence that make LPs invest in the funds that back those regions.

In short, if the startups are the product, and the LPs are the customer, then the role of a city is to strengthen the supply chain. That means refining startup quality, expanding founder education, promoting opportunity, aligning with universities and R&D, and ensuring early customers exist within reach. You don’t need to attract VCs; you need to build a market worth their inventory.

Building Better Products and Better Markets

Want investors to fund your startups? Stop trying to sell the story and start building the infrastructure.

- Focus on Founder Development, Not Pitch Training.

Don’t teach founders how to raise money; teach them how to build something worth funding. Programs like Founder Institute, Y Combinator, and Techstars succeed because they filter ruthlessly for execution, not charm. - Fund the First Customers.

Create procurement programs that buy from local startups. Cities could seed their own innovation economy if they treated startups as vendors instead of vanity projects. - Professionalize Angel and Mentor Networks.

Local angels need to be actual angels (not business investors) and mentors must be expected to have startup experience. Foster co-investment through structured syndicates. Support the mentors who aren’t just skilled, they’ve been through the startup ringer. - Measure Outcomes, Not Events.

Track founder retention, capital raised, and startup growth, not attendance at pitch nights. LPs care about measurable ROI, and so should cities. - Build Domain Clusters That Make Sense.

Stop chasing “tech.” Chase the specific industries that fit your DNA: healthcare in Nashville, logistics in Bentonville, semiconductors in Phoenix. You can’t fake an ecosystem any more than you can fake a product.

The Hard Truth: The Problem Isn’t the Capital

When founders complain that they can’t find capital, cities respond by trying to import local wealth to meetups. They host events and court people with money in an effort to encourage check-writing. But they rarely ask why investors aren’t already there. Worse, pulling business investors, wealthy community members, and capital familiar with real estate or oil is only going to frustrate matters more because startups are high risk investments unfamiliar to such people.

Capital is fluid. It hunts for yield. It’s not sentimental about geography or narrative. When it doesn’t come to you, it’s not because it’s hiding, it’s because it’s unimpressed.

The brutal reality of venture capital is that it’s a market like any other. If the customers (LPs) aren’t buying the product (startups), the problem isn’t the supply of capital. It’s the quality of inventory and the market in which it’s available.

The Fix: Stop Selling, Start Building

If your city wants venture capital, stop marketing to investors and start manufacturing scalable startups while developing your supply chain as a market in which they thrive. That means cultivating entrepreneurs who understand markets, unit economics, and the discipline of execution, not just the pitch deck template.

It means listening to the real feedback; the kind that doesn’t feel good. When capital skips over your region, it’s not rejection. It’s a signal.

As with any business, product feedback is your path to improvement – in this case, the customers are already telling you it needs work. The goal isn’t to attract capital, it’s to deserve it.

If your economic development strategy doesn’t yet understand that venture funds have customers, it’s time to redesign your startup ecosystem as though you were building a business, because you are. Let me know if I can help.

Paul O’Brien Next do “If you’re not a venture scale business, you shouldn’t be chasing venture capital in the first place.”

Rick Turoczy oh I push that a ton. Venture Capital isn’t broken; people just want it to fund something it doesn’t.

You might appreciate this, I have a policy paper floating around Washington and some states, that we need the public sector to draw stark lines between new businesses and startups – in policy, programming, and resources: https://www.linkedin.com/pulse/startups-small-businesses-state-startup-policy-capital-paul-o-brien-avqlc/

“In short, if the startups are the product, and the LPs are the customer, then the role of a city is to strengthen the supply chain. That means refining startup quality…” *

Why this escapes so many, I’ll never understand.

Startup, “we can’t find investors”

Community, “Great, here’s a meetup of local business investors.” 😐

The other non-sugar pill is… some startup babies ARE ugly. They don’t deserve capital. They’re not going to get capital. They deserve to wither on the vine and die.

That doesn’t make the founder a bad person. That doesn’t make the team a bad team. To your point, some – no matter what is done – are not going to make it. That’s literally the definition of startup.

