In the Company of Venture Capital

Wednesday, 17 February 2021

People have different definitions of “startup” and “venture capital,” and it’s that foundation that causes frustrations and misplaced expectations. What Frustrations in Venture Capital? The real reason founders are not funded VCs don’t say in a pitch process Why Venture Capitalists Aren’t Funding The Businesses We Need VCs like to take their time with their

- Published in Startups

37 Comments

Asked: What Stops VCs from Investing in Foreign Companies?

Monday, 25 January 2021

Nothing, it happens all the time. Yet, the question is common, frequently asked; begging a question its own – what are startups struggling with that they think that foreign investors won’t invest? Start with this appreciation: investing in startups is the riskiest use of capital, in the world. Gambling at a casino is more likely

- Published in Insights / Research, Raising Capital, Regional Development, Startups

The Future of our Economy Lies in Property Development and Startups Finding Common Ground

Thursday, 17 December 2020

“Perhaps one of the most important financial decisions a forest landowner will make is determining when to harvest timber.” That, the opening of a PennState article exploring the financial decisions land owners consider in this use case, including how to determine and calculate when to maximize financial returns, prompted a thought about investing in property

- Published in Economic Development, Startups

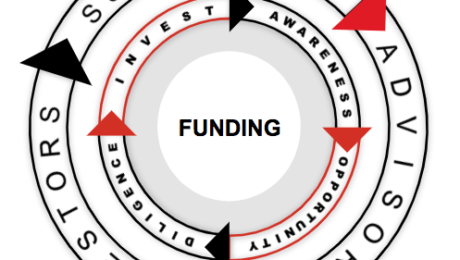

The Funding Flywheel

Wednesday, 09 September 2020

Businesses and startup founders learn early of a critical methodology in sales referred to as a funnel. Developing products and services, marketing is the process therein by which organizations get to know potential customers and then profile people so as to better understand the needs and motivations. The goal, of course, being the conversion of people

- Published in Advertising, Startups

Friends and Family Funding: Good Idea / Bad Idea (and just how it is)

Tuesday, 04 August 2020

That Friends and Family Round of funding… we’ve all heard we need it, or that that’s where founders start; but are so many really raising money from family? Let’s cut to the chase, overwhelmingly most founders can’t look to family for financial help and so how should we really think of drawing capital from loved

- Published in Startups

The Stress of Running a Venture Backed Startup

Friday, 17 July 2020

The expectations of investors, the demands of a company now more prominent in the market, but the ease of pressure in having resources available… Being venture backed doesn’t make it more stressful, nor less, it’s a matter of the stage, the expectations, and what that all means to you personally. Startup teams usually change from

- Published in Insights / Research, Startups

Pitching VCs from Far Far Away

Monday, 04 May 2020

Later this year, the Mandalorian returns to the small screen for Season 2 of one of the hottest reasons everyone has flocked to Disney+ While anxiously awaiting a show near the top of my Must See TV, my family and I spent the weekend binge watching Star Wars while I toiled away on a major

- Published in Advertising, PR, Startups