Rethinking Startup Ecosystems to Build What Investors Really Want

Monday, 28 October 2024

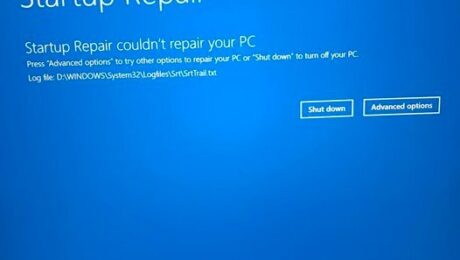

In most of the world, startups are in disrepair. No more effectively can we just reboot or defrag a computer to actually fix it, than we can try again and again to host demo days, networking events, and run incubators, expecting different results, when there is a virus in the system. Begging the question, that,

- Published in Economic Development, Industry, Insights / Research, Local, Startup Ecosystems, Startups

42 Comments

SEC’s Enhanced Disclosure Rules Could Transform Startup Fundraising

Monday, 28 October 2024

Monday Ventures: Weekly What’s Shaping the Startup Economy In late October, the U.S. Securities and Exchange Commission (SEC) passed new rules on private capital raise disclosures that have drawn widespread attention in the startup community. Historically, private companies and venture capitalists in the U.S. have enjoyed relatively light regulation in fundraising disclosures, which has allowed

- Published in Monday Ventures

The 6 Considerations of the Economic Development of Startups

Thursday, 29 August 2024

In my work with cities throughout the world, guiding how to foster entrepreneurship, few realize or fully appreciate that the experiences of my life inform what works and what doesn’t, in a region of the world trying to help startups. Raised in Michigan, I spent years exposed to what it means to have a city

- Published in Economic Development, Featured, Insights / Research, Startup Ecosystems, Startups

What it Takes to Make Your City “Next” in Innovation

Friday, 29 September 2023

So, the guy who chose and loves Austin has some thoughts about the potential of Houston. I had a chance to sit with Chris Howard during their interview series when in Austin, for Forging the Future through Softeq, where we talked about how culture and distinction draws entrepreneurship, tech, and capital. How Houston is on

- Published in Economic Development, Startups

Founders, VCs Might Not Like My Sharing This, But They Should

Thursday, 21 September 2023

One of the more challenging skills to help develop in a founder, is being able to discern b.s. from experienced and valid advice. As you might imagine (and I hope you can relate from the all too prolific frequency with which this happens), it’s particularly difficult to know how to put questions back on a

- Published in Insights / Research, Startups

Startup Founders, a Good Idea Solves a Problem, A Great Idea Creates Value

Thursday, 29 June 2023

We have a huge problem in the startup ecosystem; that’s that most founders have been misled by a lot of people to think in terms of Problem / Solution. That a solution to a problem is what matters foremost in a startup. And that has led to the notion that validation is a simple matter

- Published in Insights / Research, Startups

Developing Austin’s Startup Ecosystem

Tuesday, 28 February 2023

Regional culture, history, and infrastructure are the qualities of a region of the world that drives innovation, jobs, and economic development because technology is ultimately about people and their potential. A really a wonderful article about Austin in The New Yorker sparked a series of wonderful discussions of the past and present of the Austin

- Published in Industry, Startup Ecosystems, Startups, Texas Startups