It’s not “Invest and I will build it.”. It’s more like “I must build something worth investing in. Or I will perish, and rightfully so.”

Mark Simchock some? Most.

Missing one important step, Revenues / Profits

Measure outcomes not events. To have the outcomes, need consistent strategic events and data measurement tools.

“Fund the first customers, not the first demo day.”

Results over noise.

Yep; and not understanding this leads to a lot of issues.

This is so overlooked in the conventional venture narrative. GPs are FIDUCIARIES. Look it up vcs….

Maddi Holman see I’m not the only one who says this

Joseph Alalou there is nothing wrong with Venture Capital in the way that most complain about it. The issues are:

1. Most funds are managed well; and shouldn’t be counted among Venture Capital Funds

2. Most founders want it to be something it’s not.

This resonates and is definitely true for my home region in Europe too.

Local/national public bodies, universities, research centres, are mistaking symptoms for causes and not doing enough to address the core issue that underlies the scarcity of pre-seed startup capital (founder development without theatre -> higher founder quality -> greater capital influx).

But I would add that every two-sided platform needs to work both sides: supply (investment-worthy founders) and demand (high-risk capital).

It can be a catch 22. Capital scarcity delays people who are founder material from getting started (delays, rarely prevents). A little pre-seed capital in a region can go a long way. Which is why public money (as selective LP investments) needs to be leveraged VERY carefully.

Right on point!

The other comment aside, it’s funny how this is very similar to SEO.

Most SEOs falsely believe the websites are Google’s customers, and that Google should act in the sites’ best interest, etc. But that’s not how it works.

Google’s customers are the people doing the searching (or now prompts). Google’s only job is to maximize the joy of those people, or those customers will find a replacement for Google (or Bing, etc.)

Google is only going to recommend sites that meet that end. Full stop. Your low ranking site is such because in Google’s eyes, your site is ugly, sometimes literally. It can’t trust you’ll bring its customers joy. Whine all you want about your rank, but you’re not the customer.

Mark Simchock I’m ashamed of myself that I didn’t see that

I’ll be starting self-flagellation again after work.

Paul O’Brien Shame on you. Look ashamed. I guess the point is, most people mistakenly believe it’s all about them. When you don’t, you have an advantage.

Paul O’Brien has it down.

“Capital is fluid. It hunts for yield. It’s not sentimental about geography or narrative. When it doesn’t come to you, it’s not because it’s hiding, it’s because it’s unimpressed.”

And I’ll add this is so important and fundamental to our economy as a whole. In a free market investors flock to what can be supported by intrinsic value of the offering, policy and market dynamics. Without this underpinning of investors that give us a true litmus test of what has fundamental value in the marketplace – we are a society that is being supported by what – government funding?

Support of effective execution = revenue generation = follow on rounds.

Exactly right. Markets exist to tell us what actually creates value, not what we wish did. Too many cities treat venture capital like a civic amenity; something you can subsidize or summon through enthusiasm. But as you said, in a free market, investors are the litmus test.

If capital isn’t showing up, it’s not a moral failure of founders; it’s an economic signal that our ecosystem isn’t producing investable inventory. That’s what we should be measuring, whether we’re building startups that generate revenue, customers, and momentum strong enough to make follow-on rounds inevitable, not aspirational.

Public funding has a role, but only as a catalyst for private validation. The goal isn’t to replace the market; it’s to help it work.

You might enjoy Ally, a thought that preceded this, that when founders are in need of warm intros, it’s signal that something is wrong: https://paulobrien.substack.com/p/when-founders-need-referrals-to-meet-investors-fix-this-about-your-startup-ecosystem

This is spot on, Paul. It’s refreshing to see someone put it in plain terms — funding follows foundation. When you build something that actually solves a problem and moves the economy forward, the right capital eventually finds you. Too many chase investors before proving value. Appreciate this perspective — it’s what real builders understand.

Let’s build solid sustainable, scalable companies!

Bennie Mixon Jr. Thank you. Exactly